ACCT 224 DeVry Week 6 Quiz Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

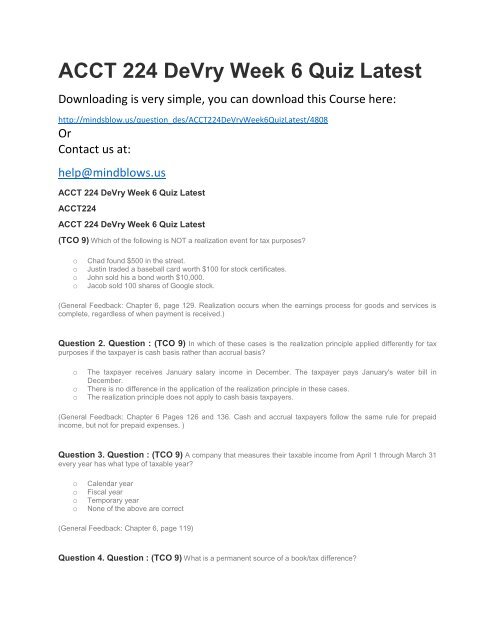

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>ACCT</strong><strong>224</strong><strong>DeVry</strong><strong>Week</strong>6<strong>Quiz</strong><strong>Latest</strong>/4808<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>ACCT</strong><strong>224</strong><br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong> <strong>Latest</strong><br />

(TCO 9) Which of the following is NOT a realization event for tax purposes?<br />

o Chad found $500 in the street.<br />

o Justin traded a baseball card worth $100 for stock certificates.<br />

o John sold his a bond worth $10,000.<br />

o Jacob sold 100 shares of Google stock.<br />

(General Feedback: Chapter 6, page 129. Realization occurs when the earnings process for goods and services is<br />

complete, regardless of when payment is received.)<br />

Question 2. Question : (TCO 9) In which of these cases is the realization principle applied differently for tax<br />

purposes if the taxpayer is cash basis rather than accrual basis?<br />

o<br />

o<br />

o<br />

The taxpayer receives January salary income in December. The taxpayer pays January's water bill in<br />

December.<br />

There is no difference in the application of the realization principle in these cases.<br />

The realization principle does not apply to cash basis taxpayers.<br />

(General Feedback: Chapter 6 Pages 126 and 136. Cash and accrual taxpayers follow the same rule for prepaid<br />

income, but not for prepaid expenses. )<br />

Question 3. Question : (TCO 9) A company that measures their taxable income from April 1 through March 31<br />

every year has what type of taxable year?<br />

o<br />

o<br />

o<br />

o<br />

Calendar year<br />

Fiscal year<br />

Temporary year<br />

None of the above are correct<br />

(General Feedback: Chapter 6, page 119)<br />

Question 4. Question : (TCO 9) What is a permanent source of a book/tax difference?

o<br />

o<br />

o<br />

o<br />

Prepaid income<br />

Bad debts<br />

Related party accruals<br />

Interest on state and local bonds<br />

(General Feedback: Chapter 6, page 144)<br />

Question 5. Question : (TCO 9) In which of the following instance(s) is the measurement of net income for tax<br />

purposes different for accrual basis and cash basis calendar year taxpayers?<br />

o<br />

o<br />

o<br />

o<br />

In December, the taxpayer signs a contract for routine legal service to be performed in December and paid<br />

for in January of the following year.<br />

The taxpayer's equipment is repaired in November and the bill is paid in December.<br />

The measurement of net income is different in both of these cases.<br />

Net income would be the same under both cash and accrual methods.<br />

(General Feedback: Chapter 6. The concept of substantial economic performance means that the accrual basis<br />

taxpayer cannot deduct the cost until the work is performed, unless the work is routine and paid within nine months.<br />

The concept does not apply here.)