BA_galutinis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

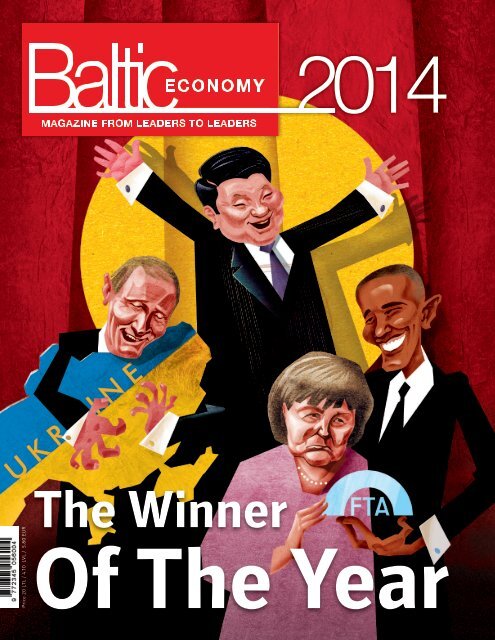

2014<br />

Price 20 LTL / 4.10 LVL / 5.80 EUR<br />

The Winner<br />

Of The Year

TO BREAK THE RULES,<br />

YOU MUST FIRST MASTER<br />

THEM.<br />

THE GRANDE COMPLICATION IS THE ULTIMATE<br />

EXPRESSION OF THE WATCHMAKER’S ART. NOW<br />

AUDEMARS PIGUET PLACES THIS SUPREME<br />

HOROLOGICAL COMPLICATION IN THE<br />

SCULPTURAL ROYAL OAK OFFSHORE.<br />

ONE WATCHMAKER IS RESPONSIBLE FOR EACH<br />

WATCH IN ITS ENTIRETY - THE 648 INDIVIDUAL<br />

PARTS, THE DETAILED ASSEMBLY, THE FINE<br />

DECORATION. TO ACHIEVE THIS, THEY HAVE<br />

MASTERED THE UNIVERSE OF THEIR CRAFT.<br />

FINALLY, THEY MUST TUNE THE CONCENTRIC<br />

CHIMES OF THE MINUTE REPEATER TO AN<br />

INTERVAL OF A PERFECT MINOR THIRD. TECHNICAL<br />

MASTERY AND THE EAR OF A CONCERT SOLOIST.<br />

THE VIRTUOSO HERITAGE OF LE BRASSUS.<br />

Parduotuvė LAIMĖS TILTAS, Gedimino pr.3A Vilnius<br />

tel.+370 5 261 60 00 www.laimestiltas.com<br />

ROYAL OAK<br />

OFFSHORE<br />

GRANDE<br />

COMPLICATION<br />

IN TITANIUM AND CERAMIC.

