BUSN 379 DeVry Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

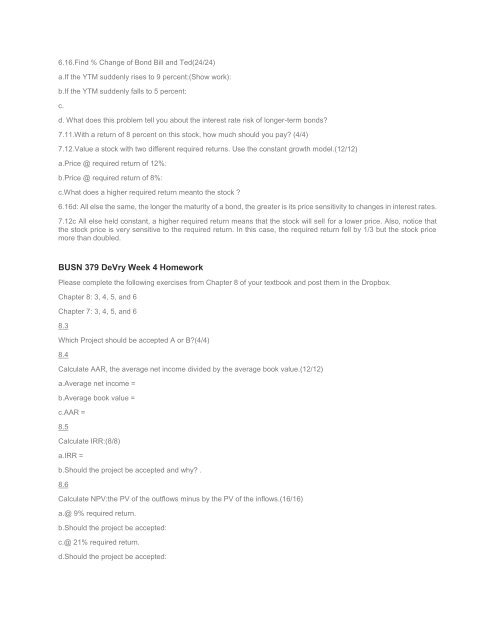

6.16.Find % Change of Bond Bill and Ted(24/24)<br />

a.If the YTM suddenly rises to 9 percent:(Show work):<br />

b.If the YTM suddenly falls to 5 percent:<br />

c.<br />

d. What does this problem tell you about the interest rate risk of longer-term bonds?<br />

7.11.With a return of 8 percent on this stock, how much should you pay? (4/4)<br />

7.12.Value a stock with two different required returns. Use the constant growth model.(12/12)<br />

a.Price @ required return of 12%:<br />

b.Price @ required return of 8%:<br />

c.What does a higher required return meanto the stock ?<br />

6.16d: All else the same, the longer the maturity of a bond, the greater is its price sensitivity to changes in interest rates.<br />

7.12c All else held constant, a higher required return means that the stock will sell for a lower price. Also, notice that<br />

the stock price is very sensitive to the required return. In this case, the required return fell by 1/3 but the stock price<br />

more than doubled.<br />

<strong>BUSN</strong> <strong>379</strong> <strong>DeVry</strong> Week 4 Homework<br />

Please complete the following exercises from Chapter 8 of your textbook and post them in the Dropbox.<br />

Chapter 8: 3, 4, 5, and 6<br />

Chapter 7: 3, 4, 5, and 6<br />

8.3<br />

Which Project should be accepted A or B?(4/4)<br />

8.4<br />

Calculate AAR, the average net income divided by the average book value.(12/12)<br />

a.Average net income =<br />

b.Average book value =<br />

c.AAR =<br />

8.5<br />

Calculate IRR:(8/8)<br />

a.IRR =<br />

b.Should the project be accepted and why? .<br />

8.6<br />

Calculate NPV:the PV of the outflows minus by the PV of the inflows.(16/16)<br />

a.@ 9% required return.<br />

b.Should the project be accepted:<br />

c.@ 21% required return.<br />

d.Should the project be accepted: