ACCT 305 DeVry Complete Quiz Package Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACCT</strong> <strong>305</strong> <strong>DeVry</strong> <strong>Complete</strong> <strong>Quiz</strong> <strong>Package</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>ACCT</strong><strong>305</strong><strong>DeVry</strong><strong>Complete</strong><strong>Quiz</strong><strong>Package</strong><strong>Latest</strong>/4140<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>ACCT</strong> <strong>305</strong> <strong>DeVry</strong> <strong>Complete</strong> <strong>Quiz</strong> <strong>Package</strong> <strong>Latest</strong><br />

<strong>ACCT</strong> <strong>305</strong> <strong>DeVry</strong> Week 1 <strong>Quiz</strong> <strong>Latest</strong><br />

Question 1. 1.(TCO 1) The acquisition costs of property, plant, and equipment do not include (Points : 4)<br />

the ordinary and necessary costs to bring the asset to its desired condition and location for use.<br />

the net invoice price.<br />

legal fees, delivery charges, installation, and any applicable sales tax.<br />

maintenance costs during the first 30 days of use.<br />

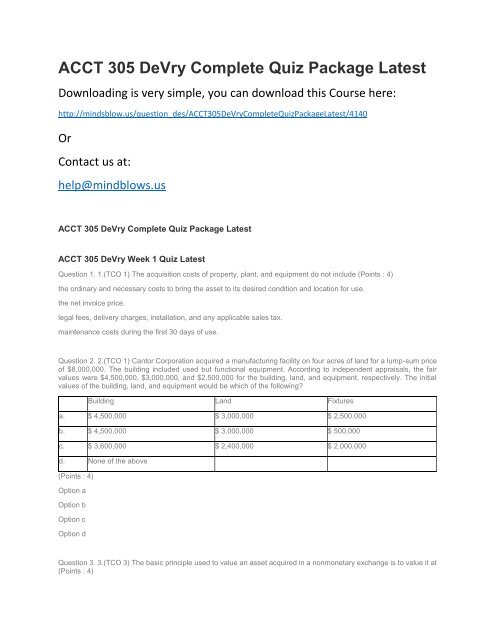

Question 2. 2.(TCO 1) Cantor Corporation acquired a manufacturing facility on four acres of land for a lump-sum price<br />

of $8,000,000. The building included used but functional equipment. According to independent appraisals, the fair<br />

values were $4,500,000, $3,000,000, and $2,500,000 for the building, land, and equipment, respectively. The initial<br />

values of the building, land, and equipment would be which of the following?<br />

Building Land Fixtures<br />

a. $ 4,500,000 $ 3,000,000 $ 2,500,000<br />

b. $ 4,500,000 $ 3,000,000 $ 500,000<br />

c. $ 3,600,000 $ 2,400,000 $ 2,000,000<br />

d. None of the above<br />

(Points : 4)<br />

Option a<br />

Option b<br />

Option c<br />

Option d<br />

Question 3. 3.(TCO 3) The basic principle used to value an asset acquired in a nonmonetary exchange is to value it at<br />

(Points : 4)

fair value of the asset(s) given up.<br />

the book value of the asset given plus any cash or other monetary consideration received.<br />

fair value or book value, whichever is smaller.<br />

the book value of the asset given.<br />

Question 4. 4.(TCO 1) Interest may be capitalized (Points : 4)<br />

on routinely manufactured goods as well as self-constructed assets.<br />

on self-constructed assets from the date an entity formally adopts a plan to build a discrete project.<br />

whether or not there is specific borrowing for the construction.<br />

whether or not there are actual interest costs incurred.<br />

Question 5. 5.(TCO 3) Alamos Co. exchanged equipment and $18,000 cash for similar equipment. The book value and<br />

the fair value of the old equipment were $82,000 and $90,000, respectively. Assuming that the exchange has<br />

commercial substance, Alamos would record a gain/(loss) of (Points : 4)<br />

$26,000.<br />

$8,000.<br />

$(8,000).<br />

$0.<br />

<strong>ACCT</strong> <strong>305</strong> <strong>DeVry</strong> Week 2 <strong>Quiz</strong> <strong>Latest</strong><br />

Operational Assets—Intangibles and Research/Development - <strong>Quiz</strong> 1.<br />

1. (TCO 2) An exclusive 20-year right to manufacture a product or use a process is a (Points : 4)<br />

patent.<br />

copyright.<br />

trademark.<br />

franchise.<br />

2. (TCO 2) Our company purchased all of the outstanding stock of another company, paying $2,700,000 cash. Our<br />

company assumed all of the liabilities of other company. Book values and fair values of acquired assets and liabilities<br />

were as follows.<br />

Book Value Fair Value<br />

Current assets, net $ 420,000 $ 450,000<br />

Property, plant and equipment, net $ 1,600,000 $ 2,250,000<br />

Liabilities $ 500,000 $ 600,000<br />

Our company would record goodwill of (Points : 4)<br />

$1,180,000.<br />

$600,000.<br />

$880,000.<br />

$100,000.

