ACC 349 Final Exam Guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

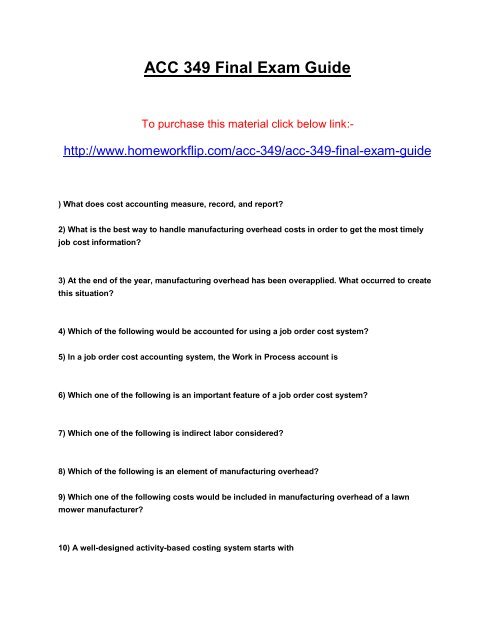

<strong>ACC</strong> <strong>349</strong> <strong>Final</strong> <strong>Exam</strong> <strong>Guide</strong><br />

To purchase this material click below link:-<br />

http://www.homeworkflip.com/acc-<strong>349</strong>/acc-<strong>349</strong>-final-exam-guide<br />

) What does cost accounting measure, record, and report?<br />

2) What is the best way to handle manufacturing overhead costs in order to get the most timely<br />

job cost information?<br />

3) At the end of the year, manufacturing overhead has been overapplied. What occurred to create<br />

this situation?<br />

4) Which of the following would be accounted for using a job order cost system?<br />

5) In a job order cost accounting system, the Work in Process account is<br />

6) Which one of the following is an important feature of a job order cost system?<br />

7) Which one of the following is indirect labor considered?<br />

8) Which of the following is an element of manufacturing overhead?<br />

9) Which one of the following costs would be included in manufacturing overhead of a lawn<br />

mower manufacturer?<br />

10) A well-designed activity-based costing system starts with

11) An activity that has a direct cause-effect relationship with the resources consumed is a(n)<br />

12) In traditional costing systems, overhead is generally applied based on<br />

13) All of the following statements are correct EXCEPT that<br />

14) Which of the following is a value-added activity?<br />

15) Which of the following is a nonvalue-added activity?<br />

16) Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs<br />

consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000.<br />

Information on the two products is:<br />

Mini A Maxi B<br />

Direct labor hours 15,000 25,000<br />

Machine setups 600 400<br />

Machine hours 24,000 26,000<br />

Inspections 800 700<br />

Overhead applied to Mini A using activity-based costing is<br />

17) Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs<br />

consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000.<br />

Information on the two products is:<br />

Mini A Maxi B<br />

Direct labor hours 15,000 25,000<br />

Machine setups 600 400<br />

Machine hours 24,000 26,000<br />

Inspections 800 700<br />

Overhead applied to Mini A using traditional costing using direct labor hours is

18) Which of the following factors would suggest a switch to activity-based costing?<br />

19) Rosen, Inc. has 10,000 obsolete calculators, which are carried in inventory at a cost of $20,000.<br />

If the calculators are scrapped, they can be sold for $1.10 each (for parts). If they are repackaged,<br />

at a cost of $15,000, they could be sold to toy stores for $2.50 per unit. What alternative should be<br />

chosen, and why?<br />

20) Walton, Inc. is unsure of whether to sell its product assembled or unassembled. The unit cost<br />

of the unassembled product is $16, while the cost of assembling each unit is estimated at $17.<br />

Unassembled units can be sold for $55, while assembled units could be sold for $71 per unit.<br />

What decision should Walton make?<br />

21) The cost to produce Part A was $10 per unit in 2005. During 2006, it has increased to $11 per<br />

unit. In 2006, Supplier Company has offered to supply Part A for $9 per unit. For the make-or-buy<br />

decision,<br />

22) Hess, Inc. sells a single product with a contribution margin of $12 per unit and fixed costs of<br />

$74,400 and sales for the current year of $100,000. How much is Hess’s break-even point?<br />

23) Hartley, Inc. has one product with a selling price per unit of $200, the unit variable cost is $75,<br />

and the total monthly fixed costs are $300,000. How much is Hartley’s contribution margin ratio?<br />

24) H55 Company sells two products, beer and wine. Beer has a 10 percent profit margin and wine<br />

has a 12 percent profit margin. Beer has a 27 percent contribution margin and wine has a 25<br />

percent contribution margin. If other factors are equal, which product should H55 push to<br />

customers?<br />

25) Which cost is charged to the product under variable costing?<br />

26) Which cost is NOT charged to the product under variable costing?<br />

27) Variable costing

28) If a company is concerned with the potential negative effects of establishing standards, they<br />

should<br />

29) The difference between a budget and a standard is that<br />

30) A standard cost is<br />

31) The per-unit standards for direct labor are 2 direct labor hours at $12 per hour. If in producing<br />

2,400 units, the actual direct labor cost was $51,200 for 4,000 direct labor hours worked, the total<br />

direct labor variance is<br />

32) The total variance is $10,000. The total materials variance is $4,000. The total labor variance is<br />

twice the total overhead variance. What is the total overhead variance?<br />

33) The per-unit standards for direct materials are 2 gallons at $4 per gallon. Last month, 11,200<br />

gallons of direct materials that actually cost $42,400 were used to produce 6,000 units of product.<br />

The direct materials quantity variance for last month was<br />

34) If the standard hours allowed are less than the standard hours at normal capacity,<br />

35) Manufacturing overhead costs are applied to work in process on the basis of<br />

36) The overhead volume variance relates only to<br />

37) At January 1, 2004, Barry, Inc. has beginning inventory of 4,000 widgets. Barry estimates it will<br />

sell 35,000 units during the first quarter of 2004 with a 10% increase in sales each quarter. Barry’s<br />

policy is to maintain an ending inventory equal to 25% of the next quarter’s sales. Each widget<br />

costs $1 and is sold for $1.50. How much is budgeted sales revenue for the third quarter of 2004?<br />

38) Lewis Hats is planning to sell 600 straw hats. Each hat requires a half pound of straw and a<br />

quarter hour of direct labor. Straw costs $0.20 per pound and employees of the company are paid<br />

$22 per hour. Lewis has 80 pounds of straw and 40 hats in beginning inventory and wants to have<br />

50 pounds of straw and 60 hats in ending inventory. How many units should Lewis Hats produce<br />

in April?

39) Gottberg Mugs is planning to sell 2,000 mugs and produce 2,200 mugs during April. Each mug<br />

requires 2 pounds of resin and a half hour of direct labor. Resin costs $1 per pound and<br />

employees of the company are paid $12.50 per hour. Manufacturing overhead is applied at a rate<br />

of 120% of direct labor costs. Gottberg has 2,000 pounds of resin in beginning inventory and<br />

wants to have 2,400 pounds in ending inventory. How much is the total amount of budgeted direct<br />

labor for April?<br />

40) The cost-plus pricing approach's major advantage is<br />

41) A company must price its product to cover its costs and earn a reasonable profit in<br />

42) Prices are set by the competitive market when