ACCT 312 DeVry Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

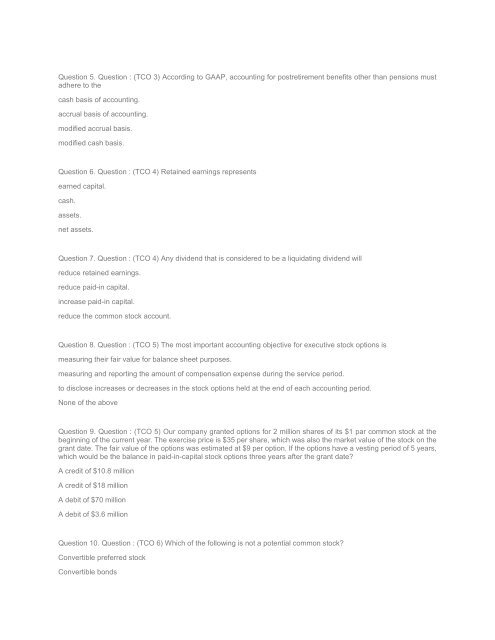

Question 5. Question : (TCO 3) According to GAAP, accounting for postretirement benefits other than pensions must<br />

adhere to the<br />

cash basis of accounting.<br />

accrual basis of accounting.<br />

modified accrual basis.<br />

modified cash basis.<br />

Question 6. Question : (TCO 4) Retained earnings represents<br />

earned capital.<br />

cash.<br />

assets.<br />

net assets.<br />

Question 7. Question : (TCO 4) Any dividend that is considered to be a liquidating dividend will<br />

reduce retained earnings.<br />

reduce paid-in capital.<br />

increase paid-in capital.<br />

reduce the common stock account.<br />

Question 8. Question : (TCO 5) The most important accounting objective for executive stock options is<br />

measuring their fair value for balance sheet purposes.<br />

measuring and reporting the amount of compensation expense during the service period.<br />

to disclose increases or decreases in the stock options held at the end of each accounting period.<br />

None of the above<br />

Question 9. Question : (TCO 5) Our company granted options for 2 million shares of its $1 par common stock at the<br />

beginning of the current year. The exercise price is $35 per share, which was also the market value of the stock on the<br />

grant date. The fair value of the options was estimated at $9 per option. If the options have a vesting period of 5 years,<br />

which would be the balance in paid-in-capital stock options three years after the grant date?<br />

A credit of $10.8 million<br />

A credit of $18 million<br />

A debit of $70 million<br />

A debit of $3.6 million<br />

Question 10. Question : (TCO 6) Which of the following is not a potential common stock?<br />

Convertible preferred stock<br />

Convertible bonds