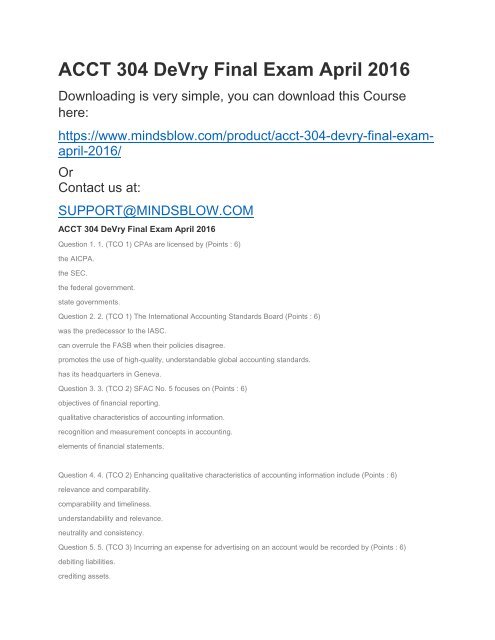

ACCT 304 DeVry Final Exam April 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>304</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong> <strong>April</strong> <strong>2016</strong><br />

Downloading is very simple, you can download this Course<br />

here:<br />

https://www.mindsblow.com/product/acct-<strong>304</strong>-devry-final-examapril-<strong>2016</strong>/<br />

Or<br />

Contact us at:<br />

SUPPORT@MINDSBLOW.COM<br />

<strong>ACCT</strong> <strong>304</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong> <strong>April</strong> <strong>2016</strong><br />

Question 1. 1. (TCO 1) CPAs are licensed by (Points : 6)<br />

the AICPA.<br />

the SEC.<br />

the federal government.<br />

state governments.<br />

Question 2. 2. (TCO 1) The International Accounting Standards Board (Points : 6)<br />

was the predecessor to the IASC.<br />

can overrule the FASB when their policies disagree.<br />

promotes the use of high-quality, understandable global accounting standards.<br />

has its headquarters in Geneva.<br />

Question 3. 3. (TCO 2) SFAC No. 5 focuses on (Points : 6)<br />

objectives of financial reporting.<br />

qualitative characteristics of accounting information.<br />

recognition and measurement concepts in accounting.<br />

elements of financial statements.<br />

Question 4. 4. (TCO 2) Enhancing qualitative characteristics of accounting information include (Points : 6)<br />

relevance and comparability.<br />

comparability and timeliness.<br />

understandability and relevance.<br />

neutrality and consistency.<br />

Question 5. 5. (TCO 3) Incurring an expense for advertising on an account would be recorded by (Points : 6)<br />

debiting liabilities.<br />

crediting assets.

debiting an expense.<br />

debiting assets.<br />

Question 6. 6. (TCO 3) Adjusting entries are primarily needed for (Points : 6)<br />

cash basis accounting.<br />

accrual accounting.<br />

current value accounting.<br />

manual accounting systems.<br />

Question 7. 7. (TCO 4) Current assets include cash and all other assets expected to become cash or be consumed<br />

(Points : 6)<br />

within 1 year.<br />

within 1 operating cycle.<br />

within 1 year or 1 operating cycle, whichever is shorter.<br />

within 1 year or 1 operating cycle, whichever is longer.<br />

Question 8. 8. (TCO 4) Notes payable(‘s) (Points : 6)<br />

is a current liability account.<br />

usually has a debit balance.<br />

is a noncurrent liability account.<br />

classification cannot be determined without additional information.<br />

Question 9. 9. (TCO 5) The distinction between operating and nonoperating income relates to (Points : 6)<br />

continuity of income.<br />

principal activities of the reporting entity.<br />

consistency of income stream.<br />

reliability of measurements.<br />

Question 10. 10. (TCO 5) On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for<br />

$80 million. The sale was completed on December 31, 2012. The following additional facts pertain to the transaction:<br />

· The Footwear Division qualifies as a component of the entity, according to GAAP, regarding discontinued operations.<br />

· The book value of Footwear's assets totaled $48 million on the date of the sale.<br />

· Footwear's operating income was a pre-tax loss of $10 million in 2012.<br />

· Foxtrot's income tax rate is 40%.<br />

In the 2012 income statement for Foxtrot Co., it would report (Points : 6)<br />

income (loss) on its total operations for the year without separation.<br />

income (loss) on its continuing operation only.<br />

income (loss) from its continuing and discontinued operations separately.<br />

income and gains separately from losses.

