Town of Waddington - St. Lawrence County Government

Town of Waddington - St. Lawrence County Government

Town of Waddington - St. Lawrence County Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

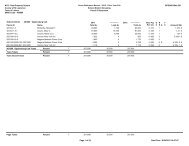

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

13.081-1-4.2 Acres, Kevin D. 35,600 30,000 30,000 0 311 W 1<br />

13.081-1-4.11 New York <strong>St</strong>ate Power Authority 19,400 16,200 16,200 0 690 8<br />

13.081-1-4.12 Village <strong>of</strong> <strong>Waddington</strong> 29,700 16,100 16,100 0 314 8<br />

13.081-1-5 <strong>St</strong>ructural Wood Corporation 269,500 16,300 290,000 0 444 1 1- 23-11<br />

13.081-1-6 Tiernan, Joseph F. 77,800 17,700 91,000 0 484 1 1- 17-10<br />

13.081-1-7 Silvin, James J (Etal) 10,800 15,300 15,300 0 311 1 1- 25-10<br />

13.081-1-8.1 Hanson, Irene 14,100 17,500 17,500 0 311 1 1- 14- 8<br />

13.081-1-9.1 Bassity, Bruce 62,800 14,700 67,000 0 210 1 1- 13-13<br />

13.081-1-12.1 Hanson, Irene 84,900 12,000 87,000 0 210 1 1- 12- 7<br />

13.081-1-13 Burley, Carmen J. 277,300 85,600 280,000 0 210 W 1<br />

13.081-1-14 Thew, Gail 260,000 78,800 264,000 0 210 W 1<br />

13.081-1-15 Cole, Doris 355,100 85,000 360,000 0 210 W 1<br />

13.081-1-16 Tisdel, Beverly 314,800 89,000 314,000 0 210 W 1<br />

13.081-1-17 Pipher, James E. Sr. 286,400 80,700 290,000 0 210 W 1<br />

13.081-1-18 Tasse, Philippe 102,200 90,200 90,200 0 311 W 1<br />

13.081-1-19 Tebo, Barbara T. 389,200 81,800 389,200 0 210 W 1<br />

13.081-1-20 Tacci, Carl J. 384,100 92,000 380,600 0 210 W 1<br />

13.081-1-21 Hanson, Donald B. 355,900 87,000 360,000 0 210 W 1<br />

13.081-1-22 Tiernan, Marshall R. 309,200 74,400 320,000 0 210 1<br />

13.081-1-23 Frary, Michael P. 81,200 67,000 67,000 0 311 W 1<br />

13.081-1-24 Acres, Kevin D. 387,900 97,800 387,900 0 210 W 1<br />

13.081-1-25 Romeo, Tenley L. 344,900 72,700 344,900 0 210 1<br />

13.081-1-26 Acres, Kevin D. 90,100 75,200 75,200 0 311 W 1<br />

13.081-1-27 <strong>St</strong>ructural Wood Corp 7,300 7,300 7,300 0 311 1<br />

13.081-1-28 Sheehan, James E. 27,500 27,500 27,500 0 311 1<br />

13.081-1-29 Clute, Priscilla <strong>St</strong>rang 148,400 27,500 160,000 0 210 1<br />

13.081-1-30 Clute, Priscilla <strong>St</strong>rang 27,500 25,000 25,000 0 311 1<br />

13.081-1-31 Kimball, Shaun H. 25,000 25,000 25,000 0 311 1<br />

13.081-1-32 Kimball, Shaun H. 25,000 25,000 25,000 0 311 1<br />

13.081-1-33 R & G Realty 22,000 25,000 25,000 0 311 1<br />

13.081-1-34 Ladouceur, Jason N. 247,600 25,000 247,600 0 210 1<br />

13.081-1-35 R & G Realty 27,500 27,500 27,500 0 311 1<br />

13.081-1-36 Pandel, Richard D. 27,500 27,500 27,500 0 311 1<br />

13.081-1-37 Pandel, George 27,500 27,500 27,500 0 311 1<br />

13.081-1-38 Sellers, Eileen 27,500 27,500 27,500 0 311 1<br />

13.081-1-39 R & G Realty 27,500 27,500 27,500 0 311 1<br />

13.081-1-40 <strong>St</strong>evens, Jason 238,000 25,000 220,000 0 210 1<br />

Page Totals Parcels 37 5,448,700 1,662,800 5,453,000<br />

Page 1 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

13.081-1-42.1 Matura, Louis 40,000 28,000 28,000 0 311 1<br />

13.081-1-43 Pandel, Richard D. 27,500 27,500 27,500 0 311 1<br />

13.081-1-44 Village <strong>of</strong> <strong>Waddington</strong> 8,800 8,800 8,800 0 311 8<br />

13.081-1-45 Village <strong>of</strong> <strong>Waddington</strong> 21,000 21,000 21,000 0 314 8<br />

21.024-1-1.11 New York <strong>St</strong>ate 258,500 102,000 258,500 0 963 8<br />

21.024-1-2 Mayette, Richard J. 198,000 33,100 208,000 0 464 W 1 1- 9- 6.1<br />

21.024-1-5 Ryan, Heather M. 78,700 20,500 82,000 0 210 W 1 1- 6- 1<br />

21.024-1-6 Cassada, Bruce 138,800 22,700 138,800 0 210 W 1 1- 31- 5<br />

21.024-1-7 Bregg, Frank A. 116,800 28,600 120,000 0 210 W 1 1- 6- 3<br />

21.024-1-8 Dumas, John (LU) 100,300 18,000 100,300 0 210 W 1 1- 8- 1<br />

21.024-1-9 Dumas, John R (LU) 95,600 20,800 98,000 0 210 W 1 1- 11- 5<br />

21.024-1-10 Haley, Daniel K. 29,000 22,700 22,700 0 311 W 1 1- 11- 6<br />

21.024-1-11 Van House, Meghan 190,000 30,800 188,000 0 210 W 1 1- 11- 8<br />

21.024-1-12 Dean, Mark 99,300 27,400 108,000 0 210 W 1 1- 7- 2<br />

21.024-1-13 Master, Gary 128,700 28,600 130,000 0 210 W 1 1- 1-11<br />

21.024-1-14 Oshier, Michael (Trust) 93,400 25,000 93,400 0 210 W 1 1- 17-13<br />

21.024-1-15 Tenbusch, John F. 112,900 31,700 116,000 0 210 W 1 1- 20- 4<br />

21.024-1-16 Greene, William R. 141,000 27,400 141,000 0 210 W 1 1- 13-15<br />

21.024-1-17 Brady, Mark 141,000 27,400 146,000 0 210 W 1 1- 24- 3<br />

21.024-1-18 Fox, Hazel M. 141,000 27,400 146,000 0 220 W 1 1- 28-10<br />

21.024-1-19.1 <strong>St</strong>rait, Russell B. 138,800 51,000 140,000 0 210 W 1 1- 26- 4<br />

21.024-1-20 <strong>St</strong>rait, Russell B. 130,800 50,000 115,000 0 210 1 1- 20- 3<br />

21.024-1-21 Bennett, Michael J. 130,600 23,600 130,600 0 210 W 1 1- 1- 5<br />

21.024-1-22 Hughes, Donald 138,800 37,400 147,000 0 210 W 1 1- 27- 4<br />

21.024-1-23 Ferriter, James P. 214,900 37,400 214,900 0 210 W 1 1- 11-11<br />

21.024-1-24 McMillan, Carol (LU) 122,000 51,000 135,000 0 220 W 1 1- 18- 7<br />

21.024-1-25 Reagan, June A (LU) 148,100 50,000 154,000 0 210 W 1 1- 22-13<br />

21.024-1-26 Daley, Gordon 201,500 53,000 201,500 0 210 W 1 1- 6-11<br />

21.024-1-27 Barkley, Weldon G. 268,200 50,000 268,200 0 210 W 1 8-103-1<br />

21.024-1-28 Village Of <strong>Waddington</strong> 5,100 2,100 2,100 0 690 8<br />

21.024-1-29 <strong>St</strong>rait, Russell B. 22,900 12,000 12,000 0 311 1<br />

21.024-2-1 Robertson, Billy J. 59,600 10,800 70,000 0 210 1 1- 5- 1<br />

21.024-2-2 Sharpe, Vivian J (LU) 58,300 9,500 67,000 0 210 1 1- 25- 7<br />

21.024-2-3 Bateman, Frank J. 160,600 13,300 170,000 0 210 1 1- 26-15<br />

21.024-2-4 Salton, Janet Veitch 61,100 10,800 68,000 0 210 1 1- 31-10<br />

21.024-2-5 Barkley, Carie Ann 66,900 10,800 78,000 0 210 1 1- 8-12<br />

21.024-2-6 Pruner, Howard 55,300 10,500 64,000 0 210 1 1- 22- 3<br />

Page Totals Parcels 37 4,143,800 1,062,600 4,219,300<br />

Page 2 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.024-2-7 Pandel, Richard D. 142,700 12,200 148,000 0 210 1 1- 9- 9<br />

21.024-2-8.1 <strong>St</strong>rait, Loraine H. 5,700 9,500 9,500 0 311 1 1- 26- 5<br />

21.024-2-8.2 Nelson, Thomas J. 158,800 12,800 162,800 0 210 1<br />

21.024-2-9 River Lanes 203,000 15,300 214,000 0 541 1 1- 23- 3<br />

21.024-2-10.1 Waddy Development Corp 9,100 13,200 13,200 0 311 1 1- 29- 1<br />

21.024-2-10.2 Village <strong>of</strong> <strong>Waddington</strong> 10,800 18,000 18,000 0 314 8<br />

21.024-2-11.1 DEA Properties Corporation 4,100 4,600 4,600 0 330 1 1- 23- 7.1<br />

21.024-2-11.2 DEA Properties Corporation 173,800 14,500 178,000 50 421 1 1-23-7.2<br />

21.024-2-12.11 Massena Savings & Loan 502,700 15,300 502,700 0 461 1 1- 23- 6<br />

21.024-2-12.12 DEA Properties Corporation 152,900 12,800 154,000 0 220 1<br />

21.024-2-13 MacDonald, Edith B (LU) 58,100 8,600 68,000 0 210 1 1- 21-15<br />

21.024-2-14.1 Perry, <strong>St</strong>ephen M. 80,500 11,800 86,000 0 210 1 1- 21- 1<br />

