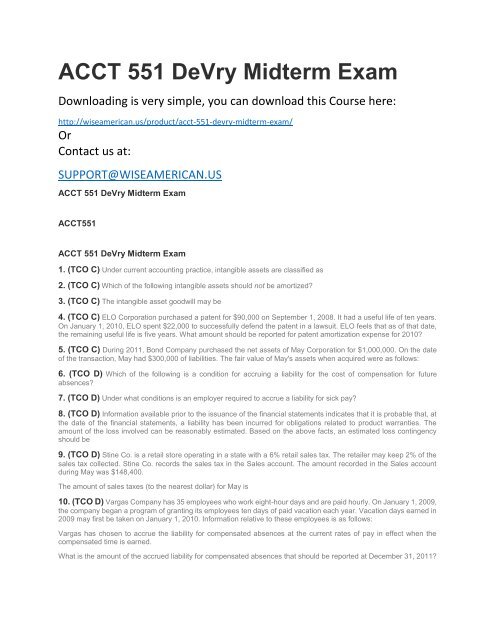

ACCT 551 DeVry Midterm Exam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>551</strong> <strong>DeVry</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>551</strong>-devry-midterm-exam/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>551</strong> <strong>DeVry</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

<strong>ACCT</strong><strong>551</strong><br />

<strong>ACCT</strong> <strong>551</strong> <strong>DeVry</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

1. (TCO C) Under current accounting practice, intangible assets are classified as<br />

2. (TCO C) Which of the following intangible assets should not be amortized?<br />

3. (TCO C) The intangible asset goodwill may be<br />

4. (TCO C) ELO Corporation purchased a patent for $90,000 on September 1, 2008. It had a useful life of ten years.<br />

On January 1, 2010, ELO spent $22,000 to successfully defend the patent in a lawsuit. ELO feels that as of that date,<br />

the remaining useful life is five years. What amount should be reported for patent amortization expense for 2010?<br />

5. (TCO C) During 2011, Bond Company purchased the net assets of May Corporation for $1,000,000. On the date<br />

of the transaction, May had $300,000 of liabilities. The fair value of May's assets when acquired were as follows:<br />

6. (TCO D) Which of the following is a condition for accruing a liability for the cost of compensation for future<br />

absences?<br />

7. (TCO D) Under what conditions is an employer required to accrue a liability for sick pay?<br />

8. (TCO D) Information available prior to the issuance of the financial statements indicates that it is probable that, at<br />

the date of the financial statements, a liability has been incurred for obligations related to product warranties. The<br />

amount of the loss involved can be reasonably estimated. Based on the above facts, an estimated loss contingency<br />

should be<br />

9. (TCO D) Stine Co. is a retail store operating in a state with a 6% retail sales tax. The retailer may keep 2% of the<br />

sales tax collected. Stine Co. records the sales tax in the Sales account. The amount recorded in the Sales account<br />

during May was $148,400.<br />

The amount of sales taxes (to the nearest dollar) for May is<br />

10. (TCO D) Vargas Company has 35 employees who work eight-hour days and are paid hourly. On January 1, 2009,<br />

the company began a program of granting its employees ten days of paid vacation each year. Vacation days earned in<br />

2009 may first be taken on January 1, 2010. Information relative to these employees is as follows:<br />

Vargas has chosen to accrue the liability for compensated absences at the current rates of pay in effect when the<br />

compensated time is earned.<br />

What is the amount of the accrued liability for compensated absences that should be reported at December 31, 2011?

11. (TCO D) Reich, Inc. issued bonds with a maturity amount of $200,000 and a maturity ten years from date of issue.<br />

If the bonds were issued at a premium, this indicates that<br />

12. (TCO D) The printing costs and legal fees associated with the issuance of bonds should<br />

13. (TCO D) Feller Company issues $20,000,000 of ten-year, 9% bonds on March 1, 2010 at 97 plus accrued interest.<br />

The bonds are dated January 1, 2010, and pay interest on June 30 and December 31. What is the total cash received<br />

on the issue date?<br />

14. (TCO D) A company issues $20,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2010. Interest is paid<br />

on June 30 and December 31. The proceeds from the bonds are $19,604,145. What is interest expense for 2011, using<br />

straight-line amortization?<br />

15. (TCO D) On January 1, Martinez Inc. issued $3,000,000, 11% bonds for $3,195,000. The market rate of interest<br />

for these bonds is 10%. Interest is payable annually on December 31. Martinez uses the effective-interest method of<br />

amortizing bond premium. At the end of the first year, Martinez should report unamortized bond premium of: