Clairfield Review Q2 08 - Syncap

Clairfield Review Q2 08 - Syncap

Clairfield Review Q2 08 - Syncap

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Second quarter 20<strong>08</strong><br />

CLAIRFIELD REVIEW<br />

A publication of <strong>Clairfield</strong> Partners: leaders in mid-market M&A and corporate finance in Europe, the USA, and Australia<br />

<strong>Clairfield</strong> UK sees silver lining<br />

Mid-market M&A remains unscathed by recent upheavals in credit markets<br />

Albert Ganyushin<br />

Andrew Taee<br />

It is said that economists have predicted nine of<br />

the past five recessions. The UK market seems particularly<br />

open to diverse interpretations. UK banks<br />

have fared better than their US counterparts in the<br />

recent write downs. The 2007 earnings for most<br />

British banks are similar to their 2006 earnings.<br />

However, the banks’ low share prices tell a different<br />

story about investor confidence.<br />

First quarter M&A figures for the UK reflect<br />

pessimism in the financial markets. Announced<br />

deals with UK targets numbered 649 in the first<br />

quarter of 20<strong>08</strong>, the lowest opening quarter volume<br />

since the first quarter of 2003. The announced<br />

value of UK-target transactions also decreased,<br />

from over 89 billion dollars in the first quarter of<br />

2007 to 50 billion dollars for the same period in<br />

20<strong>08</strong>, a drop of 44 percent.<br />

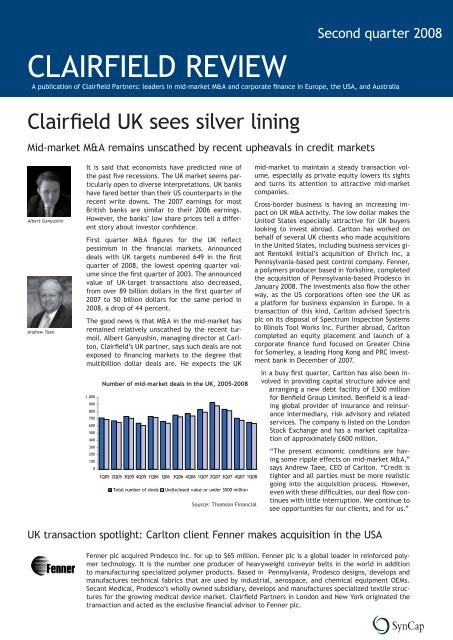

The good news is that M&A in the mid-market has<br />

remained relatively unscathed by the recent turmoil.<br />

Albert Ganyushin, managing director at Carlton,<br />

<strong>Clairfield</strong>’s UK partner, says such deals are not<br />

exposed to financing markets to the degree that<br />

multibillion dollar deals are. He expects the UK<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Number of mid-market deals in the UK, 2005-20<strong>08</strong><br />

1Q05 2Q05 3Q05 4Q05 1Q06 Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q<strong>08</strong><br />

Total number of deals Undisclosed value or under $500 million<br />

Source: Thomson Financial<br />

mid-market to maintain a steady transaction volume,<br />

especially as private equity lowers its sights<br />

and turns its attention to attractive mid-market<br />

companies.<br />

Cross-border business is having an increasing impact<br />

on UK M&A activity. The low dollar makes the<br />

United States especially attractive for UK buyers<br />

looking to invest abroad. Carlton has worked on<br />

behalf of several UK clients who made acquisitions<br />

in the United States, including business services giant<br />

Rentokil Initial’s acquisition of Ehrlich Inc, a<br />

Pennsylvania-based pest control company. Fenner,<br />

a polymers producer based in Yorkshire, completed<br />

the acquisition of Pennsylvania-based Prodesco in<br />

January 20<strong>08</strong>. The investments also flow the other<br />

way, as the US corporations often see the UK as<br />

a platform for business expansion in Europe. In a<br />

transaction of this kind, Carlton advised Spectris<br />

plc on its disposal of Spectrum Inspection Systems<br />

to Illinois Tool Works Inc. Further abroad, Carlton<br />

completed an equity placement and launch of a<br />

corporate finance fund focused on Greater China<br />

for Somerley, a leading Hong Kong and PRC investment<br />

bank in December of 2007.<br />

In a busy first quarter, Carlton has also been involved<br />

in providing capital structure advice and<br />

arranging a new debt facility of £300 million<br />

for Benfield Group Limited. Benfield is a leading<br />

global provider of insurance and reinsurance<br />

intermediary, risk advisory and related<br />

services. The company is listed on the London<br />

Stock Exchange and has a market capitalization<br />

of approximately £600 million.<br />

“The present economic conditions are having<br />

some ripple effects on mid-market M&A,”<br />

says Andrew Taee, CEO of Carlton. “Credit is<br />

tighter and all parties must be more realistic<br />

going into the acquisition process. However,<br />

even with these difficulties, our deal flow continues<br />

with little interruption. We continue to<br />

see opportunities for our clients, and for us.”<br />

UK transaction spotlight: Carlton client Fenner makes acquisition in the USA<br />

