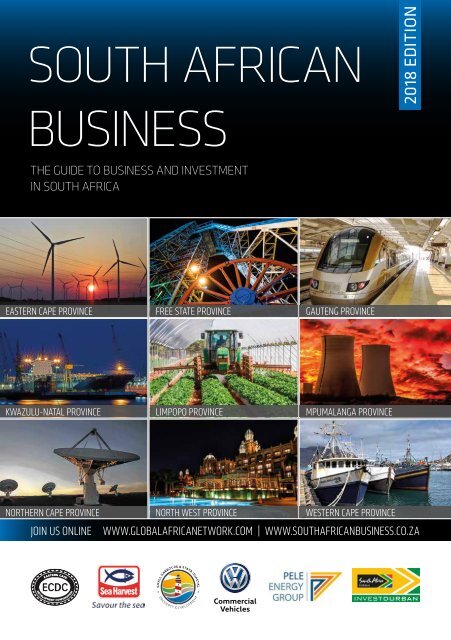

South African Business 2018 edition

Welcome to the sixth edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by an e-book edition at www.southafricanbusiness.co.za. Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provincial economies. Feature articles on topical issues such as sustainability and African trade provide unique insights, together with an interview with the newly elected chairman of the African Association of Automotive Manufacturers, Mr Thomas Schaefer. Another special feature focusses on an exciting project to transform South Africa’s small harbours and coastal properties. South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. The e-book editions can be viewed online at www.globalafricanetwork.com. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by an e-book edition at www.southafricanbusiness.co.za Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provincial economies. Feature articles on topical issues such as sustainability and African trade provide unique insights, together with an interview with the newly elected chairman of the African Association of Automotive Manufacturers, Mr Thomas Schaefer. Another special feature focusses on an exciting project to transform South Africa’s small harbours and coastal properties. South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. Visit www.globalafricanetwork.com for more business and investment news, opportunities and events.

Welcome to the sixth edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by an e-book edition at www.southafricanbusiness.co.za.

Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provincial economies. Feature articles on topical issues such as sustainability and African trade provide unique insights, together with an interview with the newly elected chairman of the African Association of Automotive Manufacturers, Mr Thomas Schaefer. Another special feature focusses on an exciting project to transform South Africa’s small harbours and coastal properties.

South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. The e-book editions can be viewed online at www.globalafricanetwork.com.

First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by an e-book edition at www.southafricanbusiness.co.za

Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provincial economies. Feature articles on topical issues such as sustainability and African trade provide unique insights, together with an interview with the newly elected chairman of the African Association of Automotive Manufacturers, Mr Thomas Schaefer. Another special feature focusses on an exciting project to transform South Africa’s small harbours and coastal properties.

South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. Visit www.globalafricanetwork.com for more business and investment news, opportunities and events.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SOUTH AFRICAN<br />

<strong>2018</strong> EDITION<br />

BUSINESS<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN SOUTH AFRICA<br />

EASTERN CAPE PROVINCE<br />

FREE STATE PROVINCE<br />

GAUTENG PROVINCE<br />

KWAZULU-NATAL PROVINCE<br />

LIMPOPO PROVINCE<br />

MPUMALANGA PROVINCE<br />

NORTHERN CAPE PROVINCE<br />

NORTH WEST PROVINCE<br />

WESTERN CAPE PROVINCE<br />

JOIN US ONLINE WWW.GLOBALAFRICANETWORK.COM | WWW.SOUTHAFRICANBUSINESS.CO.ZA<br />

Commercial<br />

Vehicles

Why Invest<br />

in Space<br />

OUR IMPACT is derived from our national capacity, experience<br />

and expertise in space science and technology through six thematic focus areas:<br />

• Earth Observation - SANSA collects, assimilates and disseminates<br />

Earth observation data to support <strong>South</strong> Africa’s policy making,<br />

economic growth and sustainable development initiatives. Earth<br />

observation data is used for human settlement growth mapping,<br />

infrastructure monitoring, as well as disaster and water resource<br />

management. Earth observation satellite data contributes to<br />

monitoring environmental variables in the water cycle such as<br />

water quantity, quality, soil erosion and vegetative health which<br />

ensures water safety and security for the country.<br />

• Space Operations - SANSA provides global competitive space<br />

operations and applications, tracking, telemetry and command<br />

services while managing ground stations for international clients.<br />

Space Operations provides world class launch support for space<br />

missions (from Earth into our solar system) and ensures satellites<br />

are continuously monitored when they are travelling over <strong>African</strong><br />

skies.<br />

• Space Science - SANSA conducts cutting edge space science<br />

research, development and magnetic technology innovation.<br />

Space science research is vital for gaining a deeper understanding<br />

of our space environment in order to protect essential<br />

infrastructure such as power grids and communication and<br />

navigation systems on Earth and in space. SANSA operates the<br />

Space Weather Regional Warning Centre for Africa, providing<br />

forecasts and warnings on space weather conditions. Extreme<br />

space weather may impact technological systems such as<br />

satellites, power grids, avionics and radio communication.<br />

• Space Engineering – SANSA aims to provide access to state-ofthe-art<br />

satellite assembly, integration and testing services, as well<br />

as satellite systems coordination and development, to ensure<br />

an environment conducive to industrial participation in satellite<br />

programmes.<br />

• Human Capital Development - SANSA aims to advance human<br />

capital development to grow the knowledge economy and<br />

create awareness about opportunities in engineering, science and<br />

technology. This is achieved through scarce skills development,<br />

summer and winter schools, the supervision of MSc and PhD<br />

students, and teaching at partner universities.<br />

• Science Advancement and Public Engagement - SANSA<br />

promotes science advancement and public engagement through<br />

participation in national science awareness events and through<br />

using the fascination of space to drive a greater uptake of studies<br />

in science, maths, engineering and technology.

SANSA<br />

provides stateof-the-art<br />

ground<br />

station facilities and<br />

services including<br />

satellite tracking, launch<br />

support, mission<br />

control and space<br />

navigation.<br />

SANSA monitors<br />

the Earth’s magnetic<br />

field and space weather<br />

storms to assist in<br />

protecting technology<br />

on Earth and in space.<br />

Satellite imagery<br />

helps manage food<br />

and water security as<br />

well as natural disasters<br />

on Earth like floods,<br />

droughts and fires.<br />

In a country faced with numerous challenges in<br />

housing, crime, poverty and the provision of basic<br />

necessities, you may ask why invest in space?<br />

The answer is clear.<br />

Space investment is essential<br />

for economic sustainability<br />

and development!<br />

Without space applications we would not be able to mitigate<br />

disasters or effectively manage our resources such as water, food, land<br />

and housing. Mobile phones, internet, GPS, ATMs, meteorological<br />

forecasting and safe land and sea travel all rely on satellites positioned<br />

in space. Government, industry and academia also rely on space<br />

data to deliver on their priorities through the creation of applied<br />

knowledge, products and services.<br />

SANSA provides value-added products and services that are utilised<br />

in both space and non-space applications. Space information<br />

enables everyday decision making at all levels of society. SANSA has<br />

contributed towards goals within the National Development Plan<br />

(NDP) and the goals of the Department of Science and Technology<br />

(DST) by delivering products and services to its stakeholders and the<br />

public.<br />

<strong>South</strong> Africa’s next earth observation satellite is an example of one of<br />

these deliverables and is also one of the incredible opportunities to<br />

showcase the importance of investment in space science, engineering<br />

and technology and for <strong>South</strong> Africa to take its place in the global<br />

space arena.<br />

@SANSA7<br />

<strong>South</strong> <strong>African</strong> National Space Agency<br />

<strong>South</strong> <strong>African</strong> National Space Agency<br />

Enterprise Building, Mark Shuttleworth Street, Innovtion Hub, Pretoria, 0087<br />