CONTENT<br />

2014<br />

EDITORIAL<br />

11 | Why the Baltics are more than<br />

just a region and what they fight for<br />

by Eduardas Eigirdas<br />

CRITICAL VIEW<br />

13 | Global economy to face<br />

apocalypse in 2014<br />

WORLD IN 2014<br />

14 | What kind of world China<br />

represents and wants to rule<br />

by Eduardas Eigirdas<br />

EVENT OF THE YEAR 2013<br />

20 | Ukraine between Russia and the<br />

EU – the main point for business<br />

by Vadim Volovoj<br />

ECONOMY INSIGHTS<br />

22 | Roubinisation of financial<br />

markets: what the financial gurus<br />

forecast for 2014<br />

by Artūras Milevskis<br />

INTERVIEW with Jolanta Latvienė<br />

29 | The investment climate for 2014<br />

CRITICAL VIEW<br />

33 | Printing money on a scale the<br />

world has never seen<br />

by Nerijus Mačiulis<br />

TRENDS<br />

34 | Energy from renewables has<br />

chilled, but not the climate<br />

36 | Why television is dying<br />

38 | Why the Vikings resemble Draculas<br />

TOPIC<br />

40 | Chinese Renminbi –<br />

American dream?<br />

by Žygimantas Mauricas<br />

46 | China wants to have a<br />

compliant middle class<br />

by Arūnas Spraunius<br />

52 | Lithuanian, Latvia and Estonia<br />

learning from Obama<br />

by Karolis Makrickas<br />

INTERVIEW with<br />

President Dalia Grybauskaitė<br />

56 | The EU has already gone<br />

through its most severe phase<br />

TOPIC<br />

60 | What Baltic real estate<br />

promoters dream about<br />

by Monika Poškaitytė<br />

2014 <strong>BA</strong>LTIC ECONOMY 7

CONTENT<br />

TOPIC<br />

108 | LNG terminal –<br />

a Lithuanian fortress<br />

by Povilas Juodelis<br />

TRANSPORT INSIGHTS<br />

112 | Lithuania builds EU-China<br />

transport corridor<br />

by Arūnas Spraunius<br />

POLITICAL INSIGHTS<br />

118 | Everyone is spying on everyone,<br />

but not everyone has snowdens<br />

by Arūnas Spraunius<br />

TOPIC<br />

120 | Investing in Belarus:<br />

pros and cons<br />

by Maksimas Saveljevas<br />

The second issue of Baltic Economy<br />

will appear in December 2014.<br />

If you are interested and want to be the first to read it,<br />

subscribe, and we will send you our magazine immediately.<br />

Subscription service:<br />

subscription@balticeconomy.eu<br />

Tel. + 370 5 2 619662<br />

Advertising Department:<br />

almantas@balticeconomy.eu<br />

Tel. + 370 5 2 619662<br />

www.valstybe.eu<br />

TRENDS<br />

66 | Estonia: small, open and on<br />

solid ground<br />

by Hardo Pajula<br />

67 | Latvia: an impressive comeback<br />

by Andris Strazds<br />

68 | Lithuania: lessons<br />

learned from the crisis<br />

by Gitanas Nauseda<br />

FINANCE INSIGHTS<br />

71 | Who is sucking the blood of the<br />

Baltic states' pensioners<br />

by Monika Poškaitytė<br />

TRENDS<br />

76 | NASDAQ OMX Baltic – three<br />

countries, one market<br />

by Ott Raidla<br />

TOPIC<br />

78 | Essential Event – the evacuation<br />

of Schibsted<br />

by Eduardas Eigirdas<br />

MEDIA INSIGHTS<br />

84 | Capitulate like Schibsted or<br />

adapt like Bonnier?<br />

By Eduardas Eigirdas<br />

INTERVIEW with Hans H. Luik<br />

90 | The way to win – to be the largest<br />

CRITICAL VIEW<br />

95 | Scandinavian investments<br />

in the Baltic states – risks and<br />

opportunities<br />

by Rems Razums<br />

TOPIC<br />

96 | Energy independence, Gazprom<br />

pipelines and Andersen's fairy tales<br />

by Eduardas Eigirdas<br />

ENERGY INSIGHTS<br />

104 | Shale gas – from America with<br />

love?<br />

by David L. Goldwyn and Leigh<br />

E. Hendrix<br />

POLITICAL INSIGHTS<br />

134 | The mutating vision of<br />

Kaliningrad and Russia's future<br />

by Vadim Volovoj<br />

BUSINESS TOURISM<br />

138 | Prospects for business tourism<br />

in Vilnius<br />

by Arūnas Spraunius<br />

INTERVIEW with David Brin<br />

142 | Why do we need to forecast<br />

the future?<br />

ENTERTAINMENT<br />

148 | Business and fun in the Baltic<br />

countries in 2014<br />

by Monika Baltrušaitytė<br />

ENTERTAINMENT<br />

152 | Latvian armoured<br />

cars for dictators<br />

by Karolis Makrickas<br />

2014 <strong>BA</strong>LTIC ECONOMY 9

EDITORIAL<br />

The Baltics Are<br />

More Than Just a Region<br />

Perhaps there exists a great<br />

number of small states all<br />

across the world convinced of<br />

their uniqueness. However,<br />

you will surely not find many<br />

which, having freed themselves<br />

from the Soviet Union<br />

are endeavouring to adopt and<br />

learn from Western democracy's<br />

experience and become a<br />

symbol of life that is based on<br />

different values. Such states are<br />

Estonia, Lithuania and Latvia.<br />

It is on their success that their<br />

own fate basically depends, as<br />

much as, in a sense, the future<br />

of all Europe and even Russia.<br />

The more successfully the Baltic<br />

States implement decisions that<br />

enhance their economic potential and social<br />

welfare, the more evident it will be that the<br />

social and economic system represented by<br />

democratic Western states is superior. That<br />

could be an example which might be disregarded<br />

by the dictators entrenched in separate<br />

Eastern states, but it will nevertheless be<br />

seen by the inhabitants of those states and<br />

will encourage them to believe in democracy<br />

and freedom as well as in themselves.<br />

That is a vexing frustration for V. Putin, for<br />

whose Eurasian Union, based on control and<br />

covenants between autocratic leaders, such<br />

as example, which is dispelling its society's<br />

humility, is especially unfavourable. Therefore,<br />

he is not so much taking care of the<br />

modernisation of the Russian<br />

economy, but rather, is striving<br />

by a variety of ways to put the<br />

economies of the Baltic States<br />

on hold. These efforts are most<br />

conspicuously manifest in the<br />

energy sector, where the Baltic<br />

States, the nearest members of<br />

the European Union to Moscow,<br />

are paying one-third more<br />

for Gazprom's gas than other<br />

more distant and considerably<br />

richer EU Member States.<br />

However, proactive actions are<br />

also being witnessed in other<br />

fields such as transport and the<br />

media. Processes that are taking<br />

place in the latter are deserving<br />

of exceptional attention,<br />

since it is with its help that business groups<br />

related to Russia very often succeed in setting<br />

the societies of the Baltic States against each<br />

other and in biasing them against decisions<br />

that are indispensable for their prosperity.<br />

This is why it is of crucial importance that we<br />

continue talking publicly about what concrete<br />

decisions may not only strengthen the Baltic<br />

States, but also Scandinavia and all of Europe.<br />

This is the main reason why we have founded<br />

this magazine. We hope and expect that it<br />

will help to better understand the processes<br />

that are ongoing in the Baltic Sea Region and<br />

will contribute towards the establishment of<br />

Western democracy's fundamental values.<br />

by Eduardas Eigirdas<br />

ISNN 1822-6574<br />

Editorial Staff of<br />

Business Magazine<br />

Director Almantas Gliožeris, almantas@balticeconomy.eu Editorial office T. Vrublevskio g. 6, LT-01100 Vilnius, +370 5 261 9662, fax +370 5 275 8882, almantas@balticeconomy.eu<br />

Editor-in-Chief Eduardas Eigirdas, eduardas@valstybe.eu Deputy Editor Vadim Volovoj, vadimas@balticeconomy.eu Chief Product Officer Ingrida Šidlauskienė ingrida@ balticeconomy.eu<br />

Editorial Staff Arūnas Spraunius, Monika Poškaitytė Designers Silva Jankauskaitė, Karolis Makrickas<br />

Subscription +370 5 231 3154, subscription@balticeconomy.eu Commercial Director Justinas Tverkus +370 5 231 3153, justinas@valstybe.eu<br />

Advertising Project Manager Žilvinas Šileikis +370 5 231 3153, zilvinas@valstybe.eu.<br />

Translation Baltijos vertimai, UAB. Printing House Lietuvos rytas Circulation Audit KPMG Baltics, UAB. Circulation 5 077 copies, plus e-version.<br />

Images Bulls Press, Scanpix/Reuters, Verslo Žinios, BFL, Flickr, Wiki Commons and Image state Visualizations Marius Zavadskis. Photographer Karolis Bingelis.<br />

Copyright © 2014 VšĮ Demokratijos plėtros fondas. All right reserved. Editorial office is not responsible for the content or language of advertising.<br />

It is forbidden to copy and distribute this magazine's contents without permission of the editorial office.

CRITICAL VIEW<br />

Global Economy<br />

to Face<br />

Apocalypse in<br />

2014!<br />

Such a conclusion comes to mind when you analyse<br />

the insights of the 2 best-known economists<br />

for 2014. Neither one of them predicts a plague, a<br />

famine, or an economic disaster. Even N. Roubinis,<br />

who in recent years predicted different challenges for<br />

the global economy rather unsuccessfully, this time refrains<br />

from apocalyptic prophecies. So ironically, it can<br />

be said that the world's economy is in a position where a<br />

serious global crisis is not currently possible, or we are observing<br />

a suspicious conspiracy of economists to conceal<br />

a looming disaster.<br />

However, the editorial board of our magazine believes<br />

that the first option is more realistic, and the majority of<br />

economists who attempted to forecast the risk of the next,<br />

greater recession following the crisis of 2008, just got tired<br />

and decided to stay with moderate insights. However, we<br />

are in no way blaming predictions that most often never<br />

come true, as closely monitoring the economic as well as<br />

scientific situation, we have to admit that today the modified,<br />

illustrated, scandalised or unrealistically exaggerated<br />

reality sells best. So if you want to get on the front covers,<br />

you simply have to dish out terrible statements that may<br />

not come true, because there is no media attempting to<br />

embrace false insights and notify the public – it does not<br />

care.<br />

Indeed, who could care about the past? Everyone cares<br />

about the future, in particular if it is very scary for someone.<br />

Therefore, we have to admit that even with our scary<br />

heading, the majority of Scandinavian entrepreneurs<br />

will never read this comment, because it, like the entire<br />

magazine, seems insufficiently cool. However, if we had<br />

used a more serious title, such as “The world economy<br />

has stabilized”, the number of our readers would probably<br />

be equal to zero. This is understandable, because there is<br />

an overload of information. The flow of information is so<br />

large that convincing the reader that he could find useful<br />

insights in our magazine is almost impossible. Therefore,<br />

the only way to attract attention is associated with emotions.<br />

It is for this reason that a large proportion of serious<br />

publications still try to focus on the status provided by the<br />

created image, catering for their audience in various ways<br />

such as constantly explaining to businessmen (and they<br />

really love it) that the state does not appreciate them, is<br />

taxing them unnecessarily and that generally, the country<br />

would collapse without them. Meanwhile, the media, with<br />

a focus on hot issues, is hunting for flagrant statements<br />

of prominent economists and politicians, often without<br />

regard to the purposes for which they are made and how<br />

true they can be.<br />

So when we talk about standing out in the information<br />

space, it is important to realize that standing out<br />

with captions is of course not serious, but pretending<br />

to read a solid release, when it constantly nourishes you<br />

with scandalised content, is ridiculous. For this reason,<br />

we expect your forgiveness, if, while reading our magazine,<br />

you get the impression that we are overly flagrant<br />

in formulating our article titles or illustrating them too<br />

“deliciously”. We only performed this unpleasant job so<br />

that you can read the essence on paper. We have no doubt<br />

about the value of this information because we only write<br />

about what is really important, and only authors whose<br />

competence and objectivity cause no doubt in sharing<br />

their insights with us.<br />

2014 <strong>BA</strong>LTIC ECONOMY 13

WORLD IN 2014 WORLD IN 2014<br />

The Winners of the Year –<br />

Good China and Grim Russia<br />

The Chinese economy has a great growth potential, and this is good news for the World<br />

economy. But it is time to answer one question – what kind of world China represents and<br />

