BUSN 380 DEVRY WEEK 7 PROBLEM SET 7

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>BUSN</strong> <strong>380</strong> <strong>DEVRY</strong> <strong>WEEK</strong> 7 <strong>PROBLEM</strong> <strong>SET</strong> 7<br />

Downloading is very simple, you can download this Course here:<br />

https://www.mindsblow.com/product/busn-<strong>380</strong>-devry-week-7-problem-set-7/<br />

Or<br />

Contact us at:<br />

SUPPORT@MINDSBLOW.COM<br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 7 Problem Set 7<br />

<strong>BUSN</strong><strong>380</strong><br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 7 Problem Set 7<br />

Problem Set 7<br />

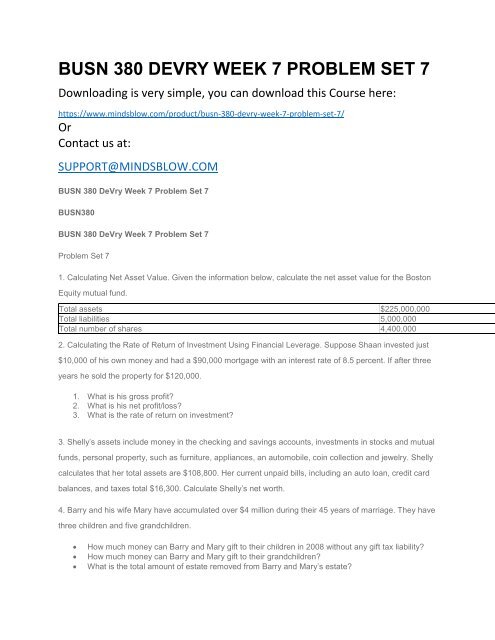

1. Calculating Net Asset Value. Given the information below, calculate the net asset value for the Boston<br />

Equity mutual fund.<br />

Total assets $225,000,000<br />

Total liabilities 5,000,000<br />

Total number of shares 4,400,000<br />

2. Calculating the Rate of Return of Investment Using Financial Leverage. Suppose Shaan invested just<br />

$10,000 of his own money and had a $90,000 mortgage with an interest rate of 8.5 percent. If after three<br />

years he sold the property for $120,000.<br />

1. What is his gross profit?<br />

2. What is his net profit/loss?<br />

3. What is the rate of return on investment?<br />

3. Shelly’s assets include money in the checking and savings accounts, investments in stocks and mutual<br />

funds, personal property, such as furniture, appliances, an automobile, coin collection and jewelry. Shelly<br />

calculates that her total assets are $108,800. Her current unpaid bills, including an auto loan, credit card<br />

balances, and taxes total $16,300. Calculate Shelly’s net worth.<br />

4. Barry and his wife Mary have accumulated over $4 million during their 45 years of marriage. They have<br />

three children and five grandchildren.<br />

<br />

<br />

<br />

How much money can Barry and Mary gift to their children in 2008 without any gift tax liability?<br />

How much money can Barry and Mary gift to their grandchildren?<br />

What is the total amount of estate removed from Barry and Mary’s estate?

5. Dave bought a rental property for $200,000 cash. One year later, he sold it for $240,000.<br />

<br />

<br />

What was the return on his $200,000 investment?<br />

Suppose Dave invested only $20,000 of his own money and borrowed $180,000 (interest free<br />

from his rich father). What was his return on investment?