ACCT 591 DeVry Complete Quiz Package

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

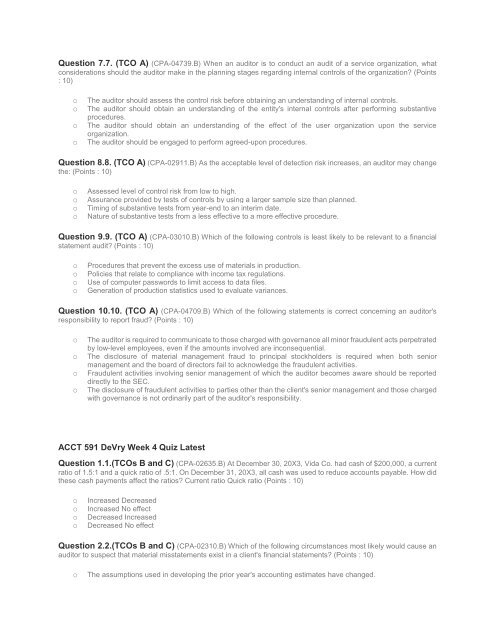

Question 7.7. (TCO A) (CPA-04739.B) When an auditor is to conduct an audit of a service organization, what<br />

considerations should the auditor make in the planning stages regarding internal controls of the organization? (Points<br />

: 10)<br />

o<br />

o<br />

o<br />

o<br />

The auditor should assess the control risk before obtaining an understanding of internal controls.<br />

The auditor should obtain an understanding of the entity's internal controls after performing substantive<br />

procedures.<br />

The auditor should obtain an understanding of the effect of the user organization upon the service<br />

organization.<br />

The auditor should be engaged to perform agreed-upon procedures.<br />

Question 8.8. (TCO A) (CPA-02911.B) As the acceptable level of detection risk increases, an auditor may change<br />

the: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Assessed level of control risk from low to high.<br />

Assurance provided by tests of controls by using a larger sample size than planned.<br />

Timing of substantive tests from year-end to an interim date.<br />

Nature of substantive tests from a less effective to a more effective procedure.<br />

Question 9.9. (TCO A) (CPA-03010.B) Which of the following controls is least likely to be relevant to a financial<br />

statement audit? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Procedures that prevent the excess use of materials in production.<br />

Policies that relate to compliance with income tax regulations.<br />

Use of computer passwords to limit access to data files.<br />

Generation of production statistics used to evaluate variances.<br />

Question 10.10. (TCO A) (CPA-04709.B) Which of the following statements is correct concerning an auditor's<br />

responsibility to report fraud? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The auditor is required to communicate to those charged with governance all minor fraudulent acts perpetrated<br />

by low-level employees, even if the amounts involved are inconsequential.<br />

The disclosure of material management fraud to principal stockholders is required when both senior<br />

management and the board of directors fail to acknowledge the fraudulent activities.<br />

Fraudulent activities involving senior management of which the auditor becomes aware should be reported<br />

directly to the SEC.<br />

The disclosure of fraudulent activities to parties other than the client's senior management and those charged<br />

with governance is not ordinarily part of the auditor's responsibility.<br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> Week 4 <strong>Quiz</strong> Latest<br />

Question 1.1.(TCOs B and C) (CPA-02635.B) At December 30, 20X3, Vida Co. had cash of $200,000, a current<br />

ratio of 1.5:1 and a quick ratio of .5:1. On December 31, 20X3, all cash was used to reduce accounts payable. How did<br />

these cash payments affect the ratios? Current ratio Quick ratio (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Increased Decreased<br />

Increased No effect<br />

Decreased Increased<br />

Decreased No effect<br />

Question 2.2.(TCOs B and C) (CPA-02310.B) Which of the following circumstances most likely would cause an<br />

auditor to suspect that material misstatements exist in a client's financial statements? (Points : 10)<br />

o<br />

The assumptions used in developing the prior year's accounting estimates have changed.