Nifty Outlook Global Markets - JRG Securities Limited

Nifty Outlook Global Markets - JRG Securities Limited

Nifty Outlook Global Markets - JRG Securities Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DECEMBER 11 2012<br />

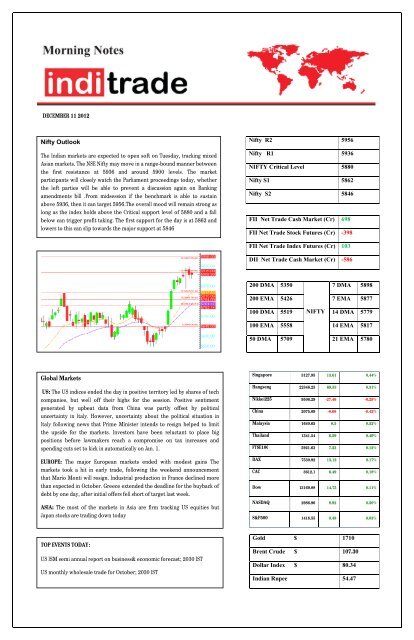

<strong>Nifty</strong> <strong>Outlook</strong><br />

tr The Indian markets are expected to open soft on Tuesday, tracking mixed<br />

Asian markets. The NSE <strong>Nifty</strong> may move in a range-bound manner between<br />

the first resistance at 5936 and around 5900 levels. The market<br />

participants will closely watch the Parliament proceedings today, whether<br />

the left parties will be able to prevent a discussion again on Banking<br />

amendments bill .From midsession if the benchmark is able to sustain<br />

above 5936, then it can target 5956.The overall mood will remain strong as<br />

long as the index holds above the Critical support level of 5880 and a fall<br />

below can trigger profit taking. The first support for the day is at 5862 and<br />

lowers to this can slip towards the major support at 5846<br />

<strong>Global</strong> <strong>Markets</strong><br />

US: The US indices ended the day in positive territory led by shares of tech<br />

companies, but well off their highs for the session. Positive sentiment<br />

generated by upbeat data from China was partly offset by political<br />

uncertainty in Italy. However, uncertainty about the political situation in<br />

Italy following news that Prime Minister intends to resign helped to limit<br />

the upside for the markets. Investors have been reluctant to place big<br />

positions before lawmakers reach a compromise on tax increases and<br />

spending cuts set to kick in automatically on Jan. 1.<br />

EUROPE: The major European markets ended with modest gains The<br />

markets took a hit in early trade, following the weekend announcement<br />

that Mario Monti will resign. Industrial production in France declined more<br />

