BUSN 380 DEVRY WEEK 1 PROBLEM SET 1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

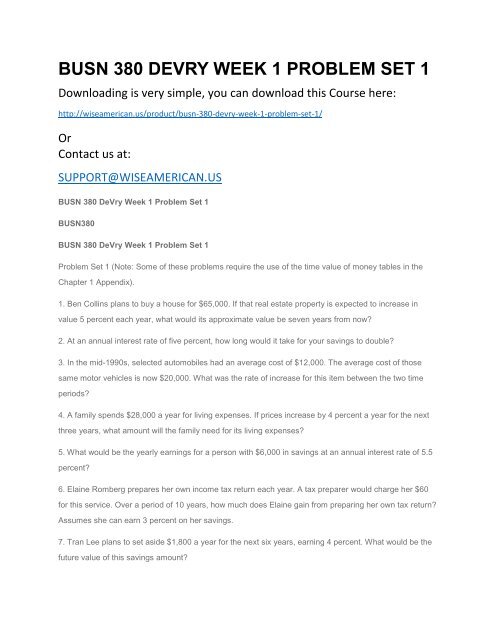

<strong>BUSN</strong> <strong>380</strong> <strong>DEVRY</strong> <strong>WEEK</strong> 1 <strong>PROBLEM</strong> <strong>SET</strong> 1<br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/busn-<strong>380</strong>-devry-week-1-problem-set-1/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 1 Problem Set 1<br />

<strong>BUSN</strong><strong>380</strong><br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 1 Problem Set 1<br />

Problem Set 1 (Note: Some of these problems require the use of the time value of money tables in the<br />

Chapter 1 Appendix).<br />

1. Ben Collins plans to buy a house for $65,000. If that real estate property is expected to increase in<br />

value 5 percent each year, what would its approximate value be seven years from now?<br />

2. At an annual interest rate of five percent, how long would it take for your savings to double?<br />

3. In the mid-1990s, selected automobiles had an average cost of $12,000. The average cost of those<br />

same motor vehicles is now $20,000. What was the rate of increase for this item between the two time<br />

periods?<br />

4. A family spends $28,000 a year for living expenses. If prices increase by 4 percent a year for the next<br />

three years, what amount will the family need for its living expenses?<br />

5. What would be the yearly earnings for a person with $6,000 in savings at an annual interest rate of 5.5<br />

percent?<br />

6. Elaine Romberg prepares her own income tax return each year. A tax preparer would charge her $60<br />

for this service. Over a period of 10 years, how much does Elaine gain from preparing her own tax return?<br />

Assumes she can earn 3 percent on her savings.<br />

7. Tran Lee plans to set aside $1,800 a year for the next six years, earning 4 percent. What would be the<br />

future value of this savings amount?

8. If you borrow $8,000 with a 5 percent interest rate to be repaid in five equal payments at the end of the<br />

next five years, what would be the amount of each payment? (Note: Use the present value of an annuity<br />

table in the Chapter 1 Appendix.)<br />

9. Based on the following data, compute the total assets, total liabilities, and net worth. Liquid assets,<br />

$3,670 Household assets, $89,890 Investment assets, $8,340 Long-term liabilities, $76,230 Current<br />

liabilities, $2,670<br />

10.Which of the following employee benefits has the greater value? Use the formula given in the<br />

“Financial Planning Calculations” – “Tax-Equivalent Employee Benefits” box found in Chapter 2 to<br />

compare these benefits. (Assume a 28 percent tax rate.)<br />

A nontaxable pension contribution of $4,300 or the use of a company car with a taxable value of $6,325.