21.024-2-16.1 Brady, Timothy T. 63,100 12,300 70,000 0 220 1 1- 4- 7<br />

21.024-2-17.1 Putney, Nancy M. 12,000 7,200 11,600 0 312 1 1- 30- 7<br />

21.024-2-18 Putney, Nancy M. 78,700 8,600 94,000 0 210 1 1- 7- 7<br />

21.024-2-19 Scott, Atchisson 101,400 11,400 100,000 0 210 1 1- 19-11<br />

21.024-2-20 Zecher, William 45,300 7,600 49,000 0 210 1 1- 30- 6<br />

21.024-2-21 Burns, Kimber L. 24,700 9,200 24,700 0 270 1 1- 18- 8<br />

21.024-2-22 Bouyea, Janine C. 66,900 12,300 76,000 0 210 1 1- 16-13<br />

21.024-2-23 Ladoceour, Mary 39,800 7,200 46,000 0 210 1 1- 5-12<br />

21.024-3-1 LaCombe, Andrew J. 94,700 11,600 99,200 0 210 1 1- 31- 1<br />

21.024-3-2 Champion, Terry A. 131,200 12,100 142,000 0 220 1 1- 13- 1<br />

21.024-3-3 Bogart, Travis 61,100 8,600 80,000 0 210 1 1- 10-13<br />

21.024-3-4 Lamora, Gerald R. 78,700 12,200 87,000 0 210 1 1- 10- 5<br />

21.024-3-5 Cavanaugh, William J. 75,600 8,000 79,000 0 210 1 1- 29-10<br />

21.024-3-6 Brady, Mark 8,100 7,100 9,800 0 312 1 1- 13-14<br />

21.024-3-7 Rivera, David G. 84,600 8,800 90,000 0 210 1 1- 27-10<br />

21.024-3-8.1 McColl, Rita M. 52,500 9,700 63,000 0 210 1 1- 1- 1<br />

21.024-3-9 Brown, Jacquelyn A. 43,600 5,600 47,000 0 210 1 1- 15- 8<br />

21.024-3-10.1 Legault, Richard 84,600 9,800 90,000 0 210 1 1- 25- 8<br />

21.024-3-11 Michaud, Paula A. 66,900 5,900 80,000 0 210 1 1- 25-14<br />

21.024-3-12 McGaw, Lance K. 55,600 6,900 63,000 0 210 1 1- 12- 8<br />

21.024-3-13 Bogart, Craig R. 48,100 4,300 51,000 0 210 1 1- 17- 7<br />

21.024-3-14 Blair, Lorraine (LU) 80,000 9,900 85,700 0 210 1 1- 2-11<br />

21.024-3-15 Braman, Lisa M. 72,900 9,300 77,000 0 210 1 1- 7- 6<br />

21.024-3-16 Clark, Betty Jean 24,700 5,700 20,000 0 270 1 1- 20- 2<br />

21.024-3-17 Champion-Hobkirk Post 420 8,500 8,500 8,500 0 311 8 1- 25- 1<br />

Page Totals Parcels 37 3,005,500 368,400 3,202,300<br />

Page 3 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.024-3-18 Veterans Hall Ex 128,300 5,100 128,300 0 534 8 8-102-15<br />

21.024-3-19 Champion-Hopkirk Post 420 9,000 9,000 9,000 0 438 8 1- 18-13<br />

21.024-3-20 Currier, Carol A. 55,300 10,200 68,000 0 210 1 1- 6- 9<br />

21.024-3-21 Presbyterian Parsonage Exempt 84,600 4,700 131,500 0 210 8 8-102- 6<br />

21.024-3-22 Presbyterian Church Exempt 566,000 9,900 611,500 0 620 8 8-102- 1<br />

21.024-4-1.1 Community Bank NA 222,200 7,500 238,000 0 461 1 1- 13-12<br />

21.024-4-2 Bruso, Christine & Lee 88,800 6,700 94,000 0 210 1 1- 27-11<br />

21.024-4-3 Haley, Daniel K. 61,500 13,700 30,000 0 210 1 1- 10- 4<br />

21.024-4-4 Dean, Richard M. 90,000 8,800 102,000 0 210 1 1- 26- 6<br />

21.024-4-5 Shoen, William L. 59,700 9,300 66,000 0 210 1 1- 30-10<br />

21.024-4-6 Brady, Timothy T. 52,500 9,500 56,000 0 210 1 1- 27-12<br />

21.024-4-7 Fay, Christopher S. 58,300 7,600 69,000 0 220 1 1- 8-14<br />

21.024-4-8 Fay, Christopher S. 2,400 4,000 4,000 0 311 1 1- 8-15<br />

21.024-4-9 <strong>St</strong>rait, Russell B. 100 300 300 0 311 1 1- 13- 3<br />

21.024-4-13 Snider, Thomas J. 43,400 7,600 43,400 0 484 1 1- 12-14<br />

21.024-4-14 Sizeland, Edward 17,200 2,500 20,000 0 484 1 1-101- 8<br />

21.024-4-15.1 <strong>St</strong>rait, Russell 39,800 7,100 42,000 0 464 1 1- 21-13<br />

21.024-4-17 Sizeland, Edward J. 52,300 10,900 61,800 0 210 1 1- 19- 9<br />

21.024-4-18 7 Main <strong>St</strong>reet Land Trust 120,000 11,600 135,000 0 411 1 1- 16-12<br />

21.024-4-19.1 Brothers, Dawn M. 55,000 6,400 64,000 0 484 1 1- 27- 7<br />

21.024-5-2 Walkovitz, Joan P. 125,100 6,800 132,000 0 210 1 1- 12-15<br />

21.024-5-4.12 Thew, James S. 800 500 500 0 311 1<br />

21.024-5-4.111 Thew, James S. 279,400 14,300 290,000 0 484 1 1- 10-15.1<br />

21.024-5-8 Masonic Building 74,400 4,500 85,000 0 484 1 1- 16- 1<br />

21.024-5-9 Snider, Thomas J. 31,900 2,200 33,000 0 484 1 1- 7- 9<br />

21.024-5-10 Ruddy, George J. 37,900 3,100 42,000 0 220 1 1- 5- 2<br />

21.024-5-11.11 Blue River Properties, LLC 107,800 2,900 109,000 40 425 1 1- 17-11<br />

21.024-5-12 Turner, John W. 69,600 3,900 80,000 0 484 1 1- 6- 2<br />

21.024-5-13 Clark House Preservation Inc 11,000 10,000 11,300 0 480 1 1- 23- 9<br />

21.024-6-1 Sharlow, Judy M. 123,800 14,000 130,000 0 210 1 1- 7-14<br />

21.024-6-2 Zagrobelny, Thad J. 7,700 11,000 11,000 0 314 1<br />

21.025-1-1 Bendert, Edward 396,400 70,000 426,000 0 210 W 1 1- 16- 2<br />

21.025-1-2 Bendert, Edward 28,000 40,000 40,000 0 311 W 1 1- 8- 4<br />

21.025-1-3 Tiernan, Timothy A. 84,800 14,000 87,000 0 210 1 1- 8-5<br />

21.025-1-4 Dumas, Keith C. Sr. 111,900 60,000 111,900 0 210 W 1 1- 22- 4<br />

21.025-1-5.2 Byrd, Sue Ellen 55,300 16,000 66,000 0 210 1<br />

21.025-1-5.11 Dumas, Alice A. 11,300 14,100 14,100 0 311 1 1- 4-11<br />

Page Totals Parcels 37 3,363,500 439,700 3,642,600<br />

Page 4 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.025-1-7 Ranson , Sherrie L. 76,700 60,000 96,000 0 582 W 1 1- 27- 2<br />

21.025-1-8.12 Village <strong>of</strong> <strong>Waddington</strong> 33,000 16,200 16,200 0 314 8<br />

21.025-1-8.13 Village <strong>of</strong> <strong>Waddington</strong> 8,800 6,300 6,300 0 314 8<br />

21.025-1-8.111 New York <strong>St</strong>ate Power Authority 317,900 124,000 154,000 0 690 W 8<br />

21.025-1-8.112 Ranson, Sherrie L. 4,400 4,400 4,400 0 311 1<br />

21.025-1-8.113 New York <strong>St</strong>ate 200 1,700 1,700 0 311 8<br />

21.025-1-8.115 New York <strong>St</strong>ate Power Authority 300 4,600 4,600 0 311 8<br />

21.025-1-9 McAllister, Richard L (LU) 45,500 5,800 72,000 0 210 W 1 1- 17- 1<br />

* 21.025-2-1<br />

Smith, Robert J. 229,200 36,000 229,200 0 210 W 1 1- 25-12<br />

21.025-2-1.1 Smith, Robert J. 54,000 235,000 0 210 W 1 1- 25-12<br />

* 21.025-2-2<br />

Heritage Homes, Inc 48,100 48,100 48,100 0 314 W 1 1- 6- 7<br />

21.025-2-2.1 Heritage Homes, Inc 48,100 48,100 0 311 W 1 1- 6- 7<br />

* 21.025-2-3<br />

Young, Patricia B. 146,900 43,000 146,900 0 210 W 1 1- 12-11<br />

21.025-2-3.1 Young, Patricia B. 49,000 146,900 0 210 W 1 1- 12-11<br />

21.025-2-4 Rose, Matthew B. 212,200 49,000 208,000 0 210 W 1 1- 22- 5<br />

21.025-2-5 Doe, Barbara Seguin 232,500 60,000 240,000 0 210 W 1 1- 7-13<br />

21.025-2-6 Doe, Barbara Seguin 56,400 48,000 48,000 0 314 W 1 1- 7-12<br />

21.025-2-7 Brining, Danielle C. 138,400 15,000 144,000 0 210 1 1- 26- 9<br />

21.025-2-8.1 Rose, Matthew B. 12,000 12,000 12,000 0 311 1 1- 30- 2.2<br />

21.025-2-8.2 Denison, Richard A. 186,300 15,000 188,000 0 210 1<br />

21.025-2-9.2 Zagrobelny, Francis E. 5,500 7,200 7,200 0 311 1<br />

21.025-2-9.4 Zagrobelny, August A. Jr. 5,900 8,800 8,800 0 311 1<br />

21.025-2-9.11 Zagrobelny, August Jr. 47,300 47,300 47,300 0 322 1 1- 30- 2.11<br />

21.025-2-12 <strong>St</strong>immel, William (Trustee) Jr. 6,200 8,000 8,000 0 311 1 1- 26- 2<br />

21.025-2-13 Clarke, Bruce T (LU) 6,400 9,000 9,000 0 311 1 1- 5- 7<br />

21.025-2-14 Clarke, Bruce T (LU) 90,200 10,000 90,200 0 210 1 1- 5- 6<br />

21.025-2-15 New York <strong>St</strong>ate Power Authority 100 2,800 2,800 0 311 8<br />

21.025-2-16 New York <strong>St</strong>ate Power Authority 200 3,500 3,500 0 314 8<br />

21.025-2-17 New York <strong>St</strong>ate Power Authority 100 900 900 0 311 8<br />

* 21.025-2-18<br />

Young, Patricia B. 100 100 100 0 314 1<br />

* 21.025-2-19<br />

Heritage Homes, Inc 300 300 300 0 314 1<br />

* 21.025-2-20<br />

Smith, Robert J. 600 600 600 0 314 1<br />

21.026-1-1 New York <strong>St</strong>ate Power Authority 55,000 86,800 86,800 0 690 W 8<br />

21.026-1-2 Fiacco, Thomas 12,100 16,500 16,500 0 314 1<br />

21.031-1-1 Mahar, Phyllis F (LU) 125,900 32,700 127,000 0 210 W 1 1- 15-10<br />

21.031-1-2 Layo, Mathew P. 132,600 38,000 138,000 0 210 W 1 1- 15- 2<br />

21.031-1-3.1 Brining, Donald R. 187,600 38,000 201,000 0 210 W 1 1- 1- 7<br />

Page Totals Parcels 31 1,999,700 882,600 2,372,200<br />

Page 5 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.031-1-4 Volpe, Gene M. 177,300 55,000 190,000 0 210 W 1 1- 3-10.1<br />

