ACCT 444 Week 1 Quiz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

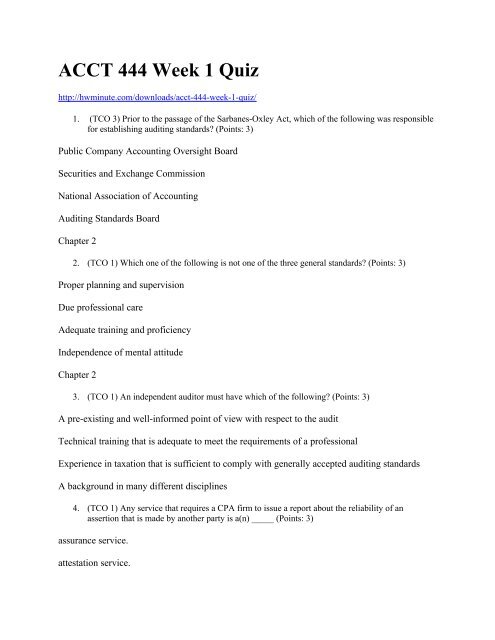

<strong>ACCT</strong> <strong>444</strong> <strong>Week</strong> 1 <strong>Quiz</strong><br />

http://hwminute.com/downloads/acct-<strong>444</strong>-week-1-quiz/<br />

1. (TCO 3) Prior to the passage of the Sarbanes-Oxley Act, which of the following was responsible<br />

for establishing auditing standards? (Points: 3)<br />

Public Company Accounting Oversight Board<br />

Securities and Exchange Commission<br />

National Association of Accounting<br />

Auditing Standards Board<br />

Chapter 2<br />

2. (TCO 1) Which one of the following is not one of the three general standards? (Points: 3)<br />

Proper planning and supervision<br />

Due professional care<br />

Adequate training and proficiency<br />

Independence of mental attitude<br />

Chapter 2<br />

3. (TCO 1) An independent auditor must have which of the following? (Points: 3)<br />

A pre-existing and well-informed point of view with respect to the audit<br />

Technical training that is adequate to meet the requirements of a professional<br />

Experience in taxation that is sufficient to comply with generally accepted auditing standards<br />

A background in many different disciplines<br />

4. (TCO 1) Any service that requires a CPA firm to issue a report about the reliability of an<br />

assertion that is made by another party is a(n) _____ (Points: 3)<br />

assurance service.<br />

attestation service.

tax service.<br />

accounting and bookkeeping service.<br />

Chapter 1<br />

5. (TCO 1) Which of the following statements is incorrect regarding the SEC’s partner rotation<br />

rules? (Points: 3)<br />

The lead and concurring partners are subject to a 5-year time out period.<br />

All audit partners must rotate off the audit engagement after 5 years.<br />

Other audit partners are subject to a 2-year time out period.<br />

Small firms may be exempted from the partner rotation requirement.<br />

6. (TCO 3) Burrow & Co., CPAs, have provided annual audit and tax compliance services to Mare<br />

Corp. for several years. Mare has been unable to pay Burrow in full for services Burrow rendered<br />

19 months ago. Burrow is ready to begin fieldwork for the current year’s audit. Under the ethical<br />

standards of the profession, which of the following arrangements will permit Burrow to begin the<br />

fieldwork on Mare’s audit? (Points: 3)<br />

Mare engages another firm to perform the fieldwork, and Burrow is limited to reviewing the<br />

workpapers and issuing the audit report.<br />

Mare sets up a 2-year payment plan with Burrow to settle the unpaid fee balance.<br />

Mare gives Burrow an 18-month note payable for the full amount of the past due fees before<br />

Burrow begins the audit.<br />

Mare commits to pay the past due fee in full before the audit report is issued.<br />

Chapter 2<br />

7. (TCO 3) Independence in auditing means (Points: 3)<br />

remaining aloof from a client.<br />

taking an unbaised and objective viewpoint.<br />

not being financially dependent on a client.<br />

being an advocate for a client.<br />

Chapter 4

8. (TCO 3) The financial interests of which of the following parties would not be included as a<br />

direct financial interest of the CPA? (Points: 3)<br />

Dependent child<br />

Relative supported by the CPA<br />

Spouse<br />

Sibling living in the same city as the CPA<br />

Chapter 4<br />

9. (TCO 1) The phrase U.S. generally accepted accounting principles is an accounting term that<br />

