Retirement Strategies The Biggest Advantage You Have Is Time

http://www.emparion.com/ The number one asset that anyone has when planning for retirement is time. But just make sure that you select the best retirement plan for you.

http://www.emparion.com/

The number one asset that anyone has when planning for retirement is time. But just make sure that you select the best retirement plan for you.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

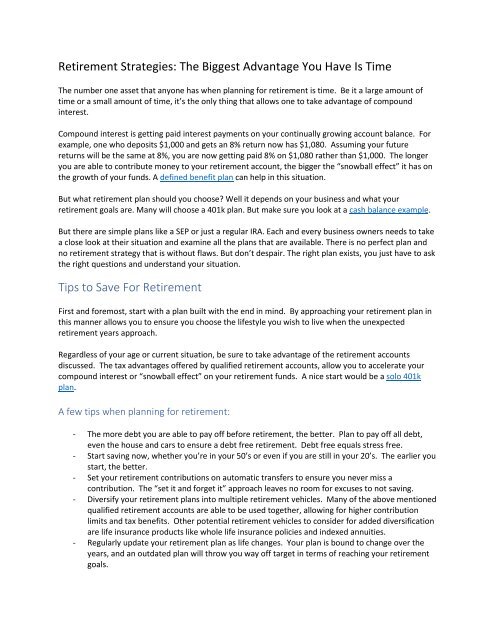

<strong>Retirement</strong> <strong>Strategies</strong>: <strong>The</strong> <strong>Biggest</strong> <strong>Advantage</strong> <strong>You</strong> <strong>Have</strong> <strong>Is</strong> <strong>Time</strong><br />

<strong>The</strong> number one asset that anyone has when planning for retirement is time. Be it a large amount of<br />

time or a small amount of time, it’s the only thing that allows one to take advantage of compound<br />

interest.<br />

Compound interest is getting paid interest payments on your continually growing account balance. For<br />

example, one who deposits $1,000 and gets an 8% return now has $1,080. Assuming your future<br />

returns will be the same at 8%, you are now getting paid 8% on $1,080 rather than $1,000. <strong>The</strong> longer<br />

you are able to contribute money to your retirement account, the bigger the “snowball effect” it has on<br />

the growth of your funds. A defined benefit plan can help in this situation.<br />

But what retirement plan should you choose? Well it depends on your business and what your<br />

retirement goals are. Many will choose a 401k plan. But make sure you look at a cash balance example.<br />

But there are simple plans like a SEP or just a regular IRA. Each and every business owners needs to take<br />

a close look at their situation and examine all the plans that are available. <strong>The</strong>re is no perfect plan and<br />

no retirement strategy that is without flaws. But don’t despair. <strong>The</strong> right plan exists, you just have to ask<br />

the right questions and understand your situation.<br />

Tips to Save For <strong>Retirement</strong><br />

First and foremost, start with a plan built with the end in mind. By approaching your retirement plan in<br />

this manner allows you to ensure you choose the lifestyle you wish to live when the unexpected<br />

retirement years approach.<br />

Regardless of your age or current situation, be sure to take advantage of the retirement accounts<br />

discussed. <strong>The</strong> tax advantages offered by qualified retirement accounts, allow you to accelerate your<br />

compound interest or “snowball effect” on your retirement funds. A nice start would be a solo 401k<br />

plan.<br />

A few tips when planning for retirement:<br />

- <strong>The</strong> more debt you are able to pay off before retirement, the better. Plan to pay off all debt,<br />

even the house and cars to ensure a debt free retirement. Debt free equals stress free.<br />

- Start saving now, whether you’re in your 50’s or even if you are still in your 20’s. <strong>The</strong> earlier you<br />

start, the better.<br />

- Set your retirement contributions on automatic transfers to ensure you never miss a<br />

contribution. <strong>The</strong> “set it and forget it” approach leaves no room for excuses to not saving.<br />

- Diversify your retirement plans into multiple retirement vehicles. Many of the above mentioned<br />

qualified retirement accounts are able to be used together, allowing for higher contribution<br />

limits and tax benefits. Other potential retirement vehicles to consider for added diversification<br />

are life insurance products like whole life insurance policies and indexed annuities.<br />

- Regularly update your retirement plan as life changes. <strong>You</strong>r plan is bound to change over the<br />

years, and an outdated plan will throw you way off target in terms of reaching your retirement<br />

goals.

When following the above listed tips, you will be sure to have a healthy balance in retirement, allowing<br />

you to retire with more than enough money.