Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

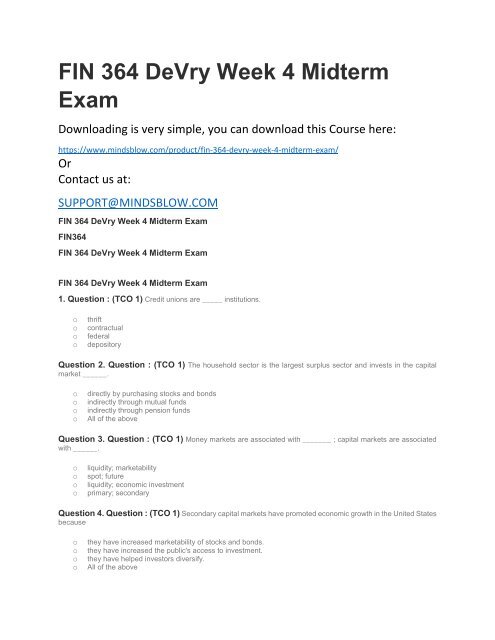

<strong>FIN</strong> <strong>364</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong><br />

<strong>Exam</strong><br />

Downloading is very simple, you can download this Course here:<br />

https://www.mindsblow.com/product/fin-<strong>364</strong>-devry-week-4-midterm-exam/<br />

Or<br />

Contact us at:<br />

SUPPORT@MINDSBLOW.COM<br />

<strong>FIN</strong> <strong>364</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

<strong>FIN</strong><strong>364</strong><br />

<strong>FIN</strong> <strong>364</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

<strong>FIN</strong> <strong>364</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

1. Question : (TCO 1) Credit unions are _____ institutions.<br />

o<br />

o<br />

o<br />

o<br />

thrift<br />

contractual<br />

federal<br />

depository<br />

Question 2. Question : (TCO 1) The household sector is the largest surplus sector and invests in the capital<br />

market ______.<br />

o<br />

o<br />

o<br />

o<br />

directly by purchasing stocks and bonds<br />

indirectly through mutual funds<br />

indirectly through pension funds<br />

All of the above<br />

Question 3. Question : (TCO 1) Money markets are associated with _______ ; capital markets are associated<br />

with ______.<br />

o<br />

o<br />

o<br />

o<br />

liquidity; marketability<br />

spot; future<br />

liquidity; economic investment<br />

primary; secondary<br />

Question 4. Question : (TCO 1) Secondary capital markets have promoted economic growth in the United States<br />

because<br />

o<br />

o<br />

o<br />

o<br />

they have increased marketability of stocks and bonds.<br />

they have increased the public's access to investment.<br />

they have helped investors diversify.<br />

All of the above

Question 5. Question : (TCO 1) Which of the following is not a debt security?<br />

o<br />

o<br />

o<br />

o<br />

Corporate bonds<br />

U.S. Government securities<br />

Federal agency securities<br />

Common stock<br />

Question 6. Question : (TCO 1) A conditional contract granting its holder the right to buy assets in the future is<br />

a ______.<br />

o<br />

o<br />

o<br />

o<br />

put<br />

forward contract<br />

futures contract<br />

call<br />

Question 7. Question : (TCO 1) The ease with which a financial claim can be resold is its ______.<br />

o<br />

o<br />

o<br />

o<br />

quality<br />

risk<br />

marketability<br />

perpetuity<br />

Question 8. Question : (TCO 2) Who has a permanent vote on the FOMC?<br />

o<br />

o<br />

o<br />

o<br />

President of the Federal Reserve Bank of New York<br />

Federal Advisory Council<br />

President of the Federal Reserve Bank of San Francisco<br />

Congress<br />

Question 9. Question : (TCO 2) An increase in Federal Reserve float<br />

o<br />

o<br />

o<br />

o<br />

decreases bank reserve deposits in the Fed.<br />

increases bank reserve deposits in the Fed.<br />

has no impact upon bank reserves deposits in the Fed.<br />

reduces the net loan granted by the Fed to member banks.<br />

Question 10. Question : (TCO 2) If the Fed wanted to increase the money supply immediately but just slightly,<br />

