FIN 351 DeVry Week 3 Quiz Latest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

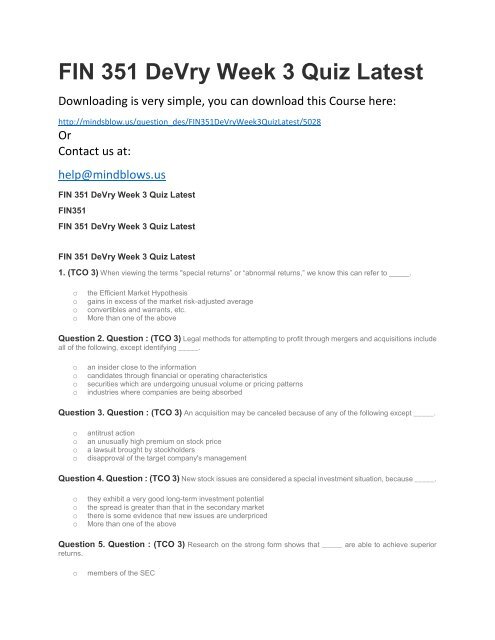

<strong>FIN</strong> <strong>351</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>Quiz</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>FIN</strong><strong>351</strong><strong>DeVry</strong><strong>Week</strong>3<strong>Quiz</strong><strong>Latest</strong>/5028<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>FIN</strong> <strong>351</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>FIN</strong><strong>351</strong><br />

<strong>FIN</strong> <strong>351</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>FIN</strong> <strong>351</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>Quiz</strong> <strong>Latest</strong><br />

1. (TCO 3) When viewing the terms "special returns” or “abnormal returns,” we know this can refer to _____.<br />

o<br />

o<br />

o<br />

o<br />

the Efficient Market Hypothesis<br />

gains in excess of the market risk-adjusted average<br />

convertibles and warrants, etc.<br />

More than one of the above<br />

Question 2. Question : (TCO 3) Legal methods for attempting to profit through mergers and acquisitions include<br />

all of the following, except identifying _____.<br />

o<br />

o<br />

o<br />

o<br />

an insider close to the information<br />

candidates through financial or operating characteristics<br />

securities which are undergoing unusual volume or pricing patterns<br />

industries where companies are being absorbed<br />

Question 3. Question : (TCO 3) An acquisition may be canceled because of any of the following except _____.<br />

o<br />

o<br />

o<br />

o<br />

antitrust action<br />

an unusually high premium on stock price<br />

a lawsuit brought by stockholders<br />

disapproval of the target company's management<br />

Question 4. Question : (TCO 3) New stock issues are considered a special investment situation, because _____.<br />

o<br />

o<br />

o<br />

o<br />

they exhibit a very good long-term investment potential<br />

the spread is greater than that in the secondary market<br />

there is some evidence that new issues are underpriced<br />

More than one of the above<br />

Question 5. Question : (TCO 3) Research on the strong form shows that _____ are able to achieve superior<br />

returns.<br />

o<br />

members of the SEC

o<br />

o<br />

o<br />

corporate insiders and public officials<br />

market specialists and corporate insiders<br />

the majority of professional mutual fund managers<br />

Question 6. Question : (TCO 3) According to the Dow Theory, daily fluctuations and secondary movements in<br />

the market are used to help identify _____.<br />

o<br />

o<br />

o<br />

o<br />

a key indicator<br />

a primary trend<br />

shifts in demand and supply<br />

More than one of the above<br />

Question 7. Question : (TCO 3) All of the following are smart money rules except ¬_____.<br />

o<br />

o<br />

o<br />

o<br />

investment advisory recommendations<br />

short sales by specialists<br />

Barron's Confidence Index<br />

None of the above<br />

Question 8. Question : (TCO 3) A low Barron's Confidence Index means that _____.<br />

o<br />

o<br />

o<br />

o<br />

investors prefer stocks to bonds<br />

the yield on bonds is greater than that on stock<br />

low-quality bonds have returns much higher than high-quality bonds<br />

low-quality bonds have returns slightly higher than high-quality bonds<br />

Question 9. Question : (TCO 3) The problem in reading charts has always been _____.<br />

o<br />

o<br />

o<br />

o<br />

with the errors that are frequently made in the graphing process<br />

understanding the past market movements<br />

in analyzing the patterns in such a fashion that they truly predict stock market movements before they unfold<br />

None of the above<br />

Question 10. Question : (TCO 3) Smart money rules or approaches to the market include _____.<br />

o<br />

o<br />

o<br />

o<br />

short sales by specialists<br />

the put-call ratio<br />

investment advisory recommendations<br />

the odd-lot theory