than expected in October. Greece extended the deadline for the buyback of<br />

debt by one day, after initial offers fell short of target last week.<br />

ASIA: The most of the markets in Asia are firm tracking US equities but<br />

Japan stocks are trading down today<br />

TOP EVENTS TODAY:<br />

US ISM semi annual report on business& economic forecast; 2030 IST<br />

US monthly wholesale trade for October; 2030 IST<br />

<strong>Nifty</strong> R2 5956<br />

<strong>Nifty</strong> R1 5936<br />

NIFTY Critical Level 5880<br />

<strong>Nifty</strong> S1 5862<br />

<strong>Nifty</strong> S2 5846<br />

FII Net Trade Cash Market (Cr) 698<br />

FII Net Trade Stock Futures (Cr) -398<br />

FII Net Trade Index Futures (Cr) 103<br />

DII Net Trade Cash Market (Cr) -586<br />

200 DMA 5350<br />

7 DMA 5898<br />

200 EMA 5426 7 EMA 5877<br />

100 DMA 5519 NIFTY 14 DMA 5779<br />

100 EMA 5558 14 EMA 5817<br />

50 DMA 5709 21 EMA 5780<br />

Singapore 3127.95 13.61 0.44%<br />

Hangseng 22346.25 69.53 0.31%<br />

Nikkei225 9506.29 -27.46 -0.29%<br />

China 2075.09 -8.68 -0.42%<br />

Malaysia 1640.65 8.5 0.52%<br />

Thailand 1341.54 6.59 0.49%<br />

FTSE100 5921.63 7.23 0.12%<br />

DAX 7530.92 13.12 0.17%<br />

CAC 3612.1 6.49 0.18%<br />

Dow 13169.88 14.75 0.11%<br />

NASDAQ 2986.96 8.92 0.30%<br />

S&P500 1418.55 0.48 0.03%<br />

Gold $ 1710<br />

Brent Crude $ 107.30<br />

Dollar Index $ 80.34<br />

Indian Rupee 54.47

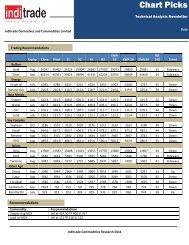

BSE Code 509148<br />

52 Week range 38.75 - 7.75<br />

Face Value(Rs) 10<br />

200 DMA 19<br />

Key Data<br />

Equity Cap (Cr)<br />

Market Cap (Cr) 79<br />

21.84<br />

Book Value 13.9<br />

P/E 7.3<br />

Key Ratios(FY12)<br />

OPM(%) 5.31<br />

NPM(%) 3.10<br />

ROCE(%) 12.5<br />

DEBT/EQUITY 3.25<br />

Share Holding (%)<br />

Promoter 53.84<br />

Institutions 1.55<br />

Public 44.61<br />

(Rs cr) FY-12 FY-11<br />

Income 340.82 340.92<br />

Expenses 315.01 306.01<br />

Oper Prof 25.81 34.91<br />

PBT 4.4 10.98<br />

Net Profit 9.39 5.07<br />

Q2<br />

comparison(Rs<br />

cr)<br />

Operating<br />

Income<br />

Sep<br />

2012<br />

Sep<br />

2011 YOY<br />

107.88 85.06 26.83<br />

Total Expenses 94.37 79.82 18.23<br />

Operating Profit 13.51 5.24 157.82<br />

Other Income 0.32 0.06 433.33<br />

PBDIT 13.83 5.30 160.94<br />

PBT 9.01 1.26 615.08<br />

Adjusted Net<br />

Profit<br />

7.13 1.26 465.87<br />

Performance<br />

1 Week : Rs 33.95 (7.66%)<br />

1 Month : Rs 36.00 (1.53%)<br />

1 Year : Rs 9.81 (272.58%)<br />

Govind Rubber <strong>Limited</strong> Recommended price 36{Moderate exposure} Target:Rs 40.50-44.50<br />

Govind Rubber <strong>Limited</strong> (GRL) engaged in auto tyres, tubes and high-end bicycle tyres<br />

manufacturing. GRL is one of the largest manufacturer of Bicycle & Rickshaw Tyres -Tubes in<br />

India, has grown manifold with an installed capacity to produce 36 Million Bicycle Tyres and<br />

Tubes per annum in 4 modern manufacturing units at Ludhiana in Punjab. GRL produce the<br />

widest Range of Tyres from 12 to 28 inch sizes with suitable tread patterns and constructions for<br />

all type of bicycles including the new generation MTB, ATB and City Cross Bicycles etc. GRL has<br />

now engaged itself in development of a range of Children Bicycles, BMX, Suspension Bikes, MTB<br />

Bicycles and many more. The company has ventured into the bicycle industry with the brand<br />

name - "TRAX" range of bicycles.GRL International Ltd, a subsidiary of Govind Rubber, has<br />

launched Trax Monarch, an high-end bicycle, for Rs 12,000 and also introduced Trax 360 degree<br />

BMX Freestyle Stunt Bike for teenagers and youngsters for Rs 6,500.GRL International has been<br />

importing bicycles from China since 2010 and including the imported stuff, the company sells 28<br />

models of bicycles.<br />

The company has a sales network of 49 Branch Offices spread across the country for catering to<br />

6400 worthy dealers .<strong>Global</strong>ly, the company have presence in 40 Countries including European<br />

Original Equipment Manufacturers. GRL is also a preferred supplier of Tyres - Tubes to all major<br />

Domestic as well as European OEMs . GRL's wholly-owned subsidiary in the Netherlands, GRL<br />

BV, has also set up an office and warehousing. GRL will market its full range of tyres and tubes in<br />

Europe through this network. GRL has entered into a joint venture for manufacturing highly<br />

specialized rubber by setting up a plant at Busan, South Korea.The company plans to set up a<br />

new tyre and bicycle manufacturing facility at Dahej in Gujarat at an investment of Rs 750 crore.<br />

GRL is preferred Supplier to renowned Indian bicycle manufacturing Companies –T I ,Avon, Hero,<br />

