FIN 516 DeVry Final Exam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

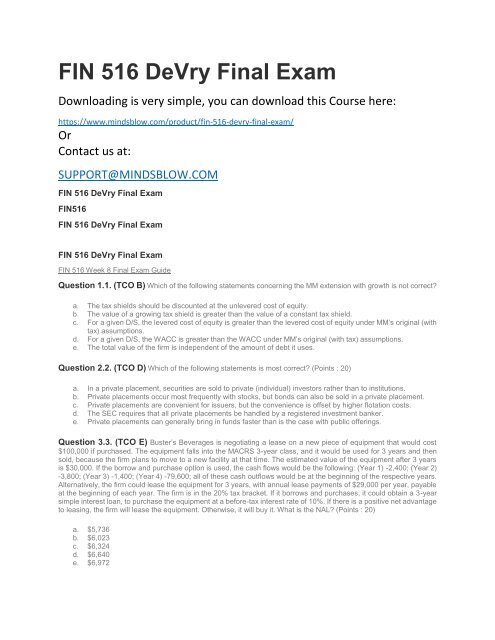

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong><br />

Downloading is very simple, you can download this Course here:<br />

https://www.mindsblow.com/product/fin-<strong>516</strong>-devry-final-exam/<br />

Or<br />

Contact us at:<br />

SUPPORT@MINDSBLOW.COM<br />

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong><br />

<strong>FIN</strong><strong>516</strong><br />

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong><br />

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Final</strong> <strong>Exam</strong><br />

<strong>FIN</strong> <strong>516</strong> Week 8 <strong>Final</strong> <strong>Exam</strong> Guide<br />

Question 1.1. (TCO B) Which of the following statements concerning the MM extension with growth is not correct?<br />

a. The tax shields should be discounted at the unlevered cost of equity.<br />

b. The value of a growing tax shield is greater than the value of a constant tax shield.<br />

c. For a given D/S, the levered cost of equity is greater than the levered cost of equity under MM’s original (with<br />

tax) assumptions.<br />

d. For a given D/S, the WACC is greater than the WACC under MM’s original (with tax) assumptions.<br />

e. The total value of the firm is independent of the amount of debt it uses.<br />

Question 2.2. (TCO D) Which of the following statements is most correct? (Points : 20)<br />

a. In a private placement, securities are sold to private (individual) investors rather than to institutions.<br />

b. Private placements occur most frequently with stocks, but bonds can also be sold in a private placement.<br />

c. Private placements are convenient for issuers, but the convenience is offset by higher flotation costs.<br />

d. The SEC requires that all private placements be handled by a registered investment banker.<br />

e. Private placements can generally bring in funds faster than is the case with public offerings.<br />

Question 3.3. (TCO E) Buster’s Beverages is negotiating a lease on a new piece of equipment that would cost<br />

$100,000 if purchased. The equipment falls into the MACRS 3-year class, and it would be used for 3 years and then<br />

sold, because the firm plans to move to a new facility at that time. The estimated value of the equipment after 3 years<br />

is $30,000. If the borrow and purchase option is used, the cash flows would be the following: (Year 1) -2,400; (Year 2)<br />

-3,800; (Year 3) -1,400; (Year 4) -79,600; all of these cash outflows would be at the beginning of the respective years.<br />

Alternatively, the firm could lease the equipment for 3 years, with annual lease payments of $29,000 per year, payable<br />

at the beginning of each year. The firm is in the 20% tax bracket. If it borrows and purchases, it could obtain a 3-year<br />

simple interest loan, to purchase the equipment at a before-tax interest rate of 10%. If there is a positive net advantage<br />

to leasing, the firm will lease the equipment. Otherwise, it will buy it. What is the NAL? (Points : 20)<br />

a. $5,736<br />

b. $6,023<br />

c. $6,324<br />

d. $6,640<br />

e. $6,972

Question 4.4. (TCO I) Suppose hockey skates sell in Canada for 105 Canadian dollars, and 1 Canadian dollar<br />

equals 0.71 U.S. dollars. If purchasing power parity (PPP) holds, what is the price of hockey skates in the United<br />

States? (Points : 20)<br />

a. $14.79<br />

b. $63.00<br />

c. $74.55<br />

d. $85.88<br />

e. $147.88<br />

Page 2<br />

Question 1.1. (TCO C) Dentaltech Inc. projects the following data for the coming year. If the firm follows the residual<br />

dividend policy and also maintains its target capital structure, what will its payout ratio be? (Points : 20)<br />

