Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

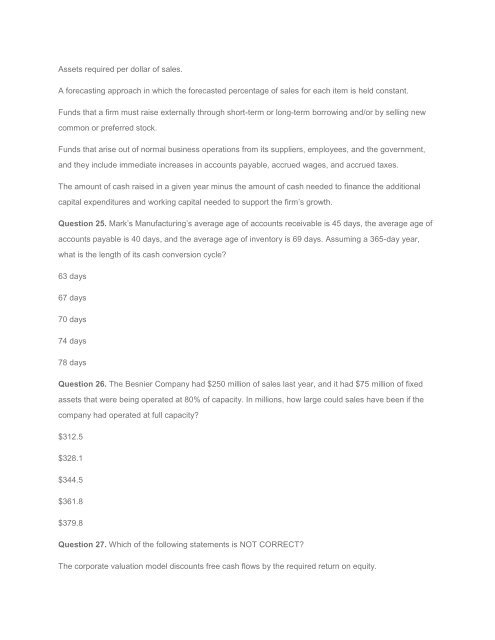

Assets required per dollar of sales.<br />

A forecasting approach in which the forecasted percentage of sales for each item is held constant.<br />

Funds that a firm must raise externally through short-term or long-term borrowing and/or by selling new<br />

common or preferred stock.<br />

Funds that arise out of normal business operations from its suppliers, employees, and the government,<br />

and they include immediate increases in accounts payable, accrued wages, and accrued taxes.<br />

The amount of cash raised in a given year minus the amount of cash needed to finance the additional<br />

capital expenditures and working capital needed to support the firm’s growth.<br />

Question 25. Mark’s Manufacturing’s average age of accounts receivable is 45 days, the average age of<br />

accounts payable is 40 days, and the average age of inventory is 69 days. Assuming a 365-day year,<br />

what is the length of its cash conversion cycle?<br />

63 days<br />

67 days<br />

70 days<br />

74 days<br />

78 days<br />

Question 26. The Besnier Company had $250 million of sales last year, and it had $75 million of fixed<br />

assets that were being operated at 80% of capacity. In millions, how large could sales have been if the<br />

company had operated at full capacity?<br />

$312.5<br />

$328.1<br />

$344.5<br />

$361.8<br />

$379.8<br />

Question 27. Which of the following statements is NOT CORRECT?<br />

The corporate valuation model discounts free cash flows by the required return on equity.