You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

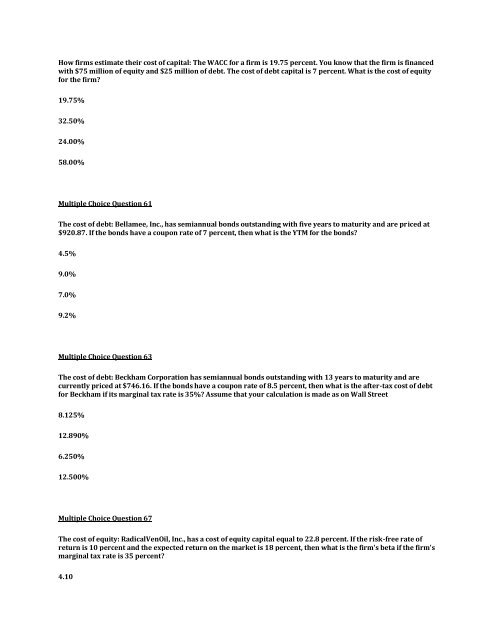

How firms estimate their cost of capital: The WACC for a firm is 19.75 percent. You know that the firm is financed<br />

with $75 million of equity and $25 million of debt. The cost of debt capital is 7 percent. What is the cost of equity<br />

for the firm?<br />

19.75%<br />

32.50%<br />

24.00%<br />

58.00%<br />

Multiple Choice Question 61<br />

The cost of debt: Bellamee, Inc., has semiannual bonds outstanding with five years to maturity and are priced at<br />

$920.87. If the bonds have a coupon rate of 7 percent, then what is the YTM for the bonds?<br />

4.5%<br />

9.0%<br />

7.0%<br />

9.2%<br />

Multiple Choice Question 63<br />

The cost of debt: Beckham Corporation has semiannual bonds outstanding with 13 years to maturity and are<br />

currently priced at $746.16. If the bonds have a coupon rate of 8.5 percent, then what is the after-tax cost of debt<br />

for Beckham if its marginal tax rate is 35%? Assume that your calculation is made as on Wall Street<br />

8.125%<br />

12.890%<br />

6.250%<br />

12.500%<br />

Multiple Choice Question 67<br />

The cost of equity: RadicalVenOil, Inc., has a cost of equity capital equal to 22.8 percent. If the risk-free rate of<br />

return is 10 percent and the expected return on the market is 18 percent, then what is the firm's beta if the firm's<br />

marginal tax rate is 35 percent?<br />

4.10