Question 11. 11. (TCO 8) When using the gross profit method to estimate ending inventory, it is not necessary to know<br />

(Points : 6)<br />

beginning inventory.<br />

net purchases.<br />

cost of goods sold.<br />

net sales.<br />

Page 2<br />

Question 1. 1.(TCO 5) The FASB's stated preference for reporting operating cash flows is the (Points : 6)<br />

indirect method.<br />

direct method.<br />

working capital method.<br />

all financial resources method.<br />

Question 2. 2.(TCO 5) Merchandise sold FOB shipping point indicates that (Points : 6)<br />

the seller pays the freight.<br />

the buyer holds title after the merchandise leaves the seller's location.<br />

the common carrier holds title until the merchandise is delivered.<br />

the sale is not consummated until the merchandise reaches the point to which it is being shipped.<br />

Question 3. 3.(TCO 5) Todd Sweeney is an artist who sells his work under consignment. (He displays his work in local<br />

barbershops, and customers buy the work there.) Sweeney recently transferred a painting to a local barbershop. The<br />

rationale for adoption of the percentage-of-completion method is that (Points : 6)<br />

results are more conservative.<br />

it provides a measure of periodic accomplishment.<br />

it is a better match with legal ownership.<br />

it results in a lower income tax.<br />

Question 4. 4.(TCO 6) Reba wishes to know how much money would be in her savings account if she deposits a given<br />

sum in an account and leaves it there at 6% interest for five years. She should use a table for the (Points : 6)<br />

future value of an ordinary annuity of 1.<br />

future value of 1.<br />

future value of an annuity of 1.<br />

present value of an annuity due of 1.<br />

Question 5. 5.(TCO 6) Yamaha Inc. hires a new chief financial officer and promises to pay him a lump-sum bonus four<br />

years after he joins the company. The new CFO insists that the company invest an amount of money at the beginning<br />

of each year in a 7% fixed rate investment fund to ensure that the bonus will be available. To determine the amount<br />

that must be invested each year, a computation must be made using the formula for (Points : 6)<br />

the future value of a deferred annuity.

the future value of an ordinary annuity.<br />

the future value of an annuity due.<br />

None of the above<br />

Question 6. 6.(TCO 7) Compensating balances represent (Points : 6)<br />

funds in a bank account that cannot be spent.<br />

balances in a payroll checking account.<br />

accounts that are subject to bank service charges.<br />

accounts on which banks pay interest, such as NOW accounts.<br />

Question 7. 7.(TCO 7) Oswego Clay Pipe Company sold $46,000 of pipe to Southeast Water District #45 on <strong>April</strong> 12<br />

of the current year with terms 1/15, n/60. Oswego uses the gross method of accounting for cash discounts. What entry<br />

would Oswego make on June 10, assuming the customer made the correct payment on that date? (Points : 6)<br />

Cash 46460<br />

Accounts Receivable 45540<br />

Discounts Receivable 460<br />

Cash 46000<br />

Accounts Receivable 45540<br />

Interest Revenue 460<br />

Cash 46000<br />

Accounts Receivable 46000<br />

Cash 46460<br />

Accounts Receivable 46000<br />

Interest Revenue 460<br />

Question 8. 8.(TCO 8) In a perpetual inventory system, the cost of inventory sold is (Points : 6)<br />

debited to accounts receivable.<br />

credited to cost of goods sold.<br />

debited to cost of goods sold.<br />

not recorded at the time.

Question 9. 9.(TCO 5) The statement of cash flows reports cash flows from the activities of (Points : 6)<br />

operating, purchasing, and investing.<br />

borrowing, paying, and investing.<br />

financing, investing, and operating.<br />

using, investing, and financing.<br />

Question 10. 10.(TCO 8) Under the retail inventory method, (Points : 6)<br />

a company measures inventory on its balance sheet by converting retail prices to cost.<br />

a company measures inventory on its balance sheet at current selling prices.<br />

a company measures inventory on its balance sheet on a LIFO basis.<br />

None of the above<br />

Question 11. 11.(TCO 8) During periods when costs are rising and inventory quantities are stable, ending inventory will<br />

be (Points : 6)<br />

higher under LIFO than FIFO.<br />

lower under average cost than LIFO.<br />

higher under average cost than FIFO.<br />

higher under FIFO than LIFO.<br />

Page 3<br />

Question 1. 1. (TCO 8) Fulbright Corp. uses the periodic inventory system. During its first year of operation, Fulbright<br />

made the following purchases (listed in chronological order of acquisition):<br />

· 40 units at $100<br />

· 70 units at $80<br />

· 170 units at $60<br />

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year. What is the ending inventory using<br />

the LIFO method? (Points : 15)<br />

Question 2. 2. (TCO 5) What is an accrued liability? Please provide two examples. (Points : 28)<br />

Question 3. 3. (TCO 7) A company's investment in receivables is affected by several related variables. Give an example<br />

of this interrelationship. (Points : 25)<br />

Question 4. 4. (TCO 8) A company purchases inventory during the year in four batches, with unit and price amounts<br />

shown below:<br />

Batch 1 – 9,500 units @ $2.10 per unit<br />

Batch 2 – 4,300 units @ $2.08 per unit<br />

Batch 3 – 3,600 units @ $2.04 per unit

Batch 4 – 7,200 units @ $2.01 per unit<br />

10,800 units were sold after Batch 2 was purchased, while 3,400 units were sold after Batch 3 was purchased.<br />

Required:<br />

-1. Calculate cost of goods sold and ending inventory under the FIFO method, using the perpetual inventory system.<br />

-2. Calculate cost of goods sold and ending inventory under the FIFO method, using the periodic inventory system.<br />

(Points : 25)<br />

Question 5. 5. (TCO 4) You are reviewing the December 31, 2012 financial statements of Ellie's Antiques who is<br />

considering an initial public offering of its shares. The following items come to your attention: (Points : 25)