T: 012 844 0500 | F: 012 844 0396 | information@sansa.org.za | www.sansa.org.za

Welcome<br />

to Durban!<br />

A lifestyle of business and pleasure together.<br />

Facilitating sustainable investment in Durban<br />

for the benefit of all<br />

Invest Durban (previously DIPA) is an<br />

entity of the eThekwini Municipality,<br />

recommended by the Durban City Council<br />

and organised private business as the<br />

most appropriate vehicle to promote and<br />

facilitate new investment into the Durban<br />

metropolitan area.<br />

Invest Durban’s primary objective is to<br />

accelerate sustainable investment in<br />

Durban for the benefit of all through the:<br />

• Proactive investment promotion<br />

and marketing of Durban Metro as a<br />

premium investment destination<br />

• Proactive communication and<br />

marketing of the City’s large investment<br />

projects and core strategies<br />

• Identification and development of new<br />

investment opportunities, especially<br />

for previously disadvantaged groups<br />

• Attraction, support and facilitation<br />

for prospective foreign investors<br />

in Durban<br />

• Improvement in the investment and<br />

economic development environment,<br />

in partnership with National, Provincial,<br />

City and <strong>Business</strong> Authorities.<br />

Invest Durban offers FREE:<br />

• Investment Information and<br />

Facilitation Services<br />

• Immigration, Import and Legal Services<br />

• <strong>Business</strong> Establishment and Incentives<br />

• Investor Administration Services

Doing business in Durban<br />

Durban has been developed around a<br />

natural ocean port, major industrial base<br />

and scenic tourism assets which play key<br />

roles in the city, plus across Africa.<br />

Strategic location<br />

The port of Durban is modern and wellequipped.<br />

It offers investors a range of<br />

competitive and strategic advantages. The<br />

city has emerged as the de facto coastal<br />

trade ‘gateway’ to <strong>South</strong>ern Africa. It boasts<br />

the largest port in Africa, as regards value of<br />

cargo, and is <strong>South</strong> Africa’s premier general<br />

cargo and container port. It is positioned<br />

to access international shipping links to the<br />

Americas, Europe, the Persian Gulf, <strong>South</strong><br />

East Asia, the Pacific Rim and Australia/New<br />

Zealand and perfectly located for the transshipment<br />

of cargoes between Eastern,<br />

Middle-Eastern and Western economies.<br />

Infrastructure and business<br />

Durban offers established and advanced<br />

road, rail, sea, air and ICT network<br />

infrastructure. This underpins the second<br />

largest industrial base in SA.<br />

Quality logistics systems include:<br />

• Port operation facilities<br />

• Rail network – cargo and passenger<br />

• International airport with air cargo<br />

facilities<br />

• Extensive road network with national and<br />

regional linkages<br />

• Oil/petroleum pipeline to Gauteng and<br />

Free State Provinces<br />

• Gas pipeline emanating from Sasol, in<br />

Mpumalanga province<br />

• Metro-wide fibre-optic systems.<br />

Durban provides a number of new<br />

opportunity areas for investors, both large<br />

and small.<br />

Investment opportunities may be<br />

categorised into the following fields:<br />

• Agri-processing<br />

• Auto and allied manufacturing<br />

• ICT, BPO and shared service centres<br />

• Medical devices, health services and<br />

pharmaceutical manufacturing<br />

• Logistics and maritime<br />

All of the above driven by world-class<br />

innovation and holistic sustainability<br />

Invest Durban, eThekwini Municipality<br />

11th Floor, 41 Margaret Mncadi Avenue (old Vic. Embankment),<br />

Durban, 4001 <strong>South</strong> Africa<br />

Tel: +27 31 311 4227 | Email: invest@durban.gov.za<br />

Website: www.durban.gov.za

CONTENTS<br />

CONTENTS<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> <strong>2018</strong> Edition.<br />

Introduction<br />

Foreword10<br />

A unique guide to business and investment in <strong>South</strong> Africa.<br />

Special features<br />

An economic overview of <strong>South</strong> Africa 12<br />

<strong>South</strong> Africa is a country of great diversity – of its population,<br />

its landscapes and its natural resources.<br />

<strong>Business</strong> expands into Africa 22<br />

Manufacturing and services are targeted for export growth.<br />

Invest in the Mountain Kingdom 28<br />

The Lesotho National Development Corporation has<br />

attractive projects in several sectors.<br />

Sustainability is a new priority for business 30<br />

The circular economy, renewable energy and energy efficiency<br />

are creating new industries.<br />

Skills development 34<br />

Job-relevant training is key to economic growth.<br />

Realising the promise of the Oceans Economy 46<br />

<strong>South</strong> Africa’s coastline is to become a catalyst for new<br />

business opportunities, economic growth and job creation.<br />

Economic sectors<br />

Agriculture 60<br />

Agriculture companies are active on the stock exchange.<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

4

O&M CAPE TOWN 2382/E<br />

IT‘S NOT JUST THE AMAROK<br />

DRIVING UP A HILL.<br />

www.amarok.co.za<br />

IT’S THE ABILITY TO<br />

HAUL A 1-TON LOAD<br />

UP A 45 O INCLINE.<br />

On the outside, you’ll see the Amarok making tough look effortless. But what you don’t see is the<br />

German-engineered TDI engine that combines 132kW of power and 420Nm of torque with<br />

outstanding fuel efficiency. You don’t see the permanent 4MOTION® system or unique off-road<br />

ABS, ASR and ESP that ensure a steady ride over even the harshest terrain. You see the one ton<br />

payload being effortlessly hauled up a 45° slope, but you don’t see the under-the-skin technology<br />

that makes tough possible.<br />

The Amarok. Not just tough, smart.<br />

Commercial<br />

Vehicles<br />

Range includes: 103kW TDI Comfortline 4x2 and 4MOTION® manual; 132kW BiTDI® Highline 4x2 and 4MOTION®, manual and automatic; 132kW BiTDI® Highline Plus 4x2 and 4MOTION®<br />

automatic; 132kW BiTDI® Extreme 4MOTION® automatic; 165kW V6 TDI 4MOTION® automatic available in Highline, Highline Plus and Extreme.

CONTENTS<br />

Mining 65<br />

The <strong>South</strong> <strong>African</strong> mining landscape is changing.<br />

Oil, gas and petrochemicals 69<br />

The sector is alive with activity.<br />

Energy 76<br />

<strong>South</strong> Africa’s energy mix is becoming more diverse.<br />

Water 84<br />

Water infrastructure is a priority.<br />

Engineering 88<br />

The renewable energy sector holds great promise for<br />

engineering firms.<br />

Manufacturing 94<br />

Large incentives are available to investors in manufacturing.<br />

Automotive 100<br />

Multi-billion-rand investments are boosting vehicle production.<br />

Chemicals and pharmaceuticals 103<br />

Drug research is in the spotlight.<br />

Food and beverages 104<br />

Consumer companies are looking to Africa for growth.<br />

Transport 106<br />

Investments in rail are increasing.<br />

<strong>Business</strong> services 110<br />

Consulting is a growth industry.<br />

Tourism 116<br />

Ten-million tourists visited <strong>South</strong> Africa in 2016.<br />

Information and communications technology 126<br />

A rural network is providing free local calls.<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

6

A city so good<br />

you’ll want to invest in it.<br />

live | play | invest<br />

Aerotropolis City<br />

The City of Ekurhuleni is home to OR Tambo International Airport, Africa’s biggest and<br />

busiest airport on the continent. The City is also considered the manufacturing hub<br />

of the country, which boasts a significant logistics corridor along the R21 highway and<br />

an extensive transport network across rail, road and air.<br />

Come invest in Ekurhuleni, the Aerotropolis City.