wants to rule?<br />

by Eduardas Eigirdas<br />

Watching global processes unfolding, we<br />

are often unable to see the gist. It might<br />

be explained by our focusing on the<br />

events taking place on our plate, which is<br />

quite normal and human. It is this human property that<br />

allows those magicians to survive who make an elephant<br />

disappear in an inexplicable way in front of a gaping audience.<br />

While doing this, they seek to draw the attention<br />

of the public to a long-legged female assistant so that the<br />

audience does not take in the whole act and grasp where<br />

the elephant has gone.<br />

This human trait is unfortunately exploited by anyone<br />

who feels like it: salesmen, politicians, economists, journalists<br />

and even doctors. Everyone endeavours to focus<br />

attention on things beneficial for them. Because of this, a<br />

person who does not consciously devote time to get to the<br />

bottom of ongoing processes is simply doomed to become<br />

an elephant admirer – usually, merely seeing an elephant’s<br />

tail in the world processes.<br />

China Manufactures the Largest Copy in the World<br />

Everyone is perfectly aware that an industry of counterfeit<br />

brands had thrived in China earlier (one hopes this<br />

is no more). The Chinese used to simply copy everything,<br />

from Rolex watches to Pampers diapers. This included<br />

everything that was in demand and that they were able to<br />

produce to at least minimum quality standards. Therefore,<br />

when a Chinese-made Rolex, after getting wet, would fall<br />

to pieces like some Chinese diapers, consumers used to<br />

understand this because they had paid a cheaper price<br />

for it. The Chinese, however, at least until now, have not<br />

dared or rather failed to copy a Porsche or a Lamborghini,<br />

though we all undoubtedly understand that they would<br />

like to. The price for a fake Porsche, and for it to drive<br />

a few hundred meters, would be rather high, so it is not<br />

worth the trouble, just as for many other cost-intensive<br />

commodities. Subsequently, before embarking on automobile<br />

manufacturing and copying the German automotive<br />

industry, China has decided to manufacture the largest<br />

copy in the world – that of the US economy.<br />

Paradoxically, a communist state, whose raison d’être<br />

ought to be protection of the interests of workers, for<br />

several decades had become a manufacturing base of the<br />

so-called imperialist and capitalist predators relying upon<br />

cheap labour and its exploitation. This must be the charm<br />

of a communist system – one may do as one pleases to<br />

the people in the name of the party’s goals. Indeed, in<br />

attempting an unbiased view, we should make a point of<br />

the fact that Western corporations, while emphasising social<br />

responsibility, had exploited the Chinese to an extent<br />

officially and unofficially sanctioned by China. An essential<br />

difference in that process is the fact that the Western<br />

corporations had been pursuing short-term goals, while<br />

China – long-term goals. Thereby corporations, competing<br />

amongst themselves, have facilitated the Chinese<br />

Communist Party both in modernising the state and accumulating<br />

money for the manufacture of the biggest<br />

copy in the world. Therefore, when reading about copies<br />

of European or US cities cropping up in China, we are, in<br />

fact, seeing small-scale models of the real Chinese dream.<br />

One may discern the big copy by looking at the stage in its<br />

entirety, leaving out the elephant.<br />

Hundreds of billions of US dollars are being invested<br />

in the transport infrastructure, construction of new cities<br />

and even the adjustment of waterway courses to satisfy<br />

the demand for water in certain regions. Hundreds of millions<br />

of the Chinese rural population have been resettled<br />

in urban areas where they will get accustomed to buying<br />

rice in shops instead of growing it on their small plots of<br />

land. Hence, the growth of urban communities is accelerated,<br />

which is destined to become the driving force behind<br />

domestic consumption. Estimating investment and<br />

changes in the education system, we may safely assume<br />

that in the short run, these new urban dwellers will turn<br />

into a labour force ready, if not for impertinently faking a<br />

Porsche, at least for launching the manufacture of a Chinese<br />

counterpart with a hieroglyph, incomprehensible to<br />

the Europeans, in place of the Porsche logo. This, however,<br />

will require another couple of years, a decade per-<br />

Thus, it makes one wonder how<br />

China could manage to impose the<br />

Renminbi, comprehending the long-term<br />

effects this would have on domination<br />

of the US dollar and the Euro.<br />

haps, and another trillion US dollars in addition. This will<br />

not come easy because the resources of cheap labour are<br />

waning. This is further corroborated by the decision made<br />

by the Communist Party of China allowing Chinese to<br />

have two babies on certain conditions. This is not an easy<br />

decision as the efficiency of labour utilisation is liable to<br />

slump in view of raising two children, so the Communist<br />

Party of China is ready to sacrifice part of the potential<br />

to prevent economic decline in the future as a result of<br />

an abrupt demographic pit. There is, of course, a theoretical<br />

premise that the villagers-turned-urbanites will be the<br />

nurses who will rear the additional several hundred million<br />

little Chinese. At any rate, it is obvious that China<br />

can hardly expect those hundreds of billions, needed for<br />

14 <strong>BA</strong>LTIC ECONOMY 2014<br />

2014 <strong>BA</strong>LTIC ECONOMY 15

WORLD IN 2014<br />

further rapid modernisation, to be coming from manufacturing<br />

and foreign trade; consequently, it is essential to<br />

make a copy of the US and, specifically, their dollar.<br />

Currency Is Also a Friend<br />

On numerous occasions, I have written in my articles<br />

that it will be fascinating to watch China seeking to make<br />

the Yuan a global currency, which, in coming decades, could<br />

become a dominant reserve currency, alongside the US dollar<br />

and the Euro. It is indeed curious as to when China, just<br />

as the US today, will be able to print a trillion Yuan in an<br />

attempt to solve her problems. Or, in what ways will it affect<br />

the potential of the US dollar and the Euro, and does it mean<br />

that a financial twilight is setting down upon the West (considering<br />

the extent of debt)? Anyway, the key issue is how will<br />

China succeed in implementing this process?<br />

Taking a glance at the processes evolving in the currency<br />

world, it becomes evident that reactions to currencies<br />

often resemble responses to something possessing<br />

human features. For example, if some Asian country fears<br />

her neighbour, in addition to foregoing her currency as a<br />

reserve currency, she would not trade with this neighbour<br />

in her own currency, instead using the US dollar or the<br />

Euro. Or if some Eastern dictator was not happy with US<br />

policies, he would straightaway tell his bankers: “Send the<br />

dollar home and replace it with the Euro.” It seems as if a<br />

currency, in addition to being a medium of exchange, is a<br />

kind of secret army for a certain nation, and holding this<br />

currency augments the potential of that nation.<br />

Before embarking on Porsche, China has<br />

decided to manufacture the largest copy<br />

in the world – that of the US economy.<br />

So, geopolitics and related emotions are merely a reality<br />

in the life of a currency. However, there was a reality<br />

when one could replace the US dollar as a reserve currency<br />

by the Euro, Japanese Yen or Swiss Franc, and there will<br />

be a totally different reality when a major part of reserves<br />

is held in the Chinese Yuan. This must be conceived by<br />

most of China’s neighbouring countries – they are far from<br />

striving to accumulate Yuan reserves, and neither are they<br />

ready to trade in this currency. Thus, it makes one wonder<br />

how China could manage to impose the Yuan, comprehending<br />

the long-term effects this would have on domination<br />

of the US dollar and the Euro. I think it would be<br />

very hard, as the adjacent countries would not be willing<br />

to strengthen China even more as long as her Communist<br />

regime posed hardly predictable threats to her neighbours,<br />

while the West would continue its effort to stay on cautiously<br />

friendly terms with the Yuan at least until China<br />

started to play a fair game. As it happens, fair play in this<br />

situation has nothing to do with copying or piracy, but<br />

rather with a situation where China makes money from<br />

free trade thriving on a global scale, and thereafter invests<br />

a large part of this money, either via state-owned companies<br />

or companies controlled by businessmen closely tied<br />

to the elite of the Communist Party, and thence buying up<br />

the world. This process will actually gather momentum<br />

when China is able to print additional trillions.<br />

Victory of the Good Communists or the Bad KGB Men?<br />

The Lithuanian monthly magazine Valstybė in the article<br />

“The British to Release the Chinese Dragon”, which<br />

appeared in the November issue, said that a deal had been<br />

