Claudia Lambert - House of Finance

Claudia Lambert - House of Finance

Claudia Lambert - House of Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

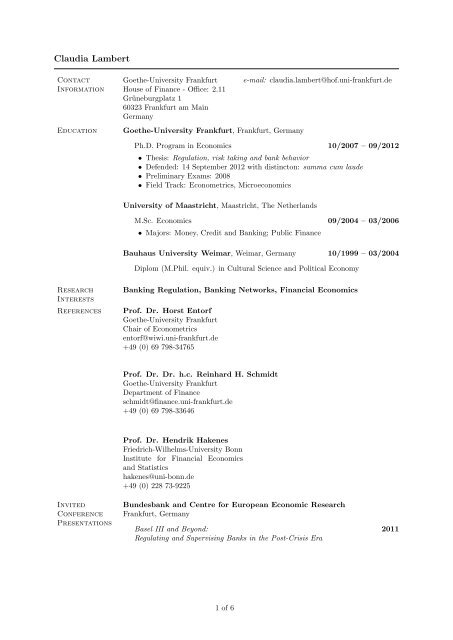

<strong>Claudia</strong> <strong>Lambert</strong><br />

Contact<br />

Information<br />

Goethe-University Frankfurt<br />

<strong>House</strong> <strong>of</strong> <strong>Finance</strong> - Office: 2.11<br />

Grüneburgplatz 1<br />

60323 Frankfurt am Main<br />

Germany<br />

Education Goethe-University Frankfurt, Frankfurt, Germany<br />

Research<br />

Interests<br />

e-mail: claudia.lambert@h<strong>of</strong>.uni-frankfurt.de<br />

Ph.D. Program in Economics 10/2007 – 09/2012<br />

• Thesis: Regulation, risk taking and bank behavior<br />

• Defended: 14 September 2012 with distincton: summa cum laude<br />

• Preliminary Exams: 2008<br />

• Field Track: Econometrics, Microeconomics<br />

University <strong>of</strong> Maastricht, Maastricht, The Netherlands<br />

M.Sc. Economics 09/2004 – 03/2006<br />

• Majors: Money, Credit and Banking; Public <strong>Finance</strong><br />

Bauhaus University Weimar, Weimar, Germany 10/1999 – 03/2004<br />

Diplom (M.Phil. equiv.) in Cultural Science and Political Economy<br />

Banking Regulation, Banking Networks, Financial Economics<br />

References Pr<strong>of</strong>. Dr. Horst Entorf<br />

Goethe-University Frankfurt<br />

Chair <strong>of</strong> Econometrics<br />

entorf@wiwi.uni-frankfurt.de<br />

+49 (0) 69 798-34765<br />

Invited<br />

Conference<br />

Presentations<br />

Pr<strong>of</strong>. Dr. Dr. h.c. Reinhard H. Schmidt<br />

Goethe-University Frankfurt<br />

Department <strong>of</strong> <strong>Finance</strong><br />

schmidt@finance.uni-frankfurt.de<br />

+49 (0) 69 798-33646<br />

Pr<strong>of</strong>. Dr. Hendrik Hakenes<br />

Friedrich-Wilhelms-University Bonn<br />

Institute for Financial Economics<br />

and Statistics<br />

hakenes@uni-bonn.de<br />

+49 (0) 228 73-9225<br />

Bundesbank and Centre for European Economic Research<br />

Frankfurt, Germany<br />

Basel III and Beyond: 2011<br />

Regulating and Supervising Banks in the Post-Crisis Era<br />

1 <strong>of</strong> 6

Conference<br />

Presentations<br />

Grants and<br />

Honors<br />

European <strong>Finance</strong> Association (EFA) 2012<br />

Copenhagen, Denmark<br />

Verein für Socialpolitik (VfS) 2012<br />

Göttingen, Germany<br />

4 th International <strong>Finance</strong> and Banking Conference (IFABS) 2012<br />

Valencia, Spain<br />

Annual Meeting <strong>of</strong> the American Economic Association (AEA) 2012<br />

