BUSN 380 DEVRY WEEK 3 PROBLEM SET 3

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

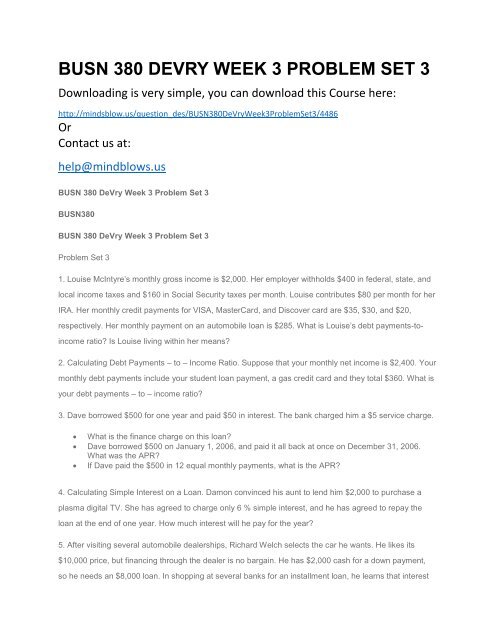

<strong>BUSN</strong> <strong>380</strong> <strong>DEVRY</strong> <strong>WEEK</strong> 3 <strong>PROBLEM</strong> <strong>SET</strong> 3<br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>BUSN</strong><strong>380</strong>DeVryWeek3ProblemSet3/4486<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 3 Problem Set 3<br />

<strong>BUSN</strong><strong>380</strong><br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 3 Problem Set 3<br />

Problem Set 3<br />

1. Louise McIntyre’s monthly gross income is $2,000. Her employer withholds $400 in federal, state, and<br />

local income taxes and $160 in Social Security taxes per month. Louise contributes $80 per month for her<br />

IRA. Her monthly credit payments for VISA, MasterCard, and Discover card are $35, $30, and $20,<br />

respectively. Her monthly payment on an automobile loan is $285. What is Louise’s debt payments-toincome<br />

ratio? Is Louise living within her means?<br />

2. Calculating Debt Payments – to – Income Ratio. Suppose that your monthly net income is $2,400. Your<br />

monthly debt payments include your student loan payment, a gas credit card and they total $360. What is<br />

your debt payments – to – income ratio?<br />

3. Dave borrowed $500 for one year and paid $50 in interest. The bank charged him a $5 service charge.<br />

What is the finance charge on this loan?<br />

Dave borrowed $500 on January 1, 2006, and paid it all back at once on December 31, 2006.<br />

What was the APR?<br />

If Dave paid the $500 in 12 equal monthly payments, what is the APR?<br />

4. Calculating Simple Interest on a Loan. Damon convinced his aunt to lend him $2,000 to purchase a<br />

plasma digital TV. She has agreed to charge only 6 % simple interest, and he has agreed to repay the<br />

loan at the end of one year. How much interest will he pay for the year?<br />

5. After visiting several automobile dealerships, Richard Welch selects the car he wants. He likes its<br />

$10,000 price, but financing through the dealer is no bargain. He has $2,000 cash for a down payment,<br />

so he needs an $8,000 loan. In shopping at several banks for an installment loan, he learns that interest

on most automobile loans is quoted at add-on rates. That is, during the life of the loan, interest is paid on<br />

the full amount borrowed even though a portion of the principal has been paid back. Richard borrows<br />

$8,000 for a period of four years at an add-on interest rate of 11 percent.<br />

Questions<br />

a. What is the total interest on Richard’s loan?<br />

b. What is the total cost of the car?<br />

c. What is the monthly payment?<br />

d. What is the annual percentage rate (APR)?