ACCT 591 DeVry Week 1 Quiz Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

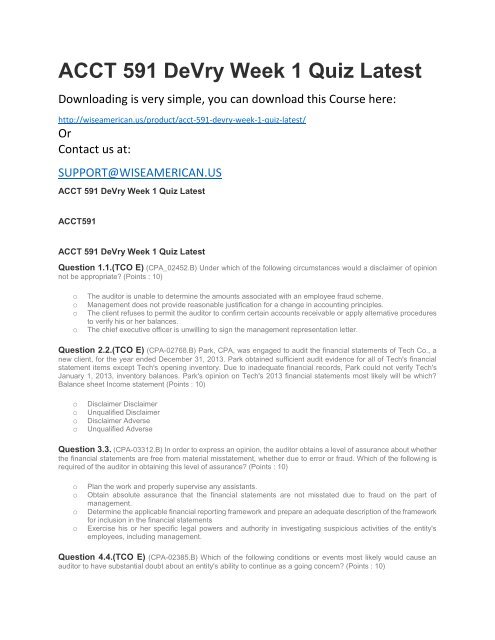

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 1 <strong>Quiz</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>591</strong>-devry-week-1-quiz-latest/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 1 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>ACCT</strong><strong>591</strong><br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 1 <strong>Quiz</strong> <strong>Latest</strong><br />

Question 1.1.(TCO E) (CPA_02452.B) Under which of the following circumstances would a disclaimer of opinion<br />

not be appropriate? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The auditor is unable to determine the amounts associated with an employee fraud scheme.<br />

Management does not provide reasonable justification for a change in accounting principles.<br />

The client refuses to permit the auditor to confirm certain accounts receivable or apply alternative procedures<br />

to verify his or her balances.<br />

The chief executive officer is unwilling to sign the management representation letter.<br />

Question 2.2.(TCO E) (CPA-02768.B) Park, CPA, was engaged to audit the financial statements of Tech Co., a<br />

new client, for the year ended December 31, 2013. Park obtained sufficient audit evidence for all of Tech's financial<br />

statement items except Tech's opening inventory. Due to inadequate financial records, Park could not verify Tech's<br />

January 1, 2013, inventory balances. Park's opinion on Tech's 2013 financial statements most likely will be which?<br />

Balance sheet Income statement (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Disclaimer Disclaimer<br />

Unqualified Disclaimer<br />

Disclaimer Adverse<br />

Unqualified Adverse<br />

Question 3.3. (CPA-03312.B) In order to express an opinion, the auditor obtains a level of assurance about whether<br />

the financial statements are free from material misstatement, whether due to error or fraud. Which of the following is<br />

required of the auditor in obtaining this level of assurance? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Plan the work and properly supervise any assistants.<br />

Obtain absolute assurance that the financial statements are not misstated due to fraud on the part of<br />

management.<br />

Determine the applicable financial reporting framework and prepare an adequate description of the framework<br />

for inclusion in the financial statements<br />

Exercise his or her specific legal powers and authority in investigating suspicious activities of the entity's<br />

employees, including management.<br />

Question 4.4.(TCO E) (CPA-02385.B) Which of the following conditions or events most likely would cause an<br />

auditor to have substantial doubt about an entity's ability to continue as a going concern? (Points : 10)

o<br />

o<br />

o<br />

o<br />

Significant related party transactions are pervasive.<br />

Usual trade credit from suppliers is denied.<br />

Arrearages in preferred stock dividends are paid.<br />

Restrictions on the disposal of principal assets are present.<br />

Question 5.5.(TCO E) (CPA-02566.B) When an independent CPA assists in preparing the financial statements of<br />

a publicly held entity but has not audited or reviewed them, the CPA should issue a disclaimer of opinion. In such<br />

situations, the CPA has no responsibility to apply any procedures beyond (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Documenting that internal control is not being relied on.<br />

Reading the financial statements for obvious material misstatements.<br />

Ascertaining whether the financial statements are in conformity with GAAP.<br />

Determining whether management has elected to omit substantially all required disclosures.<br />

Question 6.6.(TCO E) (CPA-04621.B) As of August 13, a CPA had obtained sufficient appropriate audit evidence<br />

with respect to fieldwork on an engagement to audit financial statements for the year ended June 30. On August 27,<br />

an event came to the CPA's attention that should be disclosed in the notes to the financial statements. The event was<br />

properly disclosed by the entity, but the CPA decided not to dual date the auditor's report and dated the report August<br />

27. Under these circumstances, the CPA was taking responsibility for(Points : 10)<br />

o All subsequent events that occurred through August 27.<br />

o Only the specific subsequent event disclosed by the entity.<br />

o All subsequent events that occurred through August 13 and the specific subsequent event disclosed by the<br />

entity.<br />

o Only the subsequent events that occurred through August 13.<br />

Question 7.7.(TCO E) (CPA-02820.B) Which of the following is not an example of the application of professional<br />

skepticism? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Designing additional auditing procedures to obtain more reliable evidence in support of a particular financial<br />

statement assertion<br />

Obtaining corroboration of management's explanations through consultation with a specialist<br />

Inquiring of prior year engagement personnel regarding their assessment of management's honesty and<br />

integrity<br />

Using third-party confirmations to provide support for management's representations<br />

Question 8.8.(TCO E) (CPA-02749.B) An auditor includes a separate paragraph in an otherwise unmodified report<br />

to emphasize that the entity being reported on had significant transactions with related parties. The inclusion of this<br />

separate paragraph (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Is considered an "except for" qualification of the opinion.<br />

Violates generally accepted auditing standards if this information is already disclosed in footnotes to the<br />

financial statements.<br />

Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing explanation.”<br />

Is appropriate and would not negate the unqualified opinion.<br />

Question 9.9.(TCO E) (CPA-02444.B) An auditor most likely would express an unqualified opinion and would not<br />

add explanatory language to the report if the auditor (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Wishes to emphasize that the entity had significant transactions with related parties.<br />

Concurs with the entity's change in its method of computing depreciation.<br />

Discovers that supplementary information required by FASB has been omitted.<br />

Believes that there is a probable likelihood of a material loss resulting from an uncertainty that is sufficiently<br />

supported and disclosed.

Question 10.10.(TCO E) (CPA-03151.B) Which of the following events occurring after the issuance of an auditor's<br />

report most likely would cause the auditor to make further inquiries about the previously issued financial statements?<br />

(Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

A technological development that could affect the entity's future ability to continue as a going concern<br />

The discovery of information regarding a contingency that existed before the financial statements were issued<br />

The entity's sale of a subsidiary that accounts for 30% of the entity's consolidated sales<br />

The final resolution of a lawsuit explained in a separate paragraph of the auditor's report