Fenner plc acquired Prodesco Inc. for up to $65 million. Fenner plc is a global leader in reinforced polymer<br />

technology. It is the number one producer of heavyweight conveyor belts in the world in addition<br />

to manufacturing specialized polymer products. Based in Pennsylvania, Prodesco designs, develops and<br />

manufactures technical fabrics that are used by industrial, aerospace, and chemical equipment OEMs.<br />

Secant Medical, Prodesco’s wholly owned subsidiary, develops and manufactures specialized textile structures<br />

for the growing medical device market. <strong>Clairfield</strong> Partners in London and New York originated the<br />

transaction and acted as the exclusive financial advisor to Fenner plc.

NEWS BRIEFS<br />

Partner at <strong>Clairfield</strong> Spain lectures on crossborder acquisitions<br />

Brian O’Hare<br />

<strong>Clairfield</strong> Partners Australia issues independent expert report<br />

on the Resource Pacific/Xstrata megadeal<br />

Victor Rudenno<br />

Brian O’Hare, founder and partner of Coram <strong>Clairfield</strong><br />

in Barcelona, gave a seminar on international<br />

aspects of crossborder acquisitions on April 11th.<br />

The seminar forms part of the course Company Acquisitions:<br />

A Complete Vision, offered under the<br />

auspices of the Executive Education program of<br />

Barcelona’s Pompeu Fabra University.<br />

Mr. O’Hare sits on the academic committee of the<br />

program, which is geared towards financial or legal<br />

directors and strategic consultants.<br />

The lecture focused on cross-cultural understanding<br />

in the acquisition process, a subject on which<br />

Mr. O’Hare has ample experience. In the last two<br />

years alone, he has overseen five crossborder transactions<br />

involving Spanish companies.<br />

“The students were surprised that crossborder<br />

transactions represent such a large percentage of<br />

worldwide M&A,” says Mr. O’Hare. “The fact is that<br />

50% of the business of Europe’s 100 largest com-<br />

<strong>Clairfield</strong> Partners in Australia, InterFinancial,<br />

recently participated in one of the most talked<br />

about transactions of 2007 — Resource Pacific’s<br />

AU$1 billion (€600 million) takeover bid by Swiss<br />

mining giant Xstrata.<br />

InterFinancial has extensive experience in mining<br />

and resources and had a long relationship with key<br />

executives of Resource Pacific, a coal mining company<br />

based in Sydney.<br />

Victor Rudenno, director of resources at<br />

InterFinancial’s Sydney office, managed the valuation<br />

team.<br />

Resource Pacific owned the Newpac Mine in New<br />

South Wales, an underground coal mine that recently<br />

developed a long wall mining operation. The<br />

mine, where Resource Pacific hoped to ultimately<br />

triple output of semi-coking coal to 8 million tons<br />

per year, is especially valuable now that coal prices<br />

are at record highs. Semi-coking coal is used in<br />

the production of steel.<br />

With such an attractive resource at stake, Resource<br />

Pacific was previously the object of attention with<br />

a takeover bid from New Hope Corp., also located<br />

in Australia.<br />

Xstrata Coal is the world’s largest exporter of<br />

thermal coal and the world’s sixth largest mining<br />

company. Xstrata made an initial bid in December<br />

2007 of AU$963 million, or AU$2.85 per share for<br />

Resource Pacific.<br />

Percent of total deal volume worldwide<br />

panies is outside their country of origin. Although<br />

the world is getting smaller, cultural differences<br />

continue to play a key role in business negotiations.<br />

Understanding and leveraging on these cultural<br />

differences is still oftentimes what makes or breaks<br />

a transaction.”<br />

Crossborder transaction values as percentage of<br />

transaction values worldwide<br />

24%<br />

27%<br />

36%<br />

34% 34%<br />

29%<br />

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Source: Thomson Financial<br />