21.031-1-5 Charles (f.k.a. Carter), Alison E (LU) 128,200 11,500 136,000 0 210 1 1- 12- 2<br />

21.031-1-6 Hacker, Craig A. 172,200 12,200 168,000 0 210 1 1- 21- 8<br />

21.031-1-7 Maskell, John S. 148,500 12,200 152,500 0 210 1 1- 15-15<br />

21.031-1-8.1 Porteous, John 119,400 11,500 123,200 0 210 1 1-21-11<br />

21.031-1-9 Dumas, Dennis & Sheila 78,400 11,700 88,000 0 210 1 1- 8- 2<br />

21.031-1-10 Parmerter, Mary J. 131,200 12,100 135,000 0 210 1 1- 13- 8<br />

21.031-1-11 Evans, James R. 125,200 12,200 129,200 0 210 1 1- 11-15<br />

21.031-1-12 Field, Ronald N. 107,900 10,300 107,900 0 210 1 1- 9-15<br />

21.031-1-13 Dumas, Dennis 97,500 10,300 100,700 0 210 1 1- 21-14<br />

21.031-1-14.1 Miller, Robert C. 106,200 11,100 118,000 0 210 1 1- 5- 3<br />

21.031-1-15 McQueeney, June H (LU) 102,000 10,300 109,000 0 210 1 1- 18-11<br />

21.031-1-16 Miller, Robert E. 122,300 10,300 135,000 0 210 1 1- 18-15<br />

21.031-1-17 Buckley, Helen G (LU) 102,000 10,300 116,000 0 210 1 1- 3- 7<br />

21.031-1-18 Martin, Donald M. 102,000 10,300 114,000 0 210 1 1- 12- 5<br />

21.031-1-19 Mayette, Robert L. Jr. 96,200 8,500 98,000 0 210 1 1- 16-14<br />

21.031-1-20 Cyr, Lewis 116,500 13,400 127,600 0 210 1 1- 14-10<br />

21.031-1-21 Cyr, Lewis 6,900 12,000 12,000 0 311 1 1- 15- 4<br />

21.031-1-22 Rabsatt, Calvin O. 205,300 11,500 202,000 0 210 1 1- 4- 5<br />

21.031-1-23 McCabe, Thomas H. 218,500 12,200 218,500 0 210 1 1- 14- 7<br />

21.031-1-24 Clark, Betty Jean 112,100 10,200 116,000 0 210 1 1- 5- 5<br />

21.031-1-25 Reagan, Catherine A. 39,300 8,000 39,300 0 270 1 1- 5-13<br />

21.031-1-26 Klosowski, Mark K. 104,900 10,300 112,000 0 210 1 1- 27- 9<br />

21.031-1-27 Logan, Isabel F (LU) 84,600 11,500 96,000 0 210 1 1- 15- 6<br />

21.031-1-29 New York <strong>St</strong>ate Power Authority 200 1,100 1,100 0 311 8<br />

21.031-1-30 New York <strong>St</strong>ate Power Authority 100 400 400 0 314 8<br />

21.031-2-1.1 Frary, Jon D. 97,500 10,400 101,000 0 210 1 1- 28- 7<br />

21.031-2-3.1 Moriarty, Eugene P. 81,600 11,000 84,300 0 210 1 1- 19- 6<br />

21.031-2-4.1 Dumas, Sheila M. 74,200 11,000 90,000 0 210 1 1- 26-12<br />

21.031-2-5 Griffin, Mary C. 75,800 8,200 72,000 0 210 1 1- 30-11<br />

21.031-2-6 Testa, Kathleen 78,700 7,700 78,700 0 210 1 1- 17-14<br />

21.031-2-8.2 Reynolds, David M. 6,600 8,000 8,000 0 311 1<br />

21.031-2-8.3 Reynolds, David M. 90,200 11,200 98,000 0 210 1<br />

21.031-2-9.1 Dancause, Catherine 74,600 11,300 83,000 0 210 1 1- 6-14<br />

21.031-2-10.1 French, <strong>St</strong>even 83,000 11,300 86,000 0 210 1 1- 22-10<br />

21.031-2-11.1 Hicks, Arthur 66,300 14,100 81,000 0 431 1 1- 26- 8<br />

21.031-2-12 Depue, Allen 75,800 8,900 82,000 0 210 1 1- 31- 9<br />

Page Totals Parcels 37 3,609,200 423,500 3,809,400<br />

Page 6 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.031-2-13 Hicks, Arthur J. 64,200 8,800 67,100 0 210 1 1- 19-12<br />

21.031-2-14 Paradis, Richard C. 86,000 13,400 91,000 0 210 1 1- 17- 6<br />

21.031-2-15 Dumas, Maria 96,200 14,200 101,000 0 210 1 1- 19- 7<br />

21.031-2-16 Middlemiss, Gary 80,000 6,900 85,000 0 210 1 1- 5- 4<br />

21.031-2-17 McGaw, Kathleen (LU) 55,300 8,800 58,000 0 210 1 1- 18- 3<br />

21.031-2-18 Arquiett, Robert W. 53,000 8,800 40,000 0 220 1 1- 10-10<br />

21.031-2-19 Brady, Timothy T. 55,100 8,600 40,000 0 220 1 1- 13-10<br />

21.031-2-20 Wright, James A (Etal) 97,500 9,400 80,000 0 210 1 1- 29-14<br />

21.031-2-21 Mourick, Travis J. 61,100 6,800 64,000 0 210 1 1- 8-11<br />

21.031-2-22 Newton, Candide A. 116,500 10,800 120,000 0 210 1 1-14-1.2<br />

21.031-2-23 Tiernan, William 98,300 14,500 102,000 0 433 1 1- 10- 7<br />

21.031-2-24 <strong>Waddington</strong> Land & Autocycle 311,800 17,500 256,000 0 447 1 1- 10- 6<br />

21.031-2-25 Hicks, Arthur 7,900 9,800 9,800 0 330 1 1- 26-13<br />

21.031-2-26 Ruddy, <strong>St</strong>acy L. 77,100 8,200 82,000 0 210 1 1- 1- 6<br />

21.031-2-27.1 Sharlow, Roger J. 13,300 4,000 4,000 0 311 1 1- 29- 2.1<br />

21.031-2-27.2 Delorme, Nathaniel N. 3,000 5,600 5,600 0 311 1<br />

21.031-2-27.31 Sharlow, Roger 4,000 3,000 3,000 0 311 1<br />

21.031-2-27.32 Demers, Wayne Jr. 2,000 4,000 4,000 0 311 1<br />

21.031-2-28 Pemberton, Gerald C. 77,800 8,500 80,000 0 484 1 1- 1-10<br />

21.031-2-29 Reynolds, David M. 75,800 8,400 76,000 0 210 1 1- 13- 7<br />

21.031-2-30 Delorme, Nathaniel N. 84,900 8,200 87,000 0 210 1 1- 3- 3<br />

21.031-2-31 Demers, Wayne W. 72,900 8,200 78,000 0 210 1 1- 12-12<br />

21.031-3-1 Fobare, Paul 20,400 20,400 20,400 0 311 1 1- 9- 3<br />

21.031-3-2 Martin, Shirley 102,000 12,100 102,000 0 210 1 1- 15-13<br />

21.031-3-3.1 Martin, Mildred J. 52,500 14,800 55,800 0 210 1 1- 31- 2<br />

21.031-3-4.1 Martin, Mildred J. 8,500 10,000 10,000 0 311 1 1- 4- 4<br />

21.031-3-4.3 Martin, Robert J. 9,000 11,000 11,000 0 311 1<br />

21.031-3-4.41 Martin, Mildred J. 9,000 10,000 10,000 0 311 1<br />

21.031-3-4.42 Martin, Mildred J. 7,300 8,000 8,000 0 311 1<br />

21.031-3-5.2 Thompson, Robert E. 151,600 16,700 156,600 0 210 1<br />

21.031-3-5.11 Thompson, Robert E. 13,300 14,300 14,300 0 311 1 1- 28-15<br />

21.031-3-5.12 Mayette, Julie 178,100 13,600 200,000 0 210 1<br />

21.031-3-6 Sharlow , Edwin E. 62,900 15,600 69,000 0 484 1 8-101- 7<br />

21.031-3-7.1 Seaway Trail Carwash, LLC 77,800 12,000 65,000 0 449 1<br />

21.031-3-7.2 Seaway Trail Carwash, LLC 32,000 12,000 86,000 0 435 1<br />

21.031-3-8 Pierce, Kenneth 137,800 16,900 150,000 0 210 1<br />

21.031-4-2 Pavelski, Michael A. 148,500 15,600 160,000 0 210 1 1- 20- 6<br />

Page Totals Parcels 37 2,604,400 399,400 2,651,600<br />

Page 7 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.031-4-3 Sovie, Richard J. 121,100 11,400 124,800 0 210 1 1- 19- 4<br />

21.031-4-7.2 Haenel, Vicky 145,500 15,600 156,200 0 210 1 1- 13- 5.2<br />

21.031-4-7.4 Peacock, Julie M. 86,900 10,900 89,000 0 210 1 1- 13- 5.4<br />

21.031-4-7.5 Lauterbach, Richard 131,200 15,600 150,000 0 210 1 1- 130 5.5<br />

21.031-4-7.32 Mayette, Douglas A. 9,000 12,000 12,000 0 311 1<br />

21.031-4-7.311 Burgoyne, Belle 200,000 10,900 191,000 0 210 1 1- 13- 5.31<br />

21.031-4-7.312 Pandit, Sailesh 161,500 10,900 160,000 0 210 1 1-13-5.32<br />

21.031-4-10 Sheets, Lloyd 136,000 13,800 142,000 0 210 1 PT 1-13-5<br />

21.031-5-1.2 Eick, Margaret Family 335,800 66,000 335,800 0 210 W 1<br />

* 21.031-5-1.12<br />

Auringer, John E. 335,800 66,000 335,800 0 210 W 1<br />

21.031-5-1.13 Magnusson, Richard K. 335,800 64,000 335,800 0 210 W 1<br />

21.031-5-1.121 Auringer, John E. 68,000 335,800 0 210 W 1<br />

21.031-5-2 LaLonde, Beverly A. 263,500 66,000 263,500 0 210 W 1 1-2-4.3<br />

21.031-5-3 Regan, Vincent W. 83,200 67,900 67,900 0 311 W 1<br />

21.031-5-4 Ritter, Robert V (Trust) 220,400 67,900 220,400 0 210 W 1 1-2-4.4<br />

21.031-5-5 Krol, John C. 335,800 73,100 305,000 0 210 W 1 1- 2- 4.2<br />

21.031-5-6 Village <strong>of</strong> <strong>Waddington</strong> 25,000 51,400 51,400 0 311 8<br />

21.031-5-7 New York <strong>St</strong>ate Power Authority 4,400 12,000 12,000 0 311 8<br />

21.031-5-8 New York <strong>St</strong>ate Power Authority 700 6,000 6,000 0 311 8<br />

21.031-5-9 New York <strong>St</strong>ate Power Authority 800 7,000 7,000 0 311 8<br />

21.031-5-10 New York <strong>St</strong>ate Power Authority 800 10,000 10,000 0 311 8<br />

21.031-5-11 New York <strong>St</strong>ate Power Authority 700 8,000 8,000 0 311 8<br />

