Freeman Co. is a US company that made a sale on account of $100,000 on December 20, 2010. Freeman still has the receivable

Freeman Co. is a US company that made a sale on account of $100,000 on December 20, 2010. Freeman still has the receivable

Freeman Co. is a US company that made a sale on account of $100,000 on December 20, 2010. Freeman still has the receivable

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Buy here:<br />

http://homework.plus/freeman-co-<str<strong>on</strong>g>is</str<strong>on</strong>g>-a-us-<str<strong>on</strong>g>company</str<strong>on</strong>g>-<str<strong>on</strong>g>that</str<strong>on</strong>g><str<strong>on</strong>g>made</str<strong>on</strong>g>-a-<str<strong>on</strong>g>sale</str<strong>on</strong>g>-<strong>on</strong>-<strong>account</strong>-<strong>of</strong>-100-<strong>000</strong>-<strong>on</strong>-december-<strong>20</strong>-2<br />

010-freeman-<strong>still</strong>-<strong>has</strong>-<strong>the</strong>-<strong>receivable</strong>/<br />

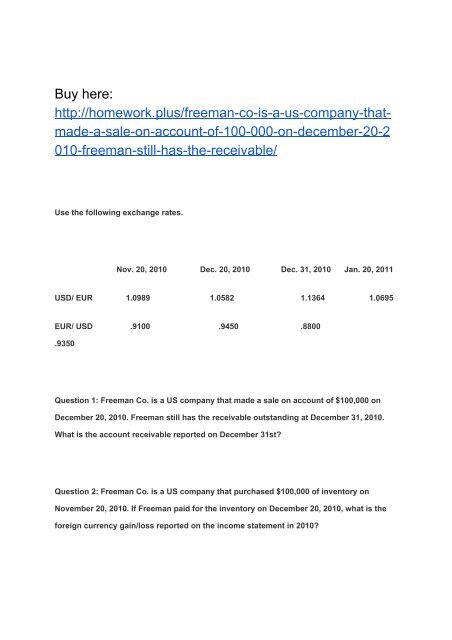

Use <strong>the</strong> following exchange rates.<br />

Nov. <strong>20</strong>, <strong>20</strong>10 Dec. <strong>20</strong>, <strong>20</strong>10 Dec. 31, <strong>20</strong>10 Jan. <strong>20</strong>, <strong>20</strong>11<br />

<str<strong>on</strong>g>US</str<strong>on</strong>g>D/ EUR 1.0989 1.0582 1.1364 1.0695<br />

EUR/ <str<strong>on</strong>g>US</str<strong>on</strong>g>D .9100 .9450 .8800<br />

.9350<br />

Questi<strong>on</strong> 1: <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <str<strong>on</strong>g>Co</str<strong>on</strong>g>. <str<strong>on</strong>g>is</str<strong>on</strong>g> a <str<strong>on</strong>g>US</str<strong>on</strong>g> <str<strong>on</strong>g>company</str<strong>on</strong>g> <str<strong>on</strong>g>that</str<strong>on</strong>g> <str<strong>on</strong>g>made</str<strong>on</strong>g> a <str<strong>on</strong>g>sale</str<strong>on</strong>g> <strong>on</strong> <strong>account</strong> <strong>of</strong> <strong>$100</strong>,<strong>000</strong> <strong>on</strong><br />

<strong>December</strong> <strong>20</strong>, <strong>20</strong>10. <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <strong>still</strong> <strong>has</strong> <strong>the</strong> <strong>receivable</strong> outstanding at <strong>December</strong> 31, <strong>20</strong>10.<br />

What <str<strong>on</strong>g>is</str<strong>on</strong>g> <strong>the</strong> <strong>account</strong> <strong>receivable</strong> reported <strong>on</strong> <strong>December</strong> 31st?<br />

