Download the Annual Report 2009 here (PDF) - Pandora

Download the Annual Report 2009 here (PDF) - Pandora

Download the Annual Report 2009 here (PDF) - Pandora

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

38<br />

PANDORA ANNUAL REPORT <strong>2009</strong> | FINANCIAL REPORT, GROUP<br />

NOTES<br />

NOTE 3. BUSINESS COMBINATIONS, CONTINUED<br />

No o<strong>the</strong>r arrangements were entered into ei<strong>the</strong>r before or in connection with <strong>the</strong> business combination that should be considered in <strong>the</strong> overall evaluation of <strong>the</strong><br />

accounting treatment of <strong>the</strong> business combination.<br />

Post-combination information<br />

From <strong>the</strong> date of acquisition, PANDORA Jewelry America ApS contributed DKK 693,526 thousand to <strong>the</strong> Group’s revenue and DKK 116,468 thousand of <strong>the</strong><br />

Group’s pre-tax profi t for <strong>the</strong> year ended 31 December 2008.<br />

Twelve month adjusted information regarding 2008 for PANDORA Production Co. Ltd., Populair A/S, Pilisar ApS<br />

and PANDORA Jewelry America ApS<br />

Had <strong>the</strong> acquisitions taken place as at 1 January 2008, management has estimated <strong>the</strong> Group’s revenue for <strong>the</strong> year ended 31 December 2008 to be DKK<br />

1,904,487 thousand, <strong>the</strong> EBITDA DKK 778,454 thousand, <strong>the</strong> EBIT DKK 738,367 thousand, <strong>the</strong> pre-tax profi t DKK 495,922 thousand and <strong>the</strong> after-tax profi t DKK<br />

355,647 thousand.<br />

The twelve month adjusted information is based on <strong>the</strong> consolidated fi nancial statements plus <strong>the</strong> full-year effect regarding PANDORA Production Co. Ltd.,<br />

Populair A/S, Pilisar ApS and PANDORA Jewelry America ApS plus <strong>the</strong> hypo<strong>the</strong>tical full year effect regarding PANDORA Production Co. Ltd., Populair A/S,<br />

Pilisar ApS and PANDORA Jewelry America ApS including <strong>the</strong> effect on income statement of hypo<strong>the</strong>tical assets and liabilities arising on <strong>the</strong> acquisition. Related<br />

party transactions with <strong>the</strong> companies are subsequently eliminated.<br />

Acquisitions after 31 December <strong>2009</strong><br />

Acquisition of <strong>the</strong> German distributor<br />

On 5 January 2010, <strong>the</strong> Group formed PANDORA Jewelry Central Western Europe A/S with <strong>the</strong> former German distributor. The formation was done through contributions<br />

from <strong>the</strong> two shareholders. The Group contributed distribution rights in <strong>the</strong> Ne<strong>the</strong>rlands, Italy and an increase in <strong>the</strong> distribution right for Germany, Austria<br />

and Switzerland, while <strong>the</strong> former German distributor contributed <strong>the</strong> ongoing business in Germany, Austria and Switzerland, including <strong>the</strong> distribution rights<br />

for PANDORA products for <strong>the</strong> remaining 1.5 year of <strong>the</strong> distribution agreement. Following <strong>the</strong> formation, <strong>the</strong> Group owns 51% and has control of PANDORA<br />

Jewelry Central Western Europe A/S, while <strong>the</strong> former German distributor owns 49% and <strong>the</strong>refore owns a non-controlling interest. In accordance with IFRS 3, this<br />

constitutes an acquisition of <strong>the</strong> activities in <strong>the</strong> business of <strong>the</strong> former German distributor, w<strong>here</strong>as <strong>the</strong> contribution of <strong>the</strong> PANDORA assets is an intra-group<br />

transaction and does not impact <strong>the</strong> consolidated fi nancial statements.<br />

The formation and acquisition took place as part of <strong>the</strong> Group’s plans to expand operations in both new and existing markets.<br />

The Group has elected to measure <strong>the</strong> 49% non-controlling interest in <strong>the</strong> acquiree at fair value.<br />

Due to <strong>the</strong> proximity of <strong>the</strong> acquisition date to <strong>the</strong> approval of <strong>the</strong>se fi nancial statements, it has not been possible to fi nalise all aspects of this business combination.<br />

The material used for <strong>the</strong> measurement of <strong>the</strong> cost price and <strong>the</strong> distribution agreement is based on budgeted and forecast amounts. T<strong>here</strong>fore, <strong>the</strong> measurement<br />

of <strong>the</strong>se items and <strong>the</strong> residual goodwill is determined only provisionally.<br />

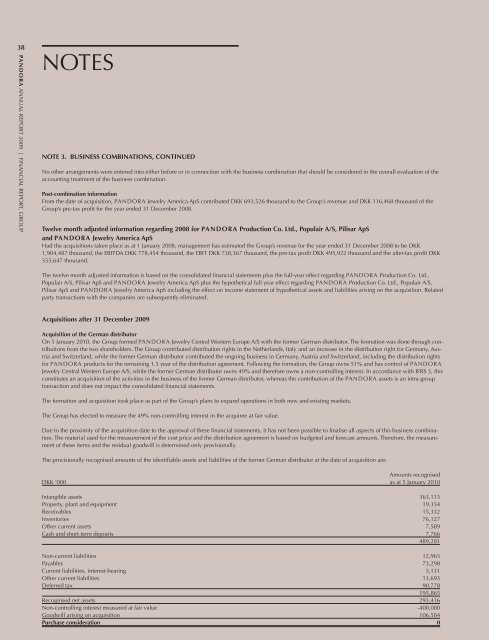

The provisionally recognised amounts of <strong>the</strong> identifi able assets and liabilities of <strong>the</strong> former German distributor at <strong>the</strong> date of acquisition are:<br />

Amounts recognised<br />

DKK ‘000 as at 5 January 2010<br />

Intangible assets 363,113<br />

Property, plant and equipment 19,354<br />

Receivables 15,332<br />

Inventories 76,127<br />

O<strong>the</strong>r current assets 7,589<br />

Cash and short-term deposits 7,766<br />

489,281<br />

Non-current liabilities 12,965<br />

Payables 73,298<br />

Current liabilities, interest-bearing 5,131<br />

O<strong>the</strong>r current liabilities 13,693<br />

Deferred tax 90,778<br />

195,865<br />

Recognised net assets 293,416<br />

Non-controlling interest measured at fair value -400,000<br />

Goodwill arising on acquisition 106,584<br />

Purchase consideration 0