* 21.031-5-12<br />

Auringer, John E. 700 700 700 0 311 1<br />

21.031-5-13 New York <strong>St</strong>ate Power Authority 100 5,000 5,000 0 311 8<br />

21.031-5-16 Acres, Chad E (Trust) 154,000 140,000 140,000 0 314 W 1 1-2-4.111<br />

21.031-5-17 Lenney, Robert J. 224,000 70,000 224,000 0 210 W 1<br />

21.031-6-1.1 <strong>Waddington</strong> Real Estate 16,100 15,000 20,000 0 312 1 1- 13- 5.11<br />

21.031-6-2 Henry, Roger 12,500 13,900 130,000 0 210 1<br />

21.031-6-3 Bailey, Suzanne I. 69,900 8,600 78,800 0 210 1 1- 2- 1<br />

21.031-6-4 Ellis, James D. 62,800 8,100 71,000 0 210 1 1- 3-12<br />

21.031-6-5 Mayette, Matthew G. 81,600 10,400 98,000 0 210 1 1- 19- 3<br />

21.031-6-7 Bogart, Toby W. 5,900 7,100 7,100 0 311 1 999-037-1.2<br />

21.031-6-8 Searles, Harry B. 78,700 10,800 86,000 0 210 1 1- 2- 2<br />

21.031-6-9 <strong>Waddington</strong> Real Estate 5,700 12,400 12,400 0 314 1<br />

21.031-6-10 <strong>Waddington</strong> Real Estate 5,700 12,800 12,800 0 314 1<br />

21.031-6-11 <strong>Waddington</strong> Real Estate 3,400 13,800 13,800 0 314 1<br />

21.031-6-12 <strong>Waddington</strong> Real Estate 3,400 13,800 13,800 0 314 1<br />

Page Totals Parcels 35 3,321,900 1,010,100 3,896,300<br />

Page 8 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.031-6-15 Mayette, Matthew G. 3,400 4,200 4,200 0 314 1<br />

21.031-6-16 <strong>Waddington</strong> Real Estate 4,600 8,000 8,000 0 314 1<br />

21.031-6-17 <strong>Waddington</strong> Real Estate 3,400 8,000 8,000 0 314 1<br />

21.031-6-18 McGee, Sean 8,000 14,000 14,000 0 314 1<br />

21.031-6-19 <strong>Waddington</strong> Real Estate 5,700 9,000 9,000 0 314 1<br />

21.032-1-23.1 <strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> 10,200 11,600 11,600 0 311 8 1- 14- 1.1<br />

21.032-1-24 <strong>Town</strong> Of <strong>Waddington</strong> Exempt 546,700 14,700 627,000 0 652 8 8-100-10<br />

21.032-1-25 <strong>Town</strong> Of <strong>Waddington</strong> Exempt 25,100 10,400 128,000 0 651 8 8-100- 8<br />

21.032-1-26 <strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> 9,000 14,700 14,700 0 314 8<br />

21.032-2-3 Bliss, Marilyn 97,500 12,700 108,000 0 210 1 1- 17- 8<br />

21.032-2-4 Putney, Arden Dale (LU) 80,000 6,900 95,000 0 210 1 1- 22- 7<br />

21.032-2-5 Putney, Howard P. 5,900 8,400 8,400 0 311 1 1- 22- 6<br />

21.032-2-6 Bashaw-<strong>St</strong>rome, Bonnie J. 69,900 9,000 80,000 0 210 1 1- 9- 2<br />

21.032-2-7 Forman-Pemberton, Carol A (Rev. Trust) 52,500 7,600 60,000 0 210 1 1- 20-13<br />

21.032-2-8 Brown, Jacquelyn A. 40,000 10,900 40,000 0 210 1 1- 29-15<br />

21.032-2-9 Brooks, Timothy H. 68,600 9,800 71,000 0 210 1 1- 5-14<br />

21.032-2-10 Hill, Marion D. 80,000 10,400 87,000 0 210 1 1- 12- 9<br />

21.032-2-11 Frary, David A. 87,300 10,800 102,000 0 210 1 1- 21- 4<br />

21.032-2-12 Mitras, Lisa M. 74,200 10,900 77,000 0 210 1 1- 18-12<br />

21.032-2-13 Sweet, Alan E. 23,300 10,900 32,000 0 210 1 1- 26-10<br />

21.032-2-14 Hacker, Craig 61,100 8,200 78,000 0 210 1 1- 25- 4<br />

21.032-2-15 Greene, Darin J. 57,200 8,600 74,600 0 210 1 1- 31- 6<br />

21.032-2-16 Greene, Darin J. 61,100 10,100 64,000 0 220 1 1- 14- 3<br />

21.032-2-17 Cassada, Bruce D. 51,000 9,500 62,000 0 210 1 1- 14-12<br />

21.032-2-18.1 McAllister, Robert T (LU) 66,900 8,700 78,000 0 210 1 1- 28- 3<br />

21.032-2-18.2 McAllister, Jack 3,800 6,400 11,000 0 270 1<br />

21.032-2-19 Kirby, John S. 62,800 8,300 72,000 0 210 1 1- 8-10<br />

21.032-2-20 29-31 Maple <strong>St</strong>reet Land Trust 51,900 8,300 64,000 0 220 1 1- 6- 4<br />

21.032-2-21 Gauthier, Gary 42,300 9,200 50,000 0 210 1 1- 30-15<br />

21.032-2-23.1 Brock, Kelsey 103,500 14,800 114,000 0 210 1 1- 29- 6<br />

21.032-2-24 LaDue, Carolyn 77,100 12,600 81,300 0 210 1 1- 31-12<br />

21.032-2-25 White, Harold 75,800 12,700 91,000 0 210 1 1- 29- 7<br />

21.032-2-26 Pier, Jeffrey J. 182,100 9,800 182,100 0 210 1 1- 11-13<br />

21.032-3-1 Hough, Richard 100,300 8,800 102,000 0 210 1 1- 2-12<br />

21.032-3-2.1 Hough, Richard 300 300 300 0 311 1 1- 23- 8<br />

21.032-3-3 Bissell, Robert F. 80,800 8,900 92,000 50 484 1 1- 21- 9<br />

21.032-3-4 Brown, Charles E. 112,100 13,100 120,000 0 210 1 1- 27- 8<br />

Page Totals Parcels 37 2,485,400 361,200 2,921,200<br />

Page 9 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.032-3-5 Williams, David W. 75,600 9,600 82,000 0 210 1 1- 2- 5<br />

21.032-3-6 Young, June H (LU) 87,400 8,300 93,000 0 210 1 1- 30- 1<br />

21.032-3-7 Village Of <strong>Waddington</strong> Exempt 266,200 11,400 514,000 0 611 8 8-100-13<br />

21.032-3-8 MacDonald, <strong>St</strong>ephen H. 68,900 11,000 72,000 0 210 1 1- 29- 5<br />

21.032-3-9 Kentner, Ray Kenneth 28,000 5,700 42,000 0 210 1 1- 6-13<br />

21.032-3-10 <strong>Town</strong> Of <strong>Waddington</strong> Exempt 214,500 8,600 340,000 0 652 8 8-100- 9<br />

21.032-3-11 Dinneen, John J. III. 97,000 9,000 105,000 0 210 1 1- 23-13<br />

21.032-3-12 Dinneen, Daniel 75,800 7,300 84,000 0 210 1 1- 13- 9<br />

21.032-3-13 Kentner, Colleen 45,300 10,400 55,000 0 210 1 1- 5- 8<br />

21.032-3-14 Field, Terrence A. 81,600 10,400 96,000 0 210 1 1- 21-12<br />

21.032-3-15 Carr, William G (LU) 61,000 9,400 70,000 0 210 1 1- 27- 6<br />

21.032-3-16 Buchardt, Judith A. 48,100 8,500 58,000 0 210 1 1- 10- 2<br />

21.032-3-17 Carr, Ruth A. 63,600 7,900 68,000 0 210 1 1- 18- 1<br />

21.032-3-18 Phillips, Mary (LU) 58,300 7,900 70,000 0 210 1 1- 21- 3<br />

21.032-3-19 Raftovich, Rose (Trustee) 66,200 4,300 68,000 0 210 1 1- 18- 6<br />

21.032-3-20.1 Badlam, Hiram L (LU) 69,900 8,200 79,000 0 210 1 1- 11- 4<br />

21.032-3-21 16 Main <strong>St</strong>reet Land Trust 50,300 3,800 60,000 0 484 1 1- 1- 3<br />

21.032-3-22 18 Main <strong>St</strong>reet Land Trust 53,800 3,800 64,000 0 481 1 1- 14- 9<br />

21.032-4-1 Association for Neighborhood 93,500 6,800 120,000 0 481 1 1- 4- 1<br />

21.032-4-2 Bisbee, James M. 66,900 9,500 77,400 0 210 1 1- 11-10<br />

21.032-4-3 Fay, Christopher 72,900 6,800 76,000 0 210 1 1- 31-11<br />

21.032-4-4 Fay, Christopher S. 71,400 9,000 80,000 0 210 1 1- 8-13<br />

21.032-4-5 Jock, Gerald P. Jr. 79,000 11,700 94,000 0 210 1 1- 10- 1<br />

21.032-4-6 O'Brian, Virginia 48,100 9,800 56,000 0 210 1 1- 20-14<br />

21.032-4-7 <strong>St</strong> Mary's <strong>of</strong> <strong>Waddington</strong> 4,800 8,200 8,200 0 311 8 1- 17- 4<br />

21.032-4-8 McIntosh, Allan G. 64,000 7,900 68,000 0 210 1 1- 6-15<br />

21.032-4-9.1 <strong>St</strong> Marys Church Exempt 239,800 15,300 239,800 0 620 8 PT 8-101-12<br />

21.032-4-10 <strong>St</strong> Marys Catholic Church 377,300 14,000 475,000 0 620 8 8-101-13<br />

21.032-4-11 <strong>St</strong> Mary's Church Exempt 5,700 8,000 8,000 0 620 8 8-101-12<br />

21.032-4-12.1 Greene, William R. 65,600 10,400 72,000 0 210 1 1- 20-15<br />

21.032-4-13 Pemberton, Gerald 74,200 10,900 84,000 0 210 1 1- 20-11<br />

21.032-4-14 <strong>St</strong> Pauls Episcopal Church 311,300 10,200 602,000 0 620 8 8-101-15<br />

21.032-4-15 <strong>St</strong> Pauls Episcopal Manse 84,600 13,800 99,000 0 210 8 8-103- 4<br />

21.032-4-16 Smith, Melissa A. 38,800 12,500 88,000 0 210 1 1- 17-15<br />

21.032-4-17 Rodriguez, Carol C. 45,000 9,400 58,000 0 210 1 1- 29- 4<br />

21.032-4-18 The Moore Foundation Inc 77,000 12,240 110,000 0 210 8 1- 22-15<br />

21.032-4-19 Bissell-Aubin, Amy 4,200 7,000 7,000 0 311 1 1- 4- 9<br />

Page Totals Parcels 37 3,335,600 338,940 4,442,400<br />

Page 10 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.032-4-20.1 Bissell-Aubin, Amy 61,100 3,600 64,000 0 210 1 1- 4- 8<br />

