Annual Report 2017

Annual Report 2017 - Federal Audit Oversight Authority FAOA

Annual Report 2017 - Federal Audit Oversight Authority FAOA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regulatory Audit | FAOA <strong>2017</strong><br />

25<br />

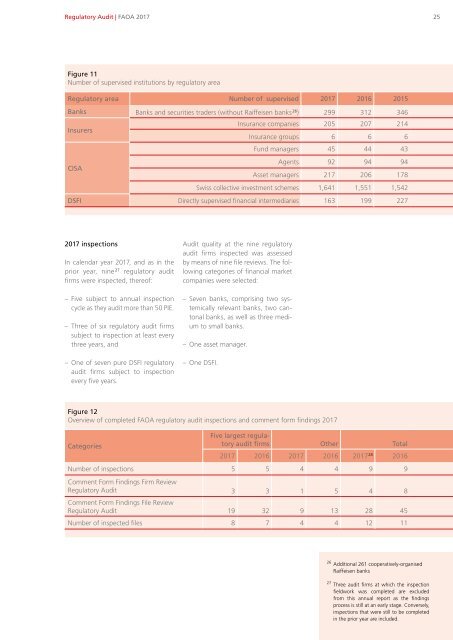

Figure 11<br />

Number of supervised institutions by regulatory area<br />

Regulatory area Number of supervised <strong>2017</strong> 2016 2015<br />

Banks Banks and securities traders (without Raiffeisen banks 26 ) 299 312 346<br />

Insurers<br />

Insurance companies 205 207 214<br />

Insurance groups 6 6 6<br />

Fund managers 45 44 43<br />

CISA<br />

Agents 92 94 94<br />

Asset managers 217 206 178<br />

Swiss collective investment schemes 1,641 1,551 1,542<br />

DSFI Directly supervised financial intermediaries 163 199 227<br />

<strong>2017</strong> inspections<br />

In calendar year <strong>2017</strong>, and as in the<br />

prior year, nine 27 regulatory audit<br />

firms were inspected, thereof:<br />

– Five subject to annual inspection<br />

cycle as they audit more than 50 PIE.<br />

– Three of six regulatory audit firms<br />

subject to inspection at least every<br />

three years, and<br />

– One of seven pure DSFI regulatory<br />

audit firms subject to inspection<br />

every five years.<br />

Audit quality at the nine regulatory<br />

audit firms inspected was assessed<br />

by means of nine file reviews. The following<br />

categories of financial market<br />

companies were selected:<br />

– Seven banks, comprising two systemically<br />

relevant banks, two cantonal<br />

banks, as well as three medium<br />

to small banks.<br />

– One asset manager.<br />

– One DSFI.<br />

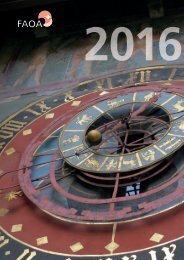

Figure 12<br />

Overview of completed FAOA regulatory audit inspections and comment form findings <strong>2017</strong><br />

Categories<br />

Five largest regulatory<br />

audit firms Other Total<br />

<strong>2017</strong> 2016 <strong>2017</strong> 2016 <strong>2017</strong> 28 2016<br />

Number of inspections 5 5 4 4 9 9<br />

Comment Form Findings Firm Review<br />

Regulatory Audit 3 3 1 5 4 8<br />

Comment Form Findings File Review<br />

Regulatory Audit 19 32 9 13 28 45<br />

Number of inspected files 8 7 4 4 12 11<br />

26 Additional 261 cooperatively-organised<br />

Raiffeisen banks<br />

27 Three audit firms at which the inspection<br />

fieldwork was completed are excluded<br />

from this annual report as the findings<br />

process is still at an early stage. Conversely,<br />

inspections that were still to be completed<br />

in the prior year are included.