CONTENTS<br />

Banking and financial services 128<br />

New banks and new stock exchanges are adding to <strong>South</strong><br />

<strong>African</strong>s’ choices.<br />

Development finance and SMME support 130<br />

<strong>South</strong> Africa has over two-million SMMEs.<br />

Government<br />

<strong>South</strong> <strong>African</strong> National Government 134<br />

Regions<br />

Eastern Cape 140<br />

Free State 142<br />

Gauteng 144<br />

KwaZulu-Natal 148<br />

Limpopo 150<br />

Mpumalanga 152<br />

Northern Cape 154<br />

North West 156<br />

Western Cape 158<br />

Reference<br />

Sector contents 58<br />

Index160<br />

Maps<br />

NAMIBIA<br />

ZIMBABWE<br />

BOTSWANA<br />

Limpopo<br />

Mpumalanga<br />

Gauteng<br />

North West<br />

SWAZI-<br />

LAND<br />

Free State<br />

KwaZulu-<br />

Natal<br />

MOZAMBIQUE<br />

<strong>South</strong> <strong>African</strong> provincial map. 15<br />

Northern Cape<br />

LESOTHO<br />

Detailed map of <strong>South</strong> Africa. 137<br />

Eastern Cape<br />

Western Cape<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

8

EPC IN POWER GENERATION<br />

Leaders in execution of turnkey engineering<br />

in <strong>South</strong> Africa<br />

Home-grown Lesedi Nuclear Services is a leading EPC (Engineering,<br />

Procurement and Construction) company with extensive experience<br />

in the execution of turnkey engineering projects, in both nuclear<br />

and conventional environments. It has operational footprints<br />

throughout the <strong>South</strong> <strong>African</strong> power industry.<br />

Having completed numerous projects,<br />

primarily at Eskom’s Koeberg Nuclear<br />

Power Plant, construction of the<br />

14X150MW Open Cycle Gas Turbine<br />

Power Plant in the Western Cape,<br />

and executing EPC contracts for the<br />

balance of plant systems for Eskom’s<br />

Medupi and Kusile Coal Power Plants<br />

- still under construction - Lesedi is<br />

well-placed to play a leading role in<br />

offering competitive EPC proposals<br />

to the country’s power infrastructure<br />

industry.<br />

Lesedi is now a Level Three B-BBEE<br />

(Empowering supplier) company<br />

and has registered *8EP, 9ME,<br />

7SF certification levels with the<br />

Construction Industry Development<br />

Board. The company’s main<br />

shareholder is global nuclear<br />

company, AREVA, with the remaining<br />

shares split between Group Five,<br />

the J&J Group and local Lesedi<br />

management. Since 2001, Lesedi<br />

Nuclear Services has provided a wide<br />

range of services to Koeberg Nuclear<br />

Power Station. Our major involvement<br />

has been in the supply of technical<br />

personnel for plant upgrades (150<br />

modifications), engineering, project<br />

management, procurement and<br />

maintenance.<br />

Lesedi has a number of key<br />

partnerships, one being our<br />

partnership with Exosun. Exosun<br />

is a worldwide leading supplier of<br />

advanced, cost-effective solar tracking<br />

solutions for ground-mounted<br />

photovoltaic (PV) plants.<br />

Since the partnership of Exosun<br />

and Lesedi took place in March<br />

2017, Lesedi has been focusing on<br />

optimising its local supply chain<br />

with a target of cost reduction and<br />

an increase in local content in order<br />

to benefit its clients and prospects.<br />

In parallel to the progress made on<br />

local manufacturing, Lesedi is also<br />

focusing on optimising logistics with<br />

local transporters and installation with<br />

our certified installers. Due to some<br />

uncertainty in the REIPPP in <strong>South</strong><br />

Africa, Lesedi is getting more involved<br />

in private projects, and also assessing<br />

a number of opportunities in SADC.<br />

Lesedi’s Competencies Include:<br />

• Project Development<br />

• Project Management<br />

• Construction Management<br />

• Design Engineering<br />

• Engineering Procurement<br />

and Construction (EPC)<br />

• Specialised Shutdown<br />

Maintenance Activities<br />

(Globally)<br />

• Provision of Technical<br />

Personnel<br />

• Heating, Ventilation and<br />

Air–Conditioning<br />

• Power Plant Construction<br />

• Nuclear, Gas Turbine, Coal<br />

Power Stations, Solar Single<br />

Excess Trucking<br />

• Biomass, BioEnergy,<br />

Hydrogen, Hydro, Waste-to-<br />

Energy<br />

LESEDI NUCLEAR SERVICES (PTY) Ltd<br />

GET IN TOUCH<br />

12 Edison Way, Century City, 7441,<br />

Cape Town, <strong>South</strong> Africa<br />

Tel: +27 21 525 1300<br />

Fax: +27 21 525 1333<br />

Email: lesedi@lesedins.co.za<br />

www.lesedins.co.za / www.areva.com<br />

*8EP Certification expected by<br />

August 2017

FOREWORD<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong><br />

A unique guide to business and investment in <strong>South</strong> Africa.<br />

Welcome to the sixth <strong>edition</strong> of the <strong>South</strong> <strong>African</strong> <strong>Business</strong><br />

journal. First published in 2011, the publication has established<br />

itself as the premier business and investment<br />

guide to <strong>South</strong> Africa, supported by an e-book <strong>edition</strong><br />

at www.southafricanbusiness.co.za.<br />

Regular pages cover all the main economic sectors of the <strong>South</strong><br />

<strong>African</strong> economy and give a snapshot of each of the country’s<br />

provincial economies. Feature articles on topical issues such as<br />

sustainability and <strong>African</strong> trade provide unique insights, together<br />

with an interview with the newly elected chairman of the <strong>African</strong><br />

Association of Automotive Manufacturers, Mr Thomas Schaefer.<br />

Another special feature focusses on an exciting project to transform<br />

<strong>South</strong> Africa’s small harbours and coastal properties.<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is complemented by nine regional publications<br />

covering the business and investment environment in each of<br />

<strong>South</strong> Africa’s provinces. The e-book <strong>edition</strong>s can be viewed online at<br />

www.globalafricanetwork.com. These unique titles are supported by<br />

a monthly business e-newsletter with a circulation of over 35 000.<br />

Chris Whales<br />

Publisher, Global Africa Network Media<br />

Email: chris@gan.co.za<br />

CREDITS<br />

Publisher: Chris Whales<br />

Publishing director:<br />

Robert Arendse<br />

Editor: John Young<br />

Online editor: Christoff Scholtz<br />

Art director: Brent Meder<br />

Design: Colin Carter<br />

Production: Lizel Olivier<br />

Ad sales: Sydwell Adonis, Nigel<br />

Williams, Gavin van der Merwe,<br />

Sam Oliver, Gabriel Venter,<br />

Siyawamkela Sthunda,<br />

Vanessa Wallace, Jeremy Petersen<br />

and Reginald Motsoahae<br />

Managing director: Clive During<br />

Administration & accounts:<br />

Charlene Steynberg and<br />

Natalie Koopman<br />

Distribution & circulation<br />

manager: Edward MacDonald<br />

Printing: FA Print<br />

DISTRIBUTION<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is distributed internationally on outgoing<br />

and incoming trade missions; to foreign offices in <strong>South</strong><br />

Africa’s main trading partners; at top national and international<br />

events; through the offices of foreign representatives in <strong>South</strong><br />

Africa; as well as nationally and regionally via chambers of<br />

commerce, tourism offices, trade and investment agencies,<br />

provincial government departments, municipalities, airport<br />

lounges and companies.<br />

PUBLISHED BY<br />

Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal address: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6200 | Fax: +27 21 674 6943<br />

Email: info@gan.co.za | Website: www.gan.co.za<br />

Member of the Audit Bureau<br />

of Circulations ISSN 2221-4194<br />

COPYRIGHT | <strong>South</strong> <strong>African</strong> <strong>Business</strong> is an independent publication<br />

published by Global Africa Network Media (Pty) Ltd. Full copyright to<br />

the publication vests with Global Africa Network Media (Pty) Ltd. No part<br />

of the publication may be reproduced in any form without the written<br />

permission of Global Africa Network Media (Pty) Ltd.<br />

PHOTO CREDITS | Pictures supplied by flickr.com, Mainstream Power,<br />

Wikimedia Commons, Anglo American, SA Tourism, Bloomberg, Eugene<br />

Armer, RailPictures, Trans Caledon Tunnel Authority, Paul Saad, BM<br />

Jackson, Aveng, Philip Mostert and Shutterstock.<br />

DISCLAIMER | While the publisher, Global Africa Network Media (Pty)<br />

Ltd, has used all reasonable efforts to ensure that the information contained<br />

in <strong>South</strong> <strong>African</strong> <strong>Business</strong> is accurate and up-to-date, the publishers<br />

make no representations as to the accuracy, quality, time-liness,<br />

or completeness of the information. Global Africa Network Media will<br />

not accept responsibility for any loss or damage suffered as a result of<br />

the use of or any reliance placed on such information.<br />

Join us!<br />

Advertise your organisation in this journal to reach<br />

business and government. Contact sales@gan.co.za

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

12

SPECIAL FEATURE<br />

AN ECONOMIC OVERVIEW OF<br />

SOUTH AFRICA<br />

<strong>South</strong> Africa is a country of great diversity – of its population, its landscapes and its natural resources.<br />

