President Stephen L. Weber - San Diego State University ...

President Stephen L. Weber - San Diego State University ...

President Stephen L. Weber - San Diego State University ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

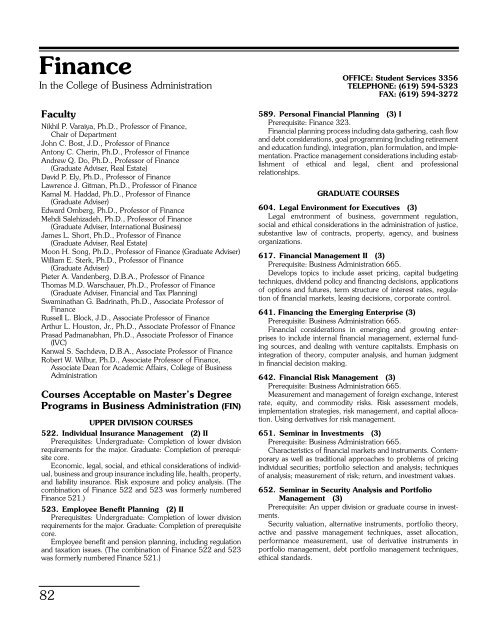

Finance OFFICE: Student Services 3356<br />

In the College of Business Administration TELEPHONE: (619) 594-5323<br />

FAX: (619) 594-3272<br />

Faculty<br />

Nikhil P. Varaiya, Ph.D., Professor of Finance,<br />

Chair of Department<br />

John C. Bost, J.D., Professor of Finance<br />

Antony C. Cherin, Ph.D., Professor of Finance<br />

Andrew Q. Do, Ph.D., Professor of Finance<br />

(Graduate Adviser, Real Estate)<br />

David P. Ely, Ph.D., Professor of Finance<br />

Lawrence J. Gitman, Ph.D., Professor of Finance<br />

Kamal M. Haddad, Ph.D., Professor of Finance<br />

(Graduate Adviser)<br />

Edward Omberg, Ph.D., Professor of Finance<br />

Mehdi Salehizadeh, Ph.D., Professor of Finance<br />

(Graduate Adviser, International Business)<br />

James L. Short, Ph.D., Professor of Finance<br />

(Graduate Adviser, Real Estate)<br />

Moon H. Song, Ph.D., Professor of Finance (Graduate Adviser)<br />

William E. Sterk, Ph.D., Professor of Finance<br />

(Graduate Adviser)<br />

Pieter A. Vandenberg, D.B.A., Professor of Finance<br />

Thomas M.D. Warschauer, Ph.D., Professor of Finance<br />

(Graduate Adviser, Financial and Tax Planning)<br />

Swaminathan G. Badrinath, Ph.D., Associate Professor of<br />

Finance<br />

Russell L. Block, J.D., Associate Professor of Finance<br />

Arthur L. Houston, Jr., Ph.D., Associate Professor of Finance<br />

Prasad Padmanabhan, Ph.D., Associate Professor of Finance<br />

(IVC)<br />

Kanwal S. Sachdeva, D.B.A., Associate Professor of Finance<br />

Robert W. Wilbur, Ph.D., Associate Professor of Finance,<br />

Associate Dean for Academic Affairs, College of Business<br />

Administration<br />

Courses Acceptable on Master’s Degree<br />

Programs in Business Administration (FIN)<br />

UPPER DIVISION COURSES<br />

522. Individual Insurance Management (2) II<br />

Prerequisites: Undergraduate: Completion of lower division<br />

requirements for the major. Graduate: Completion of prerequisite<br />

core.<br />

Economic, legal, social, and ethical considerations of individual,<br />

business and group insurance including life, health, property,<br />

and liability insurance. Risk exposure and policy analysis. (The<br />

combination of Finance 522 and 523 was formerly numbered<br />

Finance 521.)<br />

523. Employee Benefit Planning (2) II<br />

Prerequisites: Undergraduate: Completion of lower division<br />

requirements for the major. Graduate: Completion of prerequisite<br />

core.<br />

Employee benefit and pension planning, including regulation<br />

and taxation issues. (The combination of Finance 522 and 523<br />

was formerly numbered Finance 521.)<br />

82<br />

589. Personal Financial Planning (3) I<br />

Prerequisite: Finance 323.<br />

Financial planning process including data gathering, cash flow<br />

and debt considerations, goal programming (including retirement<br />

and education funding), integration, plan formulation, and implementation.<br />

Practice management considerations including establishment<br />

of ethical and legal, client and professional<br />

relationships.<br />

GRADUATE COURSES<br />

604. Legal Environment for Executives (3)<br />

Legal environment of business, government regulation,<br />

social and ethical considerations in the administration of justice,<br />

substantive law of contracts, property, agency, and business<br />

organizations.<br />

617. Financial Management II (3)<br />

Prerequisite: Business Administration 665.<br />

Develops topics to include asset pricing, capital budgeting<br />

techniques, dividend policy and financing decisions, applications<br />

of options and futures, term structure of interest rates, regulation<br />

of financial markets, leasing decisions, corporate control.<br />

641. Financing the Emerging Enterprise (3)<br />

Prerequisite: Business Administration 665.<br />

Financial considerations in emerging and growing enterprises<br />

to include internal financial management, external funding<br />

sources, and dealing with venture capitalists. Emphasis on<br />

integration of theory, computer analysis, and human judgment<br />

in financial decision making.<br />

642. Financial Risk Management (3)<br />

Prerequisite: Business Administration 665.<br />

Measurement and management of foreign exchange, interest<br />

rate, equity, and commodity risks. Risk assessment models,<br />

implementation strategies, risk management, and capital allocation.<br />

Using derivatives for risk management.<br />

651. Seminar in Investments (3)<br />

Prerequisite: Business Administration 665.<br />

Characteristics of financial markets and instruments. Contemporary<br />

as well as traditional approaches to problems of pricing<br />

individual securities; portfolio selection and analysis; techniques<br />

of analysis; measurement of risk; return, and investment values.<br />

652. Seminar in Security Analysis and Portfolio<br />

Management (3)<br />

Prerequisite: An upper division or graduate course in investments.<br />

Security valuation, alternative instruments, portfolio theory,<br />

active and passive management techniques, asset allocation,<br />

performance measurement, use of derivative instruments in<br />

portfolio management, debt portfolio management techniques,<br />

ethical standards.