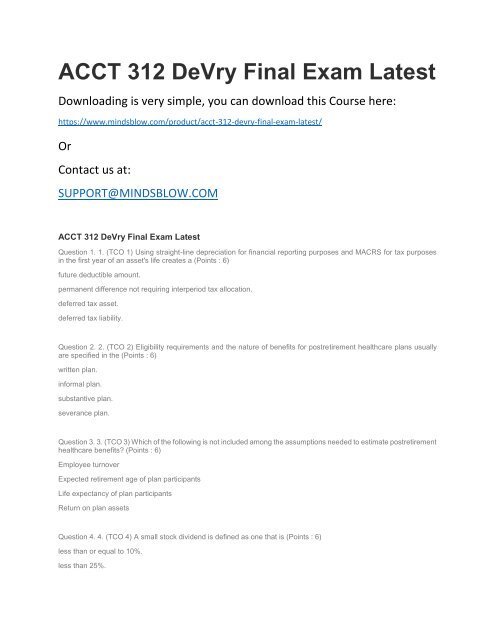

ACCT 312 DeVry Final Exam Latest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

https://www.mindsblow.com/product/acct-<strong>312</strong>-devry-final-exam-latest/<br />

Or<br />

Contact us at:<br />

SUPPORT@MINDSBLOW.COM<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong> <strong>Latest</strong><br />

Question 1. 1. (TCO 1) Using straight-line depreciation for financial reporting purposes and MACRS for tax purposes<br />

in the first year of an asset's life creates a (Points : 6)<br />

future deductible amount.<br />

permanent difference not requiring interperiod tax allocation.<br />

deferred tax asset.<br />

deferred tax liability.<br />

Question 2. 2. (TCO 2) Eligibility requirements and the nature of benefits for postretirement healthcare plans usually<br />

are specified in the (Points : 6)<br />

written plan.<br />

informal plan.<br />

substantive plan.<br />

severance plan.<br />

Question 3. 3. (TCO 3) Which of the following is not included among the assumptions needed to estimate postretirement<br />

healthcare benefits? (Points : 6)<br />

Employee turnover<br />

Expected retirement age of plan participants<br />

Life expectancy of plan participants<br />

Return on plan assets<br />

Question 4. 4. (TCO 4) A small stock dividend is defined as one that is (Points : 6)<br />

less than or equal to 10%.<br />

less than 25%.

less than or equal to 40%.<br />

less than 40%.<br />

Question 5. 5. (TCO 5) Stock options do not affect the calculation of (Points : 6)<br />

basic EPS.<br />

weighted-average common shares.<br />

the denominator in the diluted EPS fraction.<br />

diluted EPS.<br />

Question 6. 6. (TCO 7) Which of the following changes should be accounted for using the retrospective approach?<br />

(Points : 6)<br />

A change in the estimated life of a depreciable asset<br />

A change from straight-line to declining balance depreciation<br />

A change from the completed-contract method of accounting for long-term construction contracts<br />

A change to the LIFO method of costing inventories<br />

Question 7. 7. (TCO 7) A change in depreciation method is accounted for (Points : 6)<br />

retrospectively.<br />

as a cumulative adjustment to income in the year of change.<br />

prospectively, like changes in accounting estimates.<br />

None of the above<br />

Question 8. 8. (TCO 8) How is the amortization of patents reported in a statement of cash flows that is prepared using<br />

the indirect method? (Points : 6)<br />

A decrease in cash flows from investing activities<br />

An increase in cash flows from investing activities<br />

A deduction from net income in arriving at cash flows from operations<br />

An addition to net income in arriving at cash flows from operations<br />

Question 9. 9. (TCO 5) Which of the following is reported as an operating activity in the statement of cash flows? (Points<br />

: 6)<br />

The repayment of bonds payable<br />

The sale of a building<br />

The payment of interest on long-term notes<br />

The issuance of a preferred stock<br />

Question 10. 10. (TCO 6) Which of the following is not a potential common stock? (Points : 6)

Convertible preferred stock<br />

Convertible bonds<br />

Stock rights<br />

Participating preferred stock<br />

Question 11. 11. (TCO 1) Please describe the differences of how IFRS differs from U.S. GAAP in respect to deferred<br />

taxes. (Points : 30)<br />

Question 12. 12. (TCO 2) IAS 19 covers accounting for compensation plans. What are some examples of how they<br />

differ from U.S. GAAP? (Points : 30) employee services are rendered.<br />

Question 13. 13. (TCO 4) What is a stock split? How does a stock split impact outstanding shares and the per-share<br />

market price? How do stock splits impact the financial statements? (Points : 30)<br />

Question 14. 14. (TCO 5) Please describe three examples of dilutive securities in a complex capital structure, and<br />

discuss why they are dilutive. (Points : 30)<br />

Question 15. 15. (TCO 7) Please describe the retrospective approach and an example of when it should be used.<br />

(Points : 35)<br />

Question 16. 16. (TCO 8) Drexon Corp., which follows U.S. GAAP, uses the direct method to report its cash flows. The<br />

CFO is assessing the impact on cash flows of four events during the fiscal year. Specify which category each event<br />

falls under (under the direct method), and note whether it increases cash, decreases cash, or has no impact on cash.<br />

(1) 40,000 new shares of stock are issued near the close of the fiscal year.<br />

(2). Drexon purchases 60% of a subsidiary company.<br />

(3). Accounts receivable decreases from $620,000 to $610,000.<br />

(4). Dividends of $12,000 are paid on Drexon company stock. (Points : 35)