it would most likely ______.<br />

o<br />

o<br />

o<br />

o<br />

buy securities on the open market<br />

lower the Discount Rate<br />

lower reserve requirements<br />

Any of the above would be suitable for this purpose.<br />

Question 11. Question : (TCO 3) Unemployment should fall if ______.<br />

o<br />

o<br />

o<br />

o<br />

wages increase and people expect prices to rise as well<br />

wages increase and people expect prices to be stable<br />

interest rates rise more than prices are expected to rise<br />

the money supply increases<br />

Question 12. Question : (TCO 3) Monetary policies directed toward increased economic growth may have what<br />

impact upon the value of the dollar in relation to other currencies?<br />

o<br />

Increase

o<br />

o<br />

o<br />

Decrease<br />

No effect<br />

None of the above<br />

Question 13. Question : (TCO 3) The "tools" of monetary policy, whether "viable" or not, include all the following<br />

except______.<br />

o<br />

o<br />

o<br />

o<br />

changing the discount rate<br />

open market operations<br />

changes in reserve requirements<br />

changes in the Federal Funds rate<br />

Question 14. Question : (TCO 3) Monetarists and Keynesians agree that______.<br />

o<br />

o<br />

o<br />

o<br />

monetary policy influences the real sector<br />

changes in the money supply drive changes in interest rates<br />

changes in interest rates drive changes in the money supply<br />

monetary policy does not influence the real sector<br />

Question 15. Question : (TCO 2, 3) Which of the following was not a responsibility of the early Federal Reserve?<br />

o<br />

o<br />

o<br />

o<br />

Replace the National Banking system<br />

Improve the payments system<br />

Establish more rigorous bank supervision<br />

Act as "lender of last resort"<br />

Question 16. Question : (TCO 4) Which of the following statements about interest rates is incorrect?<br />

o<br />

o<br />

o<br />

o<br />

Bond prices and interest rates change inversely with one another.<br />

The expected rate of inflation affects current market interest rates.<br />

Short-term interest rates are not as volatile as long-term interest rates.<br />

Interest rates are directly related to the level of output in the economy.<br />

Question 17. Question : (TCO 4) Interest rates should increase if<br />

o<br />

o<br />

o<br />

o<br />

the economy is in a boom.<br />

inflationary expectations have decreased.<br />

the Federal Reserve has decreased M1 and the supply of loanable funds.<br />

inflationary expectations have increased.<br />

Question 18. Question : (TCO 4) Interest rates move ______ with expected inflation and _____ with economic<br />

activity.<br />

o<br />

o<br />

o<br />

o<br />

directly; inversely<br />

inversely; inversely<br />

directly; directly<br />

inversely; directly<br />

Question 19. Question : (TCO 4) If nominal interest rates are 10% and expected inflation is 5%, ______.<br />

o actual inflation exceeds 10%<br />

o the real rate of interest is 5%<br />

o market rates are expected to increase to 15%<br />

o expected interest rates are 5%

Question 20. Question : (TCO 4) With the real rate at 5%, most loans were made at 10% last year. This year,<br />

interest rates have declined to 8%. What was the expected inflation rate last year?<br />

o 5%<br />

o 2%<br />

o 10%<br />

o 8%<br />

1. Question : (TCO 1) List and briefly describe the main risks managed by financial intermediaries.<br />

Question 2. Question : (TCO 2) Explain why the Federal Reserve is less "independent" than it appears to be.<br />

Question 3. Question : (TCO 3) What should happen to consumption if the monetary base increases? Explain.<br />

Question 4. Question : (TCO 4) Explain why realized real rates of interest are sometimes negative but expected<br />

real rates are always positive. Give an example.