21.032-4-21.1 Robertson, Kim D. 37,700 4,700 49,000 0 210 1 1- 19- 1<br />

21.032-4-22 Miller, Scott J. 84,600 4,800 45,000 0 421 1 1- 25-11<br />

21.032-4-23 Miller, Scott J. 1,900 1,900 1,900 0 311 1 1- 13- 2<br />

21.032-5-1 KFM Realty, LTD 349,800 13,900 386,000 0 454 1 1- 15-11<br />

21.032-5-2.2 Hepburn Medical Center 239,800 12,200 173,000 0 642 8<br />

21.032-5-2.11 Robert J Marshall, Inc 8,700 12,000 12,000 0 330 1 1- 16-11.1<br />

21.032-5-2.12 Marshall, Robert 9,700 12,000 12,000 0 330 1<br />

21.032-5-3 Cressey, Helen D (LU) 108,000 12,600 116,000 0 210 1 1- 6- 5<br />

21.032-5-4 LeFleur, Cathy A. 72,900 10,000 84,000 0 210 1 1- 4-13<br />

21.032-5-5.1 Hale, Gene 68,800 14,000 82,000 0 210 1 1- 4-14<br />

21.032-5-6 Clark, Charles R. Jr. 86,100 15,300 90,000 0 210 1 1- 19- 8<br />

21.032-5-7 Willard, Marion Short (Trust) 58,300 16,500 69,000 0 210 1 1- 29- 9<br />

21.032-5-9 Spears, Patricia 69,900 21,000 80,000 0 210 1 1- 25-13<br />

21.032-5-10 Tiernan, Kelly J. 66,900 13,300 74,000 0 210 1 1- 27-15<br />

21.032-5-11 Tiernan, Joseph 72,900 7,900 82,000 0 220 1 1- 28- 1<br />

21.032-5-12 Houmiel, James F. 64,000 9,500 74,000 0 210 1 1- 1- 9<br />

21.032-5-13 Lanning, Donna J. 59,700 13,000 71,000 0 210 1 1- 22- 9<br />

21.032-5-14 Ryan, Thomas C. 59,700 8,500 68,000 0 210 1 1- 7-15<br />

21.032-5-15 Emrick, Angela 91,000 12,600 90,000 0 210 1 1- 14- 2<br />

21.032-5-16 Reed, Glenn O. 29,200 9,200 29,200 0 270 1 1- 30-12<br />

21.032-5-17 Sehring, George 12,000 14,200 14,200 0 311 1 1- 7-10.1<br />

21.032-5-18 Burnett, Laura 190,100 16,600 176,000 0 281 1 1- 28- 9<br />

21.032-5-19 LeFleur, George A. 102,000 10,600 120,000 0 210 1 1- 30-13<br />

21.032-5-20 Dykes, Carole H. 129,700 12,700 129,700 0 210 1 1- 10- 3<br />

21.032-5-21.1 Finnegan, Joseph A. 6,800 12,000 12,000 0 311 1 1- 12- 6<br />

21.032-5-22 <strong>Town</strong> Of <strong>Waddington</strong> Exempt 49,500 8,100 42,200 0 690 8 8-100-11<br />

21.032-5-24 LeFleur, George A. 3,500 6,000 6,000 0 311 1<br />

21.032-5-25 Village Of <strong>Waddington</strong> 4,972,000 8,000 4,972,000 0 822 8 8-101- 3<br />

21.032-5-26 Bernard, Kathleen A. 60,300 10,500 66,000 0 210 1 1- 28- 9.2<br />

21.032-5-28 Helmase, <strong>St</strong>ephen 146,600 12,500 148,000 0 210 1<br />

21.032-5-29 Santamont, Wayne J. 93,300 11,700 97,000 0 210 1<br />

21.032-6-1 Brown, Mary P. 49,400 11,700 60,000 0 210 1 1- 3- 2<br />

21.032-6-2.1 Green, William 69,900 9,600 79,000 0 220 1 1- 31- 4.1<br />

21.032-6-3 Domena, Robert 84,600 11,300 95,000 0 210 1 8-102- 4<br />

21.032-6-4.1 Domena, Robert 4,300 7,100 7,100 0 311 1 1- 7- 5<br />

21.032-6-5 Murray, Donald F. 109,000 9,500 119,000 0 421 1 1- 7- 3<br />

Page Totals Parcels 37 7,783,700 400,600 7,895,300<br />

Page 11 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.032-6-6.11 Krom, Carol L. 107,400 12,700 115,000 0 210 1 1- 7- 4<br />

21.032-6-7 Erwin, Shawn R. 86,300 12,300 102,000 0 210 1 1- 8- 7<br />

21.032-6-8 Wilkinson, Wade 92,600 9,400 94,000 0 210 1 1- 3- 5<br />

21.032-6-9 Sehring, George T. 59,700 12,100 66,000 0 210 1 1- 3- 4<br />

21.032-6-10 Tiernan, Joseph F. 30,500 19,200 36,000 0 449 1 1- 27-13<br />

21.032-6-11 Brookside Cemetery 28,800 22,000 22,000 0 695 8 8-102-14<br />

21.032-6-12 Kocher, Warren A. 104,900 14,300 111,000 0 210 1 1- 14- 6<br />

21.032-6-13 Babcock, Harold 46,500 10,700 46,500 0 270 1 1- 1-14<br />

21.032-6-14.1 Griffith, Mary (LU) 37,700 9,400 42,000 0 210 1 1- 15- 3<br />

21.032-6-15.2 Thew, James 99,100 13,800 110,000 0 210 1<br />

21.032-6-15.3 Ryan, Thomas Corcroan 14,800 14,800 14,800 0 311 1<br />

21.032-6-15.11 Adams, George G. 142,700 14,100 158,000 0 210 1 1- 1- 2<br />

21.032-6-16 Brock, Joanne 26,300 9,000 31,400 0 270 1 1- 16- 3<br />

21.032-6-17 Cameron, Thomas 3,000 2,000 2,000 0 311 1 1- 39-14<br />

21.032-6-18 Cameron, Sarah 65,600 12,100 68,000 0 210 1 1- 3-15<br />

21.032-6-19.2 Miller, Michael 2,400 3,500 3,500 0 311 1<br />

21.032-6-20.1 Miller, Karen L. 104,900 11,500 110,000 0 210 1 1- 18-14<br />

21.032-6-21.1 Palmer, James E. 107,900 12,300 117,000 0 210 1 1- 20- 5<br />

21.032-6-22 Palmer, James E. 49,400 9,300 54,000 0 210 1 1- 13-11.1<br />

21.032-6-23 Mott, Bryan F. 51,000 12,100 57,000 0 210 1 1- 2-13<br />

21.032-6-24 Mott, Brian 108,400 11,700 139,000 0 210 1 1- 6- 8<br />

21.032-6-25.1 Robinson, Shirley L. 53,500 11,500 58,000 0 210 1 1- 23-10.1<br />

21.032-6-26 Tiernan, Joseph F. 12,600 12,600 12,600 0 311 1 1- 27-14<br />

21.032-6-28 Simon, Tammy L. 58,300 11,300 71,000 0 210 1<br />

21.032-7-1 Village Of <strong>Waddington</strong> Exempt 13,500 16,500 16,500 0 963 8 8-101- 5<br />

21.032-7-2 Pickert, Daphne A. 72,900 10,700 80,000 0 210 1 1- 11-14<br />

21.032-7-3.1 Pickert, Carolyn 78,700 7,100 87,000 0 210 1 1- 21- 5<br />

21.032-7-4.1 Dumas, Gary J. 49,400 9,400 58,000 0 210 1 1- 18- 4<br />

21.032-7-5 Amo, Timothy J. II. 77,100 11,100 98,000 0 210 1 1- 12-10<br />

21.032-7-7 Bogart, <strong>St</strong>ephen W. 66,900 10,500 78,000 0 210 1 1- 24-10<br />

21.032-7-8 Lynch, Katherine R. 58,000 10,500 68,000 0 210 1 1- 23-14<br />

21.032-7-9.1 Whyte, Barbara 65,600 10,200 75,000 0 210 1 1- 14-11<br />

21.032-7-10 Kocher, Scott Anthony 67,600 11,700 85,000 0 210 1 1- 9- 8<br />

21.032-7-11 O'Bryan, Matthew D. 87,300 11,800 98,000 0 210 1 1- 21- 7<br />

21.032-7-12.1 Wilson, Michael J. 59,700 10,900 68,500 0 210 1 1- 19- 5<br />

21.032-7-13.1 Bass, Lorry A. 51,000 12,300 67,000 0 210 1 1- 4- 3<br />

21.032-7-13.2 Reynolds, David M. 81,600 9,100 91,000 0 210 1<br />

Page Totals Parcels 37 2,323,600 425,500 2,610,800<br />

Page 12 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.032-7-14 Keyes, Ronald C. 41,100 8,400 42,000 0 312 1 1- 8- 8<br />

21.032-7-15 Laying, Davalene 52,500 14,200 62,000 0 210 1 1- 25- 5<br />

21.032-7-16 Miller, Angela M. 74,200 12,300 84,000 0 210 1 1- 2- 3<br />

21.032-7-18.1 Berry, Daniel 51,000 12,300 62,000 0 210 1 1- 2- 8<br />

21.032-7-19 Prentice, Shaun L. 72,300 10,700 84,000 0 210 1 1- 3-11<br />

21.032-7-20.1 Bouchard, Robert S. 61,000 8,500 68,000 0 210 1 1- 8- 3.1<br />

21.032-7-20.2 Prentice, Shaun L. 9,600 8,500 14,000 0 312 1 1-8-3.2<br />

21.032-8-1.1 Osher, Allen P. 81,600 13,100 87,000 0 210 1 1- 5-15.1<br />

21.032-8-1.2 Village <strong>of</strong> <strong>Waddington</strong> 2,000 3,200 3,200 0 311 8 1- 5-15.2<br />

21.032-8-2 Todd, William S. 94,400 13,400 106,000 57 210 1 1- 1-15<br />

21.032-8-3 Hill, Mark R. 103,400 8,900 115,000 0 210 1 1- 10-12<br />

21.032-8-4 Johnson, Kathryn A. 66,200 10,600 77,000 0 210 1 1- 14- 4<br />

21.032-8-5 Jackson, Barbara J. 74,200 7,800 87,000 0 210 1 1- 26- 7<br />

21.032-8-6 Sharlow, Henry 64,000 11,800 69,000 0 210 1 1- 17- 3<br />

21.032-8-7 Methodist Parsonage 48,100 6,400 68,000 0 620 1 8-102- 2<br />

21.032-8-8 Methodist Church 366,100 8,400 366,100 0 210 8 1- 18- 2<br />

21.032-8-9 Pizzgi Inc 229,900 12,300 242,000 0 480 1 8-101-10<br />

21.032-8-10 Kavan, Bruce A. 93,300 10,800 97,000 0 210 1 1- 10- 8<br />

21.032-8-11 Phillips, Elizabeth 51,000 11,800 66,000 0 210 1 1- 21- 2<br />

21.032-8-12 LaClair, Joyce 61,100 8,800 72,000 0 210 1 1- 2-15<br />

21.032-8-13 McAllister, Robert Lee 52,500 12,100 61,000 0 210 1 1- 17-12<br />

21.032-8-14 Chamberlain, Jenna L. 5,900 9,300 9,300 0 311 1 1- 24- 1<br />

21.032-8-15 Chamberlain, Jenna L. 74,200 12,300 84,000 0 210 1 1- 24- 2<br />

21.032-8-16 Murphy, Michael J. Jr. 124,600 14,800 138,000 0 210 1 1- 9- 1<br />

21.032-8-17 Cameron, Debra J. 66,000 9,100 74,000 0 210 1 1- 28-13<br />

21.032-8-18 McGee, Michael 111,300 11,600 126,000 0 210 1 1- 18- 9<br />

21.032-8-19 Sharlow, Roger J. 52,500 8,100 58,000 0 210 1 1- 20- 1<br />

21.032-8-20 LeClair, Kathleen E. 56,800 8,100 64,000 0 210 1 1- 14-13<br />

21.032-8-21 Spadaccini, Philip 66,900 10,500 74,000 0 210 1 1- 28-12<br />

21.032-8-23 Pizzgi Inc 19,800 27,900 27,900 0 330 1 8-101- 9<br />

21.032-8-24 <strong>Town</strong> Of <strong>Waddington</strong> Exempt 48,400 18,400 48,400 0 556 8 8-101-4<br />