Great mineral wealth has underpinned the <strong>South</strong> <strong>African</strong> economy ever since the first diamond was<br />

stumbled upon in 1867. Gold was found soon afterwards and that industry effectively saw to it that<br />

<strong>South</strong> Africa became an industrialised nation. Now those gold mines are tapering off production but<br />

iron ore and platinum reserves are impressively large.<br />

Global demand for these resources, however, has<br />

been very variable, dependent to a large extent on<br />

the Chinese market. This is part of the reason why<br />

<strong>South</strong> Africa’s economic growth in 2015 and 2016<br />

was very modest.<br />

The other reason is policy and political uncertainty.<br />

The national government is run by the <strong>African</strong><br />

National Congress and its president, who is also<br />

president of the country, Jacob Zuma. He has repeatedly<br />

changed cabinet ministers and his decision to<br />

fire the respected Finance Minister Pravin Gordhan<br />

led to several ratings agencies downgrading <strong>South</strong><br />

Africa’s credit rating. The other historically strong<br />

economic sector, agriculture, brought good cheer to<br />

the overall economic picture in the second quarter<br />

of 2017, boosting GDP growth by 2.5%. This was<br />

because of a tremendous rally off a bad period<br />

caused by a long-term drought. So good was the<br />

recovery that <strong>South</strong> Africa reported record grain<br />

crops and exports.<br />

The grains of the central regions of the country,<br />

together with the fruits and vegetables of<br />

Mpumalanga and Limpopo, the wines and grapes<br />

of the Western Cape, and the sheep and mohair<br />

of the Eastern Cape, all contribute to a diverse and<br />

vibrant agricultural sector. There are many strong<br />

agricultural companies in the sector. KwaZulu-Natal<br />

is the country’s leading sugar area, and has a strong<br />

suite in forestry and paper production.<br />

The other economic sector that has held up<br />

well is automotive manufacturing and automotive<br />

components.<br />

13 SOUTH AFRICAN BUSINESS <strong>2018</strong>

SPECIAL FEATURE<br />

Trends<br />

There are several areas in which new or revitalised<br />

sectors are providing employment and creating new<br />

opportunities:<br />

• tourists are visiting <strong>South</strong> Africa in record numbers<br />

• the successful renewable energy private investor<br />

programme is due to be restarted<br />

• companies are trading into Africa with considerable<br />

success<br />

• niche agricultural markets are booming with macadamia<br />

nuts being the most successful. Wine and<br />

grape exports to China also hold great potential.<br />

• several provincial governments and investment<br />

agencies are establishing trade relations and<br />

study programmes with BRICS countries<br />

• private education (at school and tertiary level) is<br />

a boom sector<br />

• new banking licences have been issued and several<br />

more are in the pipeline<br />

• new stock exchanges came on line in 2017 and<br />

more are expected<br />

• investment in infrastructure (especially ICT and<br />

railways) is strong<br />

• national government has committed to the<br />

National Development Plan (NDP), a blueprint<br />

for how to move the country forward. Part of that<br />

plan entails setting up deliverable schemes, such<br />

as the Strategic Integrated Projects.<br />

Strategic Integrated Projects (SIPs)<br />

The National Department of Economic Development<br />

is responsible for economic planning. It has set<br />

out a list of 18 major projects called the Strategic<br />

Integrated Projects (SIPs) which are intended to spur<br />

growth and development in a sector or geographical<br />

area. The focus is spread across seven primary<br />

concerns to be addressed: geographic focus (five<br />

SIPs), spatial (three), energy (three), social infrastructure<br />

(three), knowledge (two), regional integration<br />

(one), water and sanitation (one).<br />

They cover all nine provinces with an emphasis<br />

on areas that need more investment, and focus on<br />

economic and social infrastructure. The 18 projects<br />

themselves contain many smaller plans and<br />

projects, each with budgets and deadlines. These<br />

projects are:<br />

1. Unlocking the Northern Mineral Belt with<br />

Waterberg as the catalyst<br />

2. The Durban-Free State-Gauteng Logistics and<br />

Industrial Corridor<br />

3. <strong>South</strong>-eastern node and corridor development<br />

4. Unlocking the economic opportunities in North<br />

West Province<br />

5. Saldanha-Northern Cape Development Corridor<br />

6. Integrated Municipal Infrastructure Project<br />

7. Integrated Urban Space and Public Transport<br />

Programme<br />

8. Green energy in support of the <strong>South</strong> <strong>African</strong><br />

economy<br />

9. Electricity generation to support socio-economic<br />

development<br />

10. Electricity transmission and distribution for all<br />

11. Agri-logistics and rural infrastructure<br />

12. Revitalisation of public hospitals and other<br />

health facilities<br />

13. National school build programme<br />

14. Higher education infrastructure<br />

15. Expanding access to communication<br />

technology<br />

16. SKA and MeerKat (international radio astronomy<br />

project)<br />

17. Regional Integration for <strong>African</strong> cooperation and<br />

development<br />

18. Water and Sanitation Infrastructure Master Plan.<br />

To illustrate how many projects are undertaken<br />

in support of an SIP, there has been a lot of action to<br />

support the overall goal of creating an integrated logistics<br />

corridor between Durban and Johannesburg<br />

(SIP 2). Projects within the SIP include:<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

14

SPECIAL FEATURE<br />

ZIMBABWE<br />

NAMIBIA<br />

BOTSWANA<br />

Limpopo<br />

0.9% (7.1%)<br />

MOZAMBIQUE<br />

North West<br />

-3.6% (6.5%)<br />

Gauteng<br />

2.1%<br />

(34.3%)<br />

Mpumalanga<br />

2.7%<br />

(7.5%)<br />

SWAZI-<br />

LAND<br />

Northern Cape<br />

2.8% (2.1%)<br />

Free State<br />

1.8%<br />

(5%)<br />

LESOTHO<br />

KwaZulu-<br />

Natal<br />

2.3%<br />

(16.1%)<br />

Western Cape<br />

2.0% (13.6%)<br />

Eastern Cape<br />

1.0% (7.6%)<br />

SA GDP: Percentage of growth per province (2014) and percentage contribution to national GDP (figures<br />

