ACCT 505 DeVry Week 4 Complete Work

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

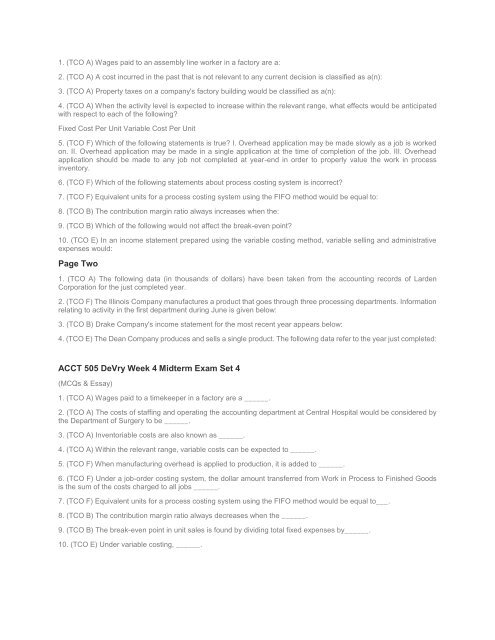

1. (TCO A) Wages paid to an assembly line worker in a factory are a:<br />

2. (TCO A) A cost incurred in the past that is not relevant to any current decision is classified as a(n):<br />

3. (TCO A) Property taxes on a company's factory building would be classified as a(n):<br />

4. (TCO A) When the activity level is expected to increase within the relevant range, what effects would be anticipated<br />

with respect to each of the following?<br />

Fixed Cost Per Unit Variable Cost Per Unit<br />

5. (TCO F) Which of the following statements is true? I. Overhead application may be made slowly as a job is worked<br />

on. II. Overhead application may be made in a single application at the time of completion of the job. III. Overhead<br />

application should be made to any job not completed at year-end in order to properly value the work in process<br />

inventory.<br />

6. (TCO F) Which of the following statements about process costing system is incorrect?<br />

7. (TCO F) Equivalent units for a process costing system using the FIFO method would be equal to:<br />

8. (TCO B) The contribution margin ratio always increases when the:<br />

9. (TCO B) Which of the following would not affect the break-even point?<br />

10. (TCO E) In an income statement prepared using the variable costing method, variable selling and administrative<br />

expenses would:<br />

Page Two<br />

1. (TCO A) The following data (in thousands of dollars) have been taken from the accounting records of Larden<br />

Corporation for the just completed year.<br />

2. (TCO F) The Illinois Company manufactures a product that goes through three processing departments. Information<br />

relating to activity in the first department during June is given below:<br />

3. (TCO B) Drake Company's income statement for the most recent year appears below:<br />

4. (TCO E) The Dean Company produces and sells a single product. The following data refer to the year just completed:<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Midterm Exam Set 4<br />

(MCQs & Essay)<br />

1. (TCO A) Wages paid to a timekeeper in a factory are a ______.<br />

2. (TCO A) The costs of staffing and operating the accounting department at Central Hospital would be considered by<br />

the Department of Surgery to be ______.<br />

3. (TCO A) Inventoriable costs are also known as ______.<br />

4. (TCO A) Within the relevant range, variable costs can be expected to ______.<br />

5. (TCO F) When manufacturing overhead is applied to production, it is added to ______.<br />

6. (TCO F) Under a job-order costing system, the dollar amount transferred from <strong>Work</strong> in Process to Finished Goods<br />

is the sum of the costs charged to all jobs ______.<br />

7. (TCO F) Equivalent units for a process costing system using the FIFO method would be equal to___.<br />

8. (TCO B) The contribution margin ratio always decreases when the ______.<br />

9. (TCO B) The break-even point in unit sales is found by dividing total fixed expenses by______.<br />

10. (TCO E) Under variable costing, ______.