You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In my youth, I listened to a haunting tune that suggested<br />

a collision with reality. “Those Were the Days,” by Mary Hopkin<br />

released on the Beatles Apple label. “Those were the days,<br />

my friend. We thought they’d never end. We’d sing and dance<br />

forever and a day. We’d live the life we choose. We’d fight<br />

and never lose! Those were the days….” Then Mary struck a<br />

sobering obstruction and things changed. As 2014 progressed,<br />

land market participants had to feel like Mary. The year began<br />

with expansion in prices and indeed finished with a substantial<br />

percentage increase, rising 9 percent to an all time high of<br />

$2,354 per acre by the end of the trading year a 33 percent<br />

expansion from 2009.<br />

Expansion continued on all fronts early in the year. Then<br />

something happened. Collapsing oil prices injected a sobering<br />

unwelcome obstruction to the continuing party. The fourth<br />

quarter presided over rising uncertainty with farmland investors<br />

anticipating years of weakened commodity prices and oil-based<br />

recreational buyers deciding to put purchase plans on hold.<br />

MARKET REPORT<br />

UNCERTAINTY, THY NAME IS OIL!<br />

That jolt did little to derail<br />

another banner year for land BY CHARLES E. GILLI<strong>LAND</strong><br />

prices, but thoughts now have<br />

turned to the existential question:<br />

will oil prices recover or continue<br />

to erode. How far will they fall?<br />

How fast will they recover? Who<br />

is to blame? And what does this mean for the <strong>Texas</strong> economy<br />

and <strong>Texas</strong> land prices.<br />

Studies suggest that overall land prices eventually follow<br />

trends in oil prices in <strong>Texas</strong>, but not for a year or two. So where<br />

does that leave land market participants? Some anticipate<br />

a quick resolution to weakened oil prices, not so much for<br />

agricultural commodities. Some foresee a prolonged decline<br />

in the face of expanding worldwide supplies of oil. No serious<br />

observer seems to have a defensible solution. So, as the year<br />

begins, we have seen a banner year in 2014, but no one can<br />

foresee where we will be in the next six months.<br />

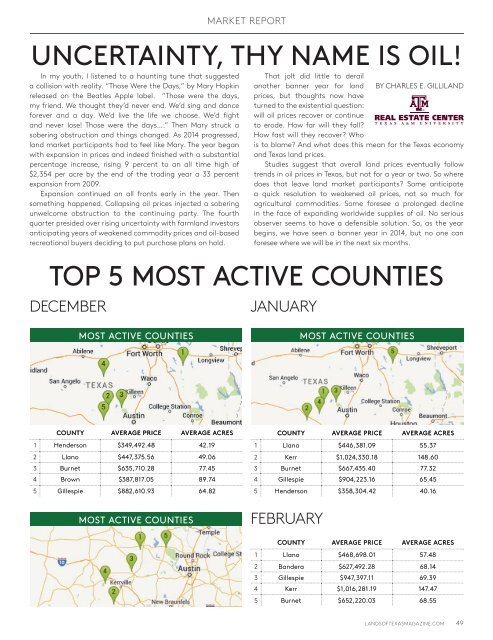

TOP 5 MOST ACTIVE COUNTIES<br />

COUNTY AVERAGE PRICE AVERAGE ACRES<br />

1 Henderson $349,492.48 42.19<br />

2 Llano $447,375.56 49.06<br />

3 Burnet $635,710.28 77.45<br />

4 Brown $387,817.05 89.74<br />

5 Gillespie $882,610.93 64.82<br />

COUNTY AVERAGE PRICE AVERAGE ACRES<br />

1 Llano $446,381.09 55.37<br />

2 Kerr $1,024,330.18 148.60<br />

3 Burnet $667,435.40 77.32<br />

4 Gillespie $904,223.16 65.45<br />

5 Henderson $358,304.42 40.16<br />

COUNTY AVERAGE PRICE AVERAGE ACRES<br />

1 Llano $468,698.01 57.48<br />

2 Bandera $627,492.28 68.14<br />

3 Gillespie $947,397.11 69.39<br />

4 Kerr $1,016,281.19 147.47<br />

5 Burnet $652,220.03 68.55<br />

<strong>LAND</strong>SOFTEXASMAGAZINE.COM<br />

49