EBIT $2,000,000<br />

Capital budget $850,000<br />

Interest rate 10%<br />

% Debt 40%<br />

Debt outstanding $5,000,000<br />

% Equity 60%<br />

Shares outstanding $5,000,000<br />

Tax rate 40%<br />

a. 37.2%<br />

b. 39.1%<br />

c. 41.2%<br />

d. 43.3%<br />

e. 45.5%<br />

Question 2.2. (TCO F) Warren Corporation’s stock sells for $42 per share. The company wants to sell some 20-<br />

year, annual interest, $1,000 par value bonds. Each bond would have 75 warrants attached to it, each exercisable into<br />

one share of stock at an exercise price of $47. The firm’s straight bonds yield 10%. Each warrant is expected to have<br />

a market value of $2.00 given that the stock sells for $42. What coupon interest rate must the company set on the<br />

bonds in order to sell the bonds-with-warrants at par? (Points : 20)<br />

a. 7.83%<br />

b. 8.24%<br />

c. 8.65%<br />

d. 9.08%<br />

e. 9.54%<br />

Question 3.3. (TCO B) Reynolds Resorts is currently 100% equity financed. The CFO is considering a<br />

recapitalization plan under which the firm would issue long-term debt with a yield of 9% and use the proceeds to<br />

repurchase common stock. The recapitalization would not change the company’s total assets, nor would it affect the<br />

firm’s basic earning power, which is currently 15%. The CFO believes that this recapitalization would reduce the WACC<br />

and increase stock price. Which of the following would also be likely to occur if the company goes ahead with the<br />

recapitalization plan? (Points : 20)<br />

a. The company’s net income would increase.<br />

b. The company’s earnings per share would decline.<br />

c. The company’s cost of equity would increase.<br />

d. The company’s ROA would increase.

e. The company’s ROE would decline<br />

Question 4.4. (TCO G) Which of the following statements is most correct? (Points : 20)<br />

a. Our bankruptcy laws were enacted in the 1800s, revised in the 1930s, and have remained unaltered since<br />

that time.<br />

b. Federal bankruptcy law deals only with corporate bankruptcies. Municipal and personal bankruptcy are<br />

governed solely by state laws.<br />

c. All bankruptcy petitions are filed by creditors seeking to protect their claims against firms in financial distress.<br />

Thus, all bankruptcy petitions are involuntary as viewed from the perspective of the firm’s management.<br />

d. Chapters 11 and 7 are the most important bankruptcy chapters for financial management purposes. If a<br />

reorganization plan cannot be worked out under Chapter 11, then the company will be liquidated as prescribed<br />

in Chapter 7 of the Act.<br />

e. Restructuring a firm’s debt can involve forgiving a certain portion of the debt, but it cannot call for changing<br />

the debt’s maturity or its contractual interest rate.<br />

Page 3<br />

Question 1.1. (TCO I) In 1985, a given Japanese imported automobile sold for 1,476,000 yen, or $8,200. If the car<br />

still sold for the same amount of yen today but the current exchange rate is 144 yen per dollar, what would the car be<br />

selling for today in U.S. dollars? (Points : 20)<br />

a. $5.964<br />

b. $8,200<br />

c. $10,250<br />

d. $12,628<br />

e. $13,525<br />

Question 2.2. (TCO H) Which of the following statements is most correct? (Points : 20)<br />

a. The acquiring firm’s required rate of return in most horizontal mergers will not be affected, because the two<br />

firms will have similar betas.<br />

b. Financial theory says that the choice of how to pay for a merger is really irrelevant because although it may<br />

affect the firm’s capital structure, it will not affect its overall required rate of return.<br />

c. The basic rationale for any financial merger is synergy, and thus, the estimation of pro-forma cash flows is the<br />

single most important part of the analysis.<br />

d. In most mergers, the benefits of synergy and the premium the acquirer pays over the market price are summed<br />

and then divided equally between the shareholders of the acquiring and target firms.<br />

e. The primary rationale for most operating mergers is synergy.<br />

Question 3.3. (TCO A) An investor who writes standard call options against stock held in his or her portfolio is said<br />

to be selling what type of options? (Points : 20)<br />

a. In-the-money<br />

b. Put<br />

c. Naked<br />

d. Covered<br />

e. Out-of-the-money<br />

Question 4.4. (TCO F) A swap is a method used to reduce financial risk. Which of the following statements about<br />

swaps, if any, is not correct? (Points : 20)<br />

a. A swap involves the exchange of cash payment obligations.<br />

b. The earliest swaps were currency swaps in which companies traded debt denominated in different currencies,<br />

say dollars and pounds.

c. Swaps are very often arranged by a financial intermediary, who may or may not take the position of one of the<br />

counterparties.<br />

d. A problem with swaps is that no standardized contracts exist, which has prevented the development of a<br />

secondary market.<br />

e. A company can swap fixed interest payments for floating interest payments.