signed with China in London on the 15th of October giving<br />

British investors the right to buy up to 80 billion Yuan<br />

worth of stocks, bonds and other money market instruments.<br />

It is claimed that this was a special step forward for<br />

the City in its aim for closer cooperation with China and,<br />

yet more importantly, in attaining the leading position in<br />

the Yuan trading business. As for China, friendly cooperation<br />

with the UK and other Western countries is simply indispensable<br />

in order to achieve an ambitious goal purporting<br />

that around a third of the total foreign trade of China<br />

will be conducted using the Yuan by 2015. It is easy to calculate<br />

that, theoretically, such a transformation will allow<br />

China to print hundreds of billions of Yuan in the short<br />

run, because with the increase of payments in a particular<br />

currency, the demand for that currency magnifies accordingly.<br />

Hence, whilst the Kremlin has been putting a spoke<br />

in the wheel of cooperation between Ukraine and the European<br />

Union (EU), China, taking advantage of her amicable<br />

communist face and the lucrative intents of certain Western<br />

countries and representatives of their financial sectors,<br />

has meanwhile made a historical step, which will have huge<br />

implications for the global economy in the coming decade.<br />

In getting to the bottom line of the ongoing processes,<br />

one must admit that, as a matter of fact, in many spheres<br />

China is accommodating itself to the model of global trade<br />

through copying the Western economic model, while, as<br />

a result of her size and the trading potential, she has already<br />

become a guarantor for global economic stability,<br />

alongside the US and the EU. Hence, the development of<br />

cooperation is inevitable as the enhancing interdependence<br />

entails the predictability of decisions made by the<br />

economic superpowers. While observing the nice side<br />

of this evolution, however, one should heed the fact that<br />

the Western nations, while moving at a rate favourable<br />

for China, due to a multitude of reasons, are overlooking<br />

manifold trends that might bring negative effects.<br />

16 <strong>BA</strong>LTIC ECONOMY 2014

WORLD IN 2014<br />

WORLD IN 2014<br />

THE WORLD IN 2014 WILL BE VERY BUSY: CHINA WILL CONTINUE TO<br />

COPY THE U.S. ECONOMY. RUSSIA WILL TRY TO TAKE OVER THE UKRAINE.<br />

U.S. AND EUROPE WILL TRY TO SIGN FTA.<br />

The fact is that as a result of cooperation on the part of<br />

the UK and other Western countries, the economic power<br />

and foreign investment of China are increasing, while at<br />

the same time, expansion of the Western corporations inside<br />

China is restricted. This manifestly demonstrates that<br />

this is a one-way process. And the most important thing<br />

is that this is not the only issue that should be of concern<br />

to the West.<br />

While the West is rolling out the red carpet for the<br />

Yuan today, an intriguing question calls for an answer<br />

with reference to the beginnings of the ideological wars.<br />

What has been the impact on the growing friendliness<br />

of the West towards the nice and inclined-to-cooperate<br />

Chinese communists propped up by the increasing efforts<br />

of the Russian KGB to ram Western interests wherever<br />

it is possible? Meshing with gas pipes, increasing energy<br />

prices and supporting dictatorships vexing to Western nations,<br />

especially those in the countries having a positive<br />

effect on oil and gas prices (by inflating them) are some<br />

of these actions. We may yet mention the influence exerted<br />

on political parties, support of oligarchic groups,<br />

wholesale buying-up of mass media and other nice affairs,<br />

which are incessantly promoted by Vladimir Putin’s<br />

fellows from the KGB not only in Ukraine or Lithuania,<br />

but also in West Europe. The real impact of these interventions<br />

is hard to assess; however, they should be taken<br />

into account when watching processes unfolding in the<br />

EU countries. For instance, the current developments in<br />

the UK where a Eurosceptic party, which was recently<br />

formed, is not only assaulting EU unity but also forcing<br />

David Cameron and his Conservative Party to initiate a<br />

referendum on Britain’s European Union membership,<br />

thus seeking to keep voters’ sympathies. An analysis of<br />

the developments unfolding in the UK inevitably brings to<br />

mind the assassination of Alexander Litvinenko and the<br />

fact that ex-KGB officers are even buying popular British<br />

newspapers. Or simply watch a few movies about the legendary<br />

British secret agent, James Bond – in these movies,<br />

the British faced their biggest challenge when they ceased<br />

understanding whether it was them watching the KGB in<br />

Great Britain, or whether a KGB agent was watching them<br />

watching the KGB, making it impossible to see who was<br />

in control of the situation. The British are making a living<br />

mainly from trade in this century and being situated<br />

on an island, their actions aimed at weakening Europe<br />

should not engender major problems for them. On the<br />

other hand, the nations which perceive the importance of<br />

the economic, financial and even military unity of Europe<br />

in the 21st century, see such referenda on secession from<br />

the European Union as bringing back the times of Joseph<br />

Stalin, when a fragmented Europe was, in a way, a menu<br />

for the dictator. Considering how the Kremlin seduces the<br />

EU states with various cooperation projects and secures<br />

its position through oligarchic structures, the expansion<br />

of this process means a direct road from a thriving region<br />

towards a menu card for a dictator. The fact that referenda<br />

on secession from the European Union have not yet<br />

been held in part of the East European countries does not<br />

mean that the oligarchic structures of V. Putin are unable<br />

to organise them. As long as the EU allocates billions, one<br />

may wait and see. Therefore, France and especially Germany,<br />

as sponsors of a larger part of the EU development,<br />

ought to focus attention on what structures maintain their<br />

influence in some countries. This may be identified on<br />

the basis of the situation in the mass media (we wrote<br />

on this subject in the article “Capitulate Like Schibsted<br />

or Adapt Like Bonnier?”). If this influence is maintained<br />

by structures relying on the centres of influence, instead<br />

of a transparently operating market, this creates conditions<br />

for the operation of oligarchic structures relying on<br />

the Kremlin. Hence, provided that oligarchic influences<br />

persist in certain countries because of failure to implement<br />

transparency standards accepted by the Western<br />

countries, referenda on secession from the European<br />

Union will undoubtedly become a matter of fact in such<br />

countries following termination of funding by the EU.<br />

How do We Know what Communists are Scheming?<br />

Everyone interested in economics and seeing more<br />

than just the elephant’s tail must have noticed that China<br />

has succeeded best in buying up lands, companies, islands<br />

or infrastructure in Africa or other countries confronted<br />

with economic hardships. This is exactly the future warranted<br />

for Europe by the expanding KGB and oligarchy<br />

based system built by V. Putin. Subsequently, from the<br />

point of view of the prospects of global dominance, such<br />

activities in Europe sponsored by the grim KGB spiritual<br />

leader V. Putin must be beneficial for Xi Jinping, the<br />

good and friendly leader of the Chinese Communist Party<br />

whose mind is exceptionally preoccupied with money and<br />

trade. To allege, however, that these actions are coordinated<br />

and that the Western countries are watching the<br />

world’s greatest show of a good cop/bad cop would be<br />

premature, although there exist a number of spheres of<br />

analysis allowing one to draw certain inferences. First and<br />

foremost, this is linked to the costs of energy resources,<br />

which lately have been largely impacted (this is especially<br />

true of gas) by the shale gas revolution in the US. If China,<br />

the world’s largest manufacturer profiting from the lower<br />

costs of energy resources, should act contrariwise, that<br />

will help Russia maintain stable income from energy exports,<br />

thereby expanding her influence. Dwindling costs<br />

of energy, on the other hand, in all likelihood are the only<br />

reason which could make V. Putin revise his policies in<br />

regard to both neighbouring states and Russia herself.<br />

Another aspect is related to Chinese investment in the<br />

countries where Russia is seeking to retain her influence.<br />

Currently, China is actively investing in Belarus, which is<br />

the most faithful ally of the Kremlin in Europe. If China<br />

strongly promotes the positions of pro-Kremlin forces<br />

through her investments in Ukraine, while Russia is striving<br />

to keep Ukraine within her sphere of influence, this<br />

will be another step towards the consolidation of anti-<br />

European forces, coincidentally compromising Ukraine’s<br />

sustainable partnership with the European Union.<br />

Having these trends in mind, it will be possible to judge<br />

what the West has nurtured when it resolved to cooperate<br />