21.032-8-25 Village Of <strong>Waddington</strong> Exempt 233,200 13,000 371,000 0 662 8 8-101- 2<br />

21.032-8-26 Allison, Marie 8,600 10,000 10,000 0 311 1<br />

21.033-1-4.1 Ellis, Ray N C. 98,400 15,100 114,000 0 210 1 1- 8- 6<br />

21.033-1-5 Ellis, Ray N. 12,500 12,800 12,800 0 311 1 1- 31- 7<br />

21.033-1-6 Boak, William 159,700 16,500 172,000 0 280 1 1- 19-10<br />

21.033-1-7 Campbell, John W. 69,900 13,900 80,000 0 220 1 1- 1- 4<br />

Page Totals Parcels 37 2,958,200 425,700 3,395,700<br />

Page 13 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.033-1-8 Davis, Regina Hawkins 35,100 12,400 39,000 0 210 1 1- 30- 3<br />

21.033-1-9 Rutherford, Byron R. 90,200 12,000 94,200 0 210 1 1- 30- 2.3<br />

21.033-1-10 Rutherford, Matthew S. 117,800 12,200 121,000 0 210 1 PT 1-30-2.1<br />

21.033-1-11 Burdick, Claude E. 92,600 14,000 102,000 0 210 1 1- 19-13<br />

21.033-1-12 <strong>Lawrence</strong>, <strong>St</strong>even 148,500 11,000 158,000 0 210 1 1- 18-10<br />

21.033-1-13 Arquiett, Robert W. 123,700 13,000 123,000 0 210 1 1- 18- 5<br />

21.033-1-14 Hayes, Ryan P. 135,500 11,700 138,000 0 210 1 1- 13- 6<br />

21.033-1-15 Caulkins, Maureen A. 106,000 10,500 116,000 0 210 1 1- 12- 4<br />

21.033-1-16 Brady, Jay V. 173,300 49,500 173,300 0 210 W 1 1- 2-14<br />

* 21.033-1-17<br />

Smith, Dana M. 254,400 40,000 254,400 0 210 W 1 1- 7- 8<br />

21.033-1-17.1 Smith, Dana M. 49,500 260,000 0 210 W 1 1- 7- 8<br />

* 21.033-1-18<br />

Smith, Dana M & Louise C 49,400 49,400 49,400 0 311 W 1 1- 3-13<br />

21.033-1-18.1 Smith, Dana M & Louise C 49,400 49,400 0 311 W 1 1- 3-13<br />

* 21.033-1-19<br />

Schreier, Phililip A. 272,000 49,500 272,000 0 210 W 1 1- 4- 2<br />

21.033-1-19.1 Schreier, Phililip A. 49,500 278,000 0 210 W 1 1- 4- 2<br />

* 21.033-1-20<br />

Grant, Colin K. Jr. 372,000 49,500 372,000 0 210 W 1 1- 28- 2<br />

21.033-1-20.1 Grant, Colin K. Jr. 45,900 372,000 0 210 W 1 1- 28- 2<br />

21.033-1-21.1 <strong>Lawrence</strong>, Faye C. 224,500 49,500 224,500 0 210 W 1 1- 28- 6<br />

21.033-1-22.1 Locy, James 233,200 49,500 233,200 0 210 W 1 1- 22-14<br />

* 21.033-1-23<br />

<strong>Lawrence</strong>, <strong>St</strong>even R. 49,500 49,500 49,500 0 311 W 1 1- 23- 4<br />

21.033-1-23.1 <strong>Lawrence</strong>, <strong>St</strong>even R. 49,500 49,500 0 311 W 1 1- 23- 4<br />

21.033-1-24.1 <strong>Lawrence</strong>, Royal S. 154,200 49,500 158,000 0 210 W 1 1- 15- 1<br />

21.033-1-25 <strong>Lawrence</strong>, Roger 183,600 49,500 183,600 0 210 W 1 1- 14-15<br />

21.033-1-26 Heisse, RoseMarie C. 190,300 49,500 185,000 0 210 W 1 1- 3- 9<br />

21.033-1-27.1 Abrunzo, Frank A. 92,000 99,000 99,000 0 311 W 1 1- 30- 5<br />

21.033-1-28.2 Condlin, Richard 138,400 49,500 138,400 0 210 W 1 1- 34- 4.2<br />

21.033-1-29 Patnode, Barbara 61,100 16,800 66,700 0 210 1 1- 20- 8<br />

21.033-1-30 Runions, Bernard R. 43,600 8,900 64,000 0 210 1 1- 30- 9<br />

21.033-1-31 Ryan, Harold (LU) 121,100 12,600 134,000 0 210 1 1- 26- 3<br />

21.033-1-32 Costanzo, Kim 87,400 10,900 108,000 0 210 1 1- 9-12<br />

21.033-1-33 Shampine, David J (LU) 112,600 10,700 122,000 0 210 1 1- 24-15<br />

21.033-1-34 Blackmore, James R. 82,000 14,400 88,000 0 210 1 1- 26- 1<br />

21.033-1-35 <strong>St</strong> Mary's Catholic Church 11,800 15,600 15,600 0 695 8 8-102- 9<br />

21.033-1-41 Palmer, Justin D. 160,200 11,600 164,000 0 210 1<br />

21.033-1-43 Babcock, S Joan (LU) 206,200 49,500 206,200 0 210 W 1 1- 28- 6<br />

21.033-1-44 Palmer, Justin D. 6,700 8,400 8,400 0 311 1 1- 30- 2.1<br />

21.033-1-46 <strong>Lawrence</strong>, <strong>St</strong>even R. 7,900 11,000 11,000 0 311 1<br />

Page Totals Parcels 32 3,139,500 956,500 4,283,000<br />

Page 14 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.033-1-47 Village <strong>of</strong> <strong>Waddington</strong> 16,300 12,800 12,800 0 311 8<br />

21.033-1-48 Condlin, Charles T. 1,000 1,700 1,700 0 311 8<br />

21.033-1-50 New York <strong>St</strong>ate Power Authority 800 1,300 1,300 0 311 8<br />

21.033-1-51 New York <strong>St</strong>ate Power Authority 2,000 3,300 3,300 0 311 8<br />

21.033-1-52 New York <strong>St</strong>ate Power Authority 2,000 2,800 2,800 0 311 8<br />

* 21.033-1-54<br />

<strong>Lawrence</strong>, <strong>St</strong>even R. 1,500 1,500 1,500 0 314 1<br />

21.033-1-57 Babcock, S. Joan 100 100 100 0 311 1<br />

* 21.033-1-58<br />

Grant, Colin K. Jr. 1,500 1,500 1,500 0 314 1<br />

* 21.033-1-59<br />

Schreier, Phillip A. 1,000 1,000 1,000 0 311 1<br />

* 21.033-1-60<br />

Smith, Dana M & Louise C 1,000 1,000 1,000 0 314 1<br />

* 21.033-1-61<br />

Smith, Dana M. 2,000 2,000 2,000 0 311 1<br />

21.033-1-62 New York <strong>St</strong>ate Power Authority 2,000 2,800 2,800 0 314 8<br />

21.033-2-1 <strong>St</strong> Mary's Catholic Church 14,000 14,000 14,000 0 695 8 8-102- 8<br />

21.033-2-2 Thomas, <strong>Lawrence</strong> W. 306,600 92,600 326,000 0 552 1 1- 27- 3<br />

21.033-2-3 New York <strong>St</strong>ate Power Authority 55,000 30,400 30,400 0 314 8<br />

21.033-2-4 New York <strong>St</strong>ate Power Authority 4,000 8,700 8,700 0 314 8<br />

21.033-2-5 New York <strong>St</strong>ate Power Authority 8,000 12,500 12,500 0 314 8<br />

21.033-2-6 New York <strong>St</strong>ate Power Authority 5,500 15,800 15,800 0 314 8<br />

21.033-2-7 New York <strong>St</strong>ate Power Authority 4,000 12,100 12,100 0 314 8<br />

21.034-1-1 Thomas, <strong>Lawrence</strong> W. 26,400 32,400 32,400 0 910 1 PT 1-27-3<br />

21.034-1-2 Mayette, Douglas A. 14,400 16,200 16,200 0 322 1 1- 16- 7<br />

21.034-1-3 Thomas, <strong>Lawrence</strong> W. 8,500 19,000 19,000 0 314 1<br />

21.039-1-2.12 Martin, Olivia 4,600 7,500 7,500 0 311 1 1- 12- 3.12<br />

21.039-1-3 Martin, Olivia 107,900 11,700 110,000 0 210 1 1- 15-12<br />

21.039-1-4 Sharlow, Roger J. 111,300 12,600 115,000 0 210 1 1- 16- 4<br />

21.039-1-5.1 Ashley, Kenneth W. 117,200 20,400 130,000 0 210 1 1- 16- 8<br />

21.039-1-8 JBSL Corporation 264,000 42,500 320,000 0 441 1 1- 12- 3.11<br />

21.039-1-9 Martin, Olivia 3,400 10,000 10,000 0 311 1<br />

21.039-3-1 <strong>Waddington</strong> Real Estate 7,400 12,300 12,300 0 311 1<br />

21.039-3-2 Caswell, Terry R. 5,900 11,000 11,000 0 311 1<br />

21.039-3-3 Caswell, Terry R. 9,600 14,000 14,000 0 311 1<br />

21.039-3-4 <strong>Waddington</strong> Real Estate 3,500 13,000 13,000 0 311 1<br />

21.039-3-5 <strong>Waddington</strong> Real Estate 3,500 14,000 14,000 0 311 1<br />

21.039-3-6 <strong>Waddington</strong> Real Estate 3,500 14,000 14,000 0 311 1<br />

21.039-3-7 Brown, William Jr. 55,300 10,700 62,000 0 210 1 1- 3- 6<br />

21.039-3-8 Brown, William Jr. 2,200 3,000 3,000 0 311 1 1- 12- 3.2<br />

21.039-3-9 Barclay, Kathleen 99,100 16,000 99,100 0 210 1<br />

Page Totals Parcels 32 1,269,000 491,200 1,446,800<br />

Page 15 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.039-3-10 Hicks, Arthur J. 6,200 12,300 12,300 0 311 1<br />