Atlas, Milton Cycles.GRL is a part of– the Siyaram Poddar group and the much awaited<br />

settlement of assets between family members have begun which is likely to be completed in the<br />

second quarter of next year.<br />

The company reported a gross turnover of Rs 355 crore in FY 12. Net profit rose 117 per cent at<br />

Rs 11.09 crore in FY 12 as against Rs 5.08 crore in the previous year .The company expects<br />

better profitability in the quarters to come due to softening of rubber prices.<br />

Risk factors: For the last two years, prices of rubber have shown undue turbulence. The rubber price upside movement can affect the<br />

profitability of the company. The promoters have pledged 76.5% of holding (which works out to 41% of total equity).The debt equity ratio of<br />

3.25 and interest coverage ratio of 1.14 in Mar 2012 indicates that if the income from sales come down, the company’s ability to meet<br />

interest expenses may be questionable. The basic fundamental ratios are not very strong. There is high competition in the segment from<br />

organized and unorganized segment.<br />

In the last couple of years the company has been struggling in its performance. If we look in to the Q1 and Q2 of this FY it seems that the<br />

company seems to be a turnaround. GRL has got a strong foothold now in the overseas market and getting very good realizations for their<br />

products. The debt amount can be brought down in the coming quarters. The stock is showing a technical break out in the charts. One can<br />

take a moderate exposure to GRL at CMP and on a decline to 33 for a short term target of 40.50 and a medium term target of 44.50.But<br />

considering the risk factors mentioned above, do not hold the stock below Rs 29.75.

PSU banking stocks will be in focus on hopes that legislation on<br />

banking sector reforms would be passed during the current session<br />

of Parliament. The Parliament is expected to amend the banking laws<br />

that includes raising the limit on shareholders' voting rights in public<br />

and private sector banks<br />

BHARAT ELECTRONICS: Has signed a pact with Israel Aerospace<br />

Industries for cooperation on future long range surface to air missile<br />

ship-defence systems.<br />

NMDC: Merchant banks have suggested a floor price of 145-150<br />

rupees for the offer for sale of shares in the state-owned company.<br />

Punj Lloyd :it has bagged a contract worth Rs 528 crore in Singapore<br />

to construct a new prison headquarter.<br />

Reliance Industries Ltd :DGH has rejected RIL's proposal to do a<br />

single test to confirm three natural gas discoveries in the flagging KG-<br />

D6 block, saying separate tests are required as the three finds are<br />

distant and unconnected<br />

RICO AUTO INDUSTRIES: One section of the company's Ferrous<br />

Foundry (Unit-I) located at Gurgaon Plant has been damaged in a fire<br />

on Dec 7.<br />

WIPRO: Cargill India, the Indian arm of US-based food company<br />

Cargill Inc,has acquired the company's Sunflower Vanaspati brand of<br />

vegetable Oil.<br />

Bank<strong>Nifty</strong> DEC Fut:12462<br />

Bank<strong>Nifty</strong> DEC Fut:12462: The market participants will closely<br />

watch the Parliament proceedings today, whether the left parties<br />

will be able to prevent a discussion again on Banking amendments<br />

bill.We can expect huge volatility during the day. The Critical level<br />

on the upside is at 12505 and if it sustain above this, the index can<br />

target 12548 followed by 12612,The major resistance on the upside<br />

is at 12675.The first minor support for the day is at 12415 and the<br />

sentiment can turn bearish below 12392 for which the lower<br />

support comes at 12333.The major support is at 12284.