Final remarks<br />

Our editorial opinion is that it is China who will enter 2014<br />

as a winner. In a world replete with challenges, and everyone<br />

from BRIC countries to Europe and the US facing grave issues,<br />

it is China which has a realistically attainable goal that might<br />

magnify her economic and financial power in the nearest future.<br />

One must invariably pay for compromises. At the time when the<br />

Euro Zone was created, countries such as Greece were admitted.<br />

Subsequently, this step required payment. It is hard to say how<br />

much the West might be forced to pay in the future as Western<br />

corporations, in pursuit of larger profit margins, have made a<br />

communist superpower out of a weak communist China.<br />

Certain events might serve as symbols of the twilight of the<br />

West. For instance, Norway was punished because in October,<br />

2010, a decision was made to award the Nobel Peace Prize to<br />

the incarcerated Chinese dissident, Liu Xiaobo. Abruptly, China<br />

shifted imports of salmon from Norway to the Faroese Islands<br />

and Great Britain. It clearly shows how such states, like China<br />

and Russia, can exploit the absence of common principles in the<br />

West, while certain countries are merely looking for short-term<br />

benefits. Thus, it is not the West who punishes for imprisoning<br />

dissidents or ignoring human rights, quite the reverse, the West<br />

itself is being punished – pushed into a corner little by little and<br />

compelled to reflect on whether admonishing others for jailed<br />

dissidents is worthwhile.<br />

The potential of the Chinese currency is dealt with in depth<br />

in the article by the economist, Žygimantas Mauricas, published<br />

in this issue. Speaking of the acceleration of changes, however,<br />

it is worthwhile to draw attention to the fact that the Chinese<br />

Yuan overtook the Euro in autumn of 2013 and has become the<br />

second most-used currency in global trade finance and transactions,<br />

such as bills of credit or bank bonds.<br />

We have given Russia the second position because she has<br />

managed to keep Ukraine in check by preventing the signing of<br />

an Association Agreement between Ukraine and the European<br />

Union. This is not a decisive victory, but it has allowedfor winning<br />

time and made Ukraine even more fractured, because<br />

had Viktor Yanukovych signed the agreement, it would have<br />

eased the tensions between the eastern and western regions of<br />

Ukraine. Now this tension will remain, facilitating interference in<br />

steady cooperation between the EU and Ukraine in the future.<br />

This is a hypothetical question thus far; however, among the<br />

developments tolerated by the West in cooperating with China,<br />

there was the fact that the latter had utilised numerous instruments<br />

in order to secure a positive foreign trade balance. This<br />

has helped China seamlessly strengthen her financial potential. I<br />

wonder whether China, having attained the status of the world’s<br />

biggest economy, will ultimately allow any of the Western superpowers<br />

to have a positive balance of trade in relations with her.<br />

with China: a partner, dreaming to copy the US economy<br />

and provide US living standards for her own citizens, or a<br />

dragon inspired by the great Mao, whose real friends are<br />

disciples of another statesman, J. Stalin, and whose major<br />

objective is not a thriving society, but a victory against the<br />

alleged enemy surviving Mao's times.<br />

18 <strong>BA</strong>LTIC ECONOMY 2014 2014 <strong>BA</strong>LTIC ECONOMY 19

EVENT OF THE YEAR 2013<br />

EVENT OF THE YEAR 2013<br />

Ukraine’s Choice –<br />

Bad News for Business!<br />

Is it worthwhile for a business to enter the Ukraine as a market? In recent years, the answer<br />

used to be - "No". That has been demonstrated by the fact that a great number of solid foreign<br />

companies have withdrawn or intend to withdraw from the Ukrainian market.<br />

by Vadim Volovoj<br />

As explained by the representatives of a variety<br />

of Western companies, they are not primarily<br />

dissatisfied with political issues, but instead,<br />

with the economic and regulatory issues of the<br />

country.<br />

As featured on the Focus.ua website, Mr. Armin Burger,<br />

the Chairperson of the Board of the Praktiker Group<br />

(a business of building hypermarkets), refers to his business<br />

project in the Ukraine as "our Ukrainian adventure",<br />

which he is willing to end as quickly as possible: four<br />

big stores will be closed or sold there in total (in Kiev,<br />

Nikolaev, Lviv and Makeyevka). Although the company<br />

was planning to expand in the Ukraine in 2007, its managers<br />

no longer tend to perceive this country's market as<br />

profitable or a priority.<br />

UKRAINIAN ECONOMY – INFLUENCE OF OLIGARCHS GROWS, WESTERN<br />

BUSINESS STEPS <strong>BA</strong>CK. THE PRO-EUROPEAN CAMP DOESN'T WIN THE<br />

PRESIDENTIAL ELECTIONS, CHANGES WILL BECOME IRREVERSIBLE.<br />

"Finn Flare", a Finnish Apparel Store Chain which owns<br />

a multitude of sales outlets in Russia and Kazakhstan, is<br />

going to close its stores in the Ukraine on a mass scale in<br />

the nearest future, since it is cumbersome and pointless to<br />

operate there due to such things as tax inspections, general<br />

economic uncertainty, high rental prices and the low<br />

level of purchasing power.<br />

And this is far from being the final list of Western<br />

companies (let alone the major Russian investment capital)<br />

that are withdrawing from the Ukraine. Among them<br />

are the "Stockmann Group" (which used to operate in the<br />

Ukraine as "Seppala"), "Peacocs" and IKEA. One of the<br />

latest examples is the "Aricent Group" of American IT<br />

Holding, which is closing its representative offices in Vinnitsa<br />

and Kiev. As reported by LB.ua, the official explanation<br />

is its unprofitable operation, whereas unofficially,<br />

there lies a suspicion that local "players" used to deliver<br />

a lot of unaccounted-for orders. Such things undermine<br />

trust more than anything else.<br />

It is obvious that the current situation is due to the aftermath<br />

of the Ukraine's post-Soviet development. Kiev has<br />

had difficulties an leading its independent life after the collapse<br />

of the USSR. The country's political system has steadily<br />

become unstable and its economy has become more<br />

like an oligarchy. As a result, the business environment in<br />

the country more closely resembles everybody's war (with<br />

the president's "family" also an economic interest group)<br />

against everybody else based on the zero-sum game principle<br />

under the terms of legal uncertainty and nihilism.<br />

It is also obvious that such an investment climate is<br />

not acceptable to solid Western entrepreneurs. The existing<br />

"rules of the game" might be suitable for Russia and<br />

the Customs Union, but not for the Euro-Atlantic community.<br />

Therefore, if the Ukraine is willing to turn into a<br />

civilised Western-like state into which solid foreign capital<br />

would be willing to invest, then it is high time for it<br />

to take a step from "yesterday" into "tomorrow", and an<br />

Association Agreement with the European Union was an<br />

excellent opportunity to do just that.<br />

Of course, the shift cannot be easy, on the contrary –<br />

long and painful. But the Ukraine's pro-European choice<br />

would consistently drive the process of liberalisation as<br />

well as improvement in the transparency of its legal system<br />

and business environment. This would likewise enable<br />

the Ukraine to free itself from the trap of the Eastern<br />

business culture, allowing it to modernise itself and<br />

become a European state in the true sense of the word.<br />

That, in its own turn, would unequivocally have a positive<br />

impact on its economic growth and would enhance<br />

its attractiveness to large-scale foreign investments,<br />

which, finding themselves in a European investment environment,<br />

would be more certain of their security and<br />

prospects.<br />

Hence, when we are speaking of the Ukraine's Europeanization,<br />

we must understand that it is not just a geopolitically<br />

important process or one more way for the<br />

aging Western Europe to gain an extra labour force in a<br />

long-term perspective. Kiev's orientation towards the EU<br />

was a positive sign, which was going to bear an immense<br />

economic significance both for the Ukraine and Western<br />

business in the future. There was a real chance for a happy<br />

end, big as never before. Bad news for business – it seems<br />

to be missed. The Kremlin prevails, for the moment...<br />

20 <strong>BA</strong>LTIC ECONOMY 2014 2014 <strong>BA</strong>LTIC ECONOMY 21

ECONOMY INSIGHTS<br />

ECONOMY INSIGHTS<br />

very simple – knowing the opinion of the majority, one<br />

can have a try at seeing what they possibly do not see.<br />

Roubinisation of Financial<br />

Markets: What Are Financial Gurus<br />

Forecasting for the Year 2014?<br />

Who could have ever thought that it would be this year that the United States of America<br />

would find itself only one day away from a declaration of bankruptcy? Who could have ever<br />

guessed that the stocks of the developed countries would be the leading asset class? How<br />

many were there foretelling that the price of gold would drop more than 20%?<br />

