ACCT 224 DeVry Week 2 Quiz Latest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 2 <strong>Quiz</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>224</strong>-devry-week-2-quiz-latest/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 2 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>ACCT</strong><strong>224</strong><br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 2 <strong>Quiz</strong> <strong>Latest</strong><br />

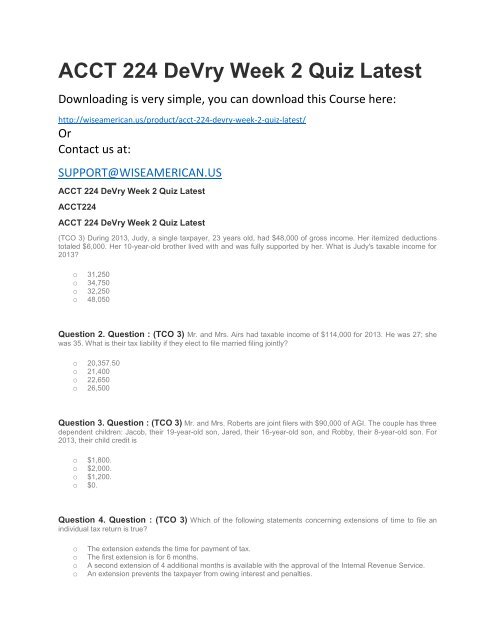

(TCO 3) During 2013, Judy, a single taxpayer, 23 years old, had $48,000 of gross income. Her itemized deductions<br />

totaled $6,000. Her 10-year-old brother lived with and was fully supported by her. What is Judy's taxable income for<br />

2013?<br />

o 31,250<br />

o 34,750<br />

o 32,250<br />

o 48,050<br />

Question 2. Question : (TCO 3) Mr. and Mrs. Airs had taxable income of $114,000 for 2013. He was 27; she<br />

was 35. What is their tax liability if they elect to file married filing jointly?<br />

o 20,357.50<br />

o 21,400<br />

o 22,650<br />

o 26,500<br />

Question 3. Question : (TCO 3) Mr. and Mrs. Roberts are joint filers with $90,000 of AGI. The couple has three<br />

dependent children: Jacob, their 19-year-old son, Jared, their 16-year-old son, and Robby, their 8-year-old son. For<br />

2013, their child credit is<br />

o $1,800.<br />

o $2,000.<br />

o $1,200.<br />

o $0.<br />

Question 4. Question : (TCO 3) Which of the following statements concerning extensions of time to file an<br />

individual tax return is true?<br />

o<br />

o<br />

o<br />

o<br />

The extension extends the time for payment of tax.<br />

The first extension is for 6 months.<br />

A second extension of 4 additional months is available with the approval of the Internal Revenue Service.<br />

An extension prevents the taxpayer from owing interest and penalties.

Question 5. Question : (TCO 3) For 2013, Michelle (a single person) had the following tax information:<br />

Wages: $56,000<br />

Itemized deductions: $3,350<br />

Michelle's taxable income for the year is<br />

o 46,000.<br />

o 43,850.<br />

o 45,350.<br />

o 40,550.<br />

(General Feedback: Chapter 14. $56,000 -$6,100 - $3,900)