in brackets).<br />

SOURCE: STATS SA WWW.STATSSA.GOV.ZA<br />

• a R2.3-billion container terminal at City Deep,<br />

Johannesburg<br />

• a R3.9-billion project to upgrade Pier 2 at the<br />

Port of Durban<br />

• R14.9-billion of rolling stock for the rail line<br />

• R30.4-billion completion of the New Multi-<br />

Product Pipeline by Transnet Pipelines<br />

• official inauguration in 2017 of the Maluti-A-<br />

Phofung Special Economic Zone (logistics<br />

hub, fuel distribution depot, manufacturing) at<br />

Harrismith in the Free State.<br />

Geography<br />

<strong>South</strong> Africa’s location between the Atlantic and<br />

Indian oceans ensures a generally temperate climate.<br />

The 2 954km coastline stretches from the border with<br />

Namibia on the Atlantic to the border with Mozambique<br />

in the east. The cold Benguela current sweeps along the<br />

western coast while the warm Indian Ocean ensures<br />

that the Mozambique/Agulhas current is temperate.<br />

<strong>South</strong> Africa’s coastal plain is separated from the<br />

interior by several mountain ranges, mostly notably the<br />

Drakensberg which runs down the country’s eastern<br />

flank. Smaller ranges in the south and west mark the<br />

distinction between the fertile coastal strip and the dry<br />

interior known as the Karoo.<br />

The city of Johannesburg is located on the continental<br />

divide, whereby water runs south of the city<br />

towards the Atlantic Ocean while waters to the north<br />

drain towards the north and east. Johannesburg is<br />

1 753m above sea level.<br />

Most of the country has summer rainfall but the<br />

Western Cape, which has a Mediterranean climate,<br />

receives its rain in winter. Droughts are not uncommon<br />

and although the national average is 464mm,<br />

most of the country receives less than 500mm of rain<br />

every year. The Western Cape is currently experiencing<br />

a severe drought.<br />

15 SOUTH AFRICAN BUSINESS <strong>2018</strong>

SPECIAL FEATURE<br />

The Orange and Vaal rivers play important roles in<br />

water schemes and irrigation and the Limpopo River<br />

defines the country’s northern boundary. A number<br />

of rivers run strongly from the Drakensberg to the sea<br />

but <strong>South</strong> Africa has no navigable rivers.<br />

Maize is produced in large quantities in the interior.<br />

The dry interior mostly supports livestock in the<br />

form of sheep and cattle. <strong>South</strong> Africa is the world<br />

leader in mohair production. Wines and fruit are specialities<br />

of the Western Cape while KwaZulu-Natal<br />

and the low-lying areas of Mpumalanga are known<br />

for sugar cane and tropical and subtropical fruits.<br />

Limpopo is a major vegetable producer.<br />

History<br />

One of <strong>South</strong> Africa’s premier museums and tourist<br />

attractions is known as the Cradle of Humankind,<br />

pointing to the fact that what is now <strong>South</strong> Africa<br />

has been home to the human species for thousands<br />

of years.<br />

Each of the country’s nine provinces presents<br />

its official documents in the relevant regional languages<br />

so the Western Cape, for example, presents<br />

material in Xhosa, Afrikaans and English. The most<br />

widely spoken languages are Zulu and Xhosa. Other<br />

languages, in order of the number of people who<br />

speak the language as a home language, are Pedi,<br />

English, Setswana, Sotho, Tsonga, Swati, Tshivenda<br />

and Ndebele.<br />

Historically, the Nguni-speaking people (Zulu,<br />

Xhosa, Swazi and Ndebele) settled along <strong>South</strong><br />

Africa’s east coast (and what is now Swaziland) while<br />

Venda and Tsonga people made their homes south<br />

of the Limpopo River. The Mapungubwe cultural<br />

landscape, a UNESCO World Heritage Site, in northern<br />

Limpopo Province illustrates a highly sophisticated<br />

kingdom that flourished between 900 and<br />

1300AD. The central regions of <strong>South</strong> Africa (and<br />

Lesotho) were populated by Sotho and Tswana.<br />

The Cape was colonised first by the Dutch, by<br />

the Batavian Republic and by the British. Prolonged<br />

British rule began in 1806. By the late 19th century<br />

there were four territories in what is now <strong>South</strong> Africa:<br />

two British colonies (Cape Colony and Natal) and two<br />

independent Boer republics. The Anglo-Boer War was<br />

fought between 1899 and 1901 and ultimately led<br />

to the creation of the Union of <strong>South</strong> Africa in 1910,<br />

uniting the four territories but ignoring the wishes of<br />

the black population. <strong>South</strong> Africa became a republic<br />

in 1960 and severed ties with Britain soon afterwards.<br />

After Nelson Mandela was released and a series of<br />

negotiating conferences were held, <strong>South</strong> Africa held<br />

its first democratic elections in 1994. <strong>South</strong> Africa reentered<br />