by Artūras Milevskis<br />

Let’s begin with the world economy<br />

First of all, let’s take a look at what is being forecasted by<br />

the International Monetary Fund (IMF) or its CEO, Christine<br />

Lagarde, for the world economy in general and for<br />

different world regions separately. The World Economic<br />

Outlook report as issued by this institution in October<br />

this year shows that the growth rate of the world’s gross<br />

domestic product as forecasted by the IMF for the year<br />

2014 will be 3.6%. This figure should exceed the growth<br />

rate forecasted for the year 2013 by approximately 0.7%<br />

or even by a quarter. The developed countries have been<br />

forecasted to enjoy an economic growth of barely 2.0% in<br />

2014, and of this the biggest positive effect should come<br />

from the U.S. economy (+2.6%), which means that the<br />

greatest amount of the entire growth of the world economy<br />

will be carried “on the shoulders” of the economies of<br />

developing countries, which have been forecasted by the<br />

IMF to enjoy a growth of 5.1% in 2014.<br />

Hence, relying specifically on the forecasts furnished<br />

by the economists of the International Monetary Fund,<br />

a conclusion may be drawn that a positive trend is expected<br />

next year. However, there arises the question of<br />

whether the same “rosy” prospects are being discerned<br />

by the representatives of other institutions. For example,<br />

Bill Gross, Manager of the “Pimco Total Return Fund”,<br />

The illusion of forecasting<br />

Research conducted by “DrKW Macro Research” shows that<br />

forecasts for macroeconomic and corporate performance, bond<br />

yields and future stock prices just follow factual data, and not<br />

vice versa as imagined by many. In other words, it’s not the<br />

forecasts furnished by specialists that show what’s ahead in the<br />

future, instead, it’s factual data that suggests how economists<br />

and analysts are going to forecast. As an example, let’s take<br />

the values of the U.S. stock index S&P 500 and the forecasts<br />

furnished by stock strategists for the same index. If we shifted<br />

the curve of the stock index in question a couple of months<br />

forward, then we would have two curves practically coinciding<br />

with each other.<br />

A<br />

major portion of the year 2013 is already in<br />

the past, so it may be asserted with confidence<br />

that it was full of surprises. Who could have<br />

ever thought that it would be this year that the<br />

United States of America would find itself only one day<br />

away from a declaration of bankruptcy, or that approximately<br />

1 million U.S. federal workers would be compelled<br />

to take unpaid vacation for more than two weeks? Who<br />

could have ever guessed that the stocks of the developed<br />

countries would be the leading asset class this year, and<br />

that they would outperform the stocks of the developing<br />

countries by more than 20%? How many were there prognosticating<br />

that the price of gold from the beginning of<br />

the year would have been corrected by more than 20%?<br />

Of course, if we returned to the beginning of the year<br />

2013, we would find a great number of very diverse forecasts,<br />

both pessimistic and optimistic. However, it will<br />

only be when the year finally ends that we will be able to<br />

say exactly who was right and who “missed” completely.<br />

But as most of you have probably understood from the<br />

title of this article, we are not going to talk about the past<br />

today, since it’s much more sagacious to talk about the<br />

future, so further on we are going to review what is being<br />

said by the authorities of the financial world about the<br />

prospects of the world economy, stock markets, gold and<br />

currencies.<br />

Surely, at this point most of you could be confronted by<br />

an elementary question: “Why should one delve into what<br />

is being forecasted by various gurus if eventually most of<br />

such forecasts prove to be wrong?” The answer would be<br />

S&P500 and forecasts<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun- Jun-<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04<br />

