PCM vol. 3 issue 3

The third issue of the Payments & Cards eMagazine \"PCM\". In this issue we talk about all things Mobile Payments and we introduce the new rubric for Merchants. Contributions from ACI WorldWide, UL, Payr, Zooz, Zapp Mobile Payments and Neste Oil.

The third issue of the Payments & Cards eMagazine \"PCM\". In this issue we talk about all things Mobile Payments and we introduce the new rubric for Merchants. Contributions from ACI WorldWide, UL, Payr, Zooz, Zapp Mobile Payments and Neste Oil.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

startup Spotlight<br />

<strong>PCM</strong>: Why is Payr needed?<br />

There has been too little real competition in the financial<br />

space, and this is still very true for personal banking and<br />

finance management. Incumbent banks have been dominating<br />

the space, moving very slowly and not listening to what their<br />

customers really want. The legacy players have been trampling<br />

all over their customer relationships and decimating trust,<br />

overcharging for everything and anything they can and so<br />

forth.<br />

For most people paying bills is boring and takes time and<br />

effort. Payr offers a faster, more convenient and independent<br />

way to do this. And we even let people save while they are<br />

paying! Similarly, to the way peer to peer payments have made<br />

it much more convenient for people to send money between<br />

friends, we want to empower consumers and businesses to<br />

efficiently pay their invoices while acting on and improving<br />

their financial situation through product & price comparison.<br />

“In short, Payr customers can pay invoices any way they want,<br />

whilst save money and get better services. All this in a faster<br />

and more convenient way than before, independently of their<br />

existing banking relations”<br />

<strong>PCM</strong>: What makes Payr different?<br />

Our big advantage is that we are able to give truly independent<br />

and actionable advice in a market dominated by the big<br />

banks. As we are not a bank or a large incumbent financial<br />

player, we are free to give objective advice and help people<br />

improve quality and cut costs on expenses that really matter,<br />

like mortgage, insurance and a whole series of utilities and<br />

services such as electricity, internet connection and mobile<br />

phone plans. To put it this way: Your bank won’t suggest that<br />

you move your loans to a competitor that offers better terms.<br />

Ever. We make it our business to do just that. Simply put; Our<br />

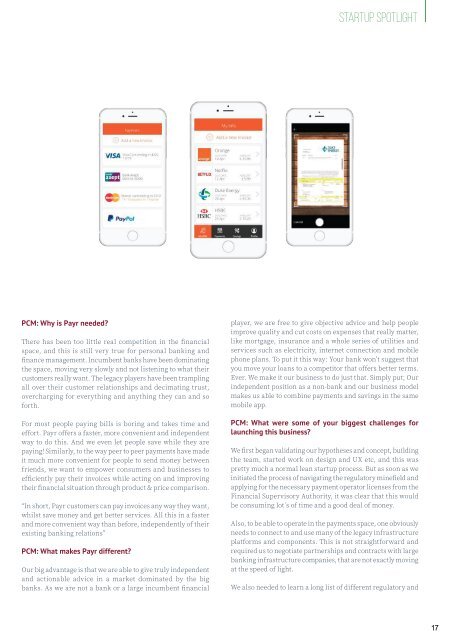

independent position as a non-bank and our business model<br />

makes us able to combine payments and savings in the same<br />

mobile app.<br />

<strong>PCM</strong>: What were some of your biggest challenges for<br />

launching this business?<br />

We first began validating our hypotheses and concept, building<br />

the team, started work on design and UX etc, and this was<br />

pretty much a normal lean startup process. But as soon as we<br />

initiated the process of navigating the regulatory minefield and<br />

applying for the necessary payment operator licenses from the<br />

Financial Supervisory Authority, it was clear that this would<br />

be consuming lot´s of time and a good deal of money.<br />

Also, to be able to operate in the payments space, one obviously<br />

needs to connect to and use many of the legacy infrastructure<br />

platforms and components. This is not straightforward and<br />

required us to negotiate partnerships and contracts with large<br />

banking infrastructure companies, that are not exactly moving<br />

at the speed of light.<br />

We also needed to learn a long list of different regulatory and<br />

17