ACCT 444 DeVry Week 2 Complete Work Latest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

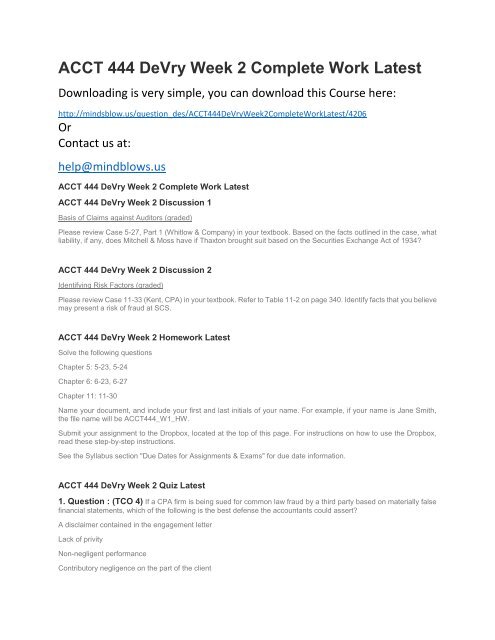

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 2 <strong>Complete</strong> <strong>Work</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>ACCT</strong><strong>444</strong><strong>DeVry</strong><strong>Week</strong>2<strong>Complete</strong><strong>Work</strong><strong>Latest</strong>/4206<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 2 <strong>Complete</strong> <strong>Work</strong> <strong>Latest</strong><br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 2 Discussion 1<br />

Basis of Claims against Auditors (graded)<br />

Please review Case 5-27, Part 1 (Whitlow & Company) in your textbook. Based on the facts outlined in the case, what<br />

liability, if any, does Mitchell & Moss have if Thaxton brought suit based on the Securities Exchange Act of 1934?<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 2 Discussion 2<br />

Identifying Risk Factors (graded)<br />

Please review Case 11-33 (Kent, CPA) in your textbook. Refer to Table 11-2 on page 340. Identify facts that you believe<br />

may present a risk of fraud at SCS.<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 2 Homework <strong>Latest</strong><br />

Solve the following questions<br />

Chapter 5: 5-23, 5-24<br />

Chapter 6: 6-23, 6-27<br />

Chapter 11: 11-30<br />

Name your document, and include your first and last initials of your name. For example, if your name is Jane Smith,<br />

the file name will be <strong>ACCT</strong><strong>444</strong>_W1_HW.<br />

Submit your assignment to the Dropbox, located at the top of this page. For instructions on how to use the Dropbox,<br />

read these step-by-step instructions.<br />

See the Syllabus section "Due Dates for Assignments & Exams" for due date information.<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 2 Quiz <strong>Latest</strong><br />

1. Question : (TCO 4) If a CPA firm is being sued for common law fraud by a third party based on materially false<br />

financial statements, which of the following is the best defense the accountants could assert?<br />

A disclaimer contained in the engagement letter<br />

Lack of privity<br />

Non-negligent performance<br />

Contributory negligence on the part of the client

Question 2. Question : (TCO 4) "Absence of reasonable care that can be expected of a person is a set of<br />

circumstances" defines<br />

pecuniary negligence.<br />

gross negligence.<br />

extreme negligence.<br />

ordinary negligence.<br />

Question 3. Question : (TCO 4) A third-party beneficiary is one that<br />

has failed to establish legal standing before the court.<br />

does not have privity of contract and is unknown to the contracting parties.<br />

does not have privity of contract, but is known to the contracting parties and intended to benefit under the contract.<br />

may establish legal standing before the court after a contract has been consummated.<br />

Question 4. Question : (TCO 4) Tort actions against CPAs are more common than breach of contract actions<br />

because<br />

there are more torts than contracts.<br />

the burden of proof is on the auditor rather than on the person suing.<br />

the person suing need prove only negligence.<br />

the amounts recoverable are normally larger.<br />

Question 5. Question : (TCO 4) If the auditor believes that the financial statements are not fairly stated or is<br />

unable to reach a conclusion because of insufficient evidence, the auditor<br />

should withdraw from the engagement.<br />

should request an increase in audit fees so that more resources can be used to conduct the audit.<br />

has the responsibility of notifying financial statement users through the auditor’s report.<br />

should notify regulators of the circumstances.<br />

Question 6. Question : (TCO 3) Which of the following is not one of the reasons that auditors provide only<br />

reasonable assurance on the financial statements?<br />

The auditor commonly examines a sample, rather than the entire population of transactions.<br />

Accounting presentations contain complex estimates, which involve uncertainty.<br />

Fraudulently prepared financial statements are often difficult to detect.<br />

Auditors believe that reasonable assurance is sufficient in the vast majority of cases.<br />

Question 7. Question : (TCO 3) In the fraud triangle, fraudulent financial reporting and misappropriation of assets<br />

share little in common.<br />

share most of the same risk factors.<br />

share the same three conditions.<br />

share most of the same conditions.<br />

Question 8. Question : (TCO 3) Fraudulent financial reporting may be accomplished through the manipulation<br />

of<br />

assets.<br />

liabilities.

evenues.<br />

all of the above.<br />

Question 9. Question : (TCO 3) Which of the following is a factor that relates to incentives to misappropriate<br />

assets?<br />

Significant accounting estimates involving subjective judgments<br />

Significant personal financial obligations<br />

Management's practice of making overly aggressive forecasts<br />

High turnover of accounting, internal audit and information technology staff<br />

Question 10. Question : (TCO 3) Which of the following characteristics is most likely to heighten an auditor's<br />

concern about the risk of material misstatements, due to fraud in an entity's financial statements?<br />

Employees who handle cash receipts are not bonded.<br />

The entity's industry is experiencing declining customer demand.<br />

Internal auditors have direct access to the board of directors and the entity's management.<br />

The board of directors is active in overseeing the entity's financial reporting policies.