Actual S&P500<br />

Forecast<br />

SOURCE: DrKW MACRO RESEARCH<br />

22 <strong>BA</strong>LTIC ECONOMY 2014<br />

2014 <strong>BA</strong>LTIC ECONOMY 23

ECONOMY INSIGHTS<br />

Bill Gross<br />

William Hunt “Bill” Gross is the manager of the<br />

world’s biggest bond fund, the “Pimco Total Return<br />

Fund”. The fund currently manages assets worth approximately<br />

250 billion U.S. dollars. Over the last 14<br />

years, the average annual return of the fund run by him<br />

was equal to 7.4%, surpassing its benchmark, i.e. the<br />

aggregate basket of U.S. bonds, by as much as 1.1%.<br />

Nouriel Roubini<br />

Nouriel Roubini is an economist, lecturer and thinker.<br />

He has earned wide recognition from financial-market<br />

players after having accurately foretold the burst of the<br />

U.S. real-estate bubble in 2007 and the global recession<br />

of 2008. Roubini is most often known for his negative<br />

forecasts, and is therefore called “Dr. Doom”. Notwithstanding<br />

his previous successful forecasts, during the<br />

last couple of years he also managed to err. For instance,<br />

after the global crisis had ended, he still continued for<br />

quite a long time to maintain that the recovery would<br />

only be short-lived and very meagre, but as almost 4<br />

years have now past, he has begun to slightly change his<br />

opinion to a more optimistic one.<br />

Laszlo Birinyi<br />

Laszlo Birinyi is a stock analyst and investor, as well<br />

as the founder of Birinyi Associates. The firm that he<br />

founded is engaged in stock analysis and investment<br />

management. He started his career in investment in<br />

1976. He was widely praised when he accurately foretold<br />

the U.S. stock market’s bottom in 2009 and the following<br />

rise in prices. He was one of the few who asserted<br />

from the very beginning that this bull market would be<br />

strong and would surely last more than a few years. So<br />

far this guess of his has proved correct, but at this point<br />

the rest of his guesses should also be remembered. For<br />

instance, before the drop of U.S. stock prices both in<br />

2008 and in 2000, Mr. Birinyi forecasted a rise in stock<br />

prices, but it all happened completely to the contrary –<br />

the two biggest stock-market crashes of the last 30<br />

years soon followed.<br />

Robert Shiller<br />

Robert Shiller is a U.S. economist, academician, author of<br />

books, and a Nobel Prize Laureate. Presently he is ranked<br />

as one of the 100 most influential economists in the world.<br />

In his book “Irrational Exuberance”, published in 2000, he<br />

warned about the price bubble forming in U.S. stocks, and<br />

especially in information technologies, about the possible<br />

burst of such a price bubble and about the huge losses<br />

that may ensue. Whereas in the second edition of his book,<br />

which was published in 2005, he warned that the rising real<br />

estate prices may lead to extremely woeful consequences:<br />

the inevitable crash of real estate prices and the ensuing<br />

financial panic.<br />

the world’s biggest bond fund, whose managed assets are<br />

currently approximately 248 billion U.S. dollars, asserts<br />

that the growth of the world economy will be weaker<br />

next year than forecasted by the majority of analysts and<br />

will barely reach 2.5%, which is almost one-third less<br />

than forecasted by the IMF. What is influencing such a<br />

considerable divergence? According to Bill Gross, since<br />

the 2009 crisis, the world has entered the so-called “New<br />

Normal” regime, i.e. where both economic growth and<br />

inflation are holding steady at very low levels, and in the<br />

near future the only option is adapting to such an environment.<br />

So, what is the famous Nouriel Roubini saying about<br />

the world economy and the key financial markets? According<br />

to him, the world economic activity is recovering<br />

very slowly, economic growth is meagre, inflation is<br />

low and the unemployment level is high. Such a reality<br />

determines extremely low interest rates in the key economies<br />

and a variety of economic promotion programmes.<br />

However, the worst thing is that these programmes,<br />

which should help the real economy and should encourage<br />

capital investments and the creation of new jobs,<br />

are failing to perform their main function. Most of the<br />

excess liquidity goes to diverse asset classes such as real<br />

estate, stocks, high-yield bonds, etc. According to N.<br />

Roubini, price bubbles are already perceptible in the real<br />

estate markets of such countries as Switzerland, Sweden,<br />

Norway, Germany, Brazil, Singapore and China. If such a<br />

situation continues, a moment will be eventually reached<br />

when many countries and most asset classes will be overwhelmed<br />

by such bubbles, and their bursting will provoke<br />

a sudden and deep recession.<br />

What are the forecasts for global stocks?<br />

Before presenting the forecasts of several different investment<br />

gurus for stock markets in 2014, let’s first remember<br />

what has occurred over the last 5 years. The current bull<br />

market commenced in March, 2009, i.e. after the biggest<br />

financial crisis in the last 70 years. During the crisis, the<br />

global stock index had lost more than 50% of its value,<br />

which means that stock prices were relatively low and<br />

that the investment sentiment and expectations for the<br />

future were rather subdued. The most comical aspect is<br />

that this period proved to be an especially good moment<br />

to invest!<br />

So over the last four-and-a-half years, global stocks<br />

have managed to rise in price by approximately 150%,<br />

which means that the average annual return of the period<br />

in question reached as much as 22%. What do you<br />

think, is that a lot or a little? When analysing the history<br />

of the last 50 years, it can be observed that the average bull<br />

market used to last approximately five and a half years and<br />

during this period, stock prices used to rise by approximately<br />

170% on average. Just having these facts allows<br />

24 <strong>BA</strong>LTIC ECONOMY 2014

ECONOMY INSIGHTS<br />

ECONOMY INSIGHTS<br />

one to draw a simple conclusion: considering its duration<br />

and growth, the current bull market should be approaching<br />

its end. At the present moment we should not be too<br />

surprised if, after such an impressive period, we meet an<br />

ever increasing number of optimists who, based on past<br />

results, will not hesitate to suggest investing in stocks.<br />

However, the most interesting thing is, what are the most<br />

renowned investors saying about the future?<br />

One of the most famous U.S. stock strategists – Laszlo<br />

Birinyi, who had quite accurately foretold the U.S. stock<br />

market’s bottom in 2009 and the following recovery, is<br />

currently forecasting a further rise in the U.S. key stock<br />

index S&P 500. According to him, the U.S. stock market<br />

is presently in the fourth or last stage of the bull market,<br />

which may extend one or two years further. He also thinks<br />

that over this period, the biggest world economy’s – U.S. –<br />

stock index should climb over 2,000 points (the current<br />

value being 1,762 points), and that before a decline in<br />

prices starts, the stock index may even reach 2,500 points<br />

(approximately 40% higher than at the present moment).<br />

His thoughts are basically accepted by the majority of<br />

Wall Street strategists, who likewise assert that the U.S.<br />

key stock index S&P 500 should exceed the limit of 2,000<br />

points sometime next year, or in the worst case, in 2015.<br />

However, the most interesting thing is that Mr. Birinyi<br />

is associating the further rise in stock prices with investors’<br />

euphoria. He deems that most investors, after the last<br />

four especially-lucrative stock market years, will then pull<br />

out and decide to replace safe investments such as cash or<br />

bonds with more aggressive investments such as stocks.<br />

This psychological turning-point will be sudden and on a<br />

mass scale, and will evoke a final rally of stock prices which<br />

will inevitably evolve into a bear market.<br />

Nevertheless, notwithstanding such tremendous optimism<br />

emanating from the majority of investment gurus,<br />

single pessimists can also be found. For instance, Robert<br />

Shiller, this year’s Laureate of the Noble Prize in Economics,<br />

maintains that U.S. stocks are relatively highly priced<br />

(he relies on the indications of his own CAPE ratio). According<br />

to him, the current pricing of U.S. stocks is at its<br />

highest since 2007, which means that, when investing in<br />

stocks for the next 5 or 10 years, one should expect poorer<br />

results than the long-term historical annual-profitability<br />

average of approximately 9%. Of course, this does not<br />

mean that U.S. stocks are going to suffer the losses that<br />

were witnessed in 2008 – 2009 for a second time, but one<br />

needs to understand that after the almost 5-year long rally<br />

of stock prices, optimists who now invest in stocks are<br />

prepared to pay practically twice as much for the same<br />

one unit of profit. Most often, it also means that one will<br />

have to wait twice as long until the investment pays off.<br />

The yellow metal<br />

Before presenting the diverse forecasts of gurus for gold, I<br />

Peter Schiff<br />

Peter Schiff is an entrepreneur, investment broker,<br />

and author. He is known for his especially negative<br />

forecasts for the U.S. economy and national currency,<br />

though he speaks positively of commodities [raw materials],<br />

especially of gold, and other countries’ currencies<br />

and stocks. He became famous in 2008 after having<br />

correctly foretold of the great recession and the burst<br />

of the stock and real estate price bubbles. However,<br />

notwithstanding this accurate guess, the majority of his<br />

forecasts made thereafter did not prove to be correct.<br />

He maintained that the bouncing back of stocks that<br />

commenced in 2009 would only be short-lived, that the<br />

price of gold over the course of several years was going<br />

to reach 5,000 U.S. dollars per troy ounce and that the<br />

U.S. dollar would continue to weaken in respect to other<br />

major currencies.<br />

Marc Faber<br />

Marc Faber is a Swiss investor and author of the wellknown<br />

monthly newsletter, “Gloom Boom & Doom Report”.<br />

During his fairly long career in personal investment, he<br />

produced a great number of recommendations, but the<br />

first recommendation that made him famous was made in<br />

1987, when he recommended that his customers sell the<br />

stock positions they possessed. For those who don’t know,<br />

in October 1987, the U.S. stock indices lost approximately<br />

20% of their value in one day. He also warned about the<br />

Japanese stock price bubble in 1990, the U.S. stock price<br />

bubble in 2000, as well as the price bubbles in stocks, real<br />

estate and commodities [raw materials] in 2008. Nevertheless,<br />

the recent years have not been very successful for him.<br />

For instance, in 2013, Mr. Faber forecasted huge losses for<br />

global stocks and a profitable year for gold, but, as we now<br />

know, the situation is completely the opposite.<br />

would first like to furnish a couple of very concrete facts.<br />

Over the last 10 years, the price of gold has risen by approximately<br />

14% per annum. Considering that this result<br />

has practically surpassed all other investment instruments,<br />

it’s no wonder that during the same period, there<br />

was also an increase in the interest shown in this investment<br />

instrument. Meanwhile, the second fact is that during<br />

the last 2 years, the price of gold has been constantly<br />

decreasing and since its peak, it has already lost nearly one<br />

