WRD CAFR FINAL 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Water Replenishment District of Southern California<br />

Notes to Financial Statements<br />

Years ended June 30, <strong>2017</strong> and 2016<br />

NOTE 9<br />

DEFERRED INFLOWS OF RESOURCES<br />

In accordance with GASB Statement No. 62, Codification of Accounting and<br />

Financial Reporting Guidance Contained in Pre-November 30, 1989 FASB and<br />

AICPA Pronouncements, for rate–regulated activities the District defers the<br />

recognition of revenues until the related costs or charges associated with the rates<br />

assessed are incurred. The balance of Deferred Revenue – Replenishment<br />

Assessments of $4.2 million and $16.0 million as of June 30, <strong>2017</strong> and 2016,<br />

respectively, pertains to assessments that were deferred until the related costs of<br />

water supply management are incurred. Pursuant to GASB Statement No. 65, Items<br />

Previously Reported as Assets and Liabilities, these amounts are reported as<br />

deferred inflows of resources in the Statement of Net Position.<br />

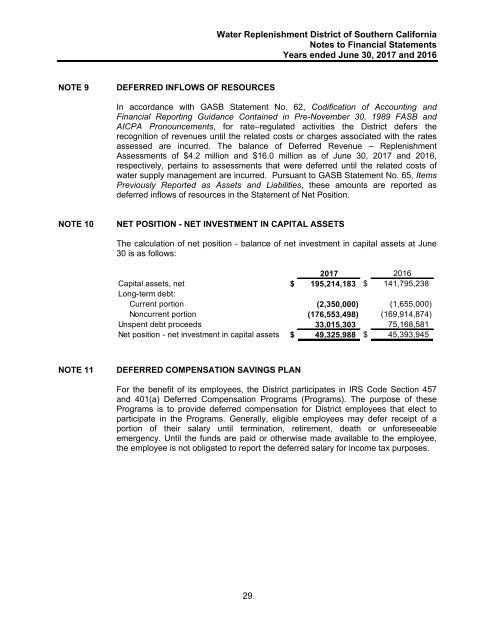

NOTE 10<br />

NET POSITION - NET INVESTMENT IN CAPITAL ASSETS<br />

The calculation of net position - balance of net investment in capital assets at June<br />

30 is as follows:<br />

<strong>2017</strong> 2016<br />

Capital assets, net $ 195,214,183 $ 141,795,238<br />

Long-term debt:<br />

Current portion (2,350,000) (1,655,000)<br />

Noncurrent portion (176,553,498) (169,914,874)<br />

Unspent debt proceeds 33,015,303 75,168,581<br />

Net position - net investment in capital assets $ 49,325,988 $ 45,393,945<br />

NOTE 11<br />

DEFERRED COMPENSATION SAVINGS PLAN<br />

For the benefit of its employees, the District participates in IRS Code Section 457<br />

and 401(a) Deferred Compensation Programs (Programs). The purpose of these<br />

Programs is to provide deferred compensation for District employees that elect to<br />

participate in the Programs. Generally, eligible employees may defer receipt of a<br />

portion of their salary until termination, retirement, death or unforeseeable<br />

emergency. Until the funds are paid or otherwise made available to the employee,<br />

the employee is not obligated to report the deferred salary for income tax purposes.<br />

29