the Commonwealth after 1994.<br />

PROVINCE CAPITAL PREMIER POPULATION AREA GRP BILLION RAND<br />

Eastern Cape Bhisho<br />

Phumulo<br />

Masualle<br />

6 916 200 168 966km 2 R289.9<br />

Free State Bloemfontein<br />

Elias Sekgobelo<br />

"Ace" Magashule<br />

2 817 900 129 825km 2 R189.1<br />

Gauteng Johannesburg David Makhura 13 400 000 18 178km 2 R1 305.6<br />

KwaZulu-<br />

Natal<br />

Pietermaritzburg Willies Mchunu 11 919 100 94 361km 2 R610.1<br />

Limpopo Polokwane<br />

Stanley<br />

Mathabatha<br />

5 800 000 125 754km 2 R271.5<br />

Mpumalanga Mbombela David Mabuza 4 283 900 76 495km 2 R284.2<br />

North West Mahikeng<br />

Supra<br />

Mahumapelo<br />

3 707 000 104 882km 2 R249.5<br />

Northern Cape Kimberley Sylvia Lucas 1 185 600 372 889km 2 R79.9<br />

Western Cape Cape Town Helen Zille 6 200 100 129 462km ² R518.1<br />

Snapshot of <strong>South</strong> Africa’s provinces<br />

SOURCE: STATSSA, 2016.<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

16

FACT FILE: REPUBLIC OF SOUTH AFRICA<br />

President: Jacob Zuma (<strong>African</strong> National<br />

Congress)<br />

Capitals: Pretoria/Tshwane (administrative,<br />

seat of government), Cape Town (legislative),<br />

Bloemfontein (judicial).<br />

Provinces and provincial capitals: Western Cape<br />

(Cape Town), Eastern Cape (Bhisho), KwaZulu-<br />

Natal (Pietermaritzburg), Mpumalanga<br />

(Nelspruit), Limpopo (Polokwane), Gauteng<br />

(Johannesburg), North West (Mafikeng),<br />

Northern Cape (Kimberley), Free State<br />

(Bloemfontein).<br />

Time: GMT+2<br />

Population: 55.91-million (2016)<br />

Population under 15 years: 30%<br />

Population over 60 years: 8%<br />

Life expectancy: 65.1 (female); 59.7 (male)<br />

Size: 1 220 813km²<br />

Major languages: <strong>South</strong> Africa has 11 official<br />

languages but the main language of government<br />

and business is English. Zulu, Xhosa and<br />

Afrikaans are widely spoken.<br />

Religion: There is no state religion. The majority<br />

of the population are Christian but many other<br />

religions are followed such as Islam, Jewish and<br />

Hindu.<br />

Currency: The rand (100 cents). R13.48 = $1<br />

(October 2017)<br />

Political system: <strong>South</strong> Africa is a republic with<br />

an executive president who is appointed by the<br />

political party that wins the majority of votes in<br />

parliamentary elections. There are three tiers<br />

of government: national, provincial and municipal<br />

but the revenue raising capacity of the<br />

latter two spheres is limited. Allocations for<br />

health and education for example, are made<br />

by national government and then administrated<br />

by provinces. Eight of <strong>South</strong> Africa’s nine<br />

provinces are run by premiers from the <strong>African</strong><br />

National Congress; the Western Cape is administered<br />

by the Democratic Alliance. In 2016,<br />

municipal elections saw the DA come to power<br />

in some of <strong>South</strong> Africa’s biggest cities, supported<br />

by other parties such as the Congress<br />

of the People and the United Democratic Front.<br />

SPECIAL FEATURE<br />

Legal system: <strong>South</strong> Africa is a constitutional<br />

state with separation of powers between the<br />

legal and executive authorities. All laws must<br />

pass muster with the Constitutional Court which<br />

is the ultimate court of appeal on legislation.<br />

<strong>South</strong> Africa’s legal system is based on Roman<br />

Dutch law.<br />

Infrastructure: Ports of Cape Town, Saldanha,<br />

Mossel Bay, Port Elizabeth, Ngqura East London,<br />

Durban and Richards’ Bay. International airports<br />

at Cape Town, Johannesburg and Durban and<br />

domestic airports at all major cities. <strong>South</strong><br />

Africa has 34 000km of railway track and half<br />

of the country’s road network is paved. Most of<br />

<strong>South</strong> Africa’s power is generated by coal-fired<br />

power stations run by the state utility Eskom.<br />

A vigorous programme to encourage private investment<br />

into renewable energy began in 2012.<br />

Resouces: Platinum, gold, iron ore, chromium,<br />

vanadium, manganese, alumino-silicates, coal,<br />

copper, diamonds, uranium, zirconium.<br />

GDP: R3 055-billion (2015)<br />

GDP growth: 0.5% (2016), projected 1.3% (2017)<br />

(SA Treasury)<br />

Exports: Precious and semi-precious stones,<br />

mineral products, base metals, vehicles,<br />

machinery, chemical products, vegetable products,<br />

fruits, foodstuffs and beverages, paper<br />

and pulp.<br />

Main export markets: China, USA, Japan,<br />

Germany, UK, India.<br />

Imports: Machinery, mineral products, vehicles,<br />

chemicals, original equipment, base metals,<br />

plastics and rubber, textiles, optical and medical,<br />

foodstuffs and beverages.<br />

Main import markets: China, Germany, USA,<br />

Japan, Saudi Arabia, Iran, UK, India, France,<br />

Nigeria.<br />

17 SOUTH AFRICAN BUSINESS <strong>2018</strong>

MESSAGE<br />

City of Ekurhuleni<br />

Message from the Executive Mayor Councillor Mzwandile Masina.<br />

In May 2016, our council embarked on a journey of social transformation,<br />

to ensure that our residents see improved and impactful service<br />

delivery, with accelerated access to a constant provision of quality<br />

services. This commitment includes a focus on economic development<br />

and increased investment.<br />

A KEY POINT OF CONNECTIVITY<br />

AND INDUSTRY<br />

Councillor Mzwandile Masina<br />

Priorities<br />

Immediate and clear priorities include security of water and energy<br />

supply; completion of transport infrastructure and launch of the much<br />

anticipated bus rapid transit system – Harambee; rollout of Wi-Fi;<br />

unleashing of strategic land parcels for development; and implementation<br />

of our 10-point economic plan. The economic plan is a comprehensive<br />

programme of economic growth and development, intended<br />

to create jobs and attract investment into the city. The Aerotropolis<br />

development is one of the key points in this economic plan.<br />

Our city is named to<br />

reflect the aspirations<br />

of our residents<br />

as a place of peace. In<br />

this spirit, we welcome you to the<br />

City of Ekurhuleni. Ekurhuleni is a<br />

major hub that connects <strong>South</strong><br />

Africa to the world, and serves<br />

as a key point of connectivity<br />

and industry for the country and<br />

continent.<br />

Building a pact<br />

This term of office is one in which we will focus on building a humane<br />

pact between the city and its citizens, in which the aspirations of our<br />

people, regardless of their current circumstances, can be given a fair<br />

opportunity for progress. The City of Ekurhuleni can’t attain these<br />

ambitious goals without the support of all of our stakeholders. In turn,<br />

we commit ourselves to deliver on our mandate, efficiently, effectively<br />

and in a way which improves the city and the state of its people.<br />

In conclusion, let me reiterate our commitment to working<br />

with all of our stakeholders, in growing and developing our city,<br />

so that we can ensure increased equality and prosperity for all of<br />

our residents.<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

18

City of Ekurhuleni<br />

Africa’s first Aerotroplis holds great promise.<br />

PROFILE<br />

A new identity for the City of Ekurhuleni is being<br />

forged out of the towns and urban nodes surrounding<br />

Africa’s biggest and busiest airport, OR Tambo<br />

International Airport. The airport is the epicentre of<br />

Africa’s first Aerotropolis, which will set it apart from<br />

any other <strong>South</strong> <strong>African</strong> city and turbocharge the<br />

regional economy.<br />

The city has prime residential estates, glitzy entertainment<br />

venues, mega shopping malls, lively townships,<br />

historical villages, good schools, recreational<br />

facilities and wide open spaces.<br />

Ekurhuleni is a digital city and is investing in digital<br />

infrastructure that will streamline the way it delivers<br />

services to the community, including smart grids,<br />

payment gateways, e-learning and e-health systems,<br />

and closed-circuit TV to improve safety and security.<br />

Ekurhuleni has long been known as the manufacturing<br />

hub of the country and it is building on this<br />

history to create a smart city that will underpin the<br />

new economic growth trajectory. The city boasts a<br />

world-class transport network, telecommunications<br />

and energy grid, a youthful citizenry and a strong<br />

financial position. Its connectivity across rail, road<br />

and air is significant. The Gillooly’s interchange is the<br />

busiest in the southern hemisphere, and Germiston<br />

railway hub is one of the busiest on the continent.<br />

The city is being developed through a series of<br />

strategic mixed-used urban developments and<br />

transformational projects like the GreenReef Megaproject,<br />

S&J Industrial Estate, Glen Gory, Leeuwpoort<br />

Housing Development, TwentyOne Industrial Park,<br />

Carnival Junction, Lordsview Industrial Park and the<br />

Riverfields R21 development, taking shape along the<br />

R21 Albertina Sisulu Highway which links Ekurhuleni<br />

to Pretoria. And the city has the infrastructure to<br />

support investments like Prasa-Gibela, which will<br />

see the building and maintenance of 600 new trains<br />

for <strong>South</strong> Africa’s rail commuter network over the<br />

next two decades. Other public-sector strategic<br />

developments which promise to bring economic<br />

development include the Tambo Springs inland port<br />

and the OR Tambo Airport cargo terminal expansion.<br />

Come LIVE PLAY INVEST<br />

in Ekurhuleni, the Aerotropolis City.<br />

The rebirth of Ekurhuleni is not just a dream. Several<br />

companies have taken up residence in their new<br />

premises and a significant logistics corridor has<br />

mushroomed along the R21 highway. Designed<br />

to strengthen the logistics, aviation and transport<br />

sector, key projects are laying the groundwork for<br />

19 SOUTH AFRICAN BUSINESS <strong>2018</strong>

PROFILE<br />

a powerful distribution centre and logistics node,<br />

including Blue Sky Logistics, Jonsson Workwear, Fast<br />

Freight, DB Schenker, Würth and DHL Supply Chain.<br />

Additional strategic land for industry is due to be<br />

released for development.<br />

One of the ways in which planners will promote<br />

competitiveness is to create an environment that<br />

will allow disruptive innovation through technology.<br />

One such project is the Alternative and Renewable<br />

Energy strategy which will limit the City’s dependence<br />

on the national grid. Ekurhuleni hopes to derive<br />

about 10% of overall electricity supply from renewable<br />

energy by 2021.<br />

Over and above this there are also six mega housing<br />

projects that are being planned across the<br />

City over the next five years. Mega human settlements<br />

are housing projects of 100,000 units<br />

or more. They offer various types of housing<br />

from fully subsidised, gap housing, social housing<br />

and bonded units. These settlements help<br />

the city to transform its disparate urban special<br />

patterns, increase access to socio economic opportunities<br />

and encourage social cohesion. These<br />

developments offer significant opportunities for<br />

investors across the full value chain including land<br />

acquisition, supply of goods and services, as well<br />

as actual implementation.<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

20

Another exciting project is the redevelopment of<br />

Germiston into an administrative headquarters for<br />

the city, with other precincts following a similar<br />

path. The Kempton Park-to-Germiston corridor<br />

aims to develop a new urban core and central<br />

business district for a metro that was formed out<br />

of nine small towns, each with its own business<br />

district. The precinct comprises 10 major projects<br />

which are mostly owned by the city – the court<br />

is owned by national government and one is privately<br />

owned. Projects include a new administration<br />

building, hotel and conference centre, knowledge<br />

centre and magistrates square. Partnership<br />

between the public and private sector will be<br />

important in enabling these developments.<br />

With this initiative and others like it, city planners<br />

are expanding the horizon that will see Ekurhuleni<br />

blossom into a prosperous region for all its citizens.<br />

PROFILE<br />

Investment facilitation<br />

The city has an Investment and Development<br />

Facilitation Strategic Policy Framework, which has<br />

been developed to improve turnaround times in<br />

facilitating and decision-making on investment and<br />

development applications, thus improving the city’s<br />

investment-friendly environment.<br />

The city boasts a business and investment onestop-shop<br />

established within the city’s Aerotropolis<br />

core. The Ekurhuleni <strong>Business</strong> Facilitation Network is<br />

situated in Kempton Park and houses the business<br />

centre to support local enterprise development and<br />

the investment centre (EIC).<br />

The Ekurhuleni Investment Committee meets twice<br />

a month to appraise and provide technical support<br />

including pre-application support to mega investment<br />

and development applications.<br />

The EIC also provides aftercare to newly established<br />

and existing businesses within the city. The centre<br />

collaborates with various provincial and national<br />

departments to provide unmatched facilitation of<br />

investments and developments within the city and<br />

support to local businesses.<br />

CONTACT INFO<br />

Ekurhuleni Investment Centre<br />

Tel: +27 11 999 3516 / 20<br />

Email: eic@ekurhuleni.gov.za<br />

Website: www.ekurhuleni.gov.za<br />

21 SOUTH AFRICAN BUSINESS <strong>2018</strong>

<strong>Business</strong> expands into Africa<br />

Manufacturing and services are targeted for export growth.<br />

Shoprite is a household name for many <strong>South</strong><br />

<strong>African</strong>s who buy their weekly groceries at<br />

one of hundreds of outlets across the country,<br />

but that is an experience which many<br />

<strong>African</strong>s living in other parts of the continent are sharing<br />