InterFinancial was engaged to provide an Independent<br />

Experts Report to shareholders with a<br />

valuation to aid in determining whether Xstrata’s<br />

bid price for Resource Pacific was fair and reasonable.<br />

After analyzing the value of Resource Pacific’s<br />

asset portfolio, it was clear that the valuation of<br />

the company was higher than the initial bid price.<br />

Given the uncertainties surrounding many of<br />

the variables that go to estimating the value of<br />

the company, InterFinancial applied a Monte Carlo<br />

simulation to provide a statistical distribution of<br />

likely values.<br />

The shareholders did not accept the initial bid<br />

and Xstrata eventually raised its offer by 12% to<br />

AU$1.<strong>08</strong> billion, or AU$3.20 per share. This price<br />

was ultimately accepted by the shareholders and<br />

Xstrata obtained 100% of the company in February<br />

20<strong>08</strong>.<br />

“Xstrata’s initial offer did not fully reflect the inherent<br />

value of the Newpac mine, which has 252<br />

million tons of coal in reserve, and the potential to<br />

significantly increase production given the available<br />

local infrastructure,” says Dr. Rudenno. “Resource<br />

Pacific also holds a four-million-ton shipping allocation<br />

at Australia’s export terminals. These allocations<br />

are rationed, so Resource Pacific’s quota<br />

is highly desirable to any mining export operation<br />

especially given the planned increase in future export<br />

capacity. It was gratifying that our valuation<br />

played a part in providing shareholders with an<br />

additional AU$119 million (€70 million) in value.”<br />

2 <strong>Clairfield</strong> <strong>Review</strong> <strong>Q2</strong> <strong>08</strong><br />

26%<br />

31%<br />

34%<br />

32%<br />

46%

SynCap<br />

Carlton<br />

Acquisition<br />

UK/Germany<br />

Rentokil Initial<br />

acquired<br />

medentex<br />

Sale<br />

Netherlands/Czech Republic<br />

Sale<br />

Netherlands<br />

Vitae<br />

was sold to<br />

Manpower Inc.<br />

Boer & Croon<br />

Independent Expert Report<br />

Australia<br />

InterFinancial<br />

Rosa Sistemi<br />

was sold to<br />

Aksìa Capital III Fund<br />

K Finance<br />

Vos Logistics<br />

sold<br />

Vos Noord<br />

to<br />

CTP Products<br />

Boer & Croon<br />

Sale<br />

Italy<br />

AU$51 million<br />

for sale of its<br />

Engineering Business<br />

<strong>Clairfield</strong> <strong>Review</strong> <strong>Q2</strong> <strong>08</strong><br />

