ACCT 444 Week 2 Homework

ACCT 444 Week 2 Homework

ACCT 444 Week 2 Homework

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

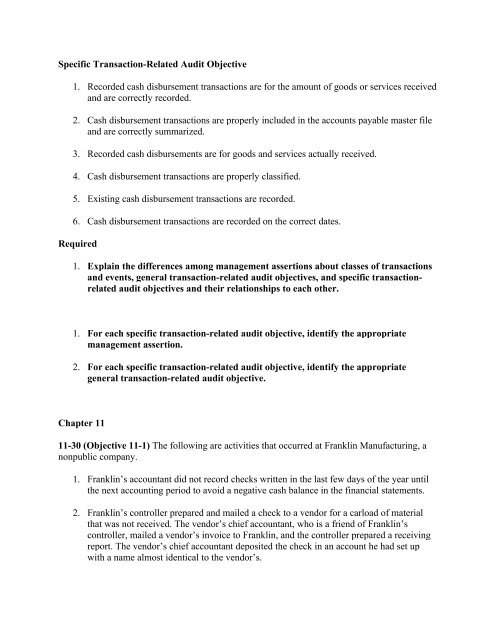

Specific Transaction-Related Audit Objective<br />

1. Recorded cash disbursement transactions are for the amount of goods or services received<br />

and are correctly recorded.<br />

2. Cash disbursement transactions are properly included in the accounts payable master file<br />

and are correctly summarized.<br />

3. Recorded cash disbursements are for goods and services actually received.<br />

4. Cash disbursement transactions are properly classified.<br />

5. Existing cash disbursement transactions are recorded.<br />

6. Cash disbursement transactions are recorded on the correct dates.<br />

Required<br />

1. Explain the differences among management assertions about classes of transactions<br />

and events, general transaction-related audit objectives, and specific transactionrelated<br />

audit objectives and their relationships to each other.<br />

1. For each specific transaction-related audit objective, identify the appropriate<br />

management assertion.<br />

2. For each specific transaction-related audit objective, identify the appropriate<br />

general transaction-related audit objective.<br />

Chapter 11<br />

11-30 (Objective 11-1) The following are activities that occurred at Franklin Manufacturing, a<br />

nonpublic company.<br />

1. Franklin’s accountant did not record checks written in the last few days of the year until<br />

the next accounting period to avoid a negative cash balance in the financial statements.<br />

2. Franklin’s controller prepared and mailed a check to a vendor for a carload of material<br />

that was not received. The vendor’s chief accountant, who is a friend of Franklin’s<br />

controller, mailed a vendor’s invoice to Franklin, and the controller prepared a receiving<br />

report. The vendor’s chief accountant deposited the check in an account he had set up<br />

with a name almost identical to the vendor’s.