more and more frequently, and in large numbers.<br />

Retailers and bankers from <strong>South</strong> Africa have been<br />

exploring opportunities north of the Limpopo River<br />

for many years, and they have been followed by engineering<br />

firms, consulting companies and, more<br />

recently, automotive manufacturers. They key attraction<br />

is the size of the market, and the potential of that<br />

market to grow and to grow more sophisticated in its<br />

tastes. Africa has a population of 1.2-billion.<br />

<strong>South</strong> <strong>African</strong> and international hotel brands are<br />

investing strongly in Africa. Tsogo Sun has hotels in<br />

Zambia, Tanzania, Kenya, Nigeria and Mozambique.<br />

Sun International operates in six countries outside<br />

<strong>South</strong> Africa. Marriott International’s acquisition of<br />

Protea Hotels has given it an expanded footprint in<br />

Africa.<br />

Hyatt Hotels & Resorts will double its presence in<br />

Africa by 2020, with new investments in Cameroon,<br />

Senegal and Algeria, to go with its existing hotels<br />

in Morocco and Tanzania. The group is eyeing<br />

East Africa, citing increased infrastructure spending<br />

there as a reason to consider investing.<br />

While <strong>South</strong> Africa is still seen as a good staging<br />

post for international firms to base their Africa strategies,<br />

some industries have refined that process. In<br />

the automotive industry, for example, head offices<br />

in Europe and the US have mandated their <strong>South</strong><br />

<strong>African</strong> operations to lead the drive into Africa.<br />

According to the CEO of Sanlam Africa<br />

Investments, St John Bungey, the subtleties of investing<br />

in Africa should be respected. The growth<br />

path and the demographics are solid reasons to<br />

invest in Africa but specific strategies are needed.<br />

He notes three key ingredients: respect for local<br />

knowledge, understanding the local environment<br />

and partnering with the right local people<br />

(Sunday Times).<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

22

SPECIAL FEATURE<br />

Fully 30% of <strong>South</strong> Africa’s<br />

exports are to other countries in<br />

Africa, but a massive 83% of this<br />

volume is into <strong>South</strong>ern Africa.<br />

This means that the potential<br />

for <strong>South</strong> Africa to grow its exports<br />

into other parts of Africa is<br />

enormous.<br />

The Export Credit Insurance<br />

Corporation of <strong>South</strong> Africa<br />

(ECIC) exists to help trade and<br />

investment across borders. ECIC<br />

provides insurance for bank loans<br />

that are taken by investors and<br />

<strong>South</strong> <strong>African</strong>s can get insurance<br />

for investments, and for small and<br />

medium enterprises there is a<br />

product available (performance<br />

bonds) to anyone exporting<br />

capital goods and services.<br />

The <strong>South</strong> <strong>African</strong> Department<br />

of Trade and Industry (dti) plays a<br />

key role in promoting trade between<br />

<strong>South</strong> Africa and the rest<br />

of Africa. <strong>South</strong> <strong>African</strong> exporters<br />

can enroll in the dti’s training<br />

programme, Global Export Passport Programme<br />

(GEPP). The dti wants to expand <strong>South</strong> <strong>African</strong> exports<br />

in manufacturing (which it wants to double<br />

in 10 years) and services (40% of the export basket<br />

by 2030).<br />

The Integrated National Export Strategy (INES)<br />

is managed by a unit called Trade and Investment<br />

<strong>South</strong> Africa (Tisa), which is targeting emerging<br />

markets, including the BRIC states (Brazil, Russia,<br />

India and China).<br />

Connecting<br />

Intra-<strong>African</strong> trade currently stands at 16% of trade<br />

volumes. This is in contrast to the continent of<br />

Europe, where 60% of all trade is conducted among<br />

European nations, and in Asia, where the figure<br />

is 40%.<br />

Border delays, tariffs and infrastructure are the<br />

biggest barriers to expanding this trade. Shoprite<br />

spends about R20 000 per week in permits, and long<br />

waits at border posts are routine. The revamped<br />

Chirundu one-stop border post in Zambia has<br />

reduced transit times by a third.<br />

There are plans to create a Tripartite Free Trade<br />

Area covering three regional groupings across<br />

26 countries. Extending from <strong>South</strong> Africa in the<br />

south to Uganda and Kenya in the north, the proposed<br />

free trade area would encompass more<br />

than 620-million consumers in three regional<br />

organisations: the <strong>South</strong>ern <strong>African</strong> Development<br />

Community (SADC), the Common Market for East<br />

and <strong>South</strong>ern Africa (Comesa) and the East <strong>African</strong><br />

Community (EAC).<br />

The Sustainable Development Investment<br />

Partnership (SDIP) comprises 30 institutions and<br />

aims to fund 16 <strong>African</strong> infrastructure projects, valued<br />

at more than $20-billion. The founders of the<br />

SDIP were the World Economic Forum (WEF) and<br />

the Organisation for Economic Co-operation and<br />

Development (OECD).<br />

China has pledged to support the rehabilitation<br />

of the railway line between Zambia and Tanzania<br />

while the Industrial and Commercial Bank of China<br />

is to invest R20-billion in renewable energy in Africa.<br />

Railway upgrades will probably reap the quickest<br />

rewards in the push to promote intra-<strong>African</strong><br />

trade. Fully 70% of the freight that arrives in <strong>South</strong><br />

Africa is delivered by road: this is both a problem<br />

and an opportunity. One of the companies<br />

eyeing that opportunity is <strong>South</strong> <strong>African</strong> rail operator<br />

Sheltam Group. It has created a rail track<br />

infrastructure funding vehicle with a dedicated<br />

<strong>African</strong> mandate.<br />

The Development Bank of <strong>South</strong>ern Africa and<br />

Transnet have developed a financing scheme for<br />

selected buyers of rail rolling stock and port equipment.<br />

Transnet is already very active in <strong>African</strong><br />

countries north of the <strong>South</strong> <strong>African</strong> border.<br />

This is part of Transnet’s Market Demand Strategy<br />

(MDS), which aims to sell it products and services<br />

around the world. Transnet Engineering’s Trans-<br />

Africa Locomotive (for branch lines and shunting<br />

yards) is being marketed to other <strong>African</strong> countries<br />

and mining companies. Transnet Engineering plans<br />

is establishing Maintenance Repair and Operations<br />

centres in four <strong>African</strong> countries.<br />

23 SOUTH AFRICAN BUSINESS <strong>2018</strong>

SPECIAL FEATURE<br />

Automotive opportunities in Africa<br />

The <strong>African</strong> Association of Automotive Manufacturers chairperson Thomas Schaefer (CEO<br />

of Volkswagen SA) explains why new <strong>African</strong> markets are vital for growth.<br />

What are the primary goals of the AAAM?<br />

The AAAM was founded with a strategic view<br />

regarding all <strong>South</strong> <strong>African</strong> original equipment<br />

manufacturers (OEMs), namely, that Africa is super<br />

important for our future. We need Africa so that<br />

<strong>South</strong> Africa can thrive. The AAAM is for the industry<br />

to say how can we work with Nigeria or Kenya for<br />

the good of both countries.<br />

Is the intention to set up full-scale plants<br />

of SA OEMs or to create independent<br />

industries?<br />

In Kenya at the moment there is no passenger car<br />

manufacturing other than what we have started.<br />

There is some truck manufacturing but nothing<br />

else, so you have to start slowly. This entails starting<br />

with semi-knock-down assembly, then medium<br />

knock-down, and finally full-scale construction. It<br />

is dependent on the annual volume you produce.<br />

Indonesia and other countries in the world have<br />

gone through this development phase. To build<br />

up a body shop with welding and all the logistics,<br />

you can only do that beyond production of 20 000<br />

or 30 000 cars per year.<br />

What is current Volkswagen operation in<br />

Kenya?<br />

We are planning on a thousand Polo vehicles per<br />

year for now, but at the moment it is a little slow<br />

because of the political aspects.<br />

Do you have something in Nigeria?<br />

In Nigeria we have had an operation since 2014; however,<br />

it was dormant until recently due to the oil and<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