Rentokil Initial acquired medentex, a German<br />

waste disposal company, for approximately<br />

€12 million. Rentokil Initial plc is<br />

one of the world’s largest business services<br />

companies with annual revenues of £2.2<br />

billion and a market cap of approximately<br />

£1.8 billion. The company has some 70,000<br />

employees providing a range of services in<br />

over 40 countries. medentex GmbH is active<br />

throughout Europe in environmentallyresponsible<br />

and hygienic disposal of waste<br />

materials from dental practices.<br />

Vos Logistics, a Dutch transport and logistics<br />

services company, sold its activities in<br />

the northern part of the Netherlands to<br />

its management. After completion of the<br />

transaction, Vos Noord was renamed De<br />

Vries Transport Group. The buy-out team<br />

was led by Edwin De Vries, managing<br />

director of Vos Noord, and sponsored by<br />

CTP Invest, a Czech commercial property<br />

developer with activities in built-to-lease<br />

property solutions and customized leasing<br />

arrangements.<br />

Vitae, a professional placement company,<br />

was acquired by Manpower, a world leader<br />

in the employment services industry.<br />

Vitae has 10 offices in the Netherlands and<br />

focuses on candidates in specialist fields.<br />

Vitae will initially operate under its own<br />

brand. Manpower, based in the USA, is a<br />

$21 billion company with a network of<br />

4,500 offices in 80 countries. Manpower<br />

Netherlands has 150 offices with 900<br />

consultants.<br />

Rosa Sistemi, a leader in the manufacturing<br />

of precision linear components, was sold to<br />

Aksia Capital III Fund. Rosa Sistemi serves<br />

companies that are active in the machinery<br />

and automation industries. Sales in<br />

2007 were approximately €11 million, with<br />

continuing growth of 20% per year and an<br />

EBITDA of approximately 20%. Aksia Group<br />

is an independent private equity fund<br />

based in Milan, Italy.<br />

CMI, an ASX listed company and leading<br />

supplier of automotive components to<br />

Australian and US automobile companies,<br />

engaged InterFinancial to prepare an Independent<br />

Expert Report in connection with<br />

the proposed sale of the majority of its CMI<br />

engineering division for AU$51 million (€30<br />

million).<br />

SELECTED TRANSACTIONS Q1 <strong>08</strong><br />

Acquisition<br />

France/Belgium<br />

Newtec Packaging<br />

acquired all industrial<br />

assets and the business<br />

of FL Systems<br />

intuitu<br />

SynCap<br />

Sale<br />

Netherlands/Belgium<br />

Vos Logistics<br />

sold<br />

Vos Tank Services<br />

to<br />

Begoos BVBA<br />

Boer & Croon<br />

K Finance<br />

Acquisition<br />

Italy<br />

Axa Private Equity<br />

acquired<br />

Idroma<br />

Merger<br />

Spain<br />

DataLogic<br />

merged with<br />

Sistac<br />

Coram <strong>Clairfield</strong><br />

K Finance<br />

Sale<br />

Italy<br />

Cape Natixis<br />

sold<br />

Schmid<br />

to<br />

Siparex<br />

Newtec–Alvey, a subsidiary of Newtec<br />

Packaging of France, acquired all industrial<br />

assets and the business of the Belgian<br />

company FL Systems. Newtec Packaging<br />

specializes in filling machines, palletizing<br />

systems, and turnkey continuous materialhandling<br />

equipment with sales of more than<br />

€55 million and 280 employees. FL Systems<br />

develops, designs, and manufactures order<br />

picking and internal goods flows systems<br />

as well as palletizing and depalletizing<br />

systems.<br />

Vos Logistics, a Dutch transport and<br />

logistics services company, sold its tank<br />

service activities to Begoos BVBA. Vos Tank<br />

Services is active in tank cleaning and tank<br />

services for logistic service providers. The<br />

main branch in Pernis, Holland is the largest<br />

tank cleaning site in the Netherlands and<br />

is strategically located in the Rotterdam<br />

harbor area. Begoos BVBA is a Belgian<br />

conglomerate of companies.<br />

AXA Private Equity acquired Idroma, an<br />

industrial holding based in Italy. Idroma<br />

controls Duplomatic Automazione, active<br />

in the manufacturing of turrets for CNC lathes,<br />

and Duplomatic Oleodinamica, active<br />

in the production of valves and hydraulic<br />

components. Its main clients are companies<br />

in the automation industries. Sales in<br />

2007 totalled approximately €42 million.<br />

The acquisition was made by the Italian<br />

team of the Small Cap Buyout unit of the<br />

French AXA Private Equity fund.<br />

Data Logic and Sistac signed a merger<br />

agreement. Datalogic, based in Reus, retails<br />

computers under the trade name “Beep”.<br />

Sistac, based in Alicante, retails computers<br />

under the “PC Box” and “PC Coste” trade<br />

names. The merged company is the leader<br />

in computer specialty stores in Spain with<br />

sales of €260 million and approximately<br />

700 retail stores. The stores will continue<br />

to use their current trade names.<br />

Cape Natixis, the Italian-French private<br />

equity fund, sold Schmid to Siparex Private<br />

Equity. Schmid, based in Milan, creates<br />

and markets fabrics and accessories for<br />

the haute couture footwear sector. Sales<br />

in 2007 reached €17 million. Schmid was<br />

sold for more than €19 million to the Italian<br />

branch of the French private equity fund<br />