Chicago, IL, USA<br />

CEPR Winter Confernce on Financial Intermediation 2012<br />

Lenzerheide, Switzerland<br />

14 th Swiss Society for Financial Market Research 2011<br />

Zurich, Switzerland<br />

French <strong>Finance</strong> Association (AFFI) 2010<br />

Paris, France<br />

Southern <strong>Finance</strong> Association Annual Meeting 2010<br />

Asheville, NC, USA<br />

International Risk Management Conference 2010<br />

Florence, Italy<br />

INFINITI Conference 2010<br />

Dublin, Ireland<br />

ESCEM Conference on Regulation 2010<br />

Paris, France<br />

Best Paper Award at the Annual Conference <strong>of</strong> the<br />

Financial Engineering and Banking Society (FEBS) 2012<br />

ESCP Europe Business School, London<br />

Goethe-University Frankfurt, Travel Grant 2012<br />

AEA Annual Meeting<br />

Goethe-University Frankfurt, Travel Grant 2010<br />

French <strong>Finance</strong> Association<br />

German Academic Exchange Service, Travel Grant 2010<br />

Southern <strong>Finance</strong> Annual Meeting<br />

German Research Foundation, Scholarship 2007 - 2008<br />

Ph.D. Program<br />

German National Academic Foundation, Scholarship 2002 - 2004<br />

Graduate Studies<br />

German National Academic Foundation, Research Grant 2003<br />

Master thesis, Visiting Scholar<br />

German Academic Exchange Service, Internship Grant 2001<br />

CBS News Productions, New York City, NY, USA<br />

2 <strong>of</strong> 6

Teaching<br />

Experience:<br />

Academic and<br />

Non-Academic<br />

Pr<strong>of</strong>essional<br />

Service<br />

Goethe-University Frankfurt, Frankfurt, Germany<br />

Instructor 2012<br />

• Microeconometrics <strong>of</strong> Banking, Undergraduate level<br />

(lecture and tutorial, independently designed)<br />

Goethe Business School, Frankfurt, Germany<br />

Executive teaching, European Supervisory Education Initiative 2012<br />

• Risk Models in Banks<br />

The role <strong>of</strong> risk management: What do we now? An Academic View<br />

Bauhaus University Weimar, Weimar, Germany<br />

Teaching Assistant 2002<br />

• Merger and Acquisitions, Undergraduate level<br />

Pr<strong>of</strong>. Dr. Matthias Maier<br />

ITGAIN Consulting GmbH, Frankfurt, Germany<br />

Executive teaching 2012<br />

• Regulating <strong>of</strong> dynamic capital markets - current developments and future<br />

challenges<br />

ITGAIN Consulting GmbH, Hamburg, Germany<br />

Executive teaching 2011<br />

• Liquidity und liquidity premium: economic and<br />

regulatory requirements under Basel III<br />

Discussant<br />

• 14 th Swiss Society for Financial Market Research, Zurich, Switzerland 2010<br />

• Southern <strong>Finance</strong> Association, Asheville, NC, USA 2010<br />

• INFINITI Conference, Dublin, Ireland 2010<br />

Referee<br />

• Southern <strong>Finance</strong> Association, Ashville, NC. USA 2010<br />

Working Papers [1] <strong>Lambert</strong>, C., F. Noth, and U. Schüwer. How do banks react to increased asset<br />

risk? Evidence from Hurricane Katrina. (Job market paper)<br />

Pr<strong>of</strong>essional<br />

Experience<br />

[2] Bülbül, D., and C. <strong>Lambert</strong>. Credit porfolio modelling and its effect on capital<br />

requirements.<br />

[3] <strong>Lambert</strong>, C. Do banks require trust to participate in opaque contracts?<br />

[4] Bülbül, D., and H. Hakenes, and C. <strong>Lambert</strong>. Driving forces behind risk<br />

management in banking.<br />

[5] <strong>Lambert</strong>, C. Government intervention, risk taking and regulatory reform.<br />

[6] <strong>Lambert</strong>, C., F. Noth, and U. Schüwer. How do insured deposits affect bank<br />

stability? Evidence from the 2008 Emergency Economic Stabilization Act.<br />

ITGAIN Consulting GmbH, Hannover, Germany<br />

Senior consultant (part time) 04/2009 – 07/2012<br />

• Global bank management<br />

KPMG DTG-AG, Frankfurt, Germany<br />

Consultant 10/2006 – 09/2007<br />

• Financial Risk Management<br />

3 <strong>of</strong> 6

Skills S<strong>of</strong>tware and Programming Skills<br />

Stata, Matlab, Visual Basic for Applications, SQL, LaTeX<br />

Languages<br />

German (native), English (fluent), Swedish (basic), Russian (basic) French (basic)<br />

4 <strong>of</strong> 6

Abstracts How do banks react to increase asset risk? Evidence from Hurricane<br />

Katrina (with Felix Noth and Ulrich Schüwer)<br />

The instability <strong>of</strong> banks during the recent financial crisis underlines the importance<br />

<strong>of</strong> understanding how banks determine their capital ratios. This paper conducts<br />

the first empirical assessment on how banks adjust their capital ratios<br />

following an exogenous shock to their asset risks. The existing literature, which<br />

uses non-experimental identification, faces the difficulty that banks typically<br />

determine capital ratios and asset risks simultaneously. Using Hurricane Katrina<br />

as a natural experiment, we find that banks in the disaster areas increase their<br />

risk-based capital ratios after the hurricane. This finding shows that banks<br />

act precautious by themselves irrespective <strong>of</strong> regulatory requirements. However,<br />

when we examine low-capitalized and high-capitalized banks separately, we find<br />

that results are driven by high-capitalized banks. In addition, high-capitalized<br />

banks increase their risk-based capital ratios by decreasing loans and not by<br />

increasing capital.<br />

Credit porfolio modelling and its effect on capital requirements (with<br />

Dilek Bülbül)<br />

The subprime crisis revealed that the adoption <strong>of</strong> suitable systems for the management<br />