24

SPECIAL FEATURE<br />

forex issues. It’s getting invigorated<br />

and we have had good meetings<br />

with the Nigerian and <strong>South</strong><br />

<strong>African</strong> governments. They are<br />

serious about curbing used car<br />

sales – that is the drag that keeps<br />

them off the new car market, the<br />

used cars getting dumped.<br />

What other markets is<br />

Volkswagen targeting?<br />

We are focusing on the East<br />

<strong>African</strong> market, in countries like<br />

Rwanda and Tanzania. Ethiopia is very promising<br />

but their massive dam for the Nile is where they are<br />

spending all their forex at the moment.<br />

Are all <strong>South</strong> Africa’s OEMs looking north?<br />

All OEMs operating in <strong>South</strong> Africa have now received<br />

the guardianship of Africa from head office.<br />

They are probably continuously looking up north<br />

to see opportunities. We are not all looking at the<br />

same countries: Ford is looking at Angola and Nissan<br />

is looking at Nigeria.<br />

Is the Department of Trade and Industry<br />

(dti) encouraging an <strong>African</strong> focus?<br />

The OEMs’ focus on Africa aligns well with the<br />

dti’s review of the Automotive Production and<br />

Development Programme (APDP) – the new APDP<br />

is about regional trade, and that is the most important<br />

aspect for the <strong>South</strong> Africa OEM industry.<br />

If we don’t get the regional trade and regional<br />

industry right then it’s going to be difficult in the<br />

future. Labour and logistics costs are high but with<br />

regional trade we could offset most of it. We are<br />

pushing the dti for better incentives to help us to<br />

open those markets.<br />

Is Africa the key?<br />

If production stays far below a million cars production<br />

per year, we will never be profitable or<br />

sustainable, so Africa could be the key? When you<br />

look at the number of cars per thousand inhabitants<br />

in most <strong>African</strong> countries there is opportunity in<br />

places like Kenya and Nigeria. If you take away the<br />

used car drag, there’s no reason why their market<br />

could not grow. If Kenya came to a level like <strong>South</strong><br />

Africa they could achieve a market of five or six<br />

hundred thousand.<br />

So you are positive about the future?<br />

Nobody else can do it better than from Africa for<br />

Africa. Although it is a <strong>South</strong> <strong>African</strong> initiative, it<br />

needs to be an <strong>African</strong> initiative. It must benefit the<br />

other countries as well. We are working to refocus<br />

the AAAM to make this a significant organisation that<br />

will bring the auto industry further in Africa. It takes<br />

determination to create an auto industry. If you focus<br />

on it, it will come – there is a real opportunity.<br />

25 SOUTH AFRICAN BUSINESS <strong>2018</strong>

FOCUS<br />

Export Credit Insurance<br />

Corporation of <strong>South</strong> Africa<br />

Celebratng 15 years of Success<br />

Proudly supporting <strong>South</strong> <strong>African</strong> exporters and investors.<br />

The Export Credit Insurance Corporation of <strong>South</strong> Africa (ECIC)<br />

was established 16 years ago, in July 2001, when it was given<br />

the mandate of filling a market gap through the provision of<br />

medium to long-term export credit and investment guarantees<br />

by underwriting bank loans for political and commercial risk insurance<br />

cover, on behalf of the <strong>South</strong> <strong>African</strong> government.<br />

The short-term transaction market was amply catered for, but medium<br />

to long-term export transactions still had a need for a dedicated<br />

export credit agency, hence the formation of the ECIC. Acting as a<br />

catalyst for private investment, the ECIC steps in where commercial<br />

lenders are either unwilling to or unable to accept long-term risks<br />

While the ECIC is part of a broader government policy, it remains<br />

an independent limited liability company, but with the government<br />

as its sole shareholder. The institution is enabled under the amended<br />

Export Credit and Foreign Investments Insurance Act of 1957.<br />

The ECIC has recently developed new products including lines of<br />

credit, lease and return of plant equipment. It also continues to be<br />

a catalyst for increased lending capacity by financial institutions by<br />

entering agreements with other export credit agencies (ECAs). In this<br />

way, it creates a framework for both re- and co-insurance. To this end,<br />

it has adopted a comprehensive plan of action aimed at actualising cooperation<br />

programmes for mutual benefit in conjunction with, among<br />

others, BRICS ECAs, Afreximbank<br />

and <strong>African</strong> Trade Insurance.<br />

Most <strong>African</strong> markets are considered<br />

as uncharted territories<br />

with challenging business environments.<br />

Thus, the business<br />

strategies foreign investors apply<br />

elsewhere in the world cannot be<br />

used in the continent.<br />

Access to competitively<br />

priced export credit creates the<br />

ability for local contractors to<br />

bulk up and compete more effectively<br />

in foreign markets.<br />

With the ECIC in support of<br />

such transactions, the <strong>South</strong><br />

<strong>African</strong> export market is enabled<br />

and contractors are becoming<br />

more credible.<br />

This has a far-reaching impact<br />

on fostering a stronger economy<br />

and drives domestic job creation,<br />

contributions to fixed capital formation<br />

and the GDP, as well as<br />

the generation of fiscal revenue.<br />

The ECIC is committed to<br />

sustainable business through<br />

innovative solutions, operational<br />

and service excellence,<br />

business development and strategic<br />

partnerships. In enabling<br />

frontier markets to optimise production,<br />

the ECIC is effectively<br />

motivating a positive socioeconomic<br />

impact.<br />

SOUTH AFRICAN BUSINESS <strong>2018</strong><br />

26

SPECIAL FEATURE<br />

Invest in the<br />

Kingdom of Lesotho<br />

The Lesotho National Development Corporation has attractive projects in several areas.<br />

Lesotho is richly endowed in mineral resources<br />

such as diamonds and has abundant water<br />

reserves. Lesotho is branded as “The Kingdom<br />

in the Sky” owing to its beautiful sceneries<br />

especially in winter when it has snowed or in spring<br />

when the alpine flora of Lesotho blossom.<br />

Lesotho is a high-altitude country, landlocked by<br />

the Republic of <strong>South</strong> Africa and criss-crossed by<br />

a network of rivers and mountain ranges. Lesotho<br />

covers an area of 30 355 square kilometres and has a<br />

population of just over two-million. The vast majority<br />

of the population is Basotho (Lesotho natives) with<br />

a small group of Europeans and Asians. The official<br />

languages of Lesotho are English and Sesotho. The<br />

country’s GDP growth rate in 2016 is estimated at 3.1%.<br />

The country is actively seeking new investments<br />

into a wide variety of sectors to boost the economy<br />

and provide employment for its people.<br />

The Lesotho National Development Corporation<br />

(LNDC) is the main parastatal of the Government<br />

of Lesotho charged with the implementation of<br />

the country’s trade and industrial development<br />

policies.<br />

The role of the Corporation is to promote Lesotho<br />

as an attractive investment location for both foreign<br />

and indigenous investors. The LNDC is the first point<br />

of contact for investors who intend to set up projects<br />

in the manufacturing and processing industries<br />

in Lesotho. In 2016, the LNDC received a best<br />

IPA (Investment Promotion Agency) Award from<br />

UNCTAD (United Nations Conference on Trade and<br />

Development) at the 14th UNCTAD Conference.<br />

Lesotho has progressed in moving from a predominantly<br />

subsistence-oriented economy to an economy<br />

exporting natural resources (diamonds and water)<br />

and manufactured goods (excelling in textiles and<br />

apparel). This has been driven by the country’s dutyfree<br />

quota-free market access to major international<br />

markets and an improving investment climate.<br />

Priority sectors for investment include:<br />