Leveraging Data-Driven Marketing for the Insurance Industry

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Introduction | Current Challenges | Solution | Boost Your <strong>Insurance</strong> Business | Summing it Up<br />

<strong>Insurance</strong> <strong>Industry</strong>: The Current Challenges<br />

According to experts, <strong>Insurance</strong> industry - one of <strong>the</strong> oldest industries that has always dealt with<br />

massive amounts of data in every aspect of <strong>the</strong>ir business - un<strong>for</strong>tunately, has not caught up with<br />

<strong>the</strong> concept of "identifying <strong>the</strong> right customers at <strong>the</strong> right time" as <strong>the</strong> rest of <strong>the</strong> world. As a<br />

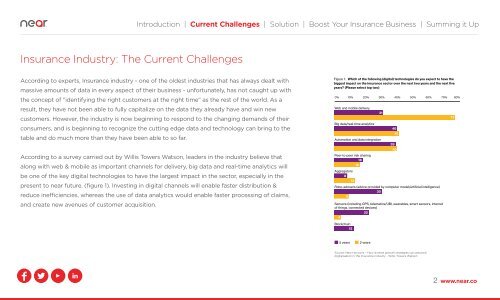

Figure 1: Which of <strong>the</strong> following (digital) technologies do you expect to have <strong>the</strong><br />

biggest impact on <strong>the</strong> insurance sector over <strong>the</strong> next two years and <strong>the</strong> next five<br />

years? (Please select top two)<br />

0% 10% 20% 30% 40% 50% 60% 70% 80%<br />

result, <strong>the</strong>y have not been able to fully capitalize on <strong>the</strong> data <strong>the</strong>y already have and win new<br />

customers. However, <strong>the</strong> industry is now beginning to respond to <strong>the</strong> changing demands of <strong>the</strong>ir<br />

consumers, and is beginning to recognize <strong>the</strong> cutting edge data and technology can bring to <strong>the</strong><br />

table and do much more than <strong>the</strong>y have been able to so far.<br />

According to a survey carried out by Willis Towers Watson, leaders in <strong>the</strong> industry believe that<br />

along with web & mobile as important channels <strong>for</strong> delivery, big data and real-time analytics will<br />

be one of <strong>the</strong> key digital technologies to have <strong>the</strong> largest impact in <strong>the</strong> sector, especially in <strong>the</strong><br />

present to near future. (figure 1). Investing in digital channels will enable faster distribution &<br />

reduce inefficiencies, whereas <strong>the</strong> use of data analytics would enable faster processing of claims,<br />

and create new avenues of customer acquisition.<br />

Web and mobile delivery<br />

Big data/real-time analytics<br />

Automation and data integration<br />

Peer-to-peer risk sharing<br />

18<br />

16<br />

Aggregators<br />

8<br />

13<br />

Robo-advisers (advice provided by computer model/artificial intelligence)<br />

30<br />

9<br />

Sensors (including GPS, telematics/UBI, wearables, smart sensors, internet<br />

of things, connected devices)<br />

22<br />

4<br />

Blockchain<br />

12<br />

31<br />

40<br />

41<br />

39<br />

40<br />

77<br />

5 years 2 years<br />

Source: New Horizons – How diverse growth strategies can advance<br />

digitalisation in <strong>the</strong> insurance industry - Willis Towers Watson<br />

2 www.near.co