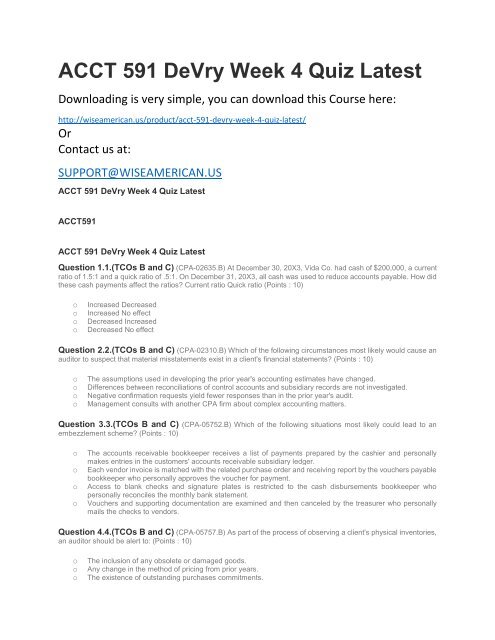

ACCT 591 DeVry Week 4 Quiz Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Quiz</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>591</strong>-devry-week-4-quiz-latest/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>ACCT</strong><strong>591</strong><br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Quiz</strong> <strong>Latest</strong><br />

Question 1.1.(TCOs B and C) (CPA-02635.B) At December 30, 20X3, Vida Co. had cash of $200,000, a current<br />

ratio of 1.5:1 and a quick ratio of .5:1. On December 31, 20X3, all cash was used to reduce accounts payable. How did<br />

these cash payments affect the ratios? Current ratio Quick ratio (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Increased Decreased<br />

Increased No effect<br />

Decreased Increased<br />

Decreased No effect<br />

Question 2.2.(TCOs B and C) (CPA-02310.B) Which of the following circumstances most likely would cause an<br />

auditor to suspect that material misstatements exist in a client's financial statements? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The assumptions used in developing the prior year's accounting estimates have changed.<br />

Differences between reconciliations of control accounts and subsidiary records are not investigated.<br />

Negative confirmation requests yield fewer responses than in the prior year's audit.<br />

Management consults with another CPA firm about complex accounting matters.<br />

Question 3.3.(TCOs B and C) (CPA-05752.B) Which of the following situations most likely could lead to an<br />

embezzlement scheme? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The accounts receivable bookkeeper receives a list of payments prepared by the cashier and personally<br />

makes entries in the customers' accounts receivable subsidiary ledger.<br />

Each vendor invoice is matched with the related purchase order and receiving report by the vouchers payable<br />

bookkeeper who personally approves the voucher for payment.<br />

Access to blank checks and signature plates is restricted to the cash disbursements bookkeeper who<br />

personally reconciles the monthly bank statement.<br />

Vouchers and supporting documentation are examined and then canceled by the treasurer who personally<br />

mails the checks to vendors.<br />

Question 4.4.(TCOs B and C) (CPA-05757.B) As part of the process of observing a client's physical inventories,<br />

an auditor should be alert to: (Points : 10)<br />

o<br />

o<br />

o<br />

The inclusion of any obsolete or damaged goods.<br />

Any change in the method of pricing from prior years.<br />

The existence of outstanding purchases commitments.

o<br />

The verification of inventory values assigned to goods in process.<br />

Question 5.5.(TCOs B and C) (CPA-02504.B) Which of the following procedures most likely would assist an<br />

auditor in determining whether management has identified all accounting estimates that could be material to the<br />

financial statements? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Inquire about the existence of related party transactions.<br />

Determine whether accounting estimates deviate from historical patterns.<br />

Confirm inventories at locations outside the entity.<br />

Review the lawyer's letter for information about litigation.<br />

Question 6.6.(TCOs B and C) (CPA-02575.B) After determining that a related party transaction has, in fact,<br />

occurred, an auditor should: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Add a separate paragraph to the auditor's standard report to explain the transaction.<br />

Perform analytical procedures to verify whether similar transactions occurred, but were not recorded.<br />

Obtain an understanding of the business purpose of the transaction.<br />

Substantiate that the transaction was consummated on terms equivalent to an arm's-length transaction.<br />

Question 7.7.(TCOs B and C) (CPA-02612.B) Which of the following procedures would an auditor most likely<br />

perform in searching for unrecorded liabilities? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Vouch a sample of accounts payable entries recorded just before year-end to the unmatched receiving report<br />

file.<br />

Compare a sample of purchase orders issued just after year-end with the year-end accounts payable trial<br />

balance.<br />

Vouch a sample of cash disbursements recorded just after year-end to receiving reports and vendor invoices.<br />

Scan the cash disbursements entries recorded just before year-end for indications of unusual transactions.<br />

Question 8.8.(TCOs B and C) (CPA-02495.B) During an audit of an entity's stockholders' equity accounts, the<br />

auditor determines whether there are restrictions on retained earnings resulting from loans, agreements, or state law.<br />

This audit procedure most likely is intended to verify management's assertions related to: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Existence.<br />

Completeness.<br />

Valuation and allocation.<br />

Classification and understandability.<br />

Question 9.9.(TCOs B and C) (CPA-02391.B) In performing a count of negotiable securities, an auditor records<br />

the details of the count on a security count worksheet. What other information is usually included on this worksheet?<br />

(Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

An acknowledgment by a client representative that the securities were returned intact.<br />

An analysis of realized gains and losses from the sale of securities during the year.<br />

An evaluation of the client's internal control concerning physical access to the securities.<br />

A description of the client's procedures that prevent the negotiation of securities by just one person.<br />

Question 10.10.(TCOs B and C) (CPA-04713.B) Analytical procedures performed in the final review stage of an<br />

audit generally would include: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Reassessing the factors that assisted the auditor in deciding on preliminary materiality levels and audit risk.<br />

Considering the adequacy of the evidence gathered in response to unexpected balances identified in planning.<br />

Summarizing uncorrected misstatements specifically identified through tests of details of transactions and<br />

balances.<br />

Calculating projected uncorrected misstatements estimated through audit sampling techniques.