ACCT 591 DeVry Complete Quiz Package

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

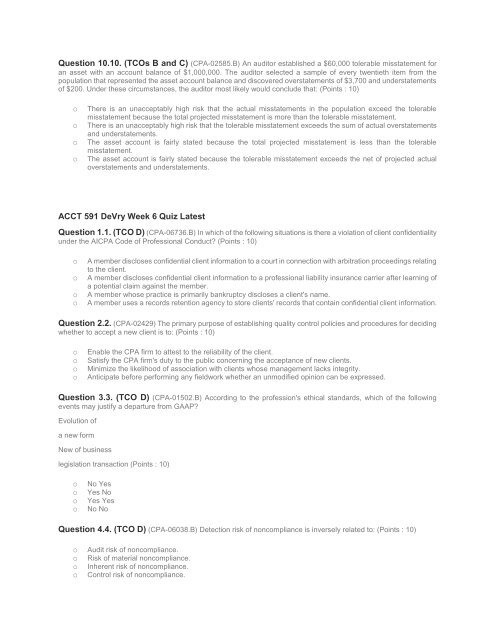

Question 10.10. (TCOs B and C) (CPA-02585.B) An auditor established a $60,000 tolerable misstatement for<br />

an asset with an account balance of $1,000,000. The auditor selected a sample of every twentieth item from the<br />

population that represented the asset account balance and discovered overstatements of $3,700 and understatements<br />

of $200. Under these circumstances, the auditor most likely would conclude that: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

There is an unacceptably high risk that the actual misstatements in the population exceed the tolerable<br />

misstatement because the total projected misstatement is more than the tolerable misstatement.<br />

There is an unacceptably high risk that the tolerable misstatement exceeds the sum of actual overstatements<br />

and understatements.<br />

The asset account is fairly stated because the total projected misstatement is less than the tolerable<br />

misstatement.<br />

The asset account is fairly stated because the tolerable misstatement exceeds the net of projected actual<br />

overstatements and understatements.<br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> Week 6 <strong>Quiz</strong> Latest<br />

Question 1.1. (TCO D) (CPA-06736.B) In which of the following situations is there a violation of client confidentiality<br />

under the AICPA Code of Professional Conduct? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

A member discloses confidential client information to a court in connection with arbitration proceedings relating<br />

to the client.<br />

A member discloses confidential client information to a professional liability insurance carrier after learning of<br />

a potential claim against the member.<br />

A member whose practice is primarily bankruptcy discloses a client's name.<br />

A member uses a records retention agency to store clients' records that contain confidential client information.<br />

Question 2.2. (CPA-02429) The primary purpose of establishing quality control policies and procedures for deciding<br />

whether to accept a new client is to: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Enable the CPA firm to attest to the reliability of the client.<br />

Satisfy the CPA firm's duty to the public concerning the acceptance of new clients.<br />

Minimize the likelihood of association with clients whose management lacks integrity.<br />

Anticipate before performing any fieldwork whether an unmodified opinion can be expressed.<br />

Question 3.3. (TCO D) (CPA-01502.B) According to the profession's ethical standards, which of the following<br />

events may justify a departure from GAAP?<br />

Evolution of<br />

a new form<br />

New of business<br />

legislation transaction (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

No Yes<br />

Yes No<br />

Yes Yes<br />

No No<br />

Question 4.4. (TCO D) (CPA-06038.B) Detection risk of noncompliance is inversely related to: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Audit risk of noncompliance.<br />

Risk of material noncompliance.<br />

Inherent risk of noncompliance.<br />

Control risk of noncompliance.