Siparex.<br />

3

4<br />

New colleagues<br />

Greg Rudd<br />

Dean Johns<br />

Berend Lockefeer<br />

Melvin Sie<br />

<strong>Clairfield</strong> Partners in Australia (InterFinancial) has<br />

recently made three new appointments.<br />

Greg Rudd was appointed internal advisor on<br />

government to the Tolhurst Group, the parent<br />

company of InterFinancial. Mr. Rudd was previously<br />

a lobbyist in his own business for 12 years. He was<br />

a senior policy advisor during the Hawke/Keating<br />

administrations in Australia from 1983 to 1996. Mr.<br />

Rudd has strong relationships with all of Australia’s<br />

current federal and state governments. Mr. Rudd<br />

also brings expertise on Malaysia, China, and<br />

Taiwan to <strong>Clairfield</strong> Partners.<br />

Dean Johns, associate director, has over five<br />

years of experience in various corporate finance<br />

assignments with Ernst & Young Transaction<br />

Advisory Services in Brisbane. Previously Mr. Johns<br />

worked at Ferrier Hodgson. His expertise covers<br />

M&A, valuations, corporate restructuring and<br />

workouts, and investigating accountant reviews.<br />

Berend Lockefeer, director, began his career<br />

in the investment banking industry (currency<br />

and interest rate derivatives) in Europe. At<br />

PricewaterhouseCoopers in Amsterdam, he was<br />

involved in M&A, capital raisings, valuations, and<br />

strategic advisory. In 2000 Mr. Lockefeer moved<br />

to London where he was appointed in an interim<br />

CLAIRFIELD PARTNERS<br />

www.clairfield.com<br />

Australia<br />

Level 3, 167 Eagle Street<br />

Brisbane<br />

Tel: +61 07 3218 9100<br />

Fax: +61 07 3218 9199<br />

www.interfinancial.com.au<br />

Austria, Czech Republic,<br />

Slovakia, Hungary, Poland<br />

Cobenzlgasse 32<br />

A-1190 Wien<br />

Tel: +43 1 470 2388<br />

Fax: +43 1 470 2670<br />

www.modern-products.net<br />

Germany, Belgium<br />

Mendelssohnstrasse 72<br />

D-60325 Frankfurt am Main<br />

Tel: +49 69 707 969 60<br />

Fax: + 49 69 707 969 99<br />

www.syncap.de<br />

intuitucapital<br />

management role in a start-up business. Mr.<br />

Lockefeer moved to Australia in 2001 and consulted<br />

to InterFinancial on a number of transactions<br />

before becoming director.<br />

Melvin Sie has joined <strong>Clairfield</strong> Partners in the<br />

Netherlands (Boer & Croon) as a business analyst.<br />

Mr. Sie holds a masters in finance & investment<br />

from RSM Erasmus University in Rotterdam and a<br />

masters in international management from ESADE<br />

in Barcelona. Prior to joing Boer & Croon, Mr. Sie<br />

completed an internship at Lazard in Amsterdam.<br />

Silvia Cartaña has rejoined <strong>Clairfield</strong> Partners<br />

in Spain (Coram <strong>Clairfield</strong>). Ms. Cartaña formerly<br />

worked as an analyst at Coram. In her new capacity<br />

as office manager, Ms. Cartaña will handle account<br />

management, human resources, and marketing.<br />

Ms. Cartaña has a degree in business administration<br />

from ESADE in Barcelona.<br />

Silke M. Pratnekar has joined <strong>Clairfield</strong> Partners<br />

in Austria and Central and Eastern Europe (MP<br />

Corporate Finance) as office manager. Ms.<br />

Pratnekar will be responsible for administration<br />

and internal business coordination. Ms. Pratnekar is<br />

studying communications science at the University<br />

of Vienna.<br />

France<br />

Place Vendôme<br />

356 rue Saint Honore<br />

75001 Paris<br />

Tel: +33 1 40 20 12 34<br />

Fax: +33 1 40 20 12 35<br />

www.intuitucapital.com<br />

Italy<br />

Via Durini 27<br />

20122 Milano<br />

Tel: +39 02 763 948 88<br />

Fax: +39 02 763 109 67<br />

www.kfinance.com<br />

The Netherlands<br />

Amstelveenseweg 760<br />

1<strong>08</strong>1 JK Amsterdam<br />

Tel: +31 20 301 4350<br />

Fax: +31 20 301 4359<br />

www.boercroon.nl<br />

Spain<br />

Diagonal 520, 6-5<br />

<strong>08</strong>006 Barcelona<br />

Tel: +34 93 487 0330<br />

Fax: +34 93 215 8186<br />

www.coram-clairfield.com<br />

United Kingdom<br />

38 Berkeley Square<br />

London W1J 5AE<br />

Tel: +44 207 355 2211<br />

Fax: +44 207 355 1633<br />

www.carltoncf.com<br />

United States<br />

18 East 41st Street<br />

New York, NY 10017<br />

Tel: +1 212 370 4343<br />

Fax: +1 212 370 4044<br />

DISCLAIMER: No part of this report may be reproduced without the written permission of <strong>Clairfield</strong> Partners or one of its partner firms. The information herein has been obtained<br />

from sources that we believe to be reliable, but we do not guarantee its accuracy or completeness. While we endeavour to update on a reasonable basis the information presented<br />

in this report, there may be regulatory, compliance or other reasons that prevent us from doing so. Much of the information contained in this report is subject to variation due to<br />

changes in market conditions, legislation or regulatory matters and <strong>Clairfield</strong> Partners does not undertake to notify any recipient of the report of changes to the information contained<br />

herein. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. Additional supporting information is available<br />

upon request. Please contact: Research Desk, <strong>Clairfield</strong> Partners, Tel: +34 93 487 4623, email: research@clairfield.com<br />

<strong>Clairfield</strong> <strong>Review</strong> <strong>Q2</strong> <strong>08</strong>