21.039-3-11 <strong>Waddington</strong> Real Estate Mge 7,300 12,000 12,000 0 311 1 999-037-1.1<br />

21.039-3-12 <strong>Waddington</strong> Real Estate 3,500 8,000 8,000 0 311 1<br />

21.040-1-2.3 Harper, Dale A. 78,700 19,200 90,000 0 210 1<br />

21.040-1-2.21 Hamilton Gardens Inc 1,788,600 18,100 1,788,600 0 633 8 1- 11-12.22<br />

21.040-1-2.22 Village <strong>of</strong> <strong>Waddington</strong> 8,200 8,200 8,200 0 311 8<br />

21.040-1-2.111 Fairbridge, Donald J. 72,300 15,000 77,000 0 210 1<br />

21.040-1-3 Laraby, Edward Jr. 35,100 8,200 35,000 0 270 1 1- 12- 1<br />

21.040-1-4 Dezell, Ann Irene (LU) 58,300 11,600 62,000 0 210 1 1- 29-13<br />

21.040-1-5.1 Fairbridge, Richard 66,900 11,300 74,000 0 210 1 1- 8- 9<br />

21.040-1-6 Crump, William James 68,600 11,000 70,000 0 210 1 1- 6- 6<br />

21.040-1-7 Beldock, Barbara 71,400 11,500 74,000 0 210 1 1- 24-12<br />

21.040-1-8 Verizon New York Inc 41,600 6,200 41,600 0 831 6 6- 32- 3<br />

21.040-1-9 <strong>Lawrence</strong>, Donald E. 66,900 13,500 74,000 0 210 1 1- 14-14<br />

21.040-1-10 Mitchell, Janet S. 65,600 9,000 74,000 0 210 1 1- 3- 1<br />

21.040-1-11 Arquiett, Robert W. 19,300 10,800 29,000 0 270 1 1- 28- 8<br />

21.040-1-12 Rupert, Gerald L. 56,800 10,700 59,000 0 210 1 1- 23-15<br />

21.040-1-13 Rubin, Russell J. 49,400 10,300 60,000 0 210 1 1- 9- 4<br />

21.040-1-15.11 Hicks, Arthur 162,300 80,000 188,000 0 210 W 1 1- 1- 8.1<br />

21.040-1-16.1 McBath, Grace P (LU) 61,100 34,000 78,000 0 210 W 1 1- 17- 5<br />

21.040-1-17 Hicks, Arthur J. 5,900 8,200 8,200 0 311 1 1- 22-11<br />

21.040-1-18 Hicks, Arthur J. 94,700 11,000 99,000 0 210 1 1- 22-12<br />

* 21.040-1-19<br />

Badlam, Michael G. 69,000 7,500 69,000 0 210 1<br />

21.040-1-19.1 Badlam, Michael G. 15,000 98,000 0 210 1<br />

21.040-1-20.1 Harper, Dale A. 14,400 14,400 14,400 0 311 W 1 1- 11-12.1<br />

* 21.040-1-21.1<br />

Badlam, Michael G. 14,000 14,000 14,000 0 311 1<br />

21.040-1-21.2 Daniels, Jean B. 5,000 7,000 35,000 0 210 1<br />

21.040-1-22.1 Sweet, Melissa J. 9,600 16,000 16,000 0 311 1<br />

21.040-1-24 VanPatten, Everett M. 78,700 22,200 85,000 0 210 1 1- 28-11<br />

21.040-1-27 New York <strong>St</strong>ate Power Authority 100 400 400 0 314 8<br />

21.040-2-6 Mayette, James Richard 50,600 14,200 46,000 0 312 1 1- 29- 8.2<br />

21.040-2-7 <strong>St</strong> <strong>Lawrence</strong> Gas Co 100,800 8,900 100,800 0 873 6 6- 32- 7<br />

21.040-2-10 New York <strong>St</strong>ate Power Authority 4,000 14,300 14,300 0 314 8<br />

21.040-2-14 McAllister, Harold A. 7,000 13,600 13,600 0 311 1<br />

21.040-2-16 McAllister, Harold A. 28,700 38,000 38,000 0 314 W 1 1- 11- 1.21<br />

21.040-2-19 Mayette, Mary 355,900 108,000 360,000 0 210 W 1 1- 16-10<br />

21.040-2-21 Moore, Joseph 110,800 25,000 122,000 0 210 W 1 1- 11- 1.22<br />

Page Totals Parcels 35 3,654,300 637,100 3,965,400<br />

Page 16 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.040-2-22 Denison, Richard A. 9,200 10,000 10,000 0 311 W 1<br />

21.040-3-1.11 Tiernan, James 13,300 13,900 13,900 0 105 1 1- 24- 8.11<br />

21.040-3-2.12 Tiernan, James 19,800 21,500 21,500 0 105 1 1- 24- 8.2<br />

21.040-3-3 Village <strong>of</strong> <strong>Waddington</strong> 13,200 14,700 14,700 0 311 8 1- 24- 8.12<br />

21.040-3-4.1 Graves, Edgar G. 7,600 12,000 12,000 0 311 W 1 1-24-8.11<br />

21.040-3-5.1 Finnegan, Spencer 11,400 14,000 14,000 0 314 W 1 1- 24- 8.31<br />

21.040-3-6.1 Graves, Kenneth L. 12,000 12,000 12,000 0 314 W 1 1- 24- 8.32<br />

21.040-3-7.1 Bajakian, Edward 12,000 14,000 14,000 0 314 W 1 1- 24- 8.42<br />

21.040-3-10.1 Bajakian, Edward Haig 27,100 30,000 30,000 0 314 W 1<br />

21.040-4-1.1 <strong>St</strong>asko, Edward R. 100,700 20,000 102,000 0 210 W 1 1- 14- 5<br />

21.040-4-2.1 <strong>St</strong>asko, Edward R. 19,900 20,000 20,000 0 311 W 1 1- 22- 2<br />

21.040-4-3.1 Molnar, John C (LU) 19,900 21,000 21,000 0 311 W 1 1- 1-12<br />

21.040-4-4.1 Molnar, John C (LU) 60,400 7,000 62,000 0 210 W 1 1- 19- 2<br />

21.040-4-5.1 Phillips, Helen 95,600 26,000 95,600 0 270 W 1 1- 28- 4<br />

21.040-4-6 Molnar, John C (LU) 6,000 4,000 8,000 0 312 1 1- 29- 8.3<br />

21.040-4-7.1 Mossow, Lyle V. 76,300 18,000 87,000 0 210 1 1- 29- 8.4<br />

21.040-4-7.2 Brassard, Kevin J. 59,000 11,500 61,000 0 210 1<br />

21.040-5-1 Belgarde, Shirley G. 500 700 700 0 314 1<br />

21.041-1-1 Ruddy, Frederick C. 178,400 43,000 179,000 0 210 W 1 1- 19-14<br />

21.041-1-2.1 Tsufis, Marcia H. 25,400 25,400 25,400 0 311 W 1 1- 7- 1.2<br />

21.041-1-2.2 Simons, Gilbert E. 146,900 25,000 148,000 0 210 W 1<br />

21.041-1-3 Drejza, Constance Mae 13,800 11,000 11,000 0 311 1 1- 23- 2<br />

21.041-1-4.1 Bogart, Ronald W. 160,000 17,000 160,000 0 210 W 1 1- 15- 9<br />

21.041-1-5.1 Caswell, Terry R. 173,700 44,000 177,000 0 210 W 1 1- 4-10<br />

21.041-1-6 Quintilliai, John 104,900 12,000 116,000 0 210 1 1- 24- 4<br />

21.041-1-7 Kirby, Melissa A. 80,000 9,800 83,000 0 210 1 1- 16- 6<br />

21.041-1-8 Village Of <strong>Waddington</strong> Exempt 127,600 2,200 127,600 0 690 8 8-101- 6<br />

21.041-1-9.5 Quintilliani, John 6,200 10,300 10,300 0 311 1 1- 7- 1.11<br />

21.041-1-9.21 Campbell, Colin 99,100 11,900 102,000 0 210 1 1- 7- 1.12<br />

21.041-1-9.22 Thomas, Peter 139,800 12,600 141,000 0 210 1<br />

21.041-1-9.31 Rowe, Michele A. 138,500 15,000 145,000 0 210 1 1- 7- 1.3<br />

* 21.041-1-9.121<br />

Mayette, Thomas J. 13,300 13,300 13,300 0 311 1 1- 7- 1.11<br />

21.041-1-10.1 Caswell, Terry 18,400 15,000 15,000 0 314 1 1- 7- 1.13<br />

21.041-1-11 Mayette, Daniel 18,400 14,000 14,000 0 311 1 1- 7- 1.14<br />

21.041-1-12 McCullough, Philip G. Jr. 137,000 18,000 128,000 0 210 W 1 1-7-1.13<br />

21.041-1-13 McIntosh, Nancy 174,900 18,000 176,000 0 210 W 1<br />

21.041-1-15.1 Mayette, Richard J. 16,800 38,000 38,000 0 311 W 1<br />

Page Totals Parcels 36 2,323,700 612,500 2,395,700<br />

Page 17 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.041-1-15.2 Brady, Timothy T. 52,400 9,800 52,000 0 210 1<br />

21.041-1-16 Mayette, Richard J. 9,000 13,000 13,000 0 311 1<br />

21.041-1-17.2 Ashley, Susan J. 96,200 13,000 104,000 0 210 1<br />

21.041-1-17.11 Leone, Enrico 8,900 13,000 13,000 0 311 1<br />

21.041-1-17.12 Koeniger, Fred H. A. 109,200 13,500 121,000 0 210 1<br />

21.041-1-18.2 Mayette, Mark 121,500 14,000 132,000 0 210 1<br />

21.041-1-19 Pemberton, Joseph J. 177,200 17,000 186,000 0 210 1<br />

21.041-1-24.1 Norton, Brian K. 26,100 25,000 25,000 0 311 W 1<br />

21.041-1-25 Tri <strong>St</strong>ate Materials NY, LLC 11,000 17,000 17,000 0 311 1<br />

21.041-1-26 Tri <strong>St</strong>ate Materials NY, LLC 15,000 15,000 15,000 0 311 1<br />

21.041-1-27 Arquiett, Robert 140,000 15,000 147,000 0 220 1<br />

21.041-1-28 Arquiett, Robert 140,000 15,000 147,000 0 220 1<br />

21.041-1-29 Arquiett, Robert 140,000 15,000 147,000 0 220 1<br />

21.041-1-30 Arquiett, William R. 140,000 15,000 147,000 50 220 1<br />

21.041-1-31 Tri <strong>St</strong>ate Materials NY, LLC 15,000 15,000 15,000 0 311 1<br />

21.041-1-32 Tri <strong>St</strong>ate Materials NY, LLC 15,000 15,000 15,000 0 311 1<br />

21.041-1-33 Tri <strong>St</strong>ate Materials NY, LLC 11,000 12,000 12,000 0 311 1<br />

21.041-1-34 Tri <strong>St</strong>ate Materials NY, LLC 8,000 9,200 9,200 0 311 1<br />