Questi<strong>on</strong> 2: <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <str<strong>on</strong>g>Co</str<strong>on</strong>g>. <str<strong>on</strong>g>is</str<strong>on</strong>g> a <str<strong>on</strong>g>US</str<strong>on</strong>g> <str<strong>on</strong>g>company</str<strong>on</strong>g> <str<strong>on</strong>g>that</str<strong>on</strong>g> purc<strong>has</strong>ed <strong>$100</strong>,<strong>000</strong> <strong>of</strong> inventory <strong>on</strong><br />

November <strong>20</strong>, <strong>20</strong>10. If <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> paid for <strong>the</strong> inventory <strong>on</strong> <strong>December</strong> <strong>20</strong>, <strong>20</strong>10, what <str<strong>on</strong>g>is</str<strong>on</strong>g> <strong>the</strong><br />

foreign currency gain/loss reported <strong>on</strong> <strong>the</strong> income statement in <strong>20</strong>10?

Questi<strong>on</strong> 3: <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <str<strong>on</strong>g>Co</str<strong>on</strong>g>. <str<strong>on</strong>g>is</str<strong>on</strong>g> a <str<strong>on</strong>g>US</str<strong>on</strong>g> <str<strong>on</strong>g>company</str<strong>on</strong>g> <str<strong>on</strong>g>that</str<strong>on</strong>g> <str<strong>on</strong>g>made</str<strong>on</strong>g> a <str<strong>on</strong>g>sale</str<strong>on</strong>g> <strong>on</strong> <strong>account</strong> <strong>of</strong> <strong>$100</strong>,<strong>000</strong> <strong>on</strong><br />

<strong>December</strong> <strong>20</strong>, <strong>20</strong>10. <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <strong>still</strong> <strong>has</strong> <strong>the</strong> <strong>receivable</strong> outstanding at <strong>December</strong> 31, <strong>20</strong>10.<br />

What <str<strong>on</strong>g>is</str<strong>on</strong>g> <strong>the</strong> amount <strong>of</strong> <str<strong>on</strong>g>sale</str<strong>on</strong>g>s reported in <strong>20</strong>10?<br />

Questi<strong>on</strong> 4: <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <str<strong>on</strong>g>Co</str<strong>on</strong>g>. purc<strong>has</strong>ed <strong>$100</strong>,<strong>000</strong> <strong>of</strong> inventory <strong>on</strong> November <strong>20</strong>, <strong>20</strong>10. If<br />

<str<strong>on</strong>g>Freeman</str<strong>on</strong>g> paid for <strong>the</strong> inventory <strong>on</strong> January <strong>20</strong>, <strong>20</strong>11, what <str<strong>on</strong>g>is</str<strong>on</strong>g> <strong>the</strong> foreign currency gain/loss<br />

reported <strong>on</strong> <strong>the</strong> income statement in <strong>20</strong>10?<br />

Questi<strong>on</strong> 5: <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> <str<strong>on</strong>g>Co</str<strong>on</strong>g>. purc<strong>has</strong>ed <strong>$100</strong>,<strong>000</strong> <strong>of</strong> inventory <strong>on</strong> November <strong>20</strong>, <strong>20</strong>10. If<br />

<str<strong>on</strong>g>Freeman</str<strong>on</strong>g> paid for <strong>the</strong> inventory <strong>on</strong> January <strong>20</strong>, <strong>20</strong>11, what <str<strong>on</strong>g>is</str<strong>on</strong>g> <strong>the</strong> amount <strong>of</strong> <strong>account</strong>s<br />

payable when remeasured at settlement date?<br />

Questi<strong>on</strong> 6: <str<strong>on</strong>g>Freeman</str<strong>on</strong>g> sold all <strong>of</strong> <strong>the</strong> inventory in <strong>20</strong>10 <str<strong>on</strong>g>that</str<strong>on</strong>g> it purc<strong>has</strong>ed for <strong>$100</strong>,<strong>000</strong> <strong>on</strong><br />

November <strong>20</strong>. What was <strong>the</strong>ir cost <strong>of</strong> goods sold related to th<str<strong>on</strong>g>is</str<strong>on</strong>g> inventory?