You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

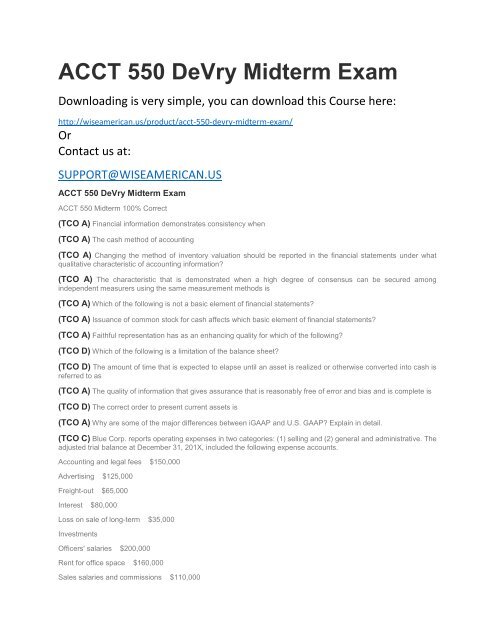

<strong>ACCT</strong> <strong>550</strong> <strong>DeVry</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>550</strong>-devry-midterm-exam/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>550</strong> <strong>DeVry</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

<strong>ACCT</strong> <strong>550</strong> <strong>Midterm</strong> 100% Correct<br />

(TCO A) Financial information demonstrates consistency when<br />

(TCO A) The cash method of accounting<br />

(TCO A) Changing the method of inventory valuation should be reported in the financial statements under what<br />

qualitative characteristic of accounting information?<br />

(TCO A) The characteristic that is demonstrated when a high degree of consensus can be secured among<br />

independent measurers using the same measurement methods is<br />

(TCO A) Which of the following is not a basic element of financial statements?<br />

(TCO A) Issuance of common stock for cash affects which basic element of financial statements?<br />

(TCO A) Faithful representation has as an enhancing quality for which of the following?<br />

(TCO D) Which of the following is a limitation of the balance sheet?<br />

(TCO D) The amount of time that is expected to elapse until an asset is realized or otherwise converted into cash is<br />

referred to as<br />

(TCO A) The quality of information that gives assurance that is reasonably free of error and bias and is complete is<br />

(TCO D) The correct order to present current assets is<br />

(TCO A) Why are some of the major differences between iGAAP and U.S. GAAP? Explain in detail.<br />

(TCO C) Blue Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The<br />

adjusted trial balance at December 31, 201X, included the following expense accounts.<br />

Accounting and legal fees $150,000<br />

Advertising $125,000<br />

Freight-out $65,000<br />

Interest $80,000<br />

Loss on sale of long-term $35,000<br />

Investments<br />

Officers' salaries $200,000<br />

Rent for office space $160,000<br />

Sales salaries and commissions $110,000

One half of the rented premises are occupied by the sales department. How much of the expenses listed above should<br />

be included in Perry's selling expenses for 201X?<br />

(TCO C) For the year ended December 31, 201X, King Inc. reported the following.<br />

Net income $60,000<br />

Preferred dividends declared $10,000<br />

Common dividend declared $2,000<br />

Unrealized holding loss, net of tax $1,000<br />

Retained earnings, beginning $80,000<br />

Balance<br />

Common stock sold during the year $80,000<br />

Retained earnings, beginning<br />

Balance<br />

Common stock $40,000<br />

Accumulated Other Comprehensive<br />

$5,000 Income, Beginning Balance<br />

What would Transformers report as the ending balance of retained earnings?<br />

(TCO C) Ivy Co. had the following account balances.<br />

Sales 120,000<br />

Cost of goods sold 70,000<br />

Salary expense 15,000<br />

Depreciation expense 20,000<br />

Dividend revenue 5,000<br />

Utilities expense 6,000<br />

Rental revenue 30,000<br />

Interest expense 10,000<br />

Advertising expense 15,000<br />

What would Ivy report as total expenses in a single-step income<br />

statement?<br />

(TCO B) Unearned rent at 1/1/1X was $7,300 and at 12/31/1X was $8,100. The records indicate cash receipts from<br />

rental sources during 201X amounted to $40,000, all of which was credited to the Unearned<br />

Rent Account. You are to prepare the missing adjusting entry. Please indicate DR (debit) or CR (credit) to the left of<br />

the account title, and place a comma between the account title and the amount of the<br />

Adjustment.<br />

(TCO B) Unearned rent at 1/1/1X was $5,500 and at 12/31/1X was $10,000. The records indicate cash receipts from<br />

rental sources during 201X amounted to $40,000, all of which was credited to the Unearned<br />

Rent Account. You are to prepare the missing adjusting entry. Please indicate DR (debit) or CR (credit) to the left of<br />

the account title, and place a comma between the account title and the amount of the<br />