(Points: 3)<br />

encompasses the conventions, rules, and procedures necessary to define U.S. accepted<br />

accounting practice at a particular time.<br />

provides a measure of conventions, rules, and procedures governed by the AICPA.<br />

is included in the audit report to indicate that the audit has been conducted in accordance with<br />

generally accepted auditing standards (GAAS).<br />

includes broad guidelines of general application but not detailed practices and procedures.<br />

Chapter 1<br />

10. (TCO 1) Which of the following statements best describes the ethical standard of the profession<br />

pertaining to advertising and solicitation? (Points: 3)<br />

A CPA may advertise in any manner that is not false, misleading, or deceptive.<br />

There are no prohibitions regarding the manner in which CPAs may solicit new business.<br />

All forms of advertising and solicitation are prohibited.<br />

A CPA may only solicit new clients through mass mailings.<br />

1. (TCO 3) The Sarbanes-Oxley Act applies to which of the following companies? (Points : 3)<br />

Privately held companies<br />

All companies<br />

All public companies and privately held companies with assets greater than $500 million

Public companies<br />

Chapter 1<br />

Question 4. 4. (TCO 1) An operational audit has as one of its objectives to (Points : 3)<br />

make recommendations for improving performance.<br />

determine whether the financial statements fairly present the entity’s operations.<br />

evaluate the feasibility of attaining the entity’s operational objectives.<br />

report on the entity’s relative success in attaining profit maximization.<br />

Chapter 1<br />

Question 5. 5. (TCO 1) Which of the following services do not need to be preapproved by the<br />

audit committee of an issuer? (Points : 3)<br />

Nonaudit services related to internal control over financial reporting<br />

Tax services<br />

Nonaudit services that are less than 5 % of total revenues from the audit client<br />

Services provided by the auditor on a recurring basis<br />

Question 8. 8. (TCO 3) Several months after an unqualified audit report was issued, the auditor<br />

discovered the financial statements were materially misstated. The client’s CEO agrees that there<br />

are misstatements, but refuses to correct them. She claims that confidentiality prevents the CPA<br />

from informing anyone. (Points : 3)<br />

The CEO is incorrect, but because the audit report has been issued, it is too late.<br />

The CEO is correct and the auditor must maintain confidentiality.<br />

The CEO is correct, but to be ethically correct the auditor should violate the confidentiality rule<br />

and disclose the error.<br />

The CEO is incorrect, and the auditor has an obligation to issue a revised audit report, even if the<br />

CEO will not correct the financial statements.<br />

Chapter 4<br />

Question 9. 9. (TCO 1) Which of the following terms identifies a requirement for audit<br />

evidence? (Points : 3)

Adequate<br />

Disconfirming<br />

Reasonable<br />

Appropriate<br />

Chapter 1<br />

Question 10. 10. (TCO 1) The auditor of an issuer may provide which of the following tax<br />

services? (Points : 3)<br />

Tax services for immediate family members of corporate officers<br />

Tax planning services<br />

Tax services for officers of the issuer<br />

Services related to confidential tax transactions<br />

5. (TCO 1) Jackson & Company, CPAs, plan to audit the financial statements of Perigee<br />

Technologies, an issuer as defined under the Sarbanes-Oxley Act of 2002. Which of the following<br />

situations would impair Jackson’s independence? (Points : 3)<br />

Discovering that Lowe, the chief financial officer of Perigee, started his accounting career 10<br />

years earlier as a staff accountant for Jackson & Company and continues to maintain ties with<br />

current partners at the firm<br />

Provision of personal tax services to Johnson, the accounts payable manager of Perigee<br />

Audit of Perigee’s internal control is performed contemporaneously with the annual financial<br />

statement audit<br />

Preparation of Perigee’s routine annual tax return, where Jackson’s fee will be calculated as a<br />

percentage of the tax refund obtained