BUSN 380 DEVRY WEEK 3 QUIZ LATEST

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

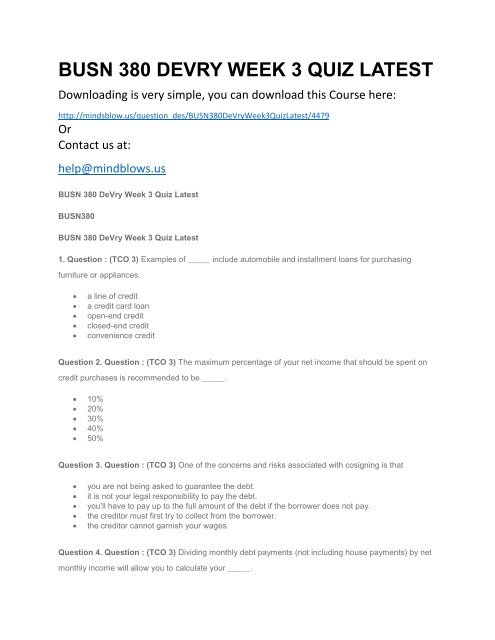

<strong>BUSN</strong> <strong>380</strong> <strong>DEVRY</strong> <strong>WEEK</strong> 3 <strong>QUIZ</strong> <strong>LATEST</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>BUSN</strong><strong>380</strong>DeVryWeek3QuizLatest/4479<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 3 Quiz Latest<br />

<strong>BUSN</strong><strong>380</strong><br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 3 Quiz Latest<br />

1. Question : (TCO 3) Examples of _____ include automobile and installment loans for purchasing<br />

furniture or appliances.<br />

<br />

<br />

<br />

<br />

<br />

a line of credit<br />

a credit card loan<br />

open-end credit<br />

closed-end credit<br />

convenience credit<br />

Question 2. Question : (TCO 3) The maximum percentage of your net income that should be spent on<br />

credit purchases is recommended to be _____.<br />

10%<br />

20%<br />

30%<br />

40%<br />

50%<br />

Question 3. Question : (TCO 3) One of the concerns and risks associated with cosigning is that<br />

<br />

<br />

<br />

<br />

<br />

you are not being asked to guarantee the debt.<br />

it is not your legal responsibility to pay the debt.<br />

you’ll have to pay up to the full amount of the debt if the borrower does not pay.<br />

the creditor must first try to collect from the borrower.<br />

the creditor cannot garnish your wages.<br />

Question 4. Question : (TCO 3) Dividing monthly debt payments (not including house payments) by net<br />

monthly income will allow you to calculate your _____.

net-worth-to-debt ratio<br />

debt-payments-to-income ratio<br />

liability status<br />

credit capacity status<br />

income-to-liability ratio<br />

Question 5. Question : (TCO 3) In determining your credit capacity, you first provide for basic<br />

necessities, such as<br />

<br />

<br />

<br />

<br />

<br />

furniture.<br />

home furnishings.<br />

mortgage or rent.<br />

automobiles.<br />

durable goods.<br />

Question 6. Question : (TCO 3) If you ask to review your file within _____ days of being notified of a<br />

denial based upon a credit report, the credit bureau cannot charge you a disclosure fee.<br />

10<br />

60<br />

30<br />

40<br />

20<br />

Question 7. Question : (TCO 3) If a bank needs to examine the value of a specific asset when you are<br />

applying for a loan, this process refers to which aspect of the five Cs of lending?<br />

<br />

<br />

<br />

<br />

<br />

Character<br />

Capacity<br />

Collateral<br />

Capital<br />

Conditions<br />

Question 8. Question : (TCO 3) When reviewing your credit file, if you find that there is information that<br />

is incorrect, then<br />

<br />

<br />

<br />

<br />

<br />

there are legal remedies available to you.<br />

you have no legal remedies.<br />

credit bureaus are not required to change it.<br />

you can’t really do much about it.<br />

don’t worry much, because you will still get the credit.<br />

Question 9. Question : (TCO 3) All of the following reasons are reasonable situations when you would<br />

decide to use credit except

orrowing for a stay in a hospital because of appendicitis.<br />

borrowing to pay for your expensive dinner and movie every week.<br />

borrowing to buy a printer for your home office now because you know it will be twice as<br />

expensive in 2 years.<br />

borrowing to purchase a car so that you can go to work full time.<br />

Question 10. Question : (TCO 3) Mary Jones has obtained a loan that must be paid over the next 12<br />

months and she will use this money for a vacation. What type of credit is being used?<br />

