ACCT 312 DeVry Complete Quiz Package

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

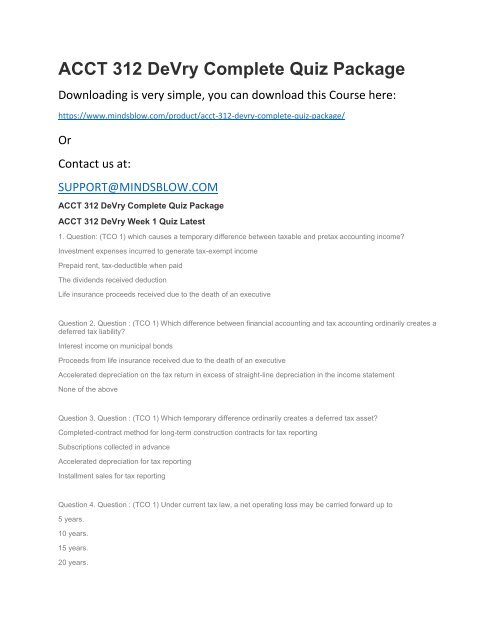

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> <strong>Complete</strong> <strong>Quiz</strong> <strong>Package</strong><br />

Downloading is very simple, you can download this Course here:<br />

https://www.mindsblow.com/product/acct-<strong>312</strong>-devry-complete-quiz-package/<br />

Or<br />

Contact us at:<br />

SUPPORT@MINDSBLOW.COM<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> <strong>Complete</strong> <strong>Quiz</strong> <strong>Package</strong><br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> Week 1 <strong>Quiz</strong> Latest<br />

1. Question: (TCO 1) which causes a temporary difference between taxable and pretax accounting income?<br />

Investment expenses incurred to generate tax-exempt income<br />

Prepaid rent, tax-deductible when paid<br />

The dividends received deduction<br />

Life insurance proceeds received due to the death of an executive<br />

Question 2. Question : (TCO 1) Which difference between financial accounting and tax accounting ordinarily creates a<br />

deferred tax liability?<br />

Interest income on municipal bonds<br />

Proceeds from life insurance received due to the death of an executive<br />

Accelerated depreciation on the tax return in excess of straight-line depreciation in the income statement<br />

None of the above<br />

Question 3. Question : (TCO 1) Which temporary difference ordinarily creates a deferred tax asset?<br />

<strong>Complete</strong>d-contract method for long-term construction contracts for tax reporting<br />

Subscriptions collected in advance<br />

Accelerated depreciation for tax reporting<br />

Installment sales for tax reporting<br />

Question 4. Question : (TCO 1) Under current tax law, a net operating loss may be carried forward up to<br />

5 years.<br />

10 years.<br />

15 years.<br />

20 years.

Question 5. Question : (TCO 1) In reconciling net income to taxable income, interest earned on municipal bonds is<br />

ignored.<br />

a temporary difference.<br />

a permanent difference.<br />

a reversing difference.<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> Week 2 <strong>Quiz</strong> Latest<br />

1. (TCO 2) Which causes a temporary difference between taxable and pretax accounting income? (Points : 4)<br />

Unrealized loss from recording investment available for sale at fair value<br />

Investment expenses incurred to generate tax-exempt income<br />

The dividends received deduction<br />

Life insurance proceeds received due to the death of an executive<br />

Question 2.2. (TCO 2) Which statement typifies defined contribution plans? (Points : 4)<br />

Investment risk is borne by the corporation sponsoring the plan.<br />

The plans are more complex than defined benefit plans.<br />

Present value factors are used to determine the annual contributions to the plan.<br />

The employer's obligation is satisfied by making the periodic contribution to the plan.<br />

Question 3.3. (TCO 2) Which is not a way of measuring the pension obligation? (Points : 4)<br />

Accumulated benefit obligation<br />

Vested benefit obligation<br />

Retiree benefit obligation<br />

Projected benefit obligation<br />

Question 4.4. (TCO 2) The PBO is increased by (Points : 4)<br />

Amortization of prior service cost.<br />

an increase in the actuary's assumed discount rate.<br />

an increase in the average life expectancy of employees.<br />

a return on plan assets that is lower than expected.<br />

Question 5.5. (TCO 3) Our company has a defined benefit pension plan. On December 31 (the end of the fiscal year),<br />

the company received the PBO report from the actuary. The following information was included in the report: ending<br />

PBO, $220,000; benefits paid to retirees, $20,000; interest cost, $14,400. The discount rate applied by the actuary was<br />

8%. Which was the beginning PBO? (Points : 4)<br />

$180,000<br />

$200,000

$214,400<br />

$224,000<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> Week 3 <strong>Quiz</strong> Latest<br />

Question 1.1. (TCO 4) The common stock account in a company's balance sheet is measured as (Points : 4)<br />

the number of common shares outstanding multiplied by the stock's par value per share.<br />

the number of common shares outstanding multiplied by the stock's current market value per share.<br />

the number of common shares issued multiplied by the stock's par value per share.<br />

None of the above<br />

Question 2.2. (TCO 4) Issued stock refers to the number of shares (Points : 4)<br />

issued for cash.<br />

in the hands of shareholders.<br />

outstanding plus treasury shares.<br />

that may be issued under state law.<br />

Question 3.3. (TCO 4) Our company declared a property dividend to give m<br />

our company would have 100 million shares, $8 par per share.<br />

the market price per share would be about $2.<br />

fractional shares would be issued.<br />

retained earnings would be reduced.<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> Week 5 <strong>Quiz</strong> Latest<br />

Question 1.1. (TCO 7) An accounting change that is reported by the prospective approach is reflected in the financial<br />

statements of (Points : 4)<br />

prior years only.<br />

prior years plus the current year.<br />

the current year only.<br />

current and future years.<br />

Question 2.2. (TCO 7) Which is not an example of a change in accounting principle? (Points : 4)<br />

A change from LIFO to FIFO for inventory costing<br />

A change to the full costing method in the extractive industries<br />

A change in the useful life of a depreciable asset<br />

A change from the cost method to the equity method of accounting for investments

Question 3.3. (TCO 7) Our company switched from double-declining balance depreciation to straight-line depreciation.<br />

As a result, (Points : 4)<br />

current income tax payable increases.<br />

the cumulative effect decreases current period earnings.<br />

prior periods' financial statements are restated.<br />

None of the above<br />

Question 4.4. (TCO 7) A change that uses the prospective approach is accounted for by (Points : 4)<br />

implementing it in the current year.<br />

reporting pro forma data.<br />

retrospective restatement of all prior financial statements in a comparative annual report.<br />

giving current recognition of the past effect of the change.<br />

Question 5.5. (TCO 7) Prior years' financial statements are restated under the (Points : 4)<br />

current approach.<br />

prospective approach.<br />

retrospective approach.<br />

None of the above