Adjustment.<br />

(TCO B) Allowance for doubtful accounts on 1/1/1X was $50,000. The balance in the allowance account on 12/31/1X<br />

after making the annual adjusting entry was $65,000, and during 201X, bad debts written off

Amounted to $40,000. You are to provide the missing adjusting entry. Please indicate DR (debit) or CR (credit) to the<br />

left of the account title,and place a comma between the account title and the amount of the<br />

Adjustment.<br />

(TCO D) Which of the following should be reported for capital stock?<br />

(TCO D) Which item below is not a current liability?<br />

(TCO A) Financial information exhibits the characteristic of consistency when<br />

(TCO D) Hall Corp.'s trial balance reflected the following account balances at December 31, 201X. Accounts<br />

receivable (net)<br />

(TCO A) Which of the following statements is not an objective of financial reporting?<br />

(TCO A) The cash method of accounting<br />

(TCO A) Changing the method of inventory valuation should be reported in the financial statements under what<br />

qualitative characteristic of accounting information?<br />

(TCO A) The two fundamental qualities for accounting information are<br />

(TCO A) The elements of financial statements include investments by owners. These are increases in an entity's net<br />

assets resulting from owners’<br />

(TCO A) Issuance of common stock for cash affects which basic element of financial statements?<br />

(TCO A) Which basic assumption may not be followed when a firm in bankruptcy reports financial results?<br />

(TCO D) Balance sheet information is useful for all of the following except to<br />

(TCO D) The balance sheet contributes to financial reporting by providing a basis for all of the following except<br />

(TCO A) The quality of information that gives assurance that is reasonably free of error and bias and is complete is<br />

(TCO D) The basis for classifying assets as current or noncurrent is conversion to cash within<br />

(TCO A) What is FASB Codification? Explain in detail.<br />

(TCO C) At Red Company, events and transactions during 20X2 included the following. The tax rate for all items is<br />

30%.<br />

(1) Depreciation for 20X1 was found to be understated by $40,000.<br />

(2) A strike by the employees of a supplier resulted in a loss of $35,000.<br />

(3) The inventory at December 31, 20X1 was overstated by $50,000.<br />

(4) A flood destroyed a building that had a book value of $500,000. Floods are very uncommon in that area.<br />

What would the effect of these events and transactions on 20X2 income from continuing operations net of tax be?<br />

(TCO C) An income statement shows "income before income taxes and extraordinary items" in the amount of<br />

$3,000,000. The income taxes payable for the year are $1,500,000, including $260,000 that is applicable to an<br />

extraordinary gain. Thus, what is the "income before extraordinary items"?<br />

(TCO C) Dolly Company reported the following information for 201X.<br />

(TCO B) Prepaid rent at 1/1/1X was $70,000. During 201X, rent payments of $120,000 were made and charged to<br />

"rent expense."<br />

The 201X income statement shows as a general expense the item "rent expense" in the amount of $126,000. You are<br />

to prepare the missing adjusting entry that must have been made, assuming reversing entries are not made. Please<br />

indicate DR (debit) or CR (credit) to the left of the account title, and place a comma between the account title and the<br />

amount of the adjustment.

(TCO B) Unearned rent at 1/1/1X was $6,000 and at 12/31/1X was $15,000. The records indicate cash receipts from<br />

rental sources during 201X amounted to $40,000, all of which was credited to the Unearned Rent Account. You are to<br />

prepare the missing adjusting entry. Please indicate DR (debit) or CR (credit) to the left of the account title, and place<br />

a comma between the account title and the amount of the adjustment.<br />

(TCO B) Prepaid rent at 1/1/1X was $25,000. During 201X, rent payments of $123,000 were made and charged to<br />

"rent expense." The 201X income statement shows as a general expense the item "rent expense" in the amount of<br />

$122,000. You are to prepare the missing adjusting entry that must have been made, assuming reversing entries are<br />

not made. Please indicate DR (debit) or CR (credit) to the left of the account title, and place a comma between the<br />

account title and the amount of the adjustment.<br />

(TCO B) Prepaid rent at 1/1/1X was $40,000. During 201X, rent payments of $115,000 were made and charged to<br />

"rent expense." The 201X income statement shows as a general expense the item "rent expense" in the amount of<br />

$125,000. You are to prepare the missing adjusting entry that must have been made, assuming reversing entries are<br />

not made. Please indicate DR (debit) or CR (credit) to the left of the account title, and place a comma between the<br />

account title and the amount of the adjustment<br />

(TCO D) Which of the following is not an acceptable major asset classification?<br />

(TCO D) An example of an item that is not an element of working capital is<br />

(TCO A) Which of the following is not a basic assumption underlying the financial accounting structure?<br />

(TCO D) The current assets section of the balance sheet should include<br />

TCO D) Ahnen Company owns the following investments.<br />

Trading securities (fair value) $70,000<br />

Available-for-sale securities (fair value) 40,000<br />

Held-to-maturity securities (amortized cost) 47,000<br />

What will Ahnen report investments in its current assets section?