<strong>of</strong> credit risk is <strong>of</strong> utmost concern. The Basel Committee on Banking<br />

Supervision (2009) advises banks to use credit portfolio models with caution<br />

when assessing the capital adequacy. This paper investigates whether decisions<br />

on total risk-based capital ratios are channeled through credit portfolio models.<br />

In other words, do credit portfolio models serve as a relevant determinant for<br />

banks to adjust their capital allocation? To empirically test the relationship we<br />

measure the average treatment effect by conducting a quasi-natural experiment in<br />

which we employ a propensity-matching approach to panel data. We find that the<br />

adoption <strong>of</strong> credit portfolio models positively and significantly affects regulatory<br />

capital decisions <strong>of</strong> banks both directly following the introduction as well as over<br />

a longer time horizon. By now it is commonly accepted that overreliance on<br />

credit portfolio models composes a fundamental cause <strong>of</strong> the current financial<br />

crisis. Our results put the debate about overreliance on quantitative models in<br />

a new perspective. This knowledge may prove valuable for regulators who aim<br />

to understand bank behaviour and thus advance regulation.<br />

5 <strong>of</strong> 6

Do banks require trust to participate in opaque contracts?<br />

The absence <strong>of</strong> trust among intermediaries became particularly evident in the<br />

midst <strong>of</strong> the financial crisis, which was accompanied by extremely rapid deterioration<br />

in economic activity. To date, the importance <strong>of</strong> trust for interbank markets<br />

is well recognized, but only a few studies have examined the role <strong>of</strong> trust in<br />

interbank relationships. This paper tests the hypothesis that trust is positively<br />

associated with banks’ participation in loan pools. The empirical results show<br />

that a bank’s decision to participate in loan pools is heavily influenced by trust.<br />

However, the results show that trust has less influence in the case <strong>of</strong> the firsttime<br />

participation <strong>of</strong> banks, which rules out endogeneity concerns. The banks are<br />

reluctant to interconnect with other banks through loan pools if they are either<br />

betrayal averse or unsure about the risk transfer mechanism that is implemented.<br />

The drivers <strong>of</strong> active risk management in banking (with Dilek Bülbül and<br />

Hendrik Hakenes)<br />

This paper investigates the factors influencing banks decision to engage in active<br />

risk management, both from a theoretical and an empirical perspective. In<br />

recent decades, credit risk management in banks has become highly sophisticated<br />

and banks became more active in the management <strong>of</strong> credit risks. We identify<br />

two driving factors: Bank competition and the sector concentration in the loan<br />

market. We find empirical support for our hypotheses, using a unique data set<br />

<strong>of</strong> 249 German banks, partially raised by hand. Bank competition pushes banks<br />

to implement active risk management. Sector concentration on the loan market<br />

promotes credit portfolio modelling, but inhibits credit risk transfer. Our study<br />

sheds light on practices <strong>of</strong> credit risk management in banking.<br />

How do insured deposits affect bank stability? Evidence from the 2008<br />

Emergency Economic Stabilization Act (with Felix Noth and Ulrich Schüwer)<br />

This paper tests the hypothesis that an increase in the amount <strong>of</strong> insured deposits<br />

causes a bank to become more risky. We use exogenous variation introduced by<br />

the U.S. Emergency Economic Stabilization Act in October 2008, which increased<br />

the deposit insurance coverage from US$ 100,000 to US$ 250,000 per depositor.<br />

For some U.S. banks, this event significantly increased the amount <strong>of</strong> insured<br />

deposits. For other U.S. banks, it had only a minor effect. Our analysis shows<br />

that an increase in the amount <strong>of</strong> insured deposits induces the more affected<br />

banks to become more risky relative to the less affected banks. In particular, the<br />

more affected banks increase their investments in risky assets. To our knowledge,<br />

this is the first study that provides causal within-country evidence on the effect<br />

<strong>of</strong> insured deposits on bank stability.<br />

Government intervention, risk taking and regulatory reform<br />

The passage <strong>of</strong> the Dodd-Frank Act was accompanied by an intense discussion <strong>of</strong><br />

its merits. There are opposing opinions as to whether the Act will stabilize<br />

the banking system or whether banks’ incentives toward risk taking will be<br />

affected. This paper analyzes whether the banks that previously participated<br />

in the Troubled Asset Relief Program (TARP) systematically differ from the<br />

banks that did not benefit from TARP after the Dodd-Frank Act was introduced.<br />

To guarantee that similar banks are compared across the two groups, I employ<br />

a difference-in-difference estimation conditional on matching. I find that the<br />

introduction <strong>of</strong> the law is generally associated with less risk taking by banks.<br />

Interestingly, however, I also observe that the banks that benefited from TARP<br />

increase their risk levels and become less stable.<br />

6 <strong>of</strong> 6