ACCT 550 Week 1 Homework Assignment

ACCT 550 Week 1 Homework Assignment

ACCT 550 Week 1 Homework Assignment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>550</strong> <strong>Week</strong> 1 <strong>Homework</strong> <strong>Assignment</strong><br />

To Download tutorial Copy and Paste below Link into your Browser<br />

https://www.essayblue.com/downloads/acct-<strong>550</strong>-week-1-homework-assignment/?ref=182<br />

for any inquiry email us at ( essayblue@gmail.com )<br />

<strong>ACCT</strong> <strong>550</strong> <strong>Week</strong> 1 <strong>Homework</strong> <strong>Assignment</strong><br />

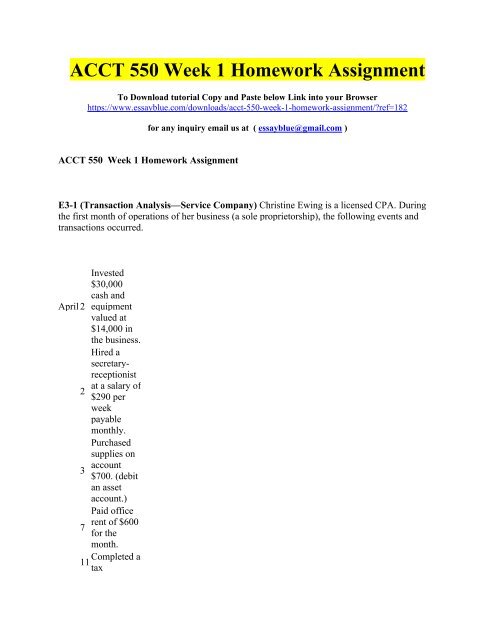

E3-1 (Transaction Analysis—Service Company) Christine Ewing is a licensed CPA. During<br />

the first month of operations of her business (a sole proprietorship), the following events and<br />

transactions occurred.<br />

April 2<br />

2<br />

3<br />

7<br />

Invested<br />

$30,000<br />

cash and<br />

equipment<br />

valued at<br />

$14,000 in<br />

the business.<br />

Hired a<br />

secretaryreceptionist<br />

at a salary of<br />

$290 per<br />

week<br />

payable<br />

monthly.<br />

Purchased<br />

supplies on<br />

account<br />

$700. (debit<br />

an asset<br />

account.)<br />

Paid office<br />

rent of $600<br />

for the<br />

month.<br />

11 Completed a<br />

tax

12 a<br />

assignment<br />

and billed<br />

client<br />

$1,100 for<br />

services<br />

rendered.<br />

(Use Service<br />

Revenue<br />

account.)<br />

Received<br />

$3,200<br />

advance on<br />

management<br />

consulting<br />

engagement.<br />

Received<br />

cash of<br />

$2,300 for<br />

17 services<br />

completed<br />

for Ferengi<br />

Co.<br />

Paid<br />

insurance<br />

21<br />

expense<br />

$110.<br />

Paid<br />

secretaryreceptionist<br />

30<br />

$1,160 for<br />

the month.<br />

A count of<br />

supplies<br />

indicated<br />

30<br />

that $120 of<br />

supplies had<br />

been used.<br />

Purchased a<br />

new<br />

computer<br />

for $5,100<br />

30<br />

with<br />

personal<br />

funds. (The<br />

computer

will be used<br />

exclusively<br />

for business<br />

purposes.)<br />

E3-5 (Adjusting Entries) The ledger of Chopin Rental Agency on March 31 of the current year<br />

includes the following selected accounts before adjusting entries have been prepared.<br />

Debit Credit<br />

$<br />

3,600<br />

Prepaid<br />

Insurance<br />

Supplies 2,800<br />

Equipment 25,000<br />

Accumulated<br />

Depreciation—<br />

Equipment<br />

$<br />

8,400<br />

Notes Payable 20,000<br />

Unearned Rent<br />

6,300<br />

Revenue<br />

Rent Revenue 60,000<br />

Interest<br />

Expense<br />

Salaries and<br />

Wages<br />

Expense<br />

14,000<br />

An analysis of the accounts shows the following.<br />

<br />

<br />

<br />

The equipment depreciates $250 per month.<br />

One-third of the unearned rent was earned during the quarter.<br />

Interest of $500 is accrued on the notes payable.<br />

Supplies on hand total $650.<br />

<br />

Insurance expires at the rate of $300 per month.<br />

most directly related to measuring the performance and financial status of an enterprise are<br />

provided below.<br />

Assets<br />

Distributions to<br />

Expenses<br />

owners

Comprehensive<br />

Liabilities<br />

Gains<br />

income<br />

Equity Revenues Losses<br />

Investments<br />

by owners<br />

Identify the element or elements associated with the 12 items below.<br />

CA1-3 (Financial Reporting and Accounting Standards) Answer the following multiplechoice<br />

questions.