<br />

<br />

<br />

<br />

<br />

Installment sales credit<br />

Incremental credit<br />

Single lump sum credit<br />

Revolving credit<br />

Installment cash credit<br />

Question 11. Question : (TCO 3) By evaluating your credit options, you can do all of the following except<br />

<br />

<br />

<br />

<br />

<br />

reduce your finance charges.<br />

reconsider your decision to borrow money.<br />

discover a less expensive type of loan.<br />

find a lender that charges a lower rate.<br />

purchase goods and services without specific limitations.<br />

Question 12. Question : (TCO 3) While collateralized loans may provide lower interest rates, these loans<br />

have a disadvantage because<br />

<br />

<br />

<br />

<br />

<br />

the loan must be repaid in a short period of time.<br />

you ruin your credit rating.<br />

the loan is difficult to obtain.<br />

commercial banks do not make such loans.<br />

the assets used as collateral are tied up until the loan has been repaid.<br />

Question 13. Question : (TCO 3) Referring to trends in credit union membership, it can be observed that<br />

membership has been<br />

restricted by the Tax Reform Act of 1986.<br />

declining gradually.<br />

static.<br />

growing steadily.<br />

restricted by state laws.<br />

Question 14. Question : (TCO 3) Which one of the following is a signal of a potential debt problem?<br />

<br />

<br />

<br />

<br />

Paying the maximum balance due each month<br />

Borrowing money to pay old debts<br />

Using savings to pay for major purchases<br />

Receiving notice of prompt payment from creditors

Occasionally working overtime and moonlighting<br />

Question 15. Question : (TCO 3) Allison Smith starts the month with a balance of $1,100 on her credit<br />

card. On the 10th day of the month, she purchases $200 in clothes with her credit card. On the 15th day<br />

of the month, she makes a payment on her credit card of $500. The average daily balance for the month<br />

including the new purchase is $883. The average daily balance for the month excluding the new purchase<br />

is $750. Allison’s interest rate is 1.5% for the month. Allison’s bank calculates the finance charge on the<br />

credit card by using the adjusted balance method. What would Allison’s finance charges be for the<br />

month?<br />

$7.50<br />

$9.00<br />

$11.25<br />

$13.25<br />

$16.50<br />

Question 16. Question : (TCO 3) Jerry Dean starts the month with a balance of $1,500 on his credit<br />

card. On the 10th day of the month, he purchases $200 in clothes with his credit card. On the 15th day of<br />

the month, he makes a payment on his credit card of $500. The average daily balance for the month<br />

including the new purchase is $883. The average daily balance for the month excluding the new purchase<br />

is $750. Jerry’s interest rate is 1.5% for the month. Jerry’s bank calculates the finance charge on the<br />

credit card by using the previous balance method. What would Jerry’s finance charges be for the month?<br />

$7.50<br />

$13.25<br />

$15.00<br />

$22.50<br />

$18.00<br />

Question 17. Question : (TCO 3) If Jeff rushes to purchase a home by obtaining an interest-only loan,<br />

and the reason why he wants a home is because he wants to have a house just like the one that his<br />

parents had when he was a teenager, this is an example of which of the following?<br />

<br />

<br />

<br />

<br />

<br />

Misunderstanding or lack of communication<br />

The use of money to punish<br />

Overindulgence of children<br />

Keeping up with the Joneses<br />

The expectation of instant comfort<br />

Question 18. Question : (TCO 3) Steve has three children and has purchased each of them his or her<br />

own TV that is placed in his or her respective room. Which reason for indebtedness is this an example of?

Misunderstanding or lack of communication<br />

Overindulgence of children<br />

The expectation of instant comfort<br />

Keeping up with the Joneses<br />

The use of money to punish<br />

Question 19. Question : (TCO 3) _____ families rely heaviest on student loans to finance college.<br />

<br />

<br />

<br />

<br />

Low-income<br />

Middle-income<br />

High-income<br />

Large Small<br />

Question 20. Question : (TCO 3) If Tracy Sears borrows $1,250 for 1 year with an APR of 9% with no<br />

service fees, what is her total cost of credit?<br />

$125<br />

$112.50<br />

$7.50<br />

$9.38<br />

$0