audit-services-redacted (411)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

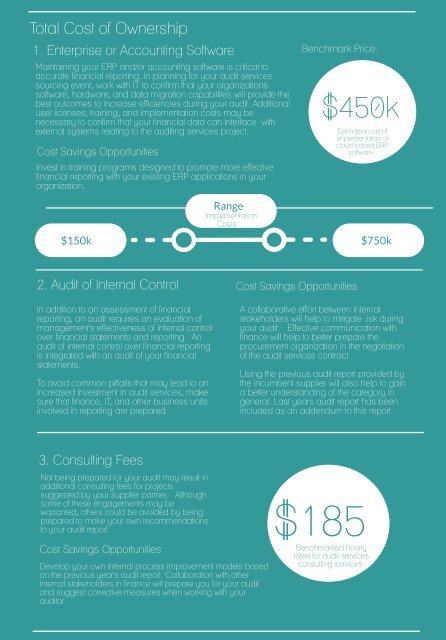

Total Cost of Ownership<br />

1. Enterprise or Accounting Software<br />

Maintaining your ERP and/or accounting software is critical to<br />

accurate financial reporting. In planning for your <strong>audit</strong> <strong>services</strong><br />

sourcing event, work with IT to confirm that your organizations<br />

software, hardware, and data migration capabilities will provide the<br />

best outcomes to increase efficiencies during your <strong>audit</strong>. Additional<br />

user licenses, training, and implementation costs may be<br />

necessary to confirm that your financial data can interface with<br />

external systems relating to the <strong>audit</strong>ing <strong>services</strong> project.<br />

Cost Savings Opportunities<br />

Benchmark Price:<br />

??? International<br />

$ Installation Fee<br />

$<br />

$<br />

$450kFlights<br />

???<br />

Estimated cost of<br />

implementation of<br />

cloud-based ERP<br />

software<br />

1217<br />

Invest in training programs designed to promote more effective<br />

financial reporting with your existing ERP applications in your<br />

organization.<br />

Range<br />

Implementation<br />

Costs<br />

$150k $750k<br />

2. Audit of Internal Control<br />

Cost Savings Opportunities<br />

In addition to an assessment of financial<br />

reporting, an <strong>audit</strong> requires an evaluation of<br />

management's effectiveness of internal control<br />

over financial statements and reporting An<br />

<strong>audit</strong> of internal control over financial reporting<br />

is integrated with an <strong>audit</strong> of your financial<br />

statements.<br />

To avoid common pitfalls that may lead to an<br />

increased investment in <strong>audit</strong> <strong>services</strong>, make<br />

sure that finance, IT, and other business units<br />

involved in reporting are prepared.<br />

A collaborative effort between internal<br />

stakeholders will help to mitigate $ risk during<br />

your <strong>audit</strong>. Effective communication with<br />

finance will help to better prepare the<br />

procurement organization in the negotiation<br />

of the <strong>audit</strong> <strong>services</strong> contract.<br />

Using the previous <strong>audit</strong> report provided by<br />

the incumbent supplier will also help to gain<br />

a better understanding of the category in<br />

general. Last years <strong>audit</strong> report has been<br />

included as an addendum to this report.<br />

3. Consulting Fees<br />

Not being prepared for your <strong>audit</strong> may result in<br />

additional consulting fees for projects<br />

suggested by your supplier partner. Although<br />

some of these engagements may be<br />

warranted, others could be avoided by being<br />

prepared to make your own recommendations<br />

to your <strong>audit</strong> report.<br />

Cost Savings Opportunities<br />

Develop your own internal process improvement models based<br />

on the previous year's <strong>audit</strong> report. Collaboration with other<br />

internal stakeholders in finance will prepare you for your <strong>audit</strong><br />

and suggest corrective measures when working with your<br />

<strong>audit</strong>or.<br />

$<br />

??? International<br />

1217<br />

$ Installation Fee<br />

$<br />

$<br />

$185Flights<br />

???<br />

Benchmarked hourly<br />

rates for <strong>audit</strong> <strong>services</strong><br />

consulting <strong>services</strong>.