21.041-1-35 Tri <strong>St</strong>ate Materials NY, LLC 8,000 9,200 9,200 0 311 1<br />

21.041-1-36 Tri <strong>St</strong>ate Materials NY, LLC 8,000 9,200 9,200 0 311 1<br />

21.041-1-37 Tri <strong>St</strong>ate Materials NY, LLC 9,000 11,000 11,000 0 311 1<br />

21.041-1-38 Tri <strong>St</strong>ate Materials (NY), LLC 13,000 15,000 15,000 0 311 1<br />

21.041-1-39 Kirby, Melissa A. 5,900 10,000 10,000 0 311 1<br />

21.041-1-40 Verville, Donald J. 164,300 15,000 160,000 0 210 1<br />

21.041-1-41 TRM Building Corporation 6,900 14,000 14,000 0 311 1<br />

21.041-1-42 TRM Building Corporation 6,900 14,000 14,000 0 311 1<br />

21.041-1-43 Falvey, Ann 146,900 14,000 154,000 0 210 1<br />

21.041-1-46 New York <strong>St</strong>ate Power Authority 200 1,500 1,500 0 314 8<br />

21.041-1-47 New York <strong>St</strong>ate Power Authority 200 1,700 1,700 0 314 8<br />

21.041-1-48 New York <strong>St</strong>ate Power Authority 400 3,300 3,300 0 314 8<br />

21.041-1-49 New York <strong>St</strong>ate Power Authority 900 5,000 5,000 0 314 8<br />

21.041-1-54 New York <strong>St</strong>ate Power Authority 300 2,400 2,400 0 314 8<br />

* 21.041-1-55<br />

Mayette, Thomas J. 100 100 100 0 314 1<br />

* 21.041-1-56<br />

Mayette, Thomas J. 100 100 100 0 314 1<br />

21.041-1-57 New York <strong>St</strong>ate Power Authority 100 400 400 0 314 8<br />

21.041-1-58 Mayette, Thomas J. 13,300 13,300 0 311 1 1- 7- 1.11<br />

21.041-2-1 Putney, Dale 1,200 1,000 1,000 0 311 1 1- 22- 8<br />

Page Totals Parcels 35 1,607,700 401,500 1,742,200<br />

Page 18 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

21.041-2-2 New York <strong>St</strong>ate Power Authority 100 400 400 0 314 8<br />

21.041-2-3 Belgarde, Shirley G. 300 300 300 0 314 1<br />

21.041-3-1.1 Jones, <strong>Lawrence</strong> 8,000 12,000 12,000 0 311 W 1 1- 28-14<br />

21.041-3-4 Belgarde, Shirley G. 800 800 800 0 314 1<br />

21.041-5-4 Village <strong>of</strong> <strong>Waddington</strong> 16,500 1,200 1,200 0 314 8<br />

21.041-6-1.12 Sharlow, William R. 130,600 13,500 134,000 0 210 1<br />

21.041-6-2 Mayette, Richard J. 113,300 26,000 132,000 0 210 W 1<br />

21.041-6-3.13 Ryan, Robert 200,600 24,000 204,000 0 210 W 1<br />

21.041-6-3.14 Peets, John M. 18,000 24,000 24,000 0 311 W 1<br />

21.041-6-3.112 Burns, Myron F. 17,600 22,000 22,000 0 311 W 1<br />

21.041-6-3.121 McDonald, Gerald 205,200 24,000 205,200 0 210 1<br />

21.041-6-4.1 Burns, Myron 216,900 26,000 216,900 0 210 W 1<br />

21.041-6-5.1 O'Neil, Sharon L. 174,900 21,000 190,000 0 210 1 1- 26-11<br />

21.041-6-6 Olmstead, <strong>St</strong>ephen (LC) 53,600 12,600 48,000 0 270 1 1- 20- 7<br />

21.041-6-7 Mayette, Douglas A. 42,300 9,800 40,000 0 270 1 1- 4-15<br />

21.041-6-8 Blair, Jason 119,400 11,200 123,000 0 210 1 1- 19-15<br />

21.041-6-10 New York <strong>St</strong>ate Power Authority 100 200 200 0 314 8<br />

21.041-6-11 New York <strong>St</strong>ate Power Authority 100 400 400 0 311 8<br />

21.041-6-12 New York <strong>St</strong>ate Power Authority 100 900 900 0 311 8<br />

21.041-6-13 New York <strong>St</strong>ate Power Authority 100 700 700 0 311 8<br />

21.041-6-14 New York <strong>St</strong>ate Power Authority 100 1,100 1,100 0 311 8<br />

21.041-6-15 New York <strong>St</strong>ate Power Authority 5,500 13,300 13,300 0 311 8<br />

21.041-6-16 New York <strong>St</strong>ate Power Authority 121,000 31,400 31,400 0 311 8<br />

21.041-6-18 Mayette, Richard J. 29,800 37,900 37,900 0 322 1 1- 7- 1.11<br />

21.041-6-19 Burns, Myron F. 17,600 8,600 8,600 0 311 1<br />

21.041-6-20 Bernard, Theodore L. 171,900 16,300 181,000 0 210 1<br />

21.041-7-1 Village <strong>of</strong> <strong>Waddington</strong> 18,700 11,600 11,600 0 314 8<br />

21.041-8-1 Belgarde, Shirley G. 100 100 100 0 311 1<br />

21.042-1-4 O'Neil, Sharon L. 6,600 7,000 7,000 0 311 1 1- 1-13<br />

21.042-1-6.2 Graves, Edmund R. Sr. 61,100 12,600 60,000 0 270 1 1-23-5.2<br />

21.042-1-6.12 Mitras, Gibson 97,900 11,800 101,000 0 210 1<br />

21.042-1-7.1 Matthews, Robert A. 52,800 12,600 52,800 0 270 1 1- 25- 2<br />

21.042-1-8.1 Sharlow, Allen 46,600 17,000 46,600 0 270 1 1- 25- 3<br />

21.042-1-10 Mayette, Terry 66,900 10,900 66,900 0 270 1 1- 16- 9<br />

* 21.042-1-11.1<br />

Mayette, Douglas 7,300 7,300 7,300 0 311 1<br />

21.042-1-11.11 Mayette, Douglas 14,000 14,000 0 311 1<br />

21.042-1-12 Mitras, Gibson 4,700 7,000 7,000 0 314 1<br />

Page Totals Parcels 36 2,019,800 444,200 1,996,300<br />

Page 19 <strong>of</strong> 51 Date/Time - 7/21/2011 08:58:07

NYS - Real Property System<br />

<strong>County</strong> <strong>of</strong> <strong>St</strong> <strong>Lawrence</strong><br />

<strong>Town</strong> <strong>of</strong> <strong>Waddington</strong> - 4082<br />

Village <strong>of</strong> <strong>Waddington</strong><br />

SWIS Code - 408201<br />

Parcel Id<br />

Name<br />

Cross Reference Report - 2011 - Current Year File<br />

Parcel ID Sequence<br />

2010 -------------- 2011<br />

Total Av Land Av<br />

--------------<br />

Total Av<br />

Res<br />

Pct<br />

Prp<br />

Cls<br />

O<br />

C<br />

R<br />

S S<br />

RPS345/V04/L001<br />

T<br />

C Account Nbr<br />

* 21.042-1-15<br />

Mayette, Douglas 100 100 100 0 314 1<br />

21.042-1-17.1 New York <strong>St</strong>ate Power Authority 100 4,400 4,400 0 314 8<br />

21.042-1-18 New York <strong>St</strong>ate Power Authority 100 12,000 12,000 0 311 8<br />

21.042-1-19 Graves, Edmund R. 4,700 7,000 7,000 0 311 1 1- 23- 5.1<br />

21.047-1-1.1 Brady, Timothy T. 28,800 28,800 28,800 0 322 1 1- 16- 5<br />

21.047-1-3.1 Tiernan, Marshall 6,200 6,200 6,200 0 311 1<br />

21.047-1-4.1 Tiernan, William P. 14,800 14,800 14,800 0 314 1 1- 24-8.5<br />

21.047-1-7 New York <strong>St</strong>ate Power Authority 100 8,700 8,700 0 311 8<br />

21.047-1-8 New York <strong>St</strong>ate Power Authority 100 12,100 12,100 0 311 8<br />

21.047-1-9 New York <strong>St</strong>ate Power Authority 900 11,500 11,500 0 311 8<br />

21.047-2-1.11 Tiernan, William 7,300 7,300 7,300 0 311 1 PT 1-11-1<br />

21.047-2-1.12 Tripp, Robert G. 2,000 2,000 2,000 0 311 1<br />

21.047-2-2 Gilmour, Richard H. 33,500 20,000 40,000 0 260 W 1<br />

21.047-2-3.1 Derouchie, Francis A. Jr. 28,700 20,000 37,000 0 260 W 1<br />

21.047-2-4.1 Forando, Jane K. 44,300 20,000 46,000 0 260 W 1<br />

21.047-2-5.1 Tiernan, William 2,400 13,800 13,800 0 311 W 1<br />

21.047-2-5.2 Tripp, Robert G. 1,000 3,000 3,000 0 311 1<br />

21.047-2-6.11 Tripp, Robert G. 13,500 14,600 14,600 0 311 W 1 1- 24-11<br />

21.047-2-6.12 Tiernan, William 8,000 14,000 14,000 0 311 1<br />

21.047-2-9 Gilmour, Richard H. 100 600 600 0 311 1<br />

* 21.047-4-1<br />

Planty, Beulah 100 100 100 0 314 1<br />

21.048-1-4.11 Wiehl, Bernard 21,700 26,000 26,000 0 105 W 1 1- 29- 8.1<br />

21.048-1-5 Tiernan, William P. 39,800 21,000 48,000 0 210 1 1- 25-15<br />

21.048-1-6 Tiernan, Jeffrey P. 46,300 31,000 60,000 0 240 1 1- 10- 9<br />

* 21.048-3-1.1<br />

Tiernan, William 14,400 14,400 14,400 0 322 1 PT 1-24-8<br />

21.048-3-1.11 Tiernan, William 15,700 15,700 0 314 1 PT 1-24-8<br />

21.048-3-1.21 Tiernan, Michael 23,500 15,000 28,500 0 260 1<br />

* 21.048-3-2<br />

Tiernan, William 14,400 14,400 14,400 0 314 1<br />

21.048-3-2.1 Tiernan, William 16,800 16,800 0 314 1<br />

21.048-3-3.1 Tiernan, William 14,400 16,000 16,000 0 314 1<br />

* 21.048-3-4.1<br />

Tiernan, William 14,400 14,400 14,400 0 314 1<br />

21.048-3-4.11 Tiernan, William 17,000 17,000 0 314 1<br />

* 21.048-3-5<br />

Tiernan, William 100 100 100 0 314 1<br />

* 21.048-3-9<br />

Tiernan, William 300 300 300 0 314 1<br />

* 21.048-3-10<br />

Tiernan, William 200 200 200 0 314 1<br />

21.048-4-1.1 Mayette, Douglas 12,100 20,000 20,000 0 314 W 1 1- 24- 8.41<br />

21.048-5-1 Belgarde, Shirley G. 100 100 100 0 311 1<br />

Page Totals Parcels 29 354,500 399,400 531,900<br />