Doing Business In Germany: A Country Commercial ... - Export.gov

Doing Business In Germany: A Country Commercial ... - Export.gov

Doing Business In Germany: A Country Commercial ... - Export.gov

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Sporting Goods Return to Top<br />

Overview<br />

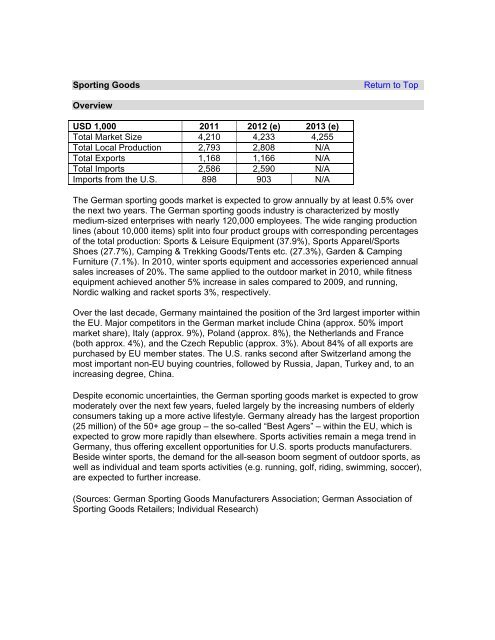

USD 1,000 2011 2012 (e) 2013 (e)<br />

Total Market Size 4,210 4,233 4,255<br />

Total Local Production 2,793 2,808 N/A<br />

Total <strong>Export</strong>s 1,168 1,166 N/A<br />

Total Imports 2,586 2,590 N/A<br />

Imports from the U.S. 898 903 N/A<br />

The German sporting goods market is expected to grow annually by at least 0.5% over<br />

the next two years. The German sporting goods industry is characterized by mostly<br />

medium-sized enterprises with nearly 120,000 employees. The wide ranging production<br />

lines (about 10,000 items) split into four product groups with corresponding percentages<br />

of the total production: Sports & Leisure Equipment (37.9%), Sports Apparel/Sports<br />

Shoes (27.7%), Camping & Trekking Goods/Tents etc. (27.3%), Garden & Camping<br />

Furniture (7.1%). <strong>In</strong> 2010, winter sports equipment and accessories experienced annual<br />

sales increases of 20%. The same applied to the outdoor market in 2010, while fitness<br />

equipment achieved another 5% increase in sales compared to 2009, and running,<br />

Nordic walking and racket sports 3%, respectively.<br />

Over the last decade, <strong>Germany</strong> maintained the position of the 3rd largest importer within<br />

the EU. Major competitors in the German market include China (approx. 50% import<br />

market share), Italy (approx. 9%), Poland (approx. 8%), the Netherlands and France<br />

(both approx. 4%), and the Czech Republic (approx. 3%). About 84% of all exports are<br />

purchased by EU member states. The U.S. ranks second after Switzerland among the<br />

most important non-EU buying countries, followed by Russia, Japan, Turkey and, to an<br />

increasing degree, China.<br />

Despite economic uncertainties, the German sporting goods market is expected to grow<br />

moderately over the next few years, fueled largely by the increasing numbers of elderly<br />

consumers taking up a more active lifestyle. <strong>Germany</strong> already has the largest proportion<br />

(25 million) of the 50+ age group – the so-called “Best Agers” – within the EU, which is<br />

expected to grow more rapidly than elsewhere. Sports activities remain a mega trend in<br />

<strong>Germany</strong>, thus offering excellent opportunities for U.S. sports products manufacturers.<br />

Beside winter sports, the demand for the all-season boom segment of outdoor sports, as<br />

well as individual and team sports activities (e.g. running, golf, riding, swimming, soccer),<br />

are expected to further increase.<br />

(Sources: German Sporting Goods Manufacturers Association; German Association of<br />

Sporting Goods Retailers; <strong>In</strong>dividual Research)