3. (TCO 2) Software development costs are capitalized if they are incurred (Points : 4)<br />

prior to the point at which technological feasibility has been established.<br />

after commercial production has begun.<br />

after technological feasibility has been established but prior to the product availability date.<br />

None of the above<br />

4. (TCO 2) Under U.S. GAAP, research expenditures are (Points : 4)<br />

expensed in the period incurred.<br />

expensed in the period they are determined to be unsuccessful.<br />

capitalized if certain criteria are met.<br />

expensed if unsuccessful, capitalized if successful.<br />

5. (TCO 2) Goodwill has (Points : 4)<br />

a life of 70 years.<br />

an indefinite life.<br />

a life of 20 years.<br />

a life of 40 years.<br />

<strong>ACCT</strong> <strong>305</strong> <strong>DeVry</strong> Week 3 <strong>Quiz</strong> <strong>Latest</strong><br />

Question 1. 1. (TCO 4) Which depreciation method multiplies a constant base by a declining fraction? (Points : 4)<br />

Straight-line<br />

Double declining balance<br />

Sum-of-the-years' digits<br />

Composite or group<br />

Question 2. 2. (TCO 4) Amortization refers to the cost allocation for (Points : 4)<br />

a patent.<br />

a building.<br />

land.<br />

a silver mine.<br />

Question 3. 3. (TCO 4) The factors that need to be determined to compute depreciation are an asset's (Points : 4)<br />

cost, residual value, and physical life.<br />

cost, replacement value, and service life.<br />

fair value, residual value, and economic life.

cost, residual value, and service life.<br />

Question 4. 4. (TCO 4) Cutter Enterprises purchased equipment for $72,000 on January 1, 2011. The equipment is<br />

expected to have a 5-year life and a residual value of $6,000. Using the straight-line method, the book value at<br />

December 31, 2011 would be (Points : 4)<br />

$57,600.<br />

$51,600.<br />

$58,800.<br />

$52,800.<br />

Question 5. 5. (TCO 4) Accounting for a change in the estimated service life of equipment (Points : 4)<br />

is handled prospectively.<br />

requires retroactive restatement of the prior year's financial statements.<br />

requires a prior period adjustment.<br />

is a cumulative adjustment to income in the current year for the difference in depreciation under the new versus old<br />

estimates.<br />

<strong>ACCT</strong> <strong>305</strong> <strong>DeVry</strong> Week 7 <strong>Quiz</strong> <strong>Latest</strong><br />

Question 1.1.(TCO 8) For the lessee to account for a lease as a capital lease, the lease must meet (Points : 4)<br />

all four of the criteria specified by GAAP regarding accounting for leases.<br />

any one of the six criteria specified by GAAP regarding accounting for leases.<br />

any two of the criteria specified by GAAP regarding accounting for leases.<br />

any one of the four criteria specified by GAAP regarding accounting for leases.<br />

Question 2.2.(TCO 8) From the perspective of the lessee, leases may be classified as either (Points : 4)<br />

direct-financing or sales-type.<br />

capital or direct-financing.<br />

capital or operating.<br />

direct-financing or operating.<br />

Question 3.3.(TCO 8) One of the four criteria for a capital lease specifies that the lease term be equal to or greater than<br />

(Points : 4)<br />

75% of the expected economic life of the leased property.<br />

90% of the expected economic life of the leased property.<br />

80% of the expected economic life of the leased property.<br />

50% of the expected economic life of the leased property.

Question 4.4.(TCO 8) On February 1, 2011, our company became the lessee of equipment under a five-year, no<br />

cancelable lease. The estimated economic life of the equipment is eight years. The fair value of the equipment was<br />

$600,000. The lease does not meet the definition of a capital lease in terms of a bargain purchase option, transfer of<br />

title, or the lease term. However, we must classify this as a capital lease if the present value of the minimum lease<br />

payments is at least (Points : 4)<br />

$600,000.<br />

$540,000.<br />

$450,000.<br />

$405,000.<br />

Question 5.5.(TCO 8) Which of the following would a lessee not record in connection with a lease? (Points : 4)<br />

Lease Revenue<br />

Amortization Expense<br />

Interest Revenue<br />

Lease Expense