ACY(case_study)-min

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ii) Show the depreciation table for the building and HILUX<br />

considering that the building life span is 10years and is<br />

depreciated using a reducing balance method. Show the journal<br />

entry for depreciation for 31/12/2011.<br />

iii) Record the disposal of the HILUX as stated by <strong>case</strong> 4 <strong>min</strong>dful<br />

that the transaction is an extra ordinary activity and is not liable<br />

for VAT and shoe the journal entries for the movement of the<br />

bill of exchange.<br />

iv) Prepare the amortization table for the loan in <strong>case</strong> five with<br />

reimbursement by constant annuity.<br />

v) Show the journal entry for the loan contract<br />

vi) The adjustment entry in relation to the loan at 31/12/2011.<br />

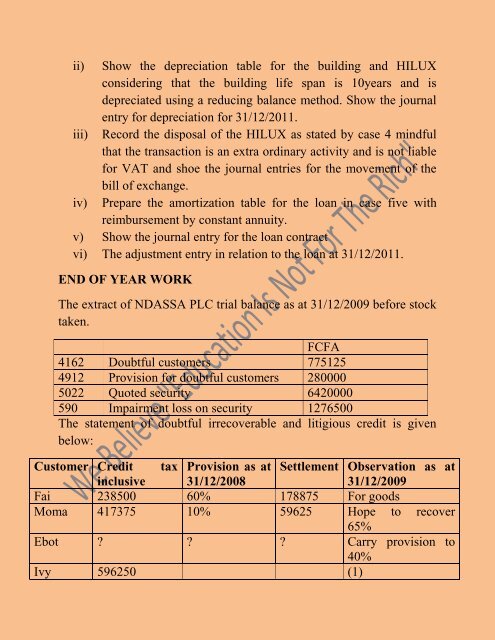

END OF YEAR WORK<br />

The extract of NDASSA PLC trial balance as at 31/12/2009 before stock<br />

taken.<br />

FCFA<br />

4162 Doubtful customers 775125<br />

4912 Provision for doubtful customers 280000<br />

5022 Quoted security 6420000<br />

590 Impairment loss on security 1276500<br />

The statement of doubtful irrecoverable and litigious credit is given<br />

below:<br />

Customer Credit tax Provision as at Settlement Observation as at<br />

inclusive 31/12/2008<br />

31/12/2009<br />

Fai 238500 60% 178875 For goods<br />

Moma 417375 10% 59625 Hope to recover<br />

65%<br />

Ebot ? ? ? Carry provision to<br />

40%<br />

Ivy 596250 (1)