Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

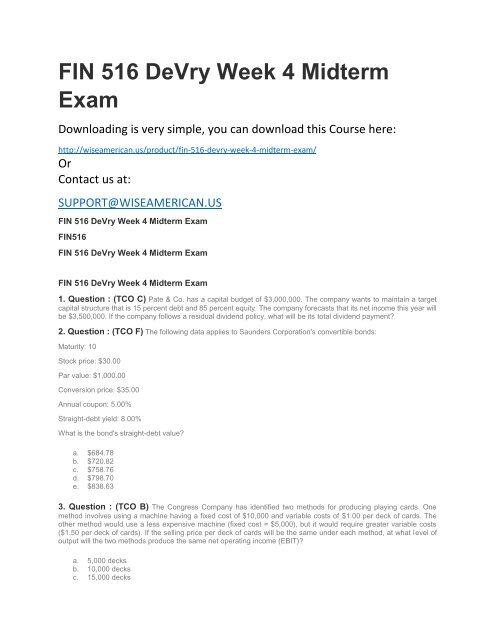

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong><br />

<strong>Exam</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/fin-<strong>516</strong>-devry-week-4-midterm-exam/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

<strong>FIN</strong><strong>516</strong><br />

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

<strong>FIN</strong> <strong>516</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

1. Question : (TCO C) Pate & Co. has a capital budget of $3,000,000. The company wants to maintain a target<br />

capital structure that is 15 percent debt and 85 percent equity. The company forecasts that its net income this year will<br />

be $3,500,000. If the company follows a residual dividend policy, what will be its total dividend payment?<br />

2. Question : (TCO F) The following data applies to Saunders Corporation's convertible bonds:<br />

Maturity: 10<br />

Stock price: $30.00<br />

Par value: $1,000.00<br />

Conversion price: $35.00<br />

Annual coupon: 5.00%<br />

Straight-debt yield: 8.00%<br />

What is the bond's straight-debt value?<br />

a. $684.78<br />

b. $720.82<br />

c. $758.76<br />

d. $798.70<br />

e. $838.63<br />

3. Question : (TCO B) The Congress Company has identified two methods for producing playing cards. One<br />

method involves using a machine having a fixed cost of $10,000 and variable costs of $1.00 per deck of cards. The<br />

other method would use a less expensive machine (fixed cost = $5,000), but it would require greater variable costs<br />

($1.50 per deck of cards). If the selling price per deck of cards will be the same under each method, at what level of<br />

output will the two methods produce the same net operating income (EBIT)?<br />

a. 5,000 decks<br />

b. 10,000 decks<br />

c. 15,000 decks

d. 20,000 decks<br />

e. 25,000 decks<br />

4. Question : (TCO B) Firm L has debt with a market value of $200,000 and a yield of nine percent. The firm's<br />

equity has a market value of $300,000, its earnings are growing at a rate of five percent, and its tax rate is 40 percent.<br />

A similar firm with no debt has a cost of equity of 12 percent. Under the MM extension with growth, what is Firm L's<br />

cost of equity?<br />

a. 11.4%<br />

b. 12.0%<br />

c. 12.6%<br />

d. 13.3%<br />

e. 14.0%<br />

5. Question : (TCO A) Which of the following statements is CORRECT?<br />

a. If the underlying stock does not pay a dividend, it makes good economic sense to exercise a call option as<br />

soon as the stock’s price exceeds the strike price by about 10%, because this permits the option holder to<br />

lock in an immediate profit.<br />

b. Call options generally sell at a price less than their exercise value.<br />

c. If a stock becomes riskier (more volatile), call options on the stock are likely to decline in value.<br />

d. Call options generally sell at prices above their exercise value, but for an inthe-money option, the greater the<br />

exercise value in relation to the strike price, the lower the premium on the option is likely to be.<br />

e. Because of the put-call parity relationship, under equilibrium conditions a put option on a stock must sell at<br />

exactly the same price as a call option on the stock.<br />

6. Question : (TCO F) Suppose the December CBOT Treasury bond futures contract has a quoted price of 80-07.<br />

What is the implied annual interest rate inherent in the futures contract? Assume this contract is based on a 20 year<br />

Treasury bond with semi-annual interest payments. The face value of the bond is $1000, and the semi-annual coupon<br />

payments are $30. The annual coupon rate on the bonds is $60 per bond (or 6%). The futures contract has 100 bonds.<br />

a. 6.86%<br />

b. 7.22%<br />

c. 7.60%<br />

d. 8.00%<br />

e. 8.40%