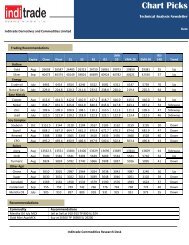

Scrip R2 R1 PP S1 S2 20SMA<br />

200<br />

SMA<br />

50<br />

SMA<br />

100<br />

SMA<br />

ACC 1442 1428 1415 1398 1385 1402 1311 1422 1381<br />

Ambuja Cement 209 208 207 205 205 205 179 208 198<br />

Axis Bank 1343 1333 1324 1312 1302 1275 1103 1216 1130<br />

Bajaj Auto 2007 1984 1955 1937 1916 1875 1672 1825 1754<br />

BPCL 367 362 356 351 347 336 351 342 346<br />

Bharati Airtel 328 323 319 312 308 313 297 287 278<br />

BHEL 247 245 244 241 240 231 233 238 230<br />

Cairn India 335 331 328 321 318 331 333 332 334<br />

Cipla 427 422 416 411 407 396 341 381 370<br />

Coal India 369 366 364 359 357 358 347 356 357<br />

DLF 228 225 222 218 216 208 203 211 211<br />

Dr.Reddy's 1956 1920 1876 1847 1812 1781 1690 1744 1705<br />

GAIL 361 357 355 350 348 348 354 361 363<br />

Grasim 3281 3241 3211 3161 3122 3252 2845 3330 3156<br />

HCL Tech 635 628 620 613 607 629 534 609 579<br />

HDFC Bank 700 696 693 689 686 672 577 647 623<br />

Hero Honda 1864 1853 1839 1830 1821 1829 1940 1845 1878<br />

Hindustan<br />

Unilever<br />

540 538 534 531 529 531 474 546 526<br />

Hindalco 126 124 123 121 120 113 119 115 115<br />

HDFC 902 884 859 847 830 803 706 778 751<br />

ICICI Bank 1144 1133 1125 1109 1099 1066 938 1065 1014<br />

IDFC 178 176 173 169 167 165 140 160 149<br />

Infosys Tech 2359 2336 2318 2290 2269 2379 2458 2403 2396<br />

ITC 307 304 301 299 297 290 255 287 274<br />

JP Associates 107 106 104 102 102 94 78 92 83<br />

Jindal Steel &<br />

Power<br />

419 415 409 405 401 385 439 396 393<br />

Kotak MahBank 688 681 671 665 659 641 586 632 606<br />

L&T 1687 1676 1668 1652 1642 1620 1407 1636 1530<br />

Lupin 617 611 604 597 592 579 557 575 580<br />

M&M 948 938 931 919 911 930 754 893 824<br />

Maruti Udyog 1527 1510 1500 1476 1460 1483 1272 1431 1309<br />

NTPC 161 159 157 154 153 163 162 166 166<br />

ONGC 272 269 267 263 261 257 271 268 275<br />

Power Grid 120 119 119 117 117 120 114 119 119<br />

PNB 867 854 834 825 812 766 799 782 758<br />

Ranbaxy 515 511 508 504 501 513 503 528 526<br />

Rel Ind 845 837 829 819 812 793 763 806 797<br />

Reliance Infra 528 523 517 513 509 475 516 494 494<br />

SBIN 2346 2333 2317 2306 2295 2160 2109 2197 2088<br />

Sesagoa 197 192 187 183 180 175 183 173 176<br />

Seimens 689 683 679 670 665 672 709 689 682<br />

Sun Pharma 720 712 704 696 689 697 635 699 682<br />

TCS 1273 1255 1243 1218 1202 1294 1253 1303 1301<br />

Tata Motors 288 284 281 275 272 271 261 269 255<br />

Tata Power 112 111 109 106 106 104 100 104 101<br />

Tata Steel 407 403 399 396 394 379 414 395 393<br />

Ultratech 1972 1960 1950 1935 1924 1936 1653 1988 1852

Prepared By:<br />

Binu Joseph<br />

Product Team<br />

Equity Research<br />

Disclaimer:<br />

This document has been prepared by <strong>JRG</strong> <strong>Securities</strong> Ltd.<br />

The information presented in this document shall not be regarded as an offer/recommendation to buy or sell securities. There is the risk of<br />

loss involved in using the information for investment purpose. The readers are urged to exercise their own judgment in investment and<br />

trading.<br />

There are rates, based on Technical levels. . Opinions expressed in this article are the independent views of the author(s). The information,<br />

opinions and analysis contained are collected from sources believed to be reliable, but no representation, expressed or implied, is made as<br />

to its accuracy, completeness or correctness.<br />

STRICTLY FOR PRIVATE CIRCULATION ONLY. Unauthorized use, disclosure, distribution or copying of this private email by<br />

anyone other than the intended recipient is strictly prohibited.<br />

Any major fundamental news or market sentiment can make these levels irrelevant or ineffective<br />

<strong>JRG</strong> <strong>Securities</strong> Ltd<br />

Plot No - 115/22/23/25,Ground Floor, West block, Surana Financial Park,<br />

Nanakramguda, Gachibowli, Hyderabad, Andhra Pradesh 500032.<br />

Landline : 040 3350 2451 http://www.inditrade.com/