MM060718

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

mokenamessenger.com news<br />

the Mokena Messenger | June 7, 2018 | 5<br />

School boards weigh putting new sales tax on ballot<br />

1 percent increase<br />

would fund facilities,<br />

maintenance in Will<br />

County<br />

Amanda Stoll, Assistant Editor<br />

A measure to place a<br />

question on the November<br />

ballot would ask residents<br />

of Will County for a 1 percent<br />

increase in sales tax to<br />

help fund capital projects<br />

and maintenance at public<br />

schools across the county.<br />

In order for the measure to<br />

appear before voters, proponents<br />

for the increase need<br />

to gain support from school<br />

boards representing more<br />

than half of the county’s students.<br />

Districts in the area seem<br />

split on the issue, with<br />

Frankfort School District<br />

157C voting to not support<br />

the measure, while Summit<br />

Hill School District 161 and<br />

New Lenox School District<br />

122 approved the measure.<br />

Both Lincoln-Way School<br />

District 210 and Mokena<br />

School District 159 are in<br />

the process of considering<br />

the proposal and are expected<br />

to vote on it in the coming<br />

months.<br />

According to information<br />

provided to the districts by<br />

Stifel Financial Corp., an<br />

investment firm based out<br />

of St. Louis, districts in the<br />

area are estimated to receive<br />

between $700,000 and $3.26<br />

million each year if the sales<br />

tax increase passes.<br />

The amount each district<br />

would receive is based on<br />

the number of its students,<br />

as a percentage of students<br />

in the county as a whole.<br />

Mokena D159 has an enrollment<br />

of 1,542 students,<br />

which is about 1.2 percent of<br />

the pubic school students in<br />

Will County, and is estimated<br />

to receive $720,254 each<br />

year if the measure were to<br />

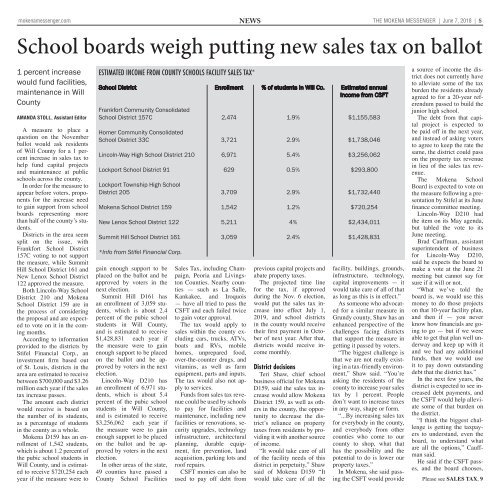

Estimated income from County Schools Facility Sales Tax*<br />

School District Enrollment % of students in Will Co. Estimated annual<br />

income from CSFT<br />

Frankfort Community Consolidated<br />

School District 157C 2,474 1.9% $1,155,583<br />

Homer Community Consolidated<br />

School District 33C 3,721 2.9% $1,738,046<br />

Lincoln-Way High School District 210 6,971 5.4% $3,256,062<br />

Lockport School District 91 629 0.5% $293,800<br />

Lockport Township High School<br />

District 205 3,709 2.9% $1,732,440<br />

Mokena School District 159 1,542 1.2% $720,254<br />

New Lenox School District 122 5,211 4% $2,434,011<br />

Summit Hill School District 161 3,059 2.4% $1,428,831<br />

*Info from Stifel Financial Corp.<br />

gain enough support to be<br />

placed on the ballot and be<br />

approved by voters in the<br />

next election.<br />

Summit Hill D161 has<br />

an enrollment of 3,059 students,<br />

which is about 2.4<br />

percent of the pubic school<br />

students in Will County,<br />

and is estimated to receive<br />

$1,428,831 each year if<br />

the measure were to gain<br />

enough support to be placed<br />

on the ballot and be approved<br />

by voters in the next<br />

election.<br />

Lincoln-Way D210 has<br />

an enrollment of 6,971 students,<br />

which is about 5.4<br />

percent of the pubic school<br />

students in Will County,<br />

and is estimated to receive<br />

$3,256,062 each year if<br />

the measure were to gain<br />

enough support to be placed<br />

on the ballot and be approved<br />

by voters in the next<br />

election.<br />

In other areas of the state,<br />

49 counties have passed a<br />

County School Facilities<br />

Sales Tax, including Champaign,<br />

Peoria and Livingston<br />

Counties. Nearby counties<br />

— such as La Salle,<br />

Kankakee, and Iroquois<br />

— have all tried to pass the<br />

CSFT and each failed twice<br />

to gain voter approval.<br />

The tax would apply to<br />

sales within the county excluding<br />

cars, trucks, ATVs,<br />

boats and RVs, mobile<br />

homes, unprepared food,<br />

over-the-counter drugs, and<br />

vitamins, as well as farm<br />

equipment, parts and inputs.<br />

The tax would also not apply<br />

to services.<br />

Funds from sales tax revenue<br />