third of its value. Most interestingly, this extremely poor<br />

result has not diminished the interest shown in the noble<br />

metal, and some are still further forecasting incredible<br />

profits for gold lovers. So, what are the gold gurus saying<br />

about the future prospects of gold?<br />

Peter Schiff is one of the most passionate gold lovers,<br />

who warned all investors in 2006 of the approaching<br />

“greatest crisis of the century”, and is quite assuredly tossing<br />

around further forecasts about growth in the price of<br />

gold. He asserts that the price of gold over the course of<br />

years could exceed 2,000 U.S. dollars per troy ounce, which<br />

means that the price of gold from its current value should<br />

shoot up by nearly 50%! What’s the main reason for making<br />

such a forecast? From a realistic point of view, nothing has<br />

changed – the U.S. continues to print money (like the central<br />

banks of most other countries), the amount of money<br />

within the system is growing, countries’ debts continue to<br />

rise, etc. According to Mr. Schiff, we are inevitably drawing<br />

closer to the moment when countries will start going bankrupt.<br />

For instance, he forecasts that before the tenure of the<br />

current U.S. President, Barack Obama, ends in 2017, the<br />

U.S. will default on paying the interest on its debt and will<br />

be compelled to declare bankruptcy. Given such a situation,<br />

gold should become one of the main hedging instruments.<br />

Should countries go bankrupt, the price of gold could rise<br />

considerably, and only those investors who have purchased<br />

real gold will be able to retain and possibly even experience<br />

growth in their assets.<br />

Peter Schiff ’s forecast is accepted by another famous<br />

investment guru, Marc Faber, who has been reprimanding<br />

the U.S. central bank’s managers for quite a long time<br />

and has been constantly recommending the purchase of<br />

physical gold. According to him, no single asset class is<br />

safe presently – neither bank deposits nor U.S. stocks or<br />

bonds, but if the price of gold happens to reach a price of<br />

1,200 – 1,250 U.S. dollars per troy ounce once again, he is<br />

certainly going to buy some extra gold and recommends<br />

the same for others.<br />

What is most interesting is that two years ago, as the<br />

correction in the price of gold started, neither of the<br />

above-mentioned two specialists made any comment as to<br />

the impending extremely great losses, and since the price<br />

of the noble metal has dropped by 30%, no other choice<br />

is left apart from saying that cheaper gold is a much more<br />

attractive investment alternative while in quest of culprits.<br />

However, when it comes to gold, unlike in the analysis<br />

of stocks, there exists a different camp – i.e. the commodities<br />

[raw materials] analysts of most banks like Goldman<br />

Sachs or Deutsche Bank. Most of them, as if agreed to in<br />

advance, are forecasting lower prices for the noble metal.<br />

For instance, Jeffrey Currie, Head of Commodities Research<br />

at the U.S. investment bank Goldman Sachs, forecasts<br />

that the average price of gold should be at least 1,050<br />

U.S. dollars per troy ounce in 2014. According to him,<br />

such weakness in the price will correlate with the fact that<br />

as the economies of the U.S. and other regions are recovering,<br />

there will be a decline in the need for promoting<br />

such economies and printing money. In turn, the threat of<br />

global crisis and high inflation will be accordingly diminished,<br />

which will lead to a greater reduction in demand<br />

for instruments used to hedge against these events – for<br />

instance, gold.<br />

Conclusions<br />

In an attempt to sum up the thoughts of all the economists,<br />

investors and analysts mentioned in this article, two directions<br />

of forecasts can be distinguished: optimistic and pessimistic.<br />

The optimists assert that economic activity in 2014<br />

should recover, which should also positively affect corporate<br />

profits and stock prices for a while. Meanwhile, the improving<br />

economic situation, especially in the United States<br />

of America, will allow the Federal Reserve Bank to start<br />

diminishing its promotion programme, which, in its own<br />

turn, should adversely affect the prices of bonds and gold.<br />

In the meantime, the pessimists’ camp asserts that the<br />

economic incentive policy implemented by the central<br />

banks of the major countries provides no real benefits for<br />

the economy and instead, just inflates the prices of financial<br />

assets. Should these bubbles burst and should a global<br />

recession start, bankruptcies of countries may ensue, in<br />

which case gold is referred to as the only source of salvation.<br />

As we can see, as many people, as many opinions. Let’s<br />

not forget that forecasting the future is an especially complex<br />

and intricate task, even for those gurus who once<br />

managed to guess it earlier. So therefore, use your own<br />

head, don’t take the forecasts of any guru for granted and<br />

be prepared to embrace the unexpected in 2014. None of<br />

us knows exactly what is waiting for us around the corner<br />

of “The New Year”.<br />

AUTHOR<br />

Artūras Milevskis,<br />

Head of the Investment Management Unit at<br />

“Synergy Finance”, lecturer at investavimas.lt,<br />

lecturer at the International Business School of<br />

Vilnius University<br />

26 <strong>BA</strong>LTIC ECONOMY 2014 2014 <strong>BA</strong>LTIC ECONOMY 27

INTERVIEW<br />

The Investment Climate for 2014<br />

Most financial institutions publish their forecasts, but not all of them are completely solid.<br />

EVLI stands out as a competent and trustworthy investment bank, operating in Nordic and<br />

Baltic countries. Therefore, looking forward to 2014, we talk to “Evli Securities AS” Management<br />

Board President Jolanta Latvienė.<br />

What are your predictions on<br />

global economic development<br />

in 2014? What kind of trends<br />

should investors pay attention to?<br />

At Evli we think that global growth<br />

will pick up in 2014, although the<br />

recovery is not believed to be strong.<br />

We see the most interesting opportunities<br />

in Europe, which is recovering<br />

from the recession. In the euro-zone,<br />

equity valuation is still not expensive.<br />

Also, as growth numbers are<br />

getting better, especially in the US,<br />

we may see the Fed start to taper at<br />

the beginning of next year. This will<br />

put some pressure on long rates that<br />

are at a very low level.<br />

At the same time, 2014 will be a very<br />

difficult year for fixed income investors,<br />

as expected return is almost<br />

close to zero in fixed income assets.<br />

The best asset class in fixed income<br />

will be euro-area high-yield bonds,<br />

which we expect to earn a return of<br />

around 5 – 7 % next year.<br />

A few years ago it was clear that<br />

the BRIC countries of Russia and<br />

China are doing great, while the<br />

USA and EU were drowning in<br />

debts. How could you define the<br />

current situation and how long is<br />

this situation going to last?<br />

As global growth is normalising,<br />

and investor sentiment is improving,<br />

their focus on weak countries<br />

with high debt levels is getting less<br />

intense. At the moment, the biggest<br />

concern in the emerging markets<br />

(EM) is the commodity market,<br />

where the trend of rising prices<br />

experienced a downturn in 2010.<br />

Currently there is an oversupply in<br />

many commodities, and the outlook<br />

is weak. Usually it takes many years<br />

to normalise the oversupply that we<br />

see in the EM countries commodity<br />

market right now. At the moment,<br />

we at Evli are cautious regarding EM<br />

equities.<br />

Which countries’ or regions’ economic<br />

situation raises the biggest<br />

concerns and which of them seem<br />

to be the best ones?<br />

We are overweight in euro-zone equities,<br />

as the situation in this area is still<br />

improving from the recession. At the<br />

moment, our biggest concerns are<br />

2014 <strong>BA</strong>LTIC ECONOMY 29

INTERVIEW<br />

JOLANTA LATVIENĖ SAYS, THAT CURRENTLY<br />

THERE IS AN OVERSUPPLY IN MANY<br />

COMMODITIES, AND THE OUTLOOK IS WEAK.<br />

regarding countries like Brazil, China<br />

and Russia, which are all highly dependent<br />

on the commodity cycle.<br />

Where do the Scandinavian<br />

countries stand in the European<br />

investment map? What issues<br />

can have an impact on investors’<br />

perceptions of the Scandinavian<br />

countries?<br />

The situation is very different depending<br />

on which Scandinavian country<br />

we are talking about. The economic<br />

situation is probably the weakest in<br />

Finland, where consumers have a lot<br />

of head wind from high debt levels<br />

and low economic growth. One of the<br />

biggest problems Finland is facing is<br />

the loss of competitiveness. Looking<br />

at the other Scandinavian countries,<br />

the outlook for growth is much<br />

stronger and more optimistic.<br />

Is there any positive news from the<br />

Baltic countries that could have a<br />

positive impact on the investors'<br />

perception of these relatively small<br />

markets?<br />

The Baltic countries are recovering<br />

quite fast and are also getting support<br />

from the fact that global growth<br />

is rising. At the moment, investors<br />

are quite cautious in emerging markets<br />

and hence their interest in the<br />

Baltic countries is very low. Eastern<br />

Europe in particular is not a place<br />

where we see a lot of client interest.<br />

Nevertheless, we hope that the latest<br />

economic performance and the ease<br />

of doing business in Baltic countries<br />

will attract more investors.<br />

When do you foresee the next<br />

global economic crisis?<br />

It has never been a good strategy<br />

The best asset class<br />

in fixed income will<br />

be euro-area highyield<br />

bonds, which<br />

we expect to earn a<br />

return of around<br />

5 – 7 % next year.<br />

for an investor to wait for the next<br />

crisis. But we think that before 2020<br />

we might have the next major crisis<br />

which will probably be related to the<br />

financial crisis of 2008 and the massive<br />

liquidity injection that central<br />

banks have done everywhere.<br />

30 <strong>BA</strong>LTIC ECONOMY 2014

CRITICAL VIEW<br />

On the Left – a Chasm,<br />

On the Right – a<br />

Gulf, and Everything<br />

Surrounded by<br />

Darkness<br />

The World has just gone through deep economic<br />

decline. Today it faces the money print it has<br />

never seen. What next?<br />

No, it’s not about politics. At least not the politics<br />

you thought about. It is about the monetary<br />

policy choices of the world’s major central<br />

banks and the attempt to decide whether they<br />

still have to fight the risks of deflation – price and wage<br />

downward spiral – or maybe extinguish the inflation that<br />

has begun to materialise in the markets of some assets.<br />

For nearly five years, the major world central banks<br />

have kept the case interest rates close to zero. But it is<br />

clear that low interest has no significant positive impact<br />

on economic growth, that the population and businesses<br />

do not want to borrow, and quite the opposite – are trying<br />

to reduce their financial obligations. In this situation,<br />

central banks chose non-traditional monetary incentives<br />

and started to increase their balances, or in other words,<br />

to print money. Since the end of 2008, this has been happening<br />

at an unprecedented rate – for example, the U.S.<br />

Federal Reserve (FED) increased the monetary base by<br />

approximately four-fold.<br />

However, the journey of central banks off the beaten<br />