ACCT 312 DeVry Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

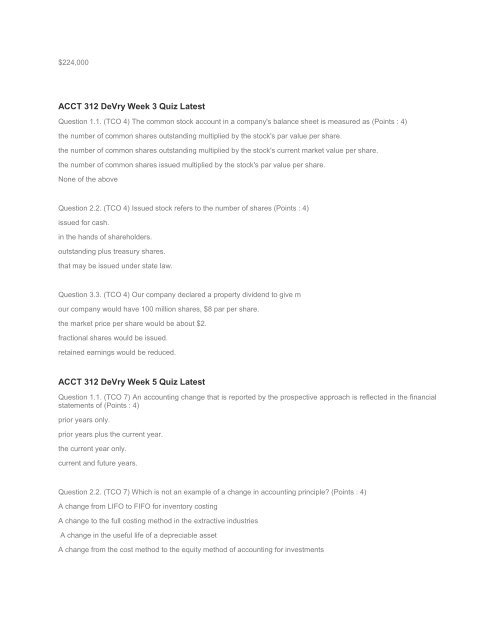

$224,000<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> Week 3 Quiz Latest<br />

Question 1.1. (TCO 4) The common stock account in a company's balance sheet is measured as (Points : 4)<br />

the number of common shares outstanding multiplied by the stock's par value per share.<br />

the number of common shares outstanding multiplied by the stock's current market value per share.<br />

the number of common shares issued multiplied by the stock's par value per share.<br />

None of the above<br />

Question 2.2. (TCO 4) Issued stock refers to the number of shares (Points : 4)<br />

issued for cash.<br />

in the hands of shareholders.<br />

outstanding plus treasury shares.<br />

that may be issued under state law.<br />

Question 3.3. (TCO 4) Our company declared a property dividend to give m<br />

our company would have 100 million shares, $8 par per share.<br />

the market price per share would be about $2.<br />

fractional shares would be issued.<br />

retained earnings would be reduced.<br />

<strong>ACCT</strong> <strong>312</strong> <strong>DeVry</strong> Week 5 Quiz Latest<br />

Question 1.1. (TCO 7) An accounting change that is reported by the prospective approach is reflected in the financial<br />

statements of (Points : 4)<br />

prior years only.<br />

prior years plus the current year.<br />

the current year only.<br />

current and future years.<br />

Question 2.2. (TCO 7) Which is not an example of a change in accounting principle? (Points : 4)<br />

A change from LIFO to FIFO for inventory costing<br />

A change to the full costing method in the extractive industries<br />

A change in the useful life of a depreciable asset<br />

A change from the cost method to the equity method of accounting for investments