could be used by schools<br />

to pay for facilities and<br />

maintenance, including new<br />

facilities or renovations, security<br />

upgrades, technology<br />

infrastructure, architectural<br />

planning, durable equipment,<br />

fire prevention, land<br />

acquisition, parking lots and<br />

roof repairs.<br />

CSFT monies can also be<br />

used to pay off debt from<br />

previous capital projects and<br />

abate property taxes.<br />

The projected time line<br />

for the tax, if approved<br />

during the Nov. 6 election,<br />

would put the sales tax increase<br />

into effect July 1,<br />

2019, and school districts<br />

in the county would receive<br />

their first payment in October<br />

of next year. After that,<br />

districts would receive income<br />

monthly.<br />

District decisions<br />

Teri Shaw, chief school<br />

business official for Mokena<br />

D159, said the sales tax increase<br />

would allow Mokena<br />

District 159, as well as others<br />

in the county, the opportunity<br />

to decrease the district’s<br />

reliance on property<br />

taxes from residents by providing<br />

it with another source<br />

of income.<br />

“It would take care of all<br />

of the facility needs of this<br />

district in perpetuity,” Shaw<br />

said of Mokena D159 “It<br />

would take care of all the<br />

facility, buildings, grounds,<br />

infrastructure, technology,<br />

capital improvements — it<br />

would take care of all of that<br />

as long as this is in effect.”<br />

As someone who advocated<br />

for a similar measure in<br />

Grundy county, Shaw has an<br />

enhanced perspective of the<br />

challenges facing districts<br />

that support the measure in<br />

getting it passed by voters.<br />

“The biggest challenge is<br />

that we are not really existing<br />

in a tax-friendly environment,”<br />

Shaw said. “You’re<br />

asking the residents of the<br />

county to increase your sales<br />

tax by 1 percent. People<br />

don’t want to increase taxes<br />

in any way, shape or form.<br />

“...By increasing sales tax<br />

for everybody in the county,<br />

and everybody from other<br />

counties who come to our<br />

county to shop, what that<br />

has the possibility and the<br />

potential to do is lower our<br />

property taxes.”<br />

In Mokena, she said passing<br />

the CSFT would provide<br />

a source of income the district<br />

does not currently have<br />

to alleviate some of the tax<br />

burden the residents already<br />

agreed to for a 20-year referendum<br />

passed to build the<br />

junior high school.<br />

The debt from that capital<br />

project is expected to<br />

be paid off in the next year,<br />

and instead of asking voters<br />

to agree to keep the rate the<br />

same, the district could pass<br />

on the property tax revenue<br />

in lieu of the sales tax revenue.<br />

The Mokena School<br />

Board is expected to vote on<br />

the measure following a presentation<br />

by Stifel at its June<br />

finance committee meeting.<br />

Lincoln-Way D210 had<br />

the item on its May agenda,<br />

but tabled the vote to its<br />

June meeting.<br />

Brad Cauffman, assistant<br />

superintendent of business<br />

for Lincoln-Way D210,<br />

said he expects the board to<br />

make a vote at the June 21<br />

meeting but cannot say for<br />

sure if it will or not.<br />

“What we’ve told the<br />

board is, we would use this<br />

money to do those projects<br />

on that 10-year facility plan,<br />

and then if — you never<br />

know how financials are going<br />

to go — but if we were<br />

able to get that plan well underway<br />

and keep up with it<br />

and we had any additional<br />

funds, then we would use<br />

it to pay down outstanding<br />

debt that the district has.”<br />

In the next few years, the<br />

district is expected to see increased<br />

debt payments, and<br />

the CSFT would help alleviate<br />

some of that burden on<br />

the district.<br />

“I think the biggest challenge<br />

is getting the taxpayers<br />

to understand, even the<br />

board, to understand what<br />

are all the options,” Cauffman<br />

said.<br />

He said if the CSFT passes,<